Succession planning for your wealth management practice

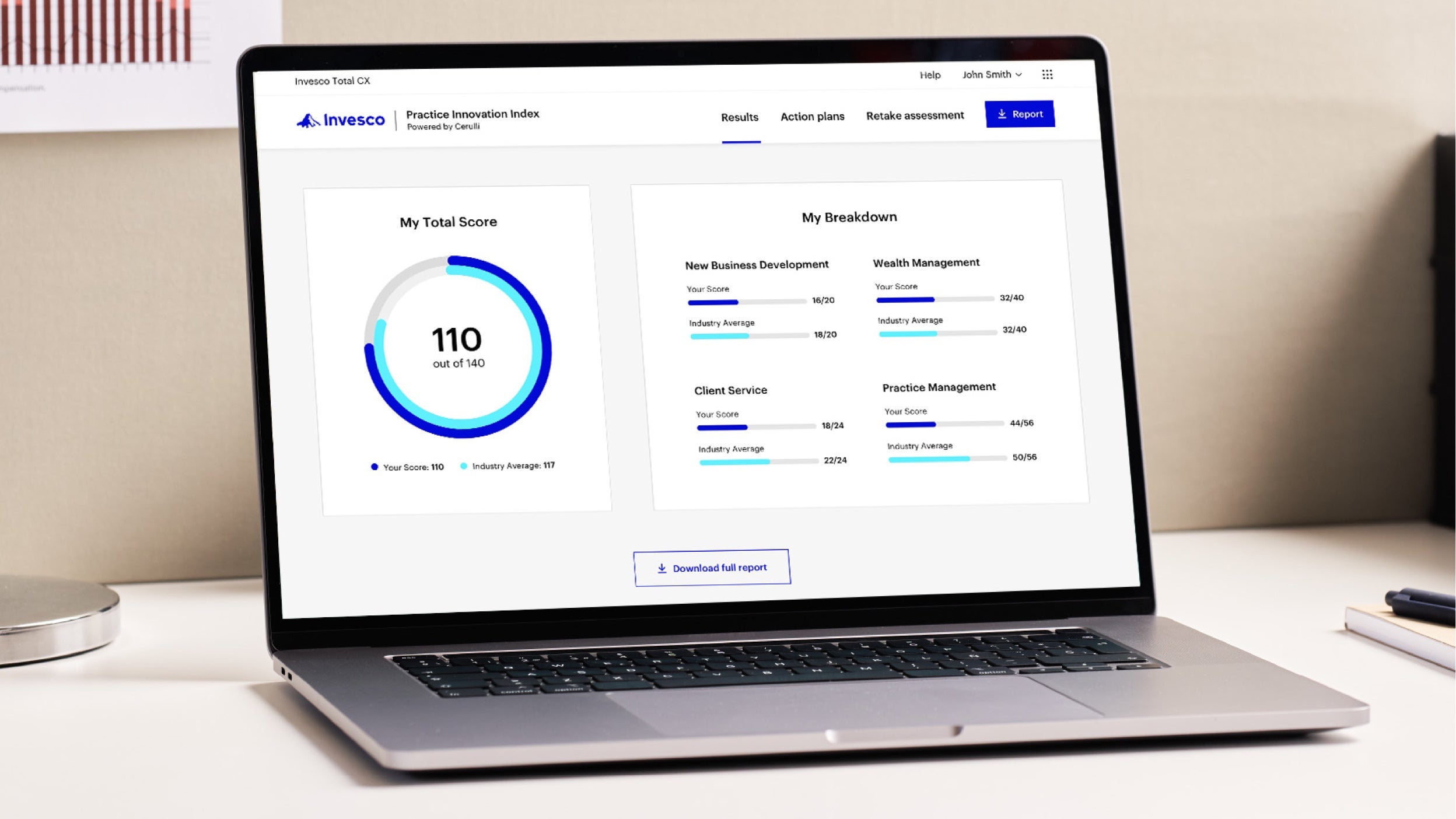

Invesco Total CX — the Total Client Experience – is a powerful platform of tools and resources designed to help financial professionals achieve greater possibilities for their clients, businesses, and portfolios. Through December 2023, we've helped more than 2,000 financial professionals benchmark their practices with the the Practice Innovation Index (PII), a diagnostic assessment focusing on four areas: New Business Development, Wealth Management, Client Service, and Practice Management.¹

from top-performing financial professionals, in key areas of management

of assessment participants, who represent various channels and practice types

across wealth management practices that contributed experiences

The latest Total CX Insights, created in partnership with Cerulli Associates, examines your peers' strategies in an effort to help you implement a more holistic and personal approach to financial planning.

Practice Innovation Index data shows that close to 40% of clients receive comprehensive lifestyle planning but only 11% receive multi-generational protection and transition planning. As the industry embraces a more holistic approach, we believe opportunities open up for practices that expand their service offerings.

Source: Practice Innovation Index diagnostic survey results of 2,250 participants, 7/13/2021-12/31/2023; Invesco and Cerulli Associates | Analyst Note: Participants were asked, "What percentage of your clients receive the following financial planning services?"

A majority (83%) of practices look to strategic asset allocation as a portfolio implementation strategy.1 Model portfolios may free up time and resources for more personalization in other areas.

Source: Practice Innovation Index diagnostic survey results of 2,250 participants, 7/13/2021-12/31/2023; Invesco and Cerulli Associates | Analyst Note: Participants were asked, “Which of the following describes your practice's portfolio construction implementation strategy?”

Alternative investments may serve many purposes in a portfolio, with diversification and volatility dampening among the most popular. Expertise in this area may enhance a practice's value proposition and attract new clients.

Source: Cerulli Associates, in partnership with the Investments & Wealth Institute | Analyst Note: Advisors were asked to select the top-three investment objectives they are looking to realize with alternative investments.

Screen image and scores are shown for illustrative purposes only.

An introductory video to the Practice Innovation Index that tells you how it works and what it offers with the goal of helping to enhance your business. Learn how to earn CE Credit at the end of the video.

Look back at previous Total CX Insights articles and download recent reports.

Lisa Kueng

I'm Lisa Kueng, Managing Director of Business Development for Invesco Global Consulting, and I'm privileged today to share the latest Total Client Experience insights. This time, we're focusing on building a sustainable practice.

Our data shows that more than a third of financial professional’s plan to retire, or at least take a significant step back from daily operations over the next decade.1 Paul Brunswick, Head of Invesco Global Consulting, is going to dive deeper into these actionable solutions.

Paul Brunswick

Thanks, Lisa. Well, before a financial professional approaches retirement, we believe they should consider developing their practice through effective teaming. Our latest research also shows that 89% of practices with greater than 500 million in AUM operate in a team-based structure.2

As a growing number of financial professionals approach retirement, they see the benefits of joining forces to create capacity and position themselves for long term growth through teaming. Teams ultimately provide a wider range of services to clients while creating career paths for internal successors. The key here is identifying those internal successors sooner rather than later. Why? Because integrating a successor on a team early helps not only to ensure a smooth transition but mitigates client flight risk when the lead financial professional retires.

According to our latest research, 47% of respondents indicated that roles and responsibilities in their practice are well-defined. Of those who are on teams, the average practice headcount is between five and six team members.2

A well-defined team creates continuity, client trust, and efficiency. Invesco believes practice leaders should openly discuss expectations with their team and align skill sets with the appropriate function.

Our final topic is preparing to transition your practice. Financial professionals know the importance of planning for a successor, but what holds them back? The emotional aspect. Matter of fact, our data indicates that 73% of respondents view emotional aspects of transferring clients to a new financial professional as a hurdle.3

This is followed by finding a qualified buyer with 59% of respondents reporting it as a succession challenge. The third is transferring clients to the buyer, which represents 50% of respondents.3

Invesco believes, however, that no matter if you are buying or selling a practice, that there are four critical variables that determine success or failure of your succession plan. The right time, the right reason, the right person, and the right communication. To help you in preparing to transition your practice, we offer a program called “Changing the Guard” that includes five steps to successfully transition your practice. Contact your senior Advisor consultant to learn more.

Lisa Kueng

All of these insights were brought to you by Invesco Total CX, the Total Client Experience. Which is a powerful platform of tools, coaching, and content.

The ”Practice Innovation Index” program is based on Invesco Global Consulting’s work with Cerulli Associates. Invesco Distributors, Inc. is not affiliated with Cerulli Associates or Cerulli, Inc. The Cerulli Associates logo is used with permission.

Invesco Global Consulting programs are for illustrative, informational and educational purposes. We make no guarantee that participation in any programs or utilization of their content will result in increased business for any financial professional.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

We’ve helped more than 2,000 financial professionals to benchmark their practices with the Practice Innovation Index (07/13/2021-09/15/2023).

There is no guarantee that any stated outlooks will come to pass.

The opinions expressed are those of the author and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Cerulli Associates utilizes the term “advisor(s)” instead of “financial professional(s).”

All data created by Invesco Global Consulting unless otherwise noted.

Note: Not all products, materials or services available at all firms. Financial professionals should contact their home offices.

1Sources: Cerulli Associates, Investment Company Institute, Insured Retirement Institute, Morningstar Direct/ AnnuityIntelligence, Investment News, Judy Diamond, Department of Labor, PLANSPONSOR, S&P Capital IQ MMD, Financial Planning, Financial Advisor magazine, and Investment Advisor magazine | Analyst Note: Cerulli's projections for advisor headcounts and advisor assets are based on both the historical movement of advisors between channels and stated channel preferences of advisors for future affiliation. In addition, Cerulli accounts for retiring advisors, trainees, and one-time occurrences such as layoffs and announced hiring plans.

2Sources: Practice Innovation Index diagnostic survey results of 1,043 participants, 7/13/2021-12/31/2022; Invesco and Cerulli Associates.

3Source: The Cerulli Report --U.S. Advisor Metrics 2022

Not a Deposit | Not FDIC Insured | Not Guaranteed by the Bank | May Lose Value | Not Insured by any Federal Government Agency

invesco.com/ic ©2023 Invesco Ltd. All rights reserved. IGC-PIITCX-VIDTS-2E 10/23 Invesco Distributors, Inc. NA3102773

Teaming may help build a sustainable practice by focusing complementary skills toward a common goal. Effective integration can potentially lay the foundation for a smooth transition from wealth manager to successor. Learn the main factors that can determine your success.

Succession planning for your wealth management practice

Grow your wealth management practice through effective teaming

We are excited to introduce the new Total CX Insights for your business.

Invesco Total CX – the Total Client Experience – is a powerful platform of tools, coaching and content. As part of that platform, we’ve helped more than 1,000 financial professionals to benchmark their practices with the Practice Innovation Index.1

The latest report2 evaluates your peers’ experiences using the Practice Innovation Index results to help you drive efficiency in your practice. We focus this quarter’s research in four primary areas: boosting productivity, maximizing time with clients, optimizing coverage ratios, and client touchpoints.

We strongly believe that high productivity can be directly attributed to thoughtful segmentation and client prioritization. In fact, the results show that almost half of respondents have implemented a customized client service model based on platinum, gold, and silver segmentation.3 Bottom line, an effective segmentation strategy will help practices not only determine how they allocate their limited time, but it also creates capacity across their growing business.

As we looked at insights around maximizing time with clients, the research indicated that wealth managers spend most of their time on client facing activities with client meetings, accounting for 21%.4 We strongly believe that by leveraging technology, wealth management practices can create automated workflows to streamline standard client service processes and communication.

This will ultimately reduce the administrative burden on senior team members, and in the end free up more time for important client- facing activities.

The numbers we saw in the research were that across all practices in the industry, senior financial professionals manage, on average, 161 client relationships.4 The takeaway here is that even though best practices on optimal client coverage are always relative, wealth managers should be mindful not to diminish client engagement or exceed their staff capacity. To strike this balance, we believe teams can establish defined segments that factor in the complexities and the needs of individual clients.

The data showed us that nearly one third, specifically, 32% of respondents who managed greater than a billion dollars in assets, utilize a pod-based approach to meet with clients. In addition, the research indicated that they meet with clients at least 11 times per year.5 Why? Because many clients will opt for a mix of both virtual and in- person meetings going forward.

Stay tuned in the quarters to come as we deliver new Total CX Insights for your business and if you haven’t already, benchmark your practice today with the Practice Innovation Index.

Not a Deposit | Not FDIC Insured | Not Guaranteed by the Bank | May Lose Value | Not Insured by any Federal Government Agency

1

1,043 participants, 7/13/2021-12/30/2022

2

"Enhancing Client Relationships and Capacity to Drive Growth" (IGC-PII-QTR-BRO-2-E)

3

Source: Practice Innovation Index diagnostic survey results of 1,043 participants, 7/13/2021-12/30/2022.

(Nearly half (48%) of Practice Innovation Index respondents have implemented a customized client service model based on platinum, gold, and silver segmentation.)

4Sources: The Cerulli Report—U.S. Advisor Metrics 2021, Cerulli Associates, in partnership with the

Investments & Wealth Institute and the Financial Planning Association® (FPA®).

5

Source: Practice Innovation Index diagnostic survey results of 1,043 participants, 7/13/2021-12/30/2022.

The ”Practice Innovation Index” program is based on Invesco Global Consulting’s work with Cerulli Associates. Invesco Distributors, Inc. is not affiliated with Cerulli Associates or Cerulli, Inc. The Cerulli Associates logo is used with permission.

Invesco Global Consulting programs are for illustrative, informational and educational purposes. We make no guarantee that participation in any programs or utilization of their content will result in increased business for any financial professional.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

The opinions expressed are those of the author and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Cerulli Associates utilizes the term “advisor(s)” instead of “financial professional(s).” All data created by Invesco Global Consulting unless otherwise noted.

Note: Not all products, materials or services available at all firms. Financial professionals should contact their home offices.

invesco.com/ic Invesco Distributors, Inc. IGC-PIITCX-VIDTS-1 04/23 ©2023 Invesco Ltd. All rights reserved. NA2853843

20230424-2853843-NA

1 - 1,043 participants, 7/13/2021-12/30/2022

2 -"Enhancing Client Relationships and Capacity to Drive Growth" (IGC-PII-QTR-BRO-2-E)

3 - Source: Practice Innovation Index diagnostic survey results of 1,043 participants, 7/13/2021-12/30/2022.

(Nearly half (48%) of Practice Innovation Index respondents have implemented a customized client service model based on platinum, gold, and silver segmentation.)

4Sources: The Cerulli Report—U.S. Advisor Metrics 2021, Cerulli Associates, in partnership with the

Investments & Wealth Institute and the Financial Planning Association® (FPA®).

5

Source: Practice Innovation Index diagnostic survey results of 1,043 participants, 7/13/2021-12/30/2022.

The ”Practice Innovation Index” program is based on Invesco Global Consulting’s work with Cerulli Associates. Invesco Distributors, Inc. is not affiliated with Cerulli Associates or Cerulli, Inc. The Cerulli Associates logo is used with permission.

Invesco Global Consulting programs are for illustrative, informational and educational purposes. We make no guarantee that participation in any programs or utilization of their content will result in increased business for any financial professional.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

The opinions expressed are those of the author and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Cerulli Associates utilizes the term “advisor(s)” instead of “financial professional(s).” All data created by Invesco Global Consulting unless otherwise noted.

Note: Not all products, materials or services available at all firms. Financial professionals should contact their home offices.

invesco.com/ic Invesco Distributors, Inc. IGC-PIITCX-VIDTS-1 04/23 ©2023 Invesco Ltd. All rights reserved. NA2853843

The Total CX Insights video is an overview of the May 2023 Report results of the Practice Innovation Index. It touches on four primary areas: boosting productivity, maximizing time with clients, optimizing coverage ratios, and client touchpoints.

Boosting Productivity

Financial professionals can use a segmented approach to client service with the goal of creating capacity and prioritizing their most valuable client relationships.

Maximizing time with clients

Focusing wealth managers’ time on high-impact client-facing activities and redistributing other responsibilities may help fuel growth.

Optimizing coverage ratios

Serving a limited number of clients may help enrich client experiences, improve business efficiencies, and promote growth opportunities.

Balancing client touchpoint quality and quantity

A proactive client engagement strategy, implemented effectively, may help grow a practice's capacity and improve the quality of their client service.

Screen image and scores are shown for illustrative purposes only.

The Practice Innovation Index – powered by Cerulli Associates – is the first diagnostic2 to analyze peer ranking and provide custom resources designed to help in every area of your practice.

Screen image and scores are shown for illustrative purposes only.

This report leverages insights from practices that participated in the Practice Innovation Index 7/13/2021-12/31/2023 as well as Cerulli’s broader research findings throughout 2023. See how top practices are implementing a more holistic and personal approach to financial planning.

1 Source: Practice Innovation Index diagnostic survey results of 2,250 participants, 7/13/2021-12/31/2023.

2 Source: Cerulli Associates. Used with permission. Invesco Distributors, Inc. is affiliated with neither Cerulli Associates nor Cerulli, Inc.

The ”Practice Innovation Index” program is based on Invesco Global Consulting’s work with Cerulli Associates. Invesco Distributors, Inc. is affiliated with neither Cerulli Associates nor Cerulli, Inc.

Invesco Global Consulting programs are for illustrative, informational and educational purposes. We make no guarantee that participation in any programs or utilization of their content will result in increased business for any financial professional.

This is not to be construed as an offer to buy or sell any financial instruments and should not be relied upon as the sole factor in an investment making decision.

Alternative products typically hold more non-traditional investments and employ more complex trading strategies, including hedging and leveraging through derivatives, short selling and opportunistic strategies that change with market conditions. Investors considering alternatives should be aware of their unique characteristics and additional risks from the strategies they use. Like all investments, performance will fluctuate. You can lose money.

Holistic wealth is a concept that elevates and emphasizes the importance of collecting experiences (as opposed to just money), engaging in meaningful work, and having more control over your daily life. Holistic wealth also includes developing financial savvy and independence, leading a life of purpose, and establishing a spiritual practice.

The model portfolio information shown herein is for illustrative purposes only. Model portfolios are available through an affiliate of Invesco Distributors, Inc. Invesco Distributors, Inc. is the US distributor for Invesco's Retail Products and Collective Trust Funds. Invesco Advisers, Inc. provides investment advisory services and does not sell securities. Both are indirect, wholly owned subsidiaries of Invesco Ltd.

The opinions expressed are those of the author and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

All data created by Invesco Global Consulting unless otherwise noted.

Note: Not all products, materials or services available at all firms. Financial professionals should contact their home offices.

NA4191654

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.