Tsinghua-Invesco China ESG research: Transition investing in China

This three-part research series covers three different opportunities and approaches to investing in China’s low-carbon transition: climate solutions, transition investing and green indexes.

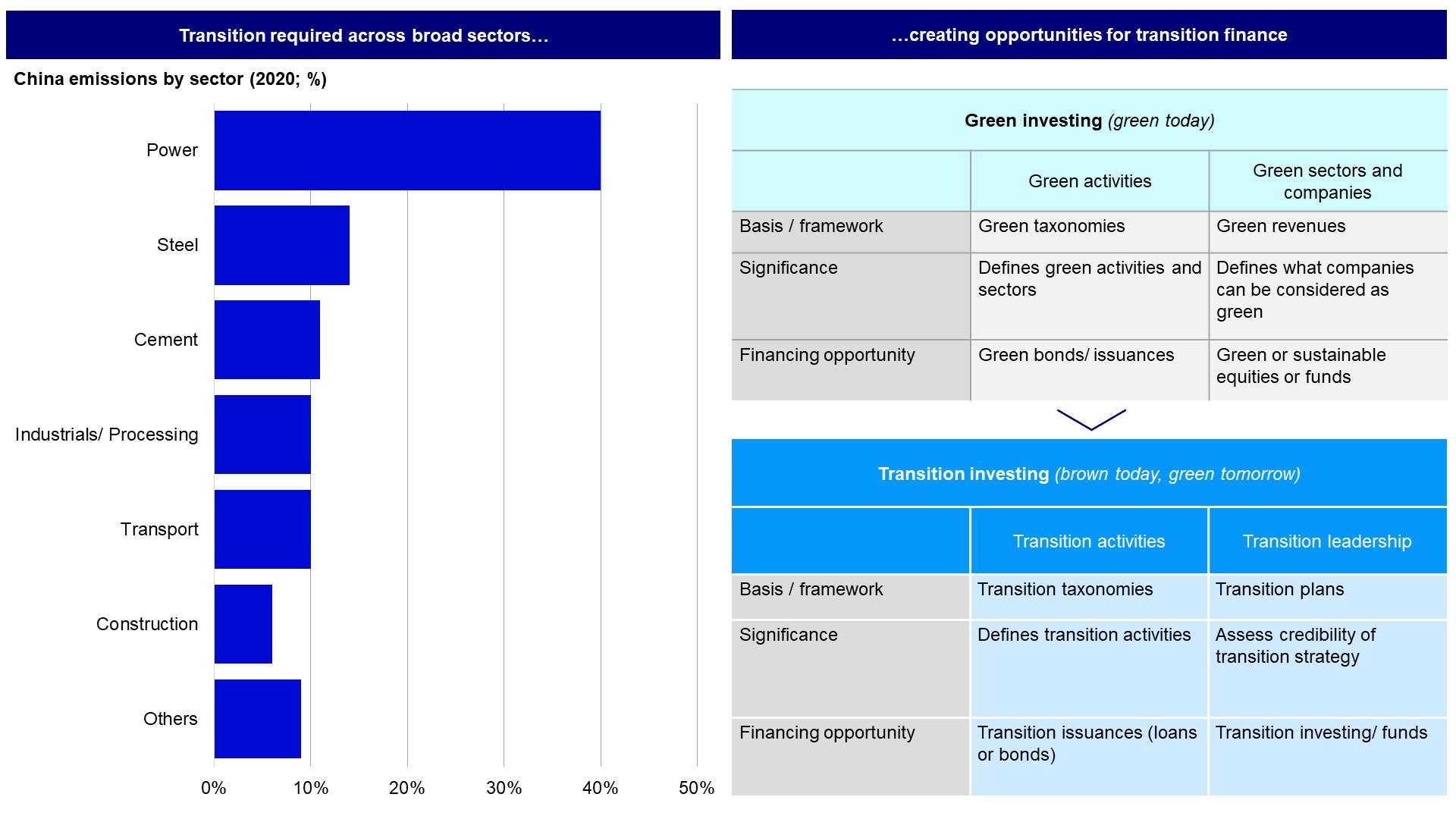

We expect the global energy transition to create demand for transition finance across a range of sectors and increased investments into green capex. This is especially key in China’s market given the scale of transition required while at the same time having to balance the country’s energy security and economic growth considerations. For the second part of our research series, we examine transition investment opportunities in China and share a proposed framework that emerged from our research for assessing transition.

Transition investing opportunities in China

The amount of energy transition investments required globally are expected to grow to nearly US $5 trillion by 20301 and China is expected to have a significant share in transition financing. There have also been increased regulatory developments in various markets relating to transition planning as well as transition taxonomies in recent years, with an aim of making more capital available for transition finance.

Source: Tsinghua-Invesco Research; for illustrative purposes only.

There are broadly speaking two approaches to transition finance - investing in transition labelled issuances and investing in transition leaders in a portfolio:

- Transition issuances: China has been rapidly developing frameworks on transition with cities like Huzhou and Shanghai launching transition taxonomies in the past year across high-emitting sectors like chemical, cement, steel, agriculture2. These taxonomies provide activity-based guidance on sector and production activities and facilitate labelled issuances. By the end of 2022, Chinese issuers raised a cumulative 10.4 billion RMB in transition labelled bonds.3 Future areas of development could include looking at issuers’ transition plans as well as just transition considerations such as the impact on employment opportunities.

- Transition leaders: Whereas transition issuances are more specific to fixed income investment opportunities, for equity investors, having a transition strategy requires analyzing issuers more broadly to understand potential transition risks or opportunities. Typically, the basis of such an analysis is to look at transition plans or issuer strategies, providing investors with insight into - potential green revenues or green capex plans and evaluating the financial impact of the issuers’ decarbonization trajectories. As shared in previous articles, the investment thesis is to identify transition leaders that are better prepared to weather potential climate risks and are looking to capture revenue opportunities presented by the energy transition. Evaluating transition leadership therefore requires a holistic framework with which to differentiate companies.

Research framework for assessing transition

Source: Tsinghua-Invesco Research; for illustrative purposes only.

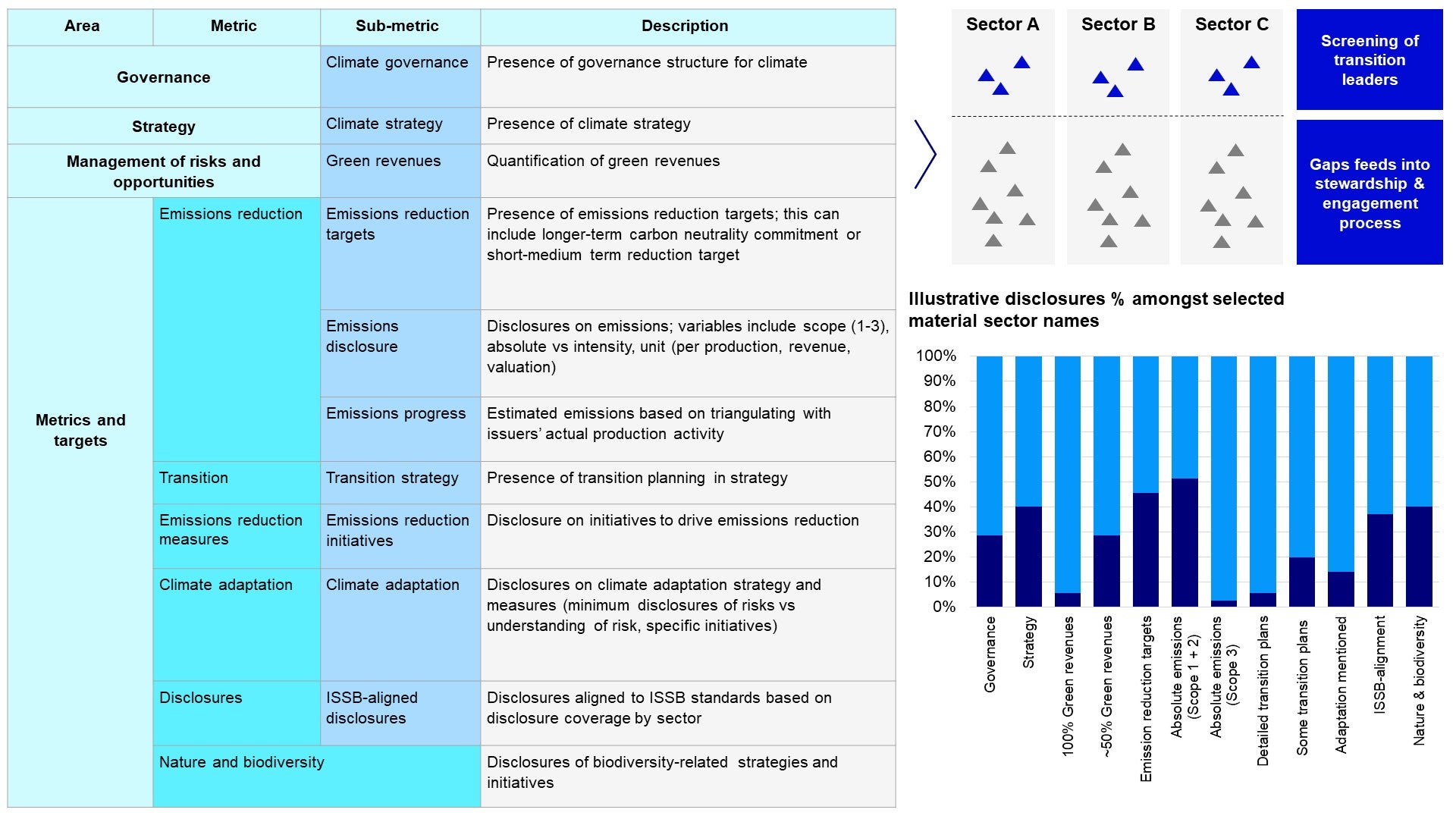

As mentioned previously, investing in climate transition in Asia requires identifying the forward-looking signals of companies. Our research framework is anchored by two key principles: 1) the use of forward-looking metrics incorporating latest trends such as International Sustainability Standards Board (ISSB) alignment and green revenues; and 2) alignment with global standards such as adopting the Task Force on Climate-Related Financial Disclosures’ (TCFD) framework for governance, strategy, risk management and metrics. Our proposed framework considers eleven metrics across the following:

- Governance: Assessing board and management alignment and commitment as a signal of the importance placed on a topic; the formation of sustainability or carbon neutrality committees

- Strategy: Enacting a strategy on climate particularly by assessing material climate risks and opportunities for a business

- Management of risks and opportunities: Quantifying and managing risks and opportunities identified such as through green revenues (with reference to Common Ground Taxonomy)

- Metrics and targets: Eight metrics across the themes of mitigation, transition, adaptation, nature and biodiversity as well as ISSB disclosures alignment.

This framework presents a list of indicators and metrics relevant for assessing issuers on their transition preparedness. Investors can take a building block approach and utilize the metrics that are most relevant for their target investments and the framework can also be used as an additional source of analysis for screening or for engagements.

Applying the framework to analyze transition progress in each sector

Source: Tsinghua-Invesco Research; for illustrative purposes only.

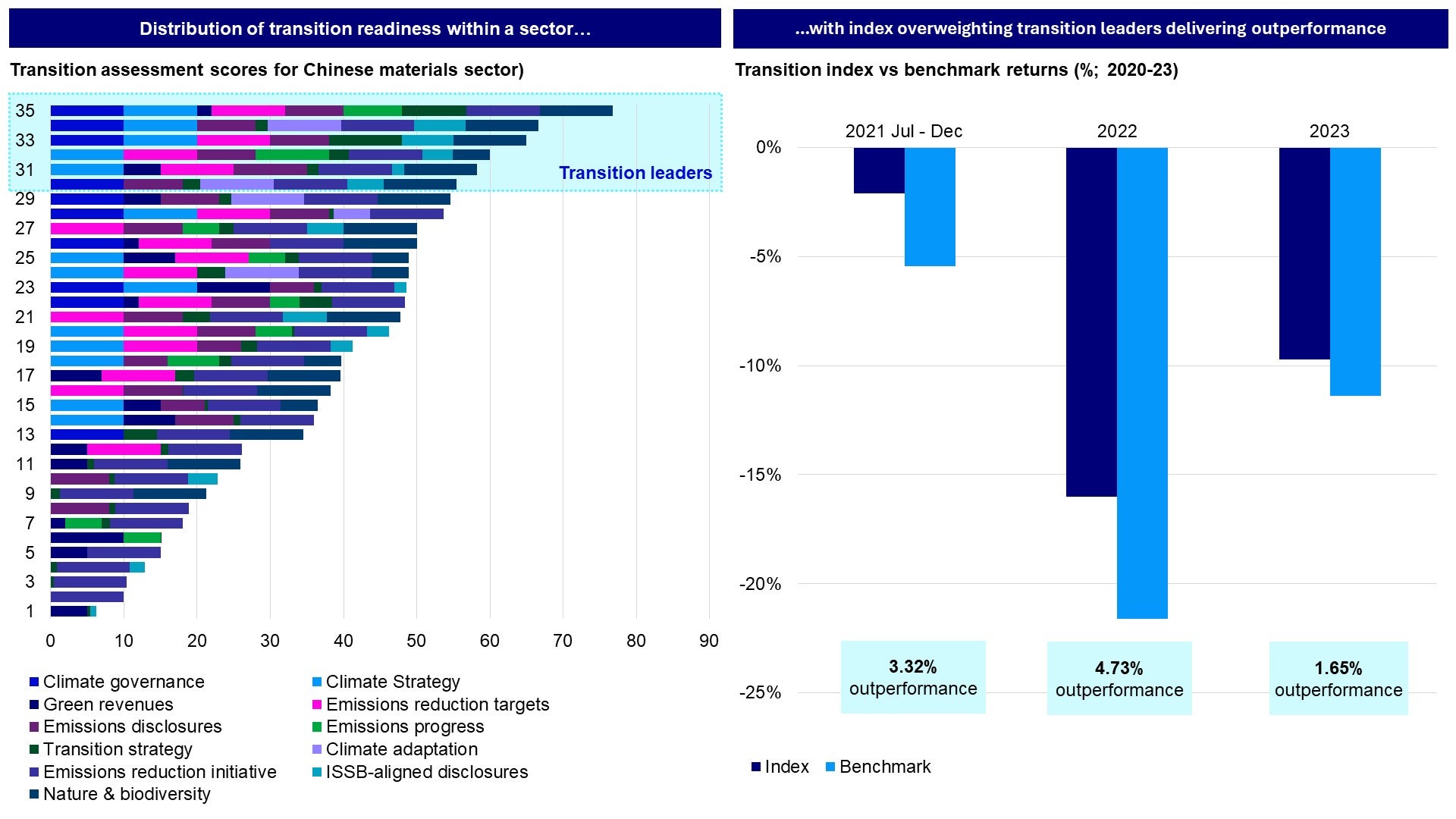

Taking the materials industry as a reference, our research analyzed 35 companies using the above framework. The results are reflective of broader industry trends. We found that while disclosures are gradually improving, the key gaps are in the details of climate strategies and plans. Generally, one-third of companies have basic governance and strategy in place. Most companies do not disclose their green revenues, but those that do see a significant share of revenues from new green materials. Nearly half the companies have emissions reduction targets and disclose their absolute emissions. Fewer companies disclose details around their specific transition initiatives and measures.

Because the range of disclosures and plans captured by these metrics is a proxy for a company’s preparedness, this analysis allows investors to assess the companies that are most likely to be transition leaders. One investment strategy might be to identify such transition leaders across each sector. For example, an index overweighting the top-performing transition leaders (as assessed by above framework) shows some outperformance compared to market benchmarks. The analysis is also helpful in reflecting on the existing gaps and risks that companies may have and can inform investors of priority issuers and topics for engagement on financially material issues.

With contributions from Alexander Chan, Yoshihiko Kawashima, Norbert Ling and Lisa Ren at Invesco, and Su Yingying and Zhou Chun Quan at Invesco Great Wall.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Footnotes

-

1

BloombergNEF, Jan 2024, Energy Transition Investment Trends (https://assets.bbhub.io/professional/sites/24/Energy-Transition-Investment-Trends-2024.pdf).

-

2

ARE, Dec 2023, Closing the gap: evolution of climate transition finance in China Closing-the-Gap_The-evolution-of-climate-transition-finance-in-China-.pdf (asiareengage.com)

-

3

ARE, Dec 2023, Closing the gap: evolution of climate transition finance in China Closing-the-Gap_The-evolution-of-climate-transition-finance-in-China-.pdf (asiareengage.com)