What drives the Asian consumer? – Premiumization

The growing Asian middle class is a well-documented phenomenon. Unsurprisingly, as Asian consumers are becoming more affluent, they have an increased focus on quality of life.

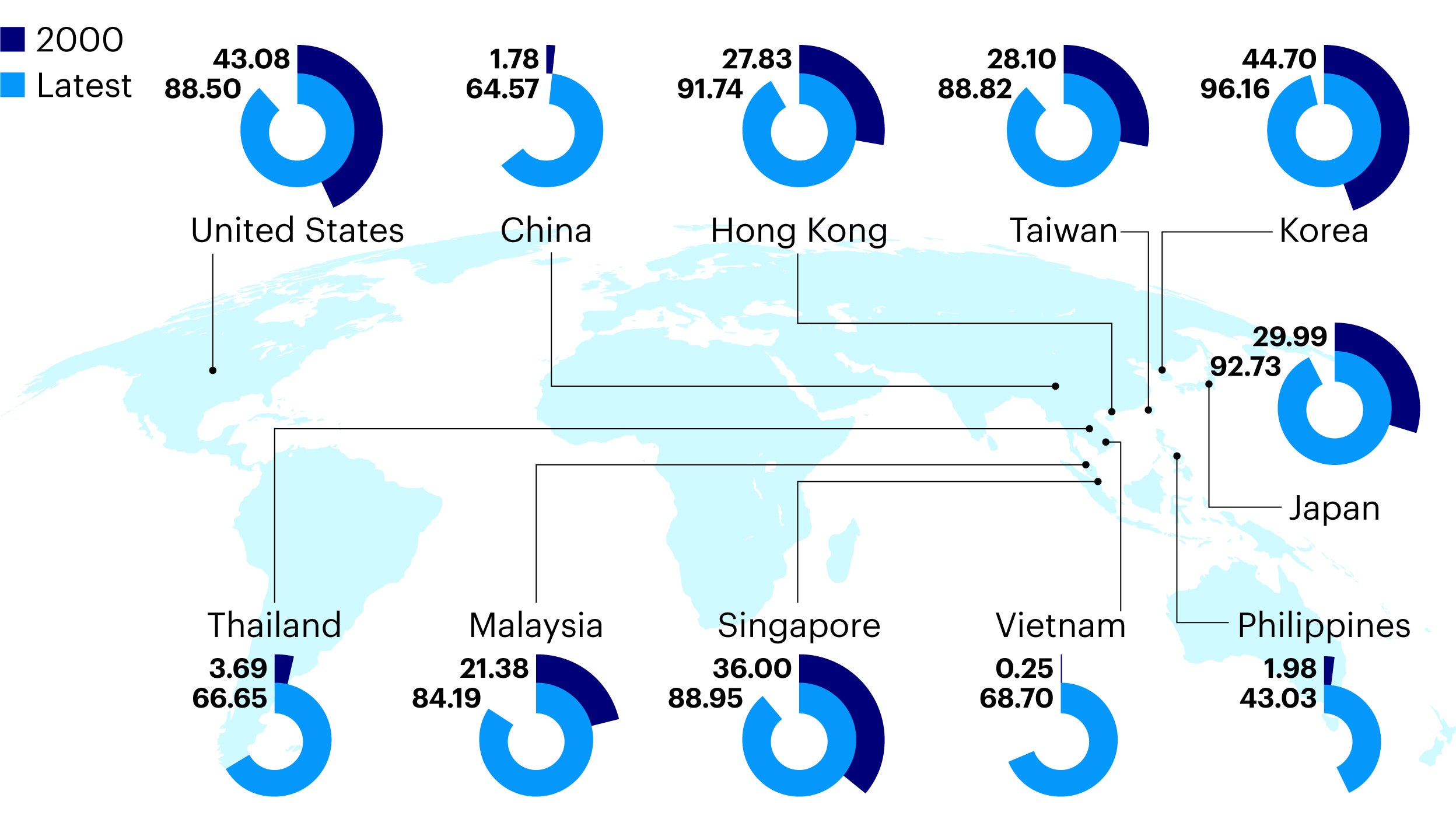

Digitalization is very evident in Asia, and is becoming a larger component of GDP in many Asian economies. Internet penetration has grown significantly across the region, largely thanks to a fast improving infrastructure and reduced costs. The pandemic has accelerated this trend as people have increasingly relied on the internet to provide connectivity in their personal and work lives during lockdowns.

We have seen a spike in many online activities, such as e-commerce and video streaming. Meanwhile, online medical consultation have gained traction as regular visits to the doctor became either risky or impossible. We believe these online behaviours are here to stay and will continue to penetrate daily life.

The internet embodies digitalisation and is a key area of focus for the team - the fund already has some interesting exposure in this space. In China alone, we hold a wide range of internet companies that function within e-commerce, mobile gaming, social media, food delivery and video streaming, among others.

With more than 900 million internet users, China is already the largest online market in the world and still has significant potential for growth. Technology has penetrated people’s lives to whole new level. China’s answer to WhatsApp, for example, is far more than the simple messaging app it once was. Owned by Chinese tech giant Tencent, WeChat now allows its users to complete payments, play games with friends, hail a ride or even book flights. Frankly, its capabilities are endless, as companies create mini-programmes through WeChat’s ‘app-within-an-app’ model. This is turning it into a one-stop shop not seen elsewhere.

We expect Chinese companies to be the driving forces in further developing the country’s digital ecosystem and it is estimated that more than US$1 trillion will be invested by Chinese companies in digital transformation from 2020 to 2023 alone. We believe these investments will form the backbone of a strong digital economy and will clearly translate to increased opportunities in the internet sector.

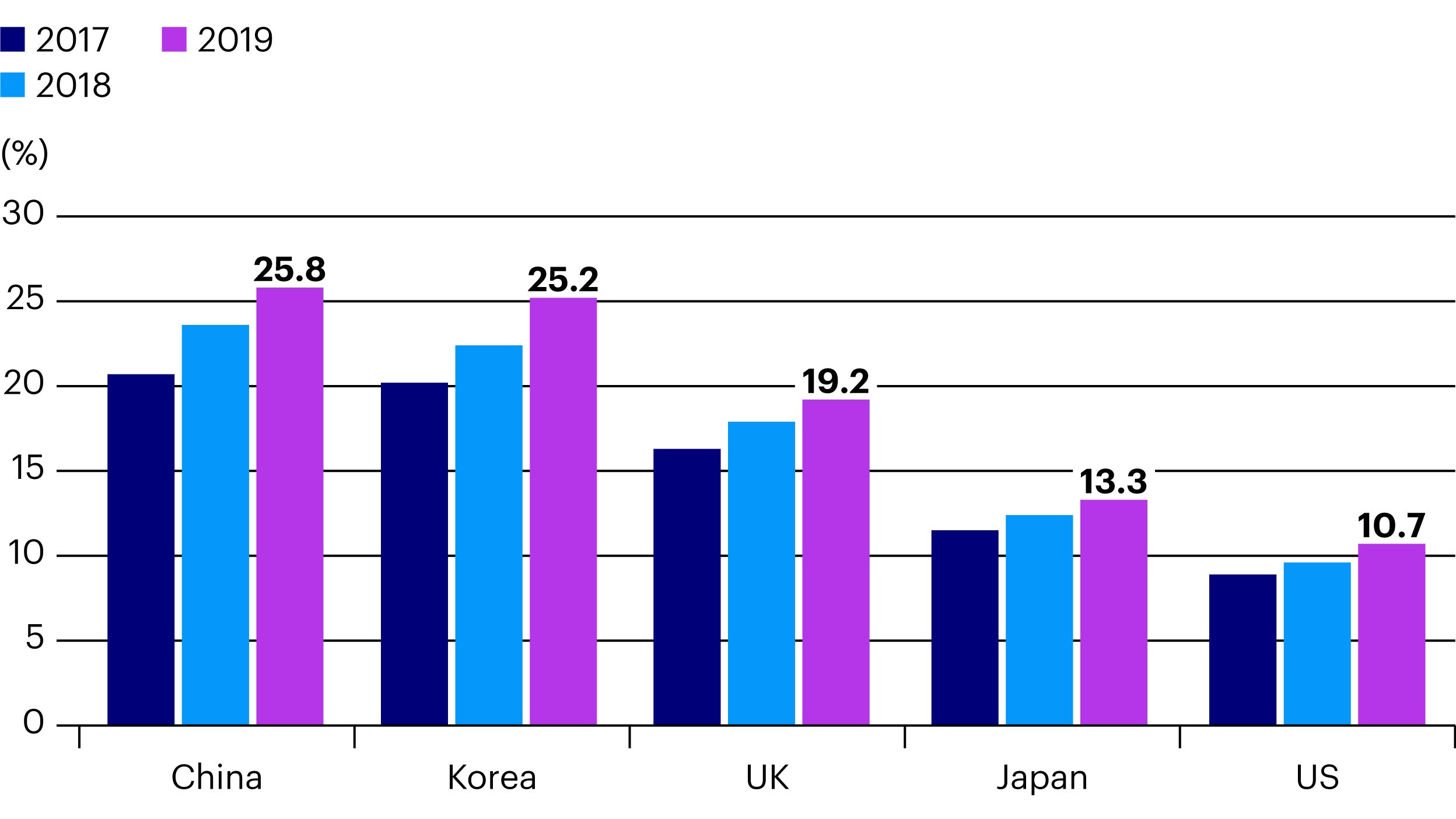

Outside China, the fund has exposure to a number of internet companies in South Korea. The country is a famously well-connected nation and has some of the world’s fastest internet speeds; it is also the sixth-largest market for eCommerce. Online sales penetration in Korea is significantly higher than that in China and the average Korean spends almost three times more on online channels than the average Chinese person. This makes Korea a natural hotbed of innovation in the internet space providing some truly standout investment opportunities.

One of the fund’s holdings in South Korea is Naver, the country’s leading search engine1 and eCommerce platform. The pandemic has boosted its eCommerce business, helping the company secure a position in one of the few remaining structural growth themes in Korea.

What drives the Asian consumer? – Premiumization

The growing Asian middle class is a well-documented phenomenon. Unsurprisingly, as Asian consumers are becoming more affluent, they have an increased focus on quality of life.

What drives the Asian consumer? – Urbanization

Cities are important engines of economic growth. Increased population density leads to more transactions, higher levels of information and interactions, which leads to greater efficiency and productivity.

What drives the Asian consumer? – Wellness

The pandemic has worked like a wake-up call, reminding us all how valuable and critical it is to stay healthy. Even before the pandemic, people in Asia were already starting adopt healthier lifestyles.

What drives the Asian consumer? – Experience

As their income levels rise, Asian consumers have become increasingly engaged with a breadth of experiences from travel and fine dining to extreme sports to enrich their lives.

1 Source: Statista. Global Consumer Survey 2020. When asked ‘Which search engines have you used in the past 4 weeks?’, 92% of respondents selected Naver. In comparison, Google came in second place at 69%.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. As a large portion of the fund is invested in less developed countries, you should be prepared to accept significantly large fluctuations in the value of the fund. The fund may invest in certain securities listed in China which can involve significant regulatory constraints that may affect the liquidity and/or the investment performance of the fund.

Data as at 30.04.2021, unless otherwise stated. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.