OMFS

Invesco Russell 2000® Dynamic Multifactor ETF

A dynamic multi-factor approach that is designed to shift factor exposure based on the current market environment.

The Invesco Russell 1000® Dynamic Multifactor ETF has a dynamic multi-factor approach that is designed to shift factor exposure based on the current market environment.

This multi-factor approach combines analysis of the macroeconomic cycle with investment factors designed to capitalize on the prevailing economic regime. To find out more about our framework and latest investment outlook, explore this month’s Portfolio Playbook.

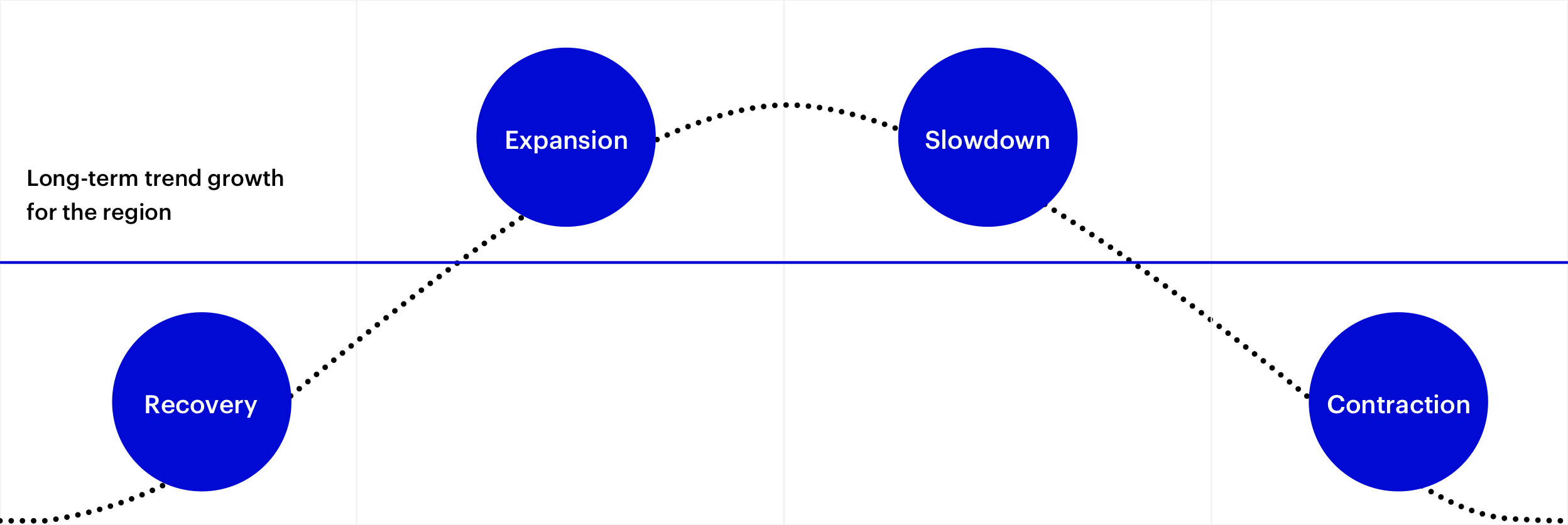

This graph demonstrates how the team defines the stages of the business cycle based on the expected level and change in economic growth and how we combine proprietary indicators to estimate one of four factor regimes: Recovery, expansion, slowdown, and contraction. In turn, these regimes determine the corresponding factor exposures, which are shown in the table below.

| Recovery | Expansion | Slowdown | Contraction | |

|---|---|---|---|---|

| Long-term economic growth trend | Growth is below trend and accelerating | Growth is above trend and accelerating | Growth is above trend and decelerating | Growth is below trend and decelerating |

| Size | X | X | ||

| Value | X | X | ||

| Momentum | X | X | ||

| Low volatility | X | X | ||

| Quality | X | X |

Factor cyclicality

It’s an index that reflects a dynamic combination of factor exposures drawn from constituent stocks of the Russell 1000 Index. The factors targeted may include low volatility, momentum, quality, size, and value. The emphasis on each factor is determined by Invesco’s Regime Model, which is informed by the economy’s trend and risk sentiment.

The FTSE Invesco Dynamic Multifactor Index Series uses a rules-based framework to target exposure to five different factors. The investment team use economic and market sentiment indicators to identify four regimes corresponding to different parts of the business cycle: Recovery, expansion, slowdown, and contraction. The FTSE Invesco Dynamic Multifactor Index Series will emphasize exposure to these factors by allocating to one of four predetermined multifactor indexes according to the Invesco economic regime signal. These multifactor indexes target a combination of factors that have historically outperformed other factors in these stages of the business cycle.

They are low volatility, momentum, quality, size, and value. Factor definitions are as follows:

Value: Equally weighted composite of cash flow yield, earnings yield and price to sales ratio.

Size: A company's size factor score is based on total market capitalization as of the last business day of the prior month.

Quality: Composite of profitability (return on assets, change in asset turnover and accruals) and a single measure of leverage.

Low Volatility: Standard deviation weekly total returns over the trailing 5 years ending on the last business day of the prior month.

Momentum: Historical return of the 11 months ending on the last business day of the prior month

OMFL typically makes dividend distributions on a quarterly basis.

They are funds that provide exposure to specific characteristics of stocks, such as value and momentum, that may impact risk and return. Factor-based ETFs may be used to target specific outcomes, such as potentially higher returns or lower volatility. Multifactor ETFs combine several of these characteristics in a single strategy.

To learn more about our multifactor offerings, explore the ETFs below:

OMFS

Invesco Russell 2000® Dynamic Multifactor ETF

IMFL

Invesco International Developed Dynamic Multifactor ETF

The Invesco Russell 1000® Dynamic Multifactor ETF seeks to track the investment results (before fees and expenses) of the Russell 1000® Invesco Dynamic Multifactor Index.

NA3533182

The Russell 1000® Index, a trademark/service mark of the Frank Russell Co.®, is an unmanaged index considered representative of large-cap stocks.

There are risks involved with investing in ETFs, including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Ordinary brokerage commissions apply. The Fund’s return may not match the return of the Underlying Index. The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Fund.

Investments focused in a particular industry or sector are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets.

Momentum style of investing is subject to the risk that the securities may be more volatile than the market as a whole or returns on securities that have previously exhibited price momentum are less than returns on other styles of investing.

Companies that issue quality stocks may experience lower than expected returns or may experience negative growth, as well as increased leverage, resulting in lower than expected or negative returns to Fund shareholders.

There is no assurance that such ETFs will provide low volatility.

The Fund may engage in frequent trading of its portfolio securities in connection with the rebalancing or adjustment of the Underlying Index.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.