Tsinghua-Invesco China ESG research: Investing in climate solutions and green revenues

This three-part research series covers three different opportunities and approaches to investing in China’s low-carbon transition: climate solutions, transition investing and green indexes.

The green sectors investment opportunity: Returns and climate solutions exposure

We believe green sectors are a critical driver for high quality economic growth and development in China. These sectors provide investment opportunities aligned to various investment objectives. Investors focused on returns can capitalize on the growth of China’s green sectors. For investors focused on decarbonization objectives, investing in green sectors can provide them with exposure to climate solutions.

Themes and considerations when investing in green sectors

Source: IEA New Energy (https://www.iea.org/reports/renewables-2023/executive-summary); Smart Grid (https://www.iea.org/data-and-statistics/charts/annual-grid-scale-battery-storage-additions-2017-2022); Battery (https://www.iea.org/data-and-statistics/charts/battery-demand-by-region-2016-2022); EVs (https://www.iea.org/data-and-statistics/charts/electric-car-sales-2016-2023 ); IEA Energy Sector Roadmap to carbon neutrality in China (Executive summary – An energy sector roadmap to carbon neutrality in China – Analysis – IEA ).

The Communist Party of China (CPC) Central Committee held its 12th group study session in February 2024 which focused on new energy technologies. President Xi emphasized the role of green sectors in driving China’s high-quality development whilst also ensuring energy security.1 China has seen significant build out of its green sectors with one of the most complete value chains globally. These sectors are expected to drive economic development, notably with additional jobs created by green sectors as well as increases in export opportunities and longer-term GNP growth. Green sectors were the largest drivers of China’s economic growth in 2023, accounting for 40% of GDP growth.2 Specific thematic areas include:

- Renewables and clean energy: Renewable energy accounted for more than 50% of China’s total installed power generation capacity in 20233 including a doubling of solar capacity and 66% increase in wind power capacity. These technologies are being exported to more than 200 countries globally and accounted for 60% of new renewable capacity added globally in 2023.4

- Electric vehicles (EVs): New electric car registrations in China grew by 35% in 2023 versus 2022 and just under 60% of new electric car registrations globally were in China5. China’s auto exports also surged to more than 63% in 20236 with a reach to various regions including Europe, Southeast Asia, and Latin America.

- Underlying infrastructure: We expect underlying clean energy and EV infrastructure to see investment growth, with grids expected to see about a 2.3x multiplier and energy storage roughly a 2.8x multiplier of investments required before 2030.7

While these sectors have seen strong growth, continued cost declines and increasing competition also signifies the need for investors to be selective in picking the right winners rather than just broad sector allocation. Investors need to understand broader supply chain dynamics particularly by analyzing opportunities in the underlying infrastructure and enabling technologies such as batteries, energy storage, and grid and transmission. Investors with additional investment objective of increasing climate solutions allocation or emissions reduction targets would also need to assess the alignment of issuers to ensure credible allocation and minimizing risks of greenwashing. These considerations call for the need for a framework to best analyze green sectors.

Framework for green sectors analysis and investing

Source: Tsinghua-Invesco Research; for illustrative purposes only.

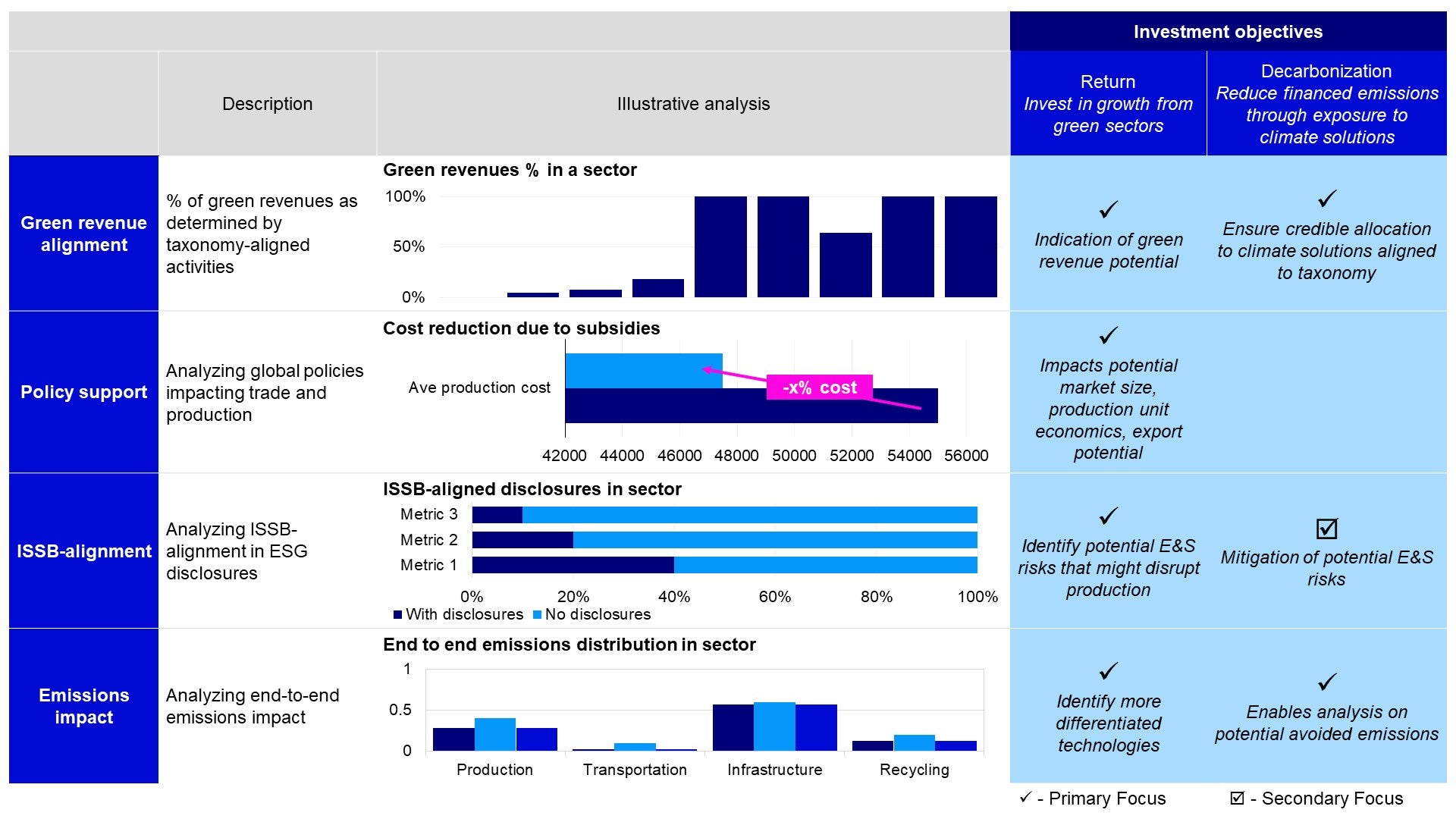

Broadly speaking, investors could be interested in green sectors either to invest in the growth of the green economy, or if they have additional investment objectives to decarbonize their financed emissions – in which case an allocation to climate solutions could help. Key areas that investors could assess include:

- Green revenue alignment: The best way to define or identify green sector names is often by determining if the revenues of these businesses can be considered green. Taxonomy alignment is often the basis, where be it the EU Taxonomy or China Green Bond Catalogue, these taxonomies help to define the different types of green and sustainable activities and products or services. Taxonomy alignment can provide a “first look” analysis of whether an investment can be considered a climate solution. Green revenue as a proportion of total revenue is another metric which can be particularly helpful in analyzing issuers that are not pure-play solutions names but rather transition names that are gradually increasing their share of climate solutions.

- Policy support: Green sectors have been a priority area for government policy; understanding the extent of government policy helps to provide context on where the sector could be headed in the future. The range of policies include:

- Industrial policy: This includes holistic sectoral policies across production, consumption, financing, and infrastructure. Under China’s 1+N policy, the EV sector for example crosses multiple areas involving industrial production, infrastructure, energy, and transport. These policies can also help to inform the potential size of the market given national targets for renewable growth or EV market share.

- Taxes, subsidies, and loans: To incentivize production and consumption uptake, China’s government has enacted policies around production tax reductions, subsidies, or loans for green sectors. These help to improve the unit economics of production and can enhance the initial market uptake of the segment. It is important to note however that EV subsidies have been declining over time as the market matures and that purchase subsidies ceased at the end of 2022.[1]

- Cross-border implications: There is an increasing emphasis being placed on investors to understand policy developments globally that might affect China’s market growth. While industrial policies overseas like the EU Green Deal offer valuable insights into how global market sizes might shape up, recent supply chain policies might also impact the extent of export opportunities for China. Notable policies include the EU Carbon Border Adjustment Mechanism which seeks to address carbon leakage through carbon taxation on imports to the EU in sectors like cement, power, steel and aluminum, or the US’s Inflation Reduction Act designed to incentivize local green sector production in the US through production tax credits.

- International Sustainability Standards Board (ISSB) and material risks: ISSB-aligned disclosures in green sectors provide a helpful reference framework with which to identify financially material ESG risks and metrics. For example, for the solar sector, water resource management and potential water stresses is a key area that investors can look at to determine how companies are sufficiently managing production-related risks. Companies with better disclosure standards can act as a proxy of whether they have adequately put in place supply chain policies or measures to prevent production disruptions. For investors with additional ESG investment objectives on top of financial returns, this analysis can also help to identify potential environmental and social risks.

- Emissions impact (output): Global regulations relating to carbon footprint in products such as the EU Ecodesign and Energy Label legislation for solar photovoltaic modules need to understand the end-to-end emissions impact. Companies with a competitive advantage in bringing down lifecycle emissions could be more favorable when considering export opportunities to Europe. Tsinghua’s research explores the approaches to assessing emissions impact including process-based life cycle assessment (PLCA), input-output life cycle assessment (I-O LCA) and hybrid life cycle assessment (HLCA). These approaches enable a comprehensive look at emissions across the value chain from production (including processing of materials) to transportation to recycling. Investors with climate solutions allocation as an objective can also go one step further to analyze the degree of avoided emissions to factor into their allocation decisions.

The above framework provides investors looking at green sectors with various dimensions for analysis. It illustrates how various factors can impact market growth and valuations of green sectors including competitive advantages, risks, and policy tailwinds. At the same time, the framework also provides assessment criteria that increases the credibility of identifying climate solutions in a portfolio.

With contributions from Alexander Chan, Yoshihiko Kawashima, Norbert Ling and Lisa Ren at Invesco, and Su Yingying and Zhou Chun Quan at Invesco Great Wall.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Footnotes

-

1

English.Gov.Cn, Mar 2024, Xi stresses high-quality development of new energy, greater contributions to building clean, beautiful world; https://english.www.gov.cn/news/202403/02/content_WS65e14600c6d0868f4e8e47ec.html

-

2

Carbon Brief, Jan 2024, Clean energy was top driver of China’s economic growth in 2023, https://www.carbonbrief.org/analysis-clean-energy-was-top-driver-of-chinas-economic-growth-in-2023/#:~:text=Chart%20by%20Carbon%20Brief.,up%20from%207.2%25%20in%202022.

-

3

English.Gov.Cn, Jan 2024, China drives world renewables capacity addition in 2023, https://english.www.gov.cn/news/202401/13/content_WS65a22a99c6d0868f4e8e30aa.html#:~:text=China's%20installed%20capacity%20of%20renewable,by%20the%20National%20Energy%20Administration.

-

4

English.Gov.Cn, Jan 2024, China drives world renewables capacity addition in 2023, https://english.www.gov.cn/news/202401/13/content_WS65a22a99c6d0868f4e8e30aa.html#:~:text=China's%20installed%20capacity%20of%20renewable,by%20the%20National%20Energy%20Administration.

-

5

IEA, Jan 2024, Global EV Outlook 2024, https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars

-

6

AP, Jan 2024, China auto exports rose 64% in 2023, https://apnews.com/article/china-auto-exports-ev-hybrid-7d553c31597125d6702b6691a8542cb1

-

7

BloombergNEF 2024, Jan 2024, Energy Transition Investment Trends (https://assets.bbhub.io/professional/sites/24/Energy-Transition-Investment-Trends-2024.pdf).

-

8

Yahoo Finance, Mar 2024, A closer look at China’s changing EV landscape, https://finance.yahoo.com/news/closer-look-chinas-changing-ev-134800981.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAANxPnOLUrRYOiR1XClsL01LZuwCbta99yTx-T36_TcTBfH9wfSJwBH5M0QQS-KbwEtXPjOS5vFCpACiATU0ufhcOkU0FPnRE_bGdh9nKY7dWJ7xX5OtZ1notCRoUMLXXo9kdt5mTSCE3_cjz8HIKexG1Ww30Mr4UCcBseZ6iHoT