Equities What drives the Asian consumer? – Digitalization

Digitalization is very evident in Asia, and is becoming a larger component of GDP in many Asian economies.

We believe Asian consumer demand represents one of the most exciting consumer stories in investment history. Supported by a large population base and fast economic growth, Asia’s consumer economy is simply massive. It has more than half of the world’s total middle class and is the world’s largest retail market. It is well documented that both of these are poised for further expansion.

At the heart of this, we see five mega trends propelling this sustained consumption growth in Asia - digitalization, premiumization, experience, urbanization and wellness. Each of these trends is unique and structural and reflects the driving forces behind this growth.

Despite disruptions caused by the ongoing pandemic, we believe these trends remain intact, with some even being accelerated during this challenging period. For example, our transition to an online lifestyle and our increasing awareness of personal health issues.

The Invesco Asia Consumer Demand Fund is manged by the Asia Equity Investment Team and is focused on consumer demand-related stocks in the Asia ex-Japan region. Launched in 2008, the fund has one of the longest track records in this sector.

We believe five mega trends represent significant forces of structural growth, which will shape the Asian consumer landscape in the years to come. These trends provide a stock selection framework for our highly active strategy that allows us to seek opportunities across economic areas, without being confined by traditional sectors.

Digitalization is very evident in Asia, and is becoming a larger component of GDP in many Asian economies.

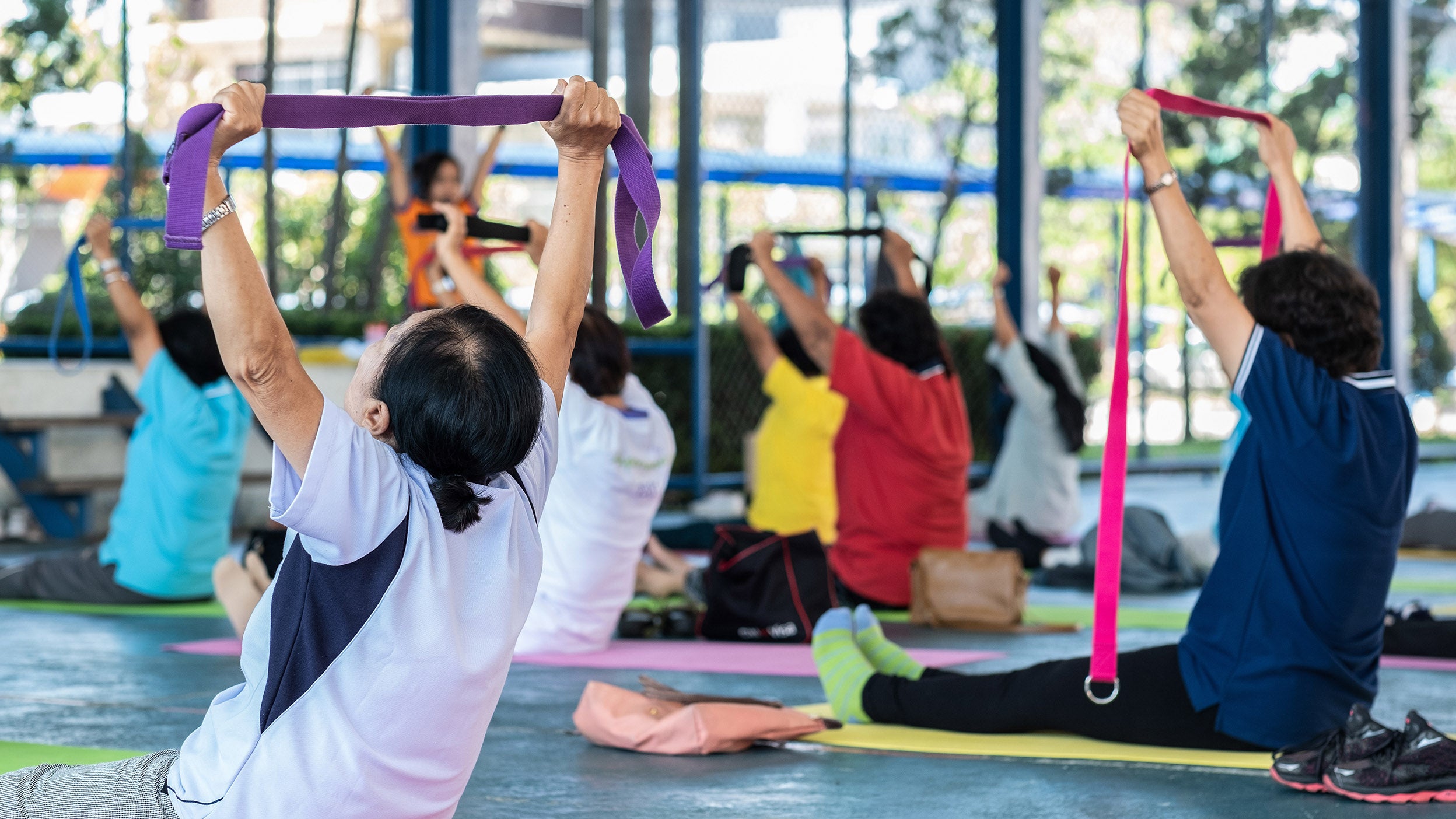

The growing Asian middle class is a well-documented phenomenon. Unsurprisingly, as Asian consumers are becoming more affluent, they have an increased focus on quality of life.

As their income levels rise, Asian consumers have become increasingly engaged with a breadth of experiences from travel and fine dining to extreme sports to enrich their lives.

Cities are important engines of economic growth. Increased population density leads to more transactions, higher levels of information and interactions, which leads to greater efficiency and productivity.

The pandemic has worked like a wake-up call, reminding us all how valuable and critical it is to stay healthy. Even before the pandemic, people in Asia were already starting adopt healthier lifestyles.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. As a large portion of the fund is invested in less developed countries, you should be prepared to accept significantly large fluctuations in the value of the fund. The fund may invest in certain securities listed in China which can involve significant regulatory constraints that may affect the liquidity and/or the investment performance of the fund.

Data as at 30.04.2021, unless otherwise stated. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.