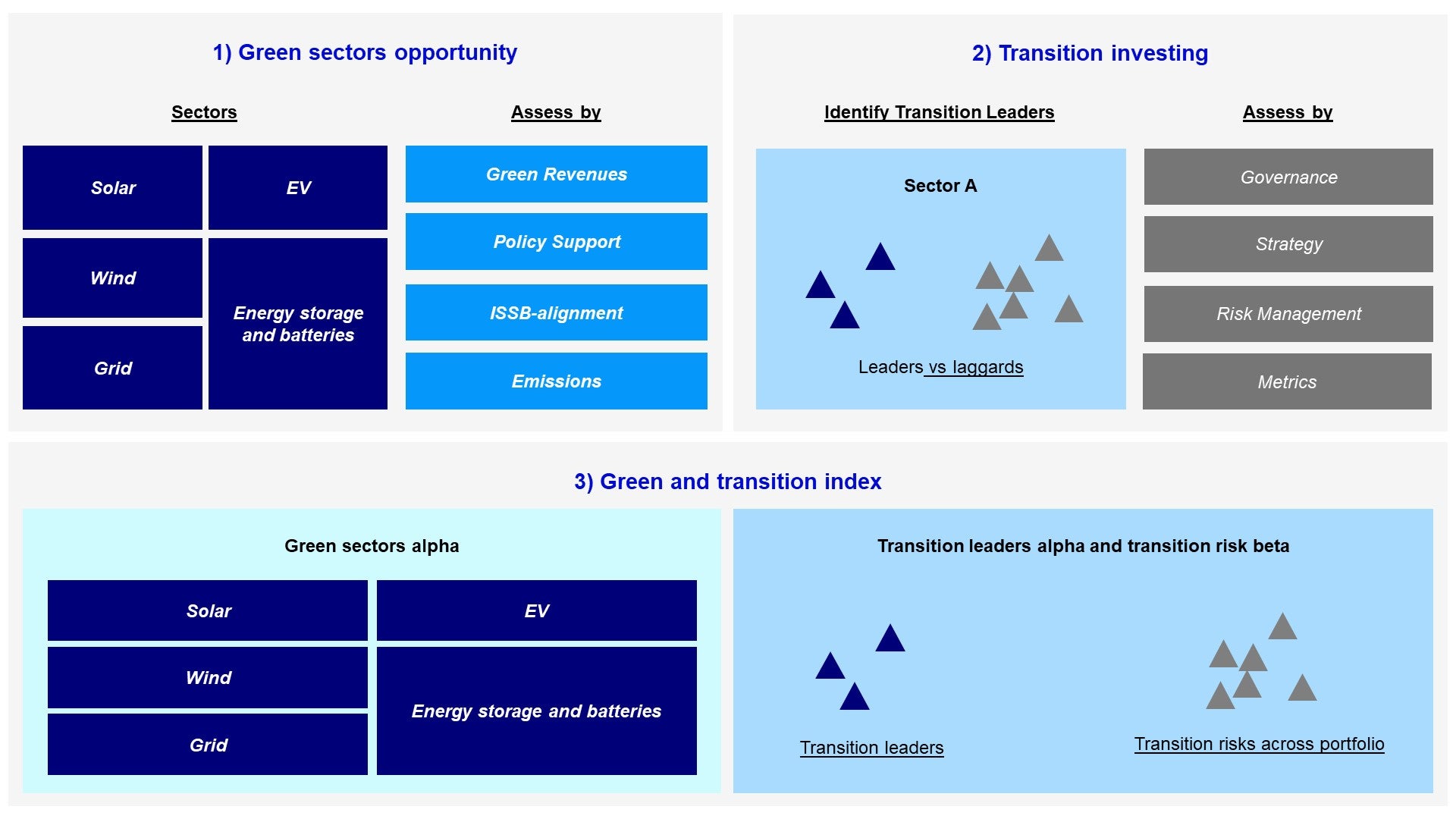

1) Green sectors investment opportunity: investing in green revenue and climate solutions

- Opportunity: Chinese green sectors could see meaningful growth given policy targets and export opportunities and could be both a source of thematic alpha as well as helping investors increase climate solutions allocation to meet decarbonization targets in investment portfolio

- Approach: A framework to analyze green sectors investments would consider: a) green revenues alignment; b) policy tailwinds; c) material risks and disclosures; and d) emissions.

- Green revenues: Using taxonomy alignment to identify green activities helps minimize greenwashing and enables investors to assess the extent of each company’s green revenues.

- Policy support: Analyzing the degree of policy support across the value chain given that we expect policy tailwinds to be a strong driver of sector growth. This would include looking at taxes, subsidies, loans, national targets, and carbon taxation policies.

- Material risks and disclosures: Looking at the alignment of disclosures with International Sustainability Standards Board (ISSB) standards can help provide a lens on how well companies are managing material risks in their supply chains and operations.

- Emissions impact: Assessing end-to-end emissions through approaches like process-based life cycle assessment (PLCA) and hybrid life cycle assessment (HLCA). Understanding the full emissions lifecycle of these sectors would be critical for export potential given carbon regulations relating such as the EU Ecodesign and Energy Label legislation for solar photovoltaics modules.

2) Framework for transition investing: Identifying transition leadership in China

- Opportunity: The increase in global carbon pricing through emissions trading schemes and taxes creates material costs for high-emitting businesses. At the same time, the growth of green revenues brings about new market opportunities. Companies making early transition progress in disclosures and planning can be seen as transition leaders and can capture financial upside as these risks and opportunities are priced in by the market.

- Approach: Tsinghua’s research has expanded on previous work on high-emitting sectors in China; expanding its coverage to new sectors including petrochemicals, cement, and aluminum. An updated transition framework also helps to assess issuers based on forward-looking metrics to identify transition leaders in each sector. Such a framework could include:

- Governance: Assessing board and management alignment and commitment as a signal of the importance placed on the topic; the formation of sustainability or carbon neutrality committees

- Strategy: Enacting a strategy on climate particularly by assessing material climate risks and opportunities for a business

- Risks and opportunities: Quantifying and managing risks and opportunities identified such as through green revenues (with reference to the Common Ground Taxonomy)

- Metrics and targets: Eight metrics across the themes of mitigation, transition, adaptation, and nature and biodiversity.

3) China’s green and transition index strategy: Combining alpha and beta exposure in index construction

- Opportunity: Green and transition indexes can drive financial product innovation and market growth. These indexes can present investors with an innovative and cost-effective approach to achieve portfolio thematic alpha and diversification while also supporting China’s low-carbon transition.

- Approach: Combining alpha and beta in green and transition index construction through the creation of a green index which is 2x overweight on green sectors and 1.5x overweight on transition leaders. The index would enable exposure to thematic alpha of green sector growth and transition leaders whilst also allowing for beta management through oversight of transition risks.

In this research series we examine each of the above opportunities and approaches and showcase how our research findings can help offer a framework for investing in China’s low carbon transition and high-quality development.

With contributions from Alexander Chan, Yoshihiko Kawashima, Norbert Ling and Lisa Ren at Invesco, and Su Yingying and Zhou Chun Quan at Invesco Great Wall.