XSHD

Invesco S&P SmallCap High Dividend Low Volatility ETF

Explore the potential benefits of combining high dividend and low volatility strategies.

The Invesco S&P 500 High Dividend Low Volatility ETF is designed for investors seeking income from companies in the S&P 500® Index using a low volatility screen in an effort to avoid “value traps” or reduce the volatility in high dividend yield stocks.

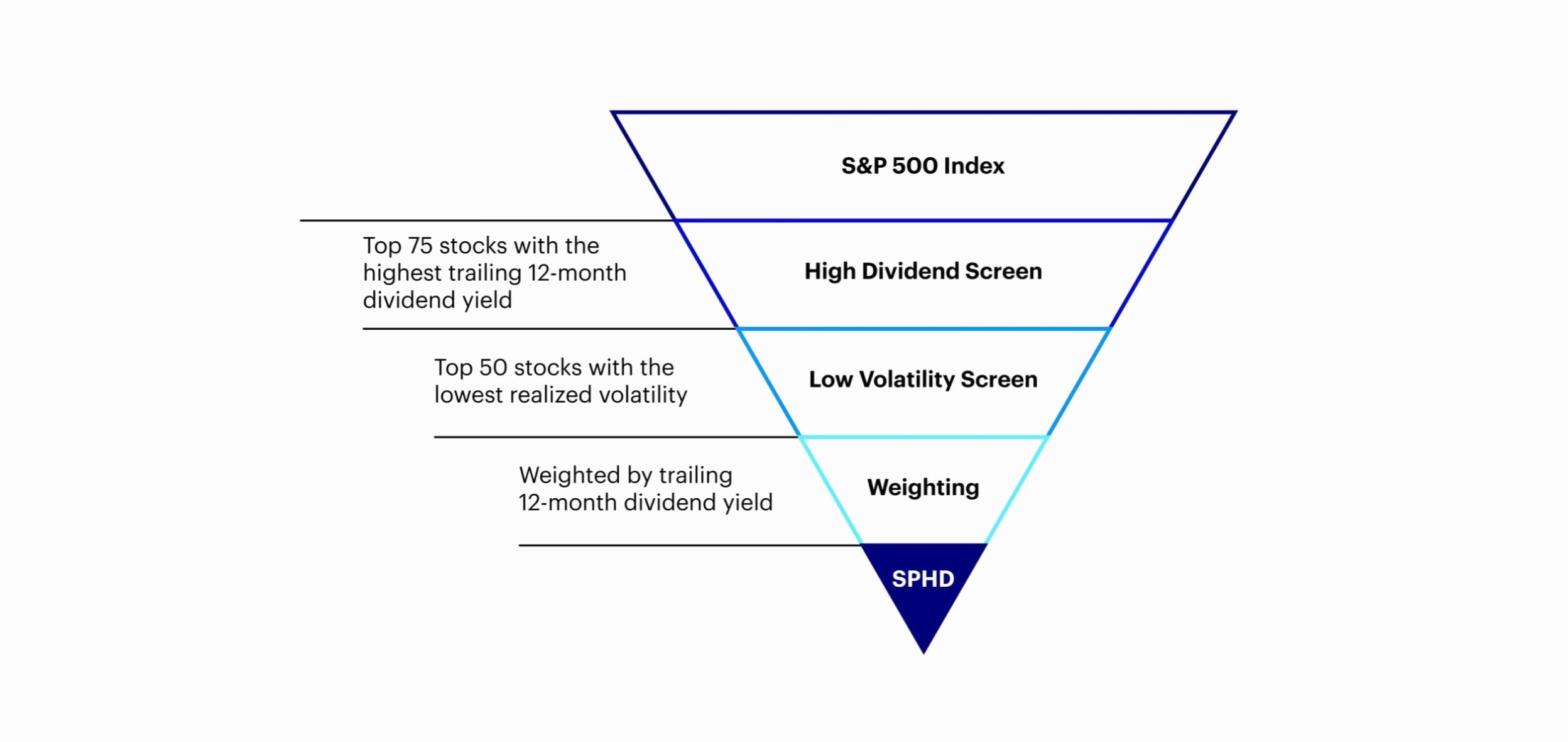

SPHD takes the S&P 500 Index and applies a high dividend and low volatility screen to narrow down a subset of stocks with the highest dividend yield and lowest realized volatility, then weights each stock based on dividend yield.

For illustrative purposes only.

The index constituents are weighted by trailing 12-month dividend yield. At each rebalancing, modifications are made to stock weights to ensure diversification across individual stocks and sectors. The weight for each index constituent is constrained between 0.05% and 3.0%, and the weight of each GICS sector is capped at 25%.

The fund and the underlying index are reconstituted semi-annually, effective after the close of the last business day of January and July and are rebalanced quarterly, effective after the close of the last business day of January, April, July, and October.

Get timely answers to important questions regarding this product.

SPHD typically makes dividend distributions monthly.

The main benefits of dividend ETFs are that they may potentially provide investors with a higher level of equity income and stability, as more of the return comes from current income rather than future profit growth.

SPHD’s underlying index, the S&P 500 Low Volatility High Dividend Index, is rebalanced and reconstituted semi-annually, in January and July.

SPHD tracks the S&P 500 Low Volatility High Dividend Index, which measures the performance of the 50 least-volatile high dividend-yielding stocks in the S&P 500 Index.

SPHD can be used in equity portfolios for investors seeking high dividend income with potentially lower volatility. By screening for both yield and volatility, SPHD may help reduce the volatility associated with dividend strategies.

The Invesco S&P 500® High Dividend Low Volatility ETF seeks to track the investment results (before fees and expenses) of the S&P 500® Low Volatility High Dividend Index.

NA3147078

The S&P 500 Low Volatility High Dividend Index is composed of 50 securities traded on the S&P 500 Index that historically have provided high dividend yields and low volatility.

The S&P 500® Index is a market-capitalization-weighted index (largest companies based on market capitalization make up largest portion of the index) consisting of the 500 largest, most prominent, publicly-traded companies in the US as determined by S&P. An investment cannot be made directly into an index.

There are risks involved with investing in ETFs, including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Ordinary brokerage commissions apply. The Fund’s return may not match the return of the Underlying Index. The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Fund.

Investments focused in a particular industry or sector are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

Securities that pay high dividends as a group can fall out of favor with the market, causing such companies to underperform companies that do not pay high dividends.

There is no assurance that the Fund will provide low volatility.

The Fund may become “non-diversified,” as defined under the Investment Company Act of 1940, as amended, solely as a result of a change in relative market capitalization or index weighting of one or more constituents of the Index. Shareholder approval will not be sought when the Fund crosses from diversified to non-diversified status under such circumstances.

Shares are not individually redeemable and owners of the Shares may acquire those Shares from the Fund and tender those Shares for redemption to the Fund in Creation Unit aggregations only, typically consisting of 10,000, 20,000, 25,000, 50,000, 80,000, 100,000 or 150,000 Shares.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.