Sustainable investing in China fixed income: China’s taxonomy is aligning with international standards

This is the second of a four-part blog series that seeks to demystify China’s sustainable investing landscape for fixed income. In our first blog we outlined the importance of China’s role in sustainable investing. In this piece we cover how China’s taxonomy is aligning with international standards. In future blogs we will look at which thematic investing opportunities may currently exist in China, and how the country's sustainability labelled bond market has evolved over time. Visit our ESG Education page to stay tuned to this series.

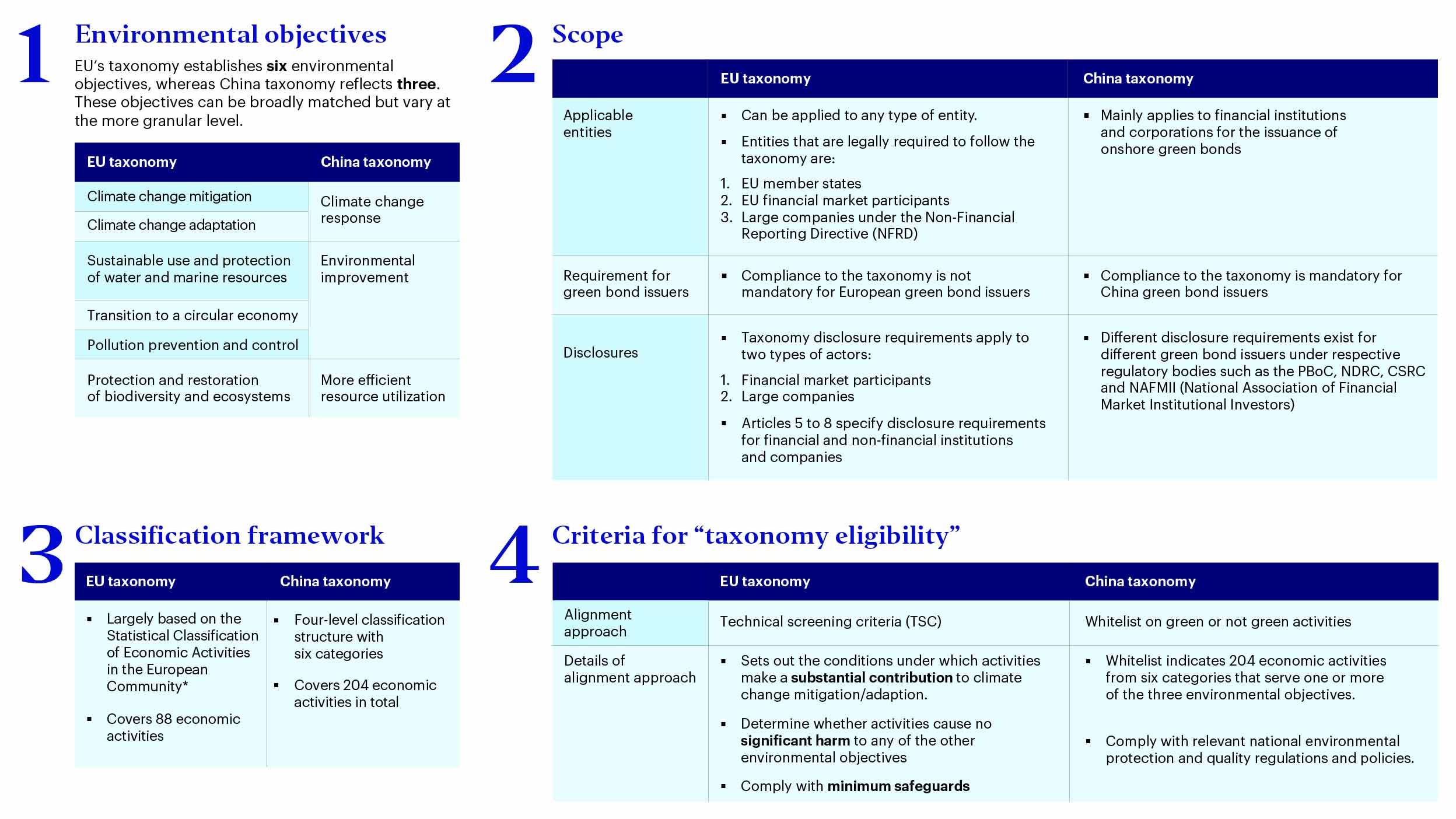

In June 2020, the European Commission published the EU taxonomy for sustainable activities, the first official system to define and classify environmentally sustainable economic activities in Europe. Apart from the EU, its member states, financial market participants and large companies under the Non-Financial Reporting Directive (NFRD), international companies that finance, operate, or are listed in Europe are obliged to follow this taxonomy.

Earlier, financial market participants in Europe were cautious about investing in green activities given the propensity for greenwashing. The EU taxonomy provides a scientific classification to define ‘green’ activities. Borrowers and fundraisers are also subject to a standard information disclosure process.

China’s green taxonomy, known as the “Green Bond Endorsed Project Catalogue” was first released by the People's Bank of China (PBoC) in 2015. This was a significant step and following this China became the world’s largest green bond market within a single year, making up 40 percent of total green bond issuance in 2017.1 The main feedback on the catalogue was that it conflicted with other documents issued by the National Development and Reform Commission (NDRC) and the China Securities Regulatory Commission (CSRC). Since then, China’s regulators have made tremendous efforts to coordinate in order to bring the country’s classifications closer to international standards.

The revised edition, published in April 2021, was jointly issued by the PBoC, NDRC and CSRC. The catalogue shows improvement in the alignment of China’s taxonomy with international standards, including adoption of the “no significant harm” principle and exclusion of clean use of coal, considered a breakthrough particularly given the country’s heavy reliance on coal-fired power. The latest taxonomy presents clear green definitions at the activity level in China with the aim to enhance disclosures and transparency across the board.

Sources: European Commission, People’s Bank of China, National Development and Reform Commission, China Securities Regulatory Commission. Data compiled by Invesco. Notes: *This statistical classification is commonly referred to as NACE (Nomenclature statistique des Activités économiques dans la Communauté européenne).

Latest developments and convergence in the future

In July 2020, the same month as the launch of the EU taxonomy, the EU and China initiated a working group within the International Platform on Sustainable Finance (IPSF) to undertake a technical comparison of taxonomies from the two jurisdictions. The Common Ground Taxonomy (CGT), a comparative study of the green taxonomies of China and the EU, was published in early November of last year at the COP26.2 It puts forward areas of commonality and differences between the EU and China’s green taxonomies, providing a valuable tool to enable the comparability and interoperability of these taxonomies.

We believe the convergence between these taxonomies will continue to happen, which can help to promote China’s sustainable investments at home and abroad. Initiatives such as the CGT are catalyzing the development of the international green finance market. Such breakthroughs are expected to further spur cross-border investments in this space.

Notably Hong Kong’s central bank, the Hong Kong Monetary Authority (HKMA), which is also a member of the IPSF, intends to take the CGT as reference to design a tailored sustainable finance taxonomy that aligns with the city’s own economic structure. Hong Kong financial regulators set this as one of the five near-term action points outlined in the city’s green finance strategic plan released in December 2020.3

Footnotes

-

1

China’s Green Bond Market, December 2019, https://hkgreenfinance.org/wp-content/uploads/2019/12/China%E2%80%99s-Green-Bond-Market.pdf

-

2

Common Ground Taxonomy – Climate Change Mitigation, November 2021, Common ground taxonomy – Climate change mitigation instruction report (europa.eu)

-

3

Natixis, November 2021, EU-China Common Ground Taxonomy, a painkiller to taxonomy headaches? | Our Center of Expertise (natixis.com)