Tsinghua-Invesco China ESG research: Green and transition indexes in China

This three-part research series covers three different opportunities and approaches to investing in China’s low-carbon transition: climate solutions, transition investing and green indexes.

We are seeing growth in sustainable investments globally and particularly in China, alongside increasing demand for transition financing. Indexes have always served as a compass and signal for market trends, growth, and volatility. 2022 saw ESG indexes grow by 55.1% year-on-year1 and since then we’ve seen a proliferation of relevant investment opportunities in green and transition indexes.

Green indexes can drive financial product innovation and market growth

As shared in a previous article, ESG index and passive strategies help to facilitate financial product innovation and can be customized for investor’s objectives and preferences to achieve thematic exposure. In the context of the China market, we believe three opportunities stand out:

- Asset allocation into green and transition investments: Green and transition indexes provide a framework for defining green and transition investments and facilitate asset allocation and capital flows towards these opportunities. This objective also aligns with China’s Central Finance Work Conference priority areas where green finance is a key component.

- Incorporating green considerations and risks into an investment strategy: There has been an increasing emphasis on climate-related risks as seen in regulatory developments; green indexes can allow for better risk management and climate considerations in the investment process.

- Supporting industrial and manufacturing upgrades: Capital flows into green and transition sectors can support China's economic transition by focusing on quality growth through exports and manufacturing upgrades.

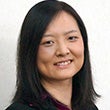

Index landscape: Indexes can be customized based on investors’ objectives and preferences

Source: Tsinghua-Invesco Research; for illustrative purposes only.

Global indexes have a range of approaches that can be implemented with a long history since the 1990s when social and sustainability indexes were created. Globally there are more than 50,000 ESG indexes2 that generally fit into three broad categories:

- ESG screened or leaders: Excluding companies with lower scores or certain sectors or on the flip side adopting positive screening for portfolio construction. This can be based on financially material risks or sectoral/ value preferences of investors.

- ESG tilting: Increasing portfolio weights based on ESG metrics; ESG ratings or ESG momentum/ trends

- ESG optimization: Optimizing on an indicator or outcome (e.g. lower carbon emissions versus benchmark)

Within the China landscape, ESG indexes have focused more on themes selection with many more aligned to clean energy or electric vehicle (EV) themes. Broad themes include:

- ESG: ESG leaders or ESG screened such as excluding companies with lower ESG ratings; screening or tilting on ESG ratings; using ESG as a factor to mitigate financially material ESG risks while also considering other value, quality, or growth factors

- Green themes: Themes relating to green technologies or green consumption, including looking at technologies relating to solar, wind, batteries and energy storage, grid and EVs; universe construction based on alignment to the theme in question

- Transition: Focused on carbon neutrality; universe construction based on assessing companies’ transition progress such as looking at metrics relating to targets, emissions progress and transition plans

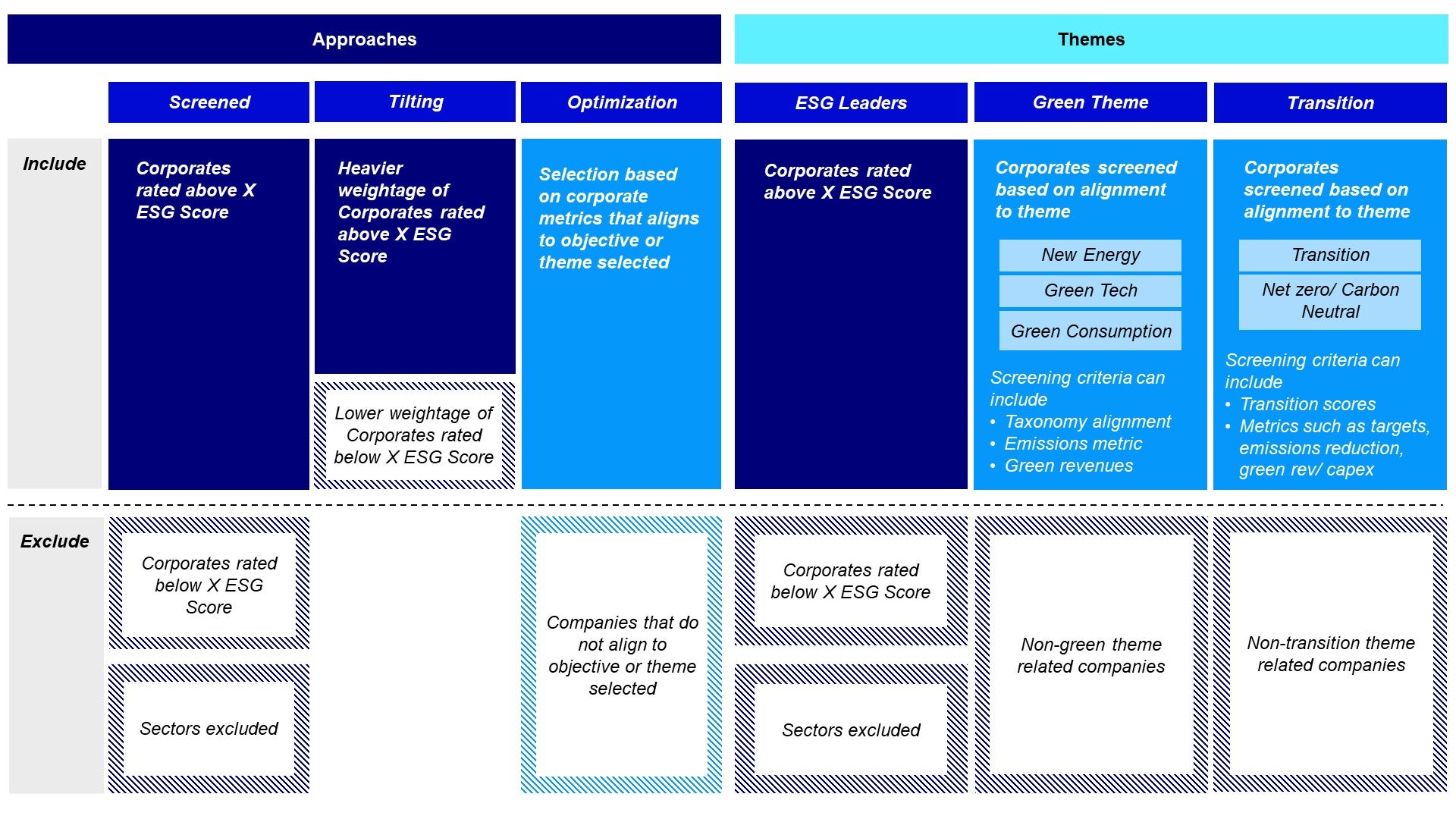

Construction approaches: Combining alpha and beta in index construction

Source: Tsinghua-Invesco Research; for illustrative purposes only.

Green and transition investing if combined through an index could offer investors exposure to both alpha and beta management.

- Green sectors can be a source of thematic alpha exposure. China’s green sectors like renewables and EVs can be a driver of quality economic growth and export opportunities.

- Transition assessment can be seen as additional risk management in a portfolio. For one it enables portfolio diversification as the inclusion of high-emitting sectors can mitigate market volatility, promote sector diversification and prevent concentration. The economic share of transition sectors also presents longer-term upside for transition leaders who are better positioned with reduced risks on costs if carbon pricing comes into play and increased opportunities relating to capture green revenues growth.

- Climate outcomes alignment: For investors with climate targets and commitments, this strategy looks at aligning a portfolio to outcomes, such as allocating to climate solutions while also progressively looking to decarbonize the portfolio.

- Research findings: As detailed in Figure 2, the model index in Tsinghua’s research is 2x overweight on green sectors and a 1.5x overweight on transition leaders (top 20% performers in each sector). Backtesting of the index over past 4 years shows an annualized outperformance of 9.4% compared to the benchmark.

Globally, we believe opportunities exist across the themes of climate mitigation (solutions and technologies driving decarbonization), adaptation (solutions that can increase climate resiliency), and transition (adoption of green technologies and business models). Complementing our previous analysis across Asia, ASEAN, Japan and India, this research series delves into the various opportunities in the China market and calls for investors to consider three broad approaches to investing in green and transition opportunities.

With contributions from Alexander Chan, Yoshihiko Kawashima, Norbert Ling and Lisa Ren at Invesco, and Su Yingying and Zhou Chun Quan at Invesco Great Wall.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.