What drives the Asian consumer? – Digitalization

Digitalization is very evident in Asia, and is becoming a larger component of GDP in many Asian economies.

Cities are important engines of economic growth. Increased population density leads to more transactions, higher levels of information and interactions, which leads to greater efficiency and productivity.

Indian cities, for example, despite accounting for only 35% of the country’s population, generate 75% of its GDP. If we take out more developed economies like Korea and Singapore, urbanization rates in most parts of Asia are low compared with the global average, leaving ample room for further expansion.

According to the United Nations, India and China are projected to add 671 million to their urban populations between 2018 and 2050, which represents more than a quarter of the global increase in urban population during this period.

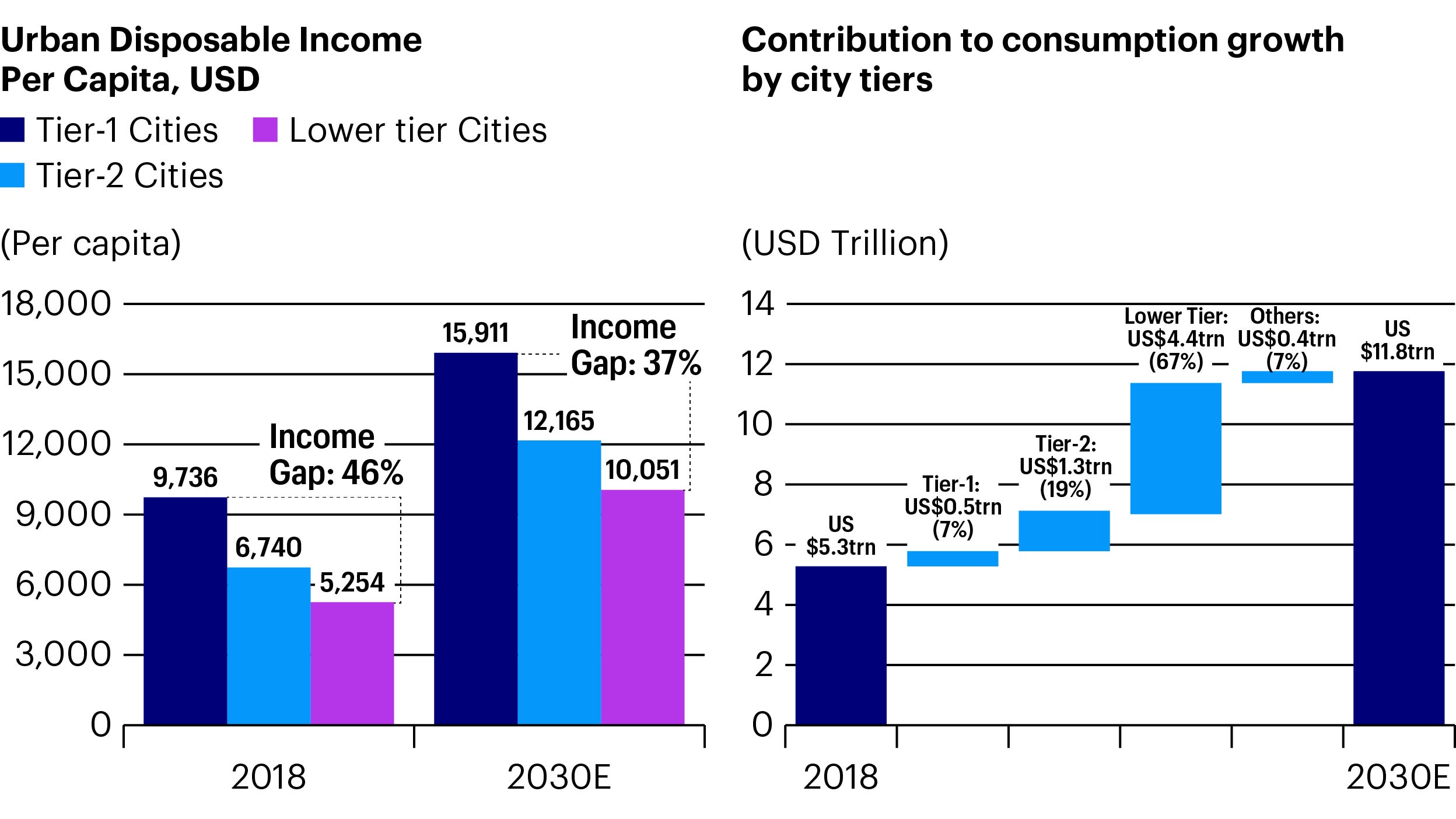

We believe there are multiple ways companies can ride this trend and create true financial impacts. In China, we see companies developing differentiated and targeted strategies towards consumers in lower-tier cities. The income gap is narrowing across Chinese cities, with lower-tier cities contributing two-third of China’s consumption by 2030. We believe this to be the driver of the next leg of revenue growth.

In India, we have exposures to a number of private financial institutions. We believe they will be key beneficiaries as people increasingly accessfinancial products and services when they move to cities. Moving to cities tends to lead to a deeper banking relationship and clients become more open to exploring financial products.

What drives the Asian consumer? – Digitalization

Digitalization is very evident in Asia, and is becoming a larger component of GDP in many Asian economies.

What drives the Asian consumer? – Premiumization

The growing Asian middle class is a well-documented phenomenon. Unsurprisingly, as Asian consumers are becoming more affluent, they have an increased focus on quality of life.

What drives the Asian consumer? – Wellness

The pandemic has worked like a wake-up call, reminding us all how valuable and critical it is to stay healthy. Even before the pandemic, people in Asia were already starting adopt healthier lifestyles.

What drives the Asian consumer? – Experience

As their income levels rise, Asian consumers have become increasingly engaged with a breadth of experiences from travel and fine dining to extreme sports to enrich their lives.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. As a large portion of the fund is invested in less developed countries, you should be prepared to accept significantly large fluctuations in the value of the fund. The fund may invest in certain securities listed in China which can involve significant regulatory constraints that may affect the liquidity and/or the investment performance of the fund.

Data as at 30.04.2021, unless otherwise stated. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.