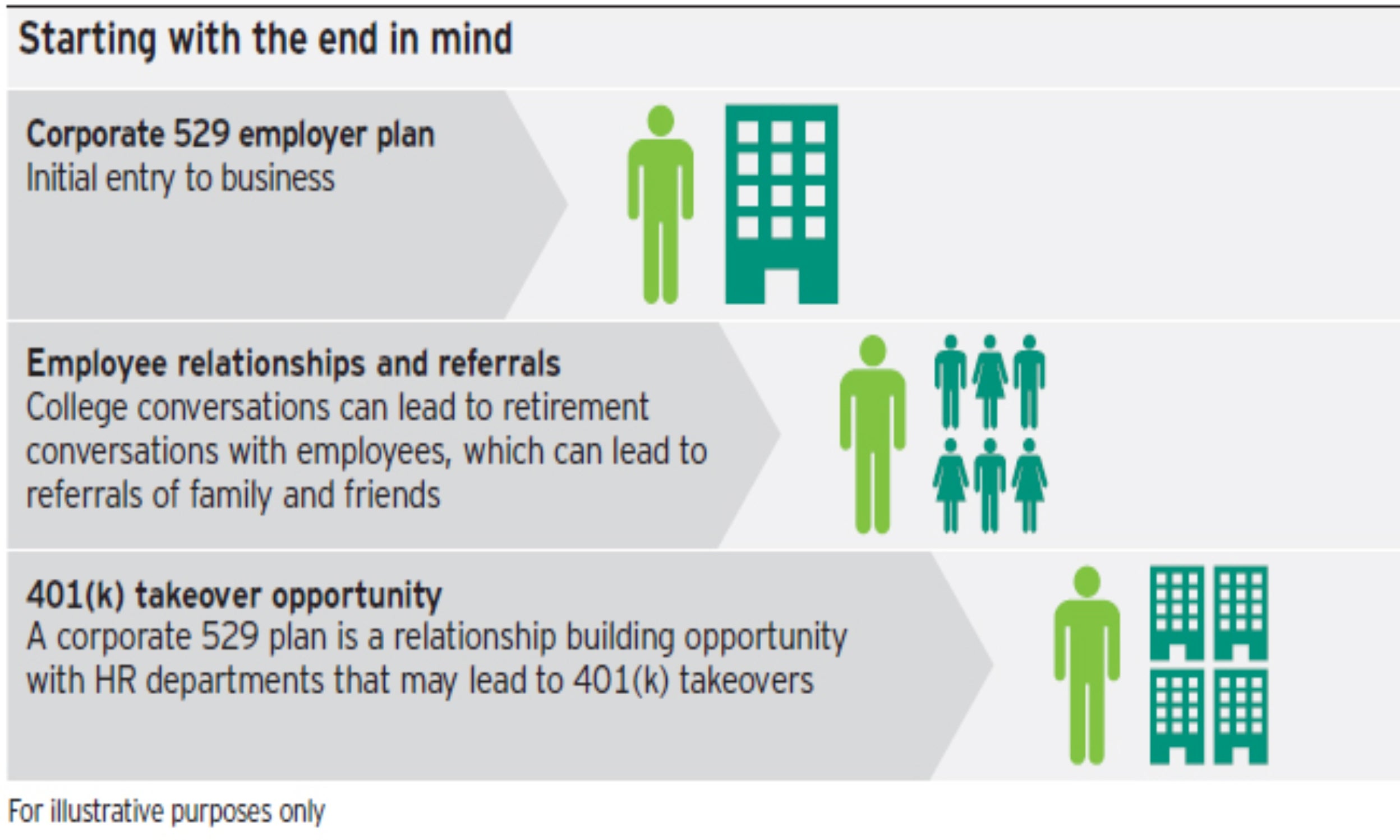

Grow your relationships with employers

An employer-sponsored 529 payroll deposit plan can help financial professionals strengthen their employer relationships.

Clients who are business owners or executives may be interested in offering a 529 plan via payroll deduction as an employee benefit. CollegeBound 529 may help deepen employer relationships while providing an easy-to-administer employee solution.

Learn the advantages of CollegeBound 529.

529 payroll direct deposit plans:

- Offer a true benefit that is meaningful to the employee

- Can increase employee satisfaction

- Require little-to-no additional work for corporate HR departments

- Can be offered at little-to-no cost to the employer

Unit classes to meet your business goals:

- Class A@NAV (Corporate) units. Available to all employer plans regardless of size

The Program Description provides information on eligibility and other important topics; read and consider it carefully before investing.

Learn more about how corporate plans may help you grow your relationship with employers

Investment Minimums and Maximums

| Minimum Initial Purchase | $0 |

| Minimum Subsequent Purchase | $0 |

| Maximum account balance limit (earnings can continue to grow past the maximum account balance limit) | $520,000 |

Annual contribution limit without incurring gift-tax consequences

|

The Program Description discusses fees and expenses; read and consider it carefully before investing.

Employers with an employer identification number (EIN) are eligible to establish an employer-sponsored plan.