ETF The strategic advantage of AAA-rated CLO Notes

Invesco Private Credit’s Kevin Petrovcik discusses new developments for AAA-rated Collateralised Loan Obligation (CLO) note investments and their potential advantages.

Exchange-traded funds and commodities are a hotbed of innovation and an exciting way for investors to access capital markets. Read our insights on the latest news and developments in this fast moving area.

Invesco Private Credit’s Kevin Petrovcik discusses new developments for AAA-rated Collateralised Loan Obligation (CLO) note investments and their potential advantages.

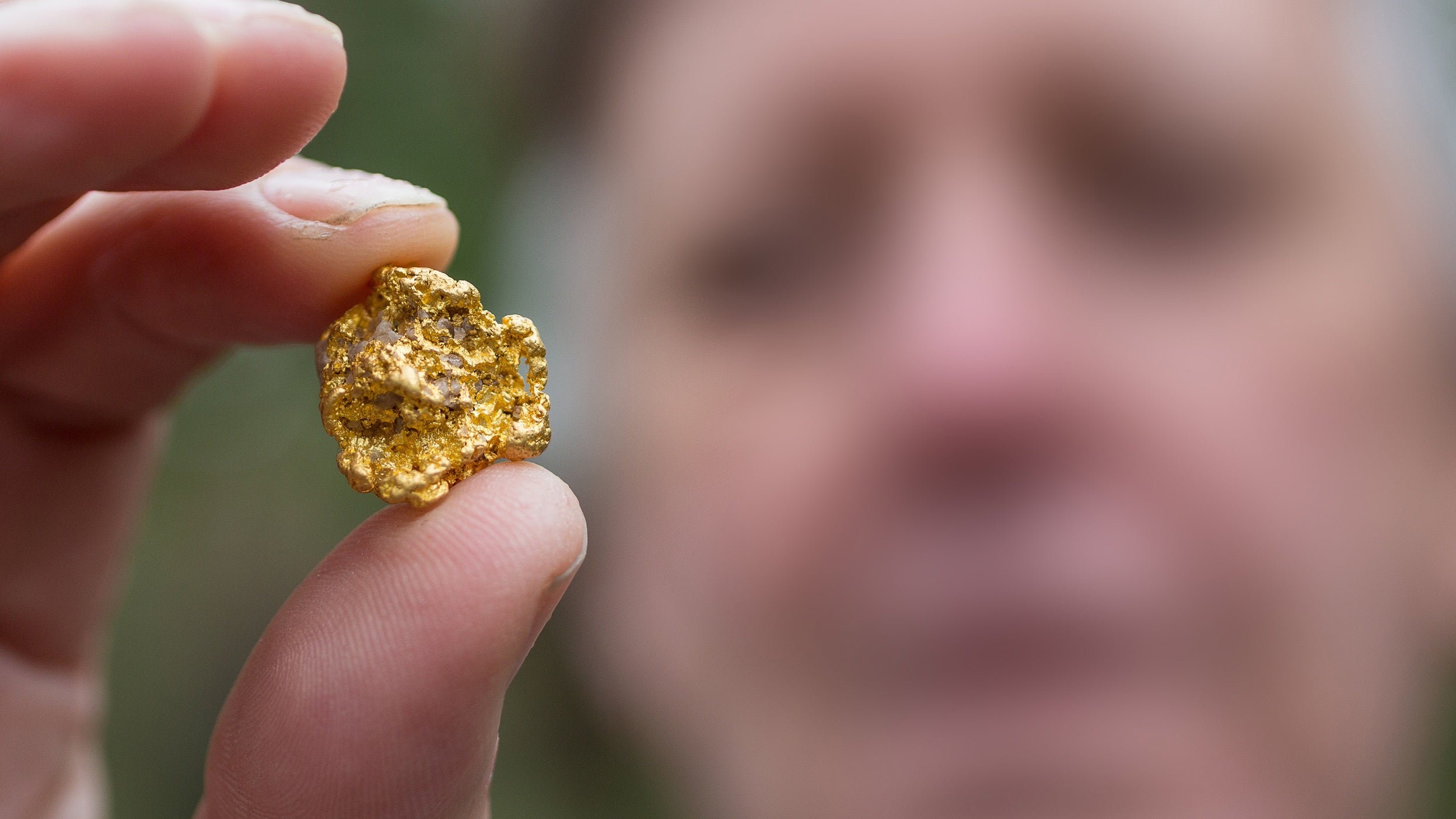

Gold had a remarkable month, gaining 9.3% after breaking through US$3,000 and ending March at US$3,124. Economic and geopolitical uncertainty drove the gold price higher ahead of the trade tariffs scheduled to be announced on 2 April. Discover insights into the key macro events and what we think you should be keeping your eyes on in the near term.

Bond markets struggled in March, primarily due to concerns about the potential impact of upcoming US policies. Read our latest thoughts on how fixed income markets fared during the month and what we think you should be looking out for in the near term.

US equity markets were boosted in Q4 by enthusiasm around Trump’s election victory, although enthusiasm was tempered in December by the Fed’s cautious approach to future interest rate cuts. Read our quarterly US equities update to find out more.

As we enter the final quarter of the year, our experts look back at the ‘year of the bond market’ and share their thoughts on the outlook for Fixed Income assets going forward.

Bond ladders are portfolios of bonds with sequential maturity dates. As bonds reach maturity, the proceeds can be used to fund a specific expense, such as saving for a house or retirement, or reinvested into new bonds with longer maturities.

The crypto market is preparing for the next Bitcoin halving. What does the halving mean and what are the longer-term prospects for investors in Bitcoin?

Explore the case for the Nasdaq-100 index and how its constituents are driving innovation across the global economy.

The Nasdaq-100 is an index that tracks the 100 largest non-financial companies by market capitalization listed on the Nasdaq.

Technology has disrupted just about everything. Learn how innovation is driving something as simple as your favourite cup of coffee.

In this second part of the Gold Report, we explore the various sources of supply and demand to further explain recent movements in the gold price.

Today, gold plays an important part in some investors’ portfolios, for a variety of reasons. From central banks wanting to diversify their reserves to individuals wanting physical assets that may retain value over time. Find out more.