Being both defensive and flexible is key for investors during these moments.

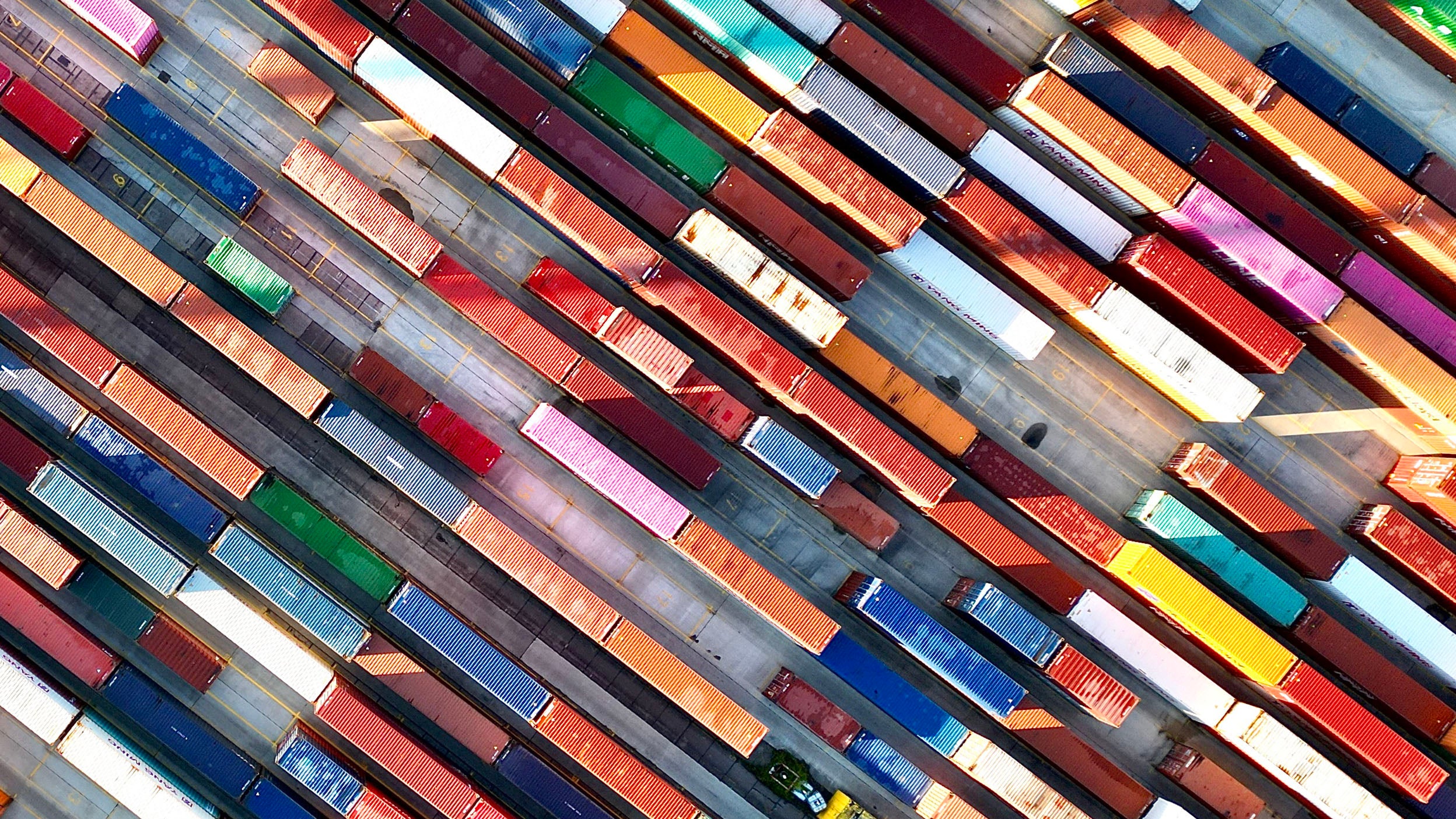

We have witnessed a dramatic repricing of risk in the first few months of 2025. Following the “Liberation Day” tariffs, US equity markets have posted their 16th worst two-day period since 1928. The once unstoppable US large cap equity market has underperformed its global counterparts since Trump’s election on November 4th, 2024, with a rotation into non-US equities and “risk-off” assets underway.

Being both defensive and flexible is key for investors during these moments as trade policies could be reversed just as quickly as they have been imposed. We have written extensively about the risks looming over US equity markets for quite some time, with elevated valuations and market concentration being key themes of our capital market assumption (CMA) publications.

Optimize your investment process and outcomes with expert guidance and innovative analytics from Invesco.

Portfolio Playbook

Transcript

Alternatives Playbook

Transcript

Asset allocation

Tactical Asset Allocation

Transcript

Partner with us for a portfolio consultation

Our Investment Solutions team can collaborate with you and your Invesco strategic partner to optimize your portfolio outcomes.

Relative tactical asset allocation (TAA) positioning and CMA scoring (Q4 2024)

We measure the portfolio risk for the tactical asset allocation positioning and CMA scoring across asset levels and opine on where it makes more sense to source the risk along the spectrum. on a range of Shown is the relative tactical asset allocation positioning related to risk divided into three categories: underweight, neutral and overweight across various asset classes.

- The top ledger shows the spectrum range beginning on the left-hand side is maximum overweight, middle is neutral, and the far right-hand side is maximum underweight

- First line: Fixed income CMA scoring and equities TAA positioning are between maximum overweight and neutral in the below average portfolio risk.

- Second line: US equities TAA positioning is below average portfolio risk and DM ex-US equities CMA scoring is moderately above average portfolio risk

- Third line: DM equities TAA positioning is below average portfolio risk and EM equities CMA scoring is moderately above average portfolio risk

- Fourth line: Large-cap equities TAA positioning is below average portfolio risk and small-cap equities CMA scoring is above average portfolio risk

- Fifth line: Government TAA positioning is nearing neutral portfolio risk and credit CMA scoring is above average portfolio risk

- Sixth line: Quality credit TAA positioning is nearing neutral portfolio risk and risky credit CMA scoring is above average portfolio risk

- Seventh line: Short duration CMA scoring is neutral and long duration is moderately above average portfolio risk

Fixed income commentary

CMA returns for fixed income have dropped over the quarter, with current yields falling below their expected future yields, creating a negative valuation change as yields shift upward as they mature. Global aggregate bonds are expected to return 4.5% over the next decade, around -0.6% less than last quarter and 1% less than we anticipated last year. Credit assets are still expected to outperform government bonds, with broadly syndicated loans and high yield both expected to return 5.7%, -0.7% less than last quarter.

Equities commentary

Our CMA return for global equities is 5.4%, slightly higher than that of US equities, and dragged down due to the large overweight in the index towards overvalued US large cap equities. Quarter-over-quarter all major equity CMA’s have declined mostly due to higher valuations (-0.5% globally), outside of Japan, whose fundamentals (as measured by the price-to-book ratio) have returned to their long-term average. The change in the valuation component of China in particular stands out at -1.9%, with the price of the index rising considerably this past quarter on the hopes of a yet-to-be delivered stimulus package. When gauging relative opportunities outside of the US, emerging markets (EM) stand out due to a compelling expected earnings growth rate and a slightly positive tailwind from valuations. Within the US, small cap equities are more attractive than their larger counterparts as they have higher expected earnings growth rates and are near fair-value.

Alternatives commentary

Global REITS, infrastructure, hedge funds, and commodities all are attractive relative to traditional assets as they are all expected to outperform US equities on a forward basis. Real assets are still recovering following the increase in interest rates relative to public equities and have a more attractive valuations. Further, they provide impressive dividend yields and are valuable diversifiers with low correlations to both equities and fixed income. From a risk adjusted perspective, all major alternative assets that we cover have expected return-to-risk ratios near double that of US equities, with global infrastructure (0.7) and hedge funds (0.8) standing out.

NA4409498