Markets and Economy US stocks bear the brunt of global economic uncertainty

The global economic outlook is uncertain, yet European, UK, Chinese, and Japanese stocks all rose last week while US stocks fell.

Fresh perspectives on economic trends and events impacting the global markets.

Get timely investment ideas, an overview of what’s happening in the markets, and tips to help optimize your portfolios in our monthly playbook.

The global economic outlook is uncertain, yet European, UK, Chinese, and Japanese stocks all rose last week while US stocks fell.

While stock market volatility can be unsettling in times of uncertainty, remembering these things can help you weather the storm.

Six things to watch in the coming weeks, including US Treasury yields, US and European sentiment, US earnings outlook, and Chinese economic data.

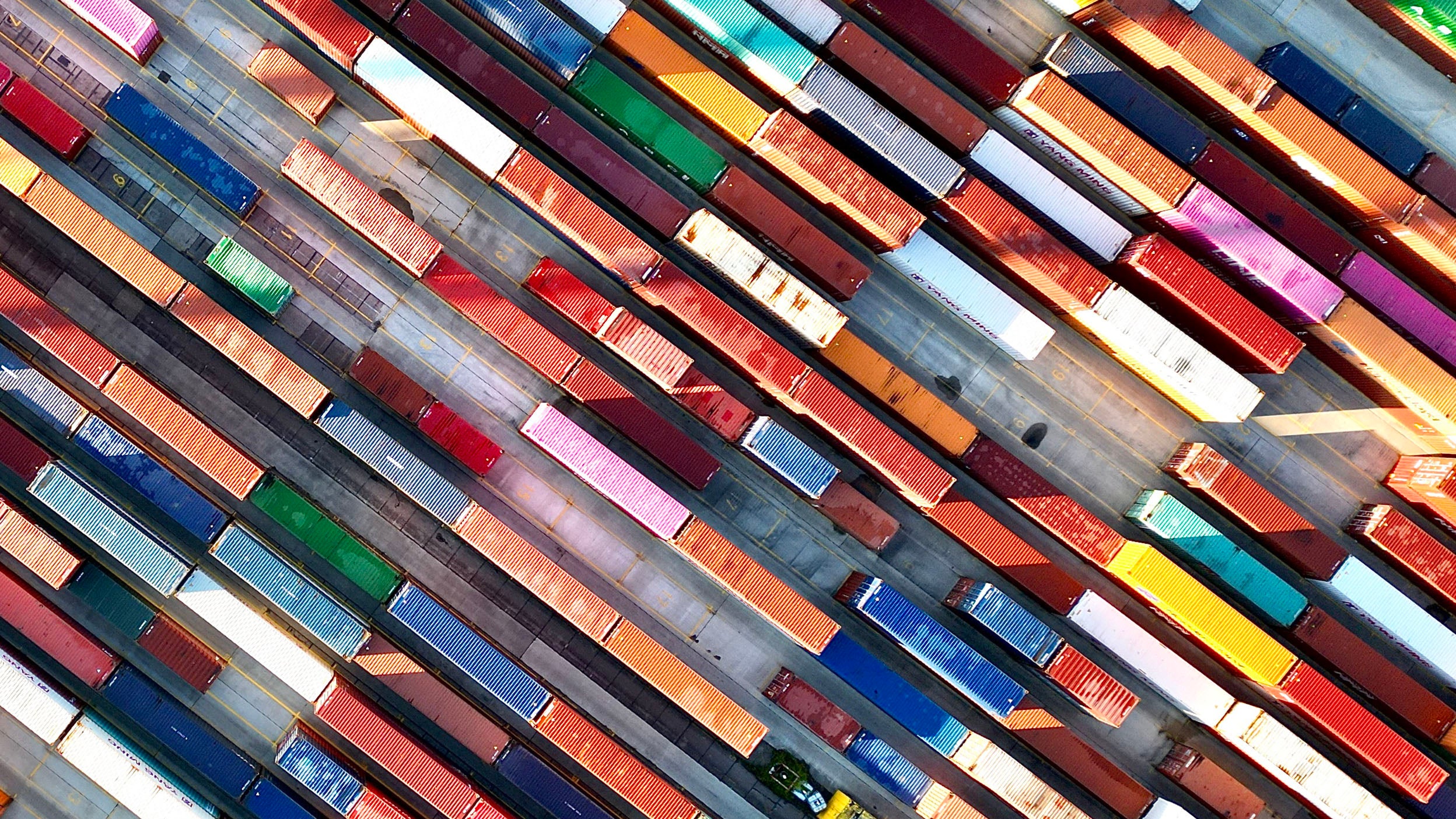

As a trade war rages, a massive market sell-off in the US and around the world raises many questions for investors.

We assess what President Trump’s “Liberation Day” tariffs might mean for US and global markets, equities, and more.

With policy uncertainty rattling markets and consumer sentiment, it’s important to remember the market's long-term growth throughout its history.

While the setup for markets was good coming into 2025, they’ve struggled as investors assess ongoing changes to the US policy approach.

A Purchasing Managers’ Index (PMI) tells economists and investors whether the manufacturing and services sectors are contracting or expanding.

There are signs of softening global growth prospects and rising economic policy uncertainty, plus a tectonic shift in fiscal stimulus around the globe.

Get straightforward insight from our market and economic experts on what investors need to know about soft landings, inflation, the economy, government debt, election season, and more.

Insights from our income experts on investing opportunities around the globe.

Our latest thinking on opportunities and potential ways to use ETFs in a portfolio.

Learn about investing in ETFs, including the basics, benefits, and choosing one.

Candid conversations with fund managers, market strategists, and more.

AEM723/ AEM731

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.