Invesco ICVC Securities Lending

In December 2020, Invesco launched a programme, enabling our entire ICVC fund range1 to engage in securities lending for the purpose of enhancing overall performance for the benefit of investors.

This guide provides details of the Securities Lending programme. Please contact us if you have further queries.

What is Securities Lending?

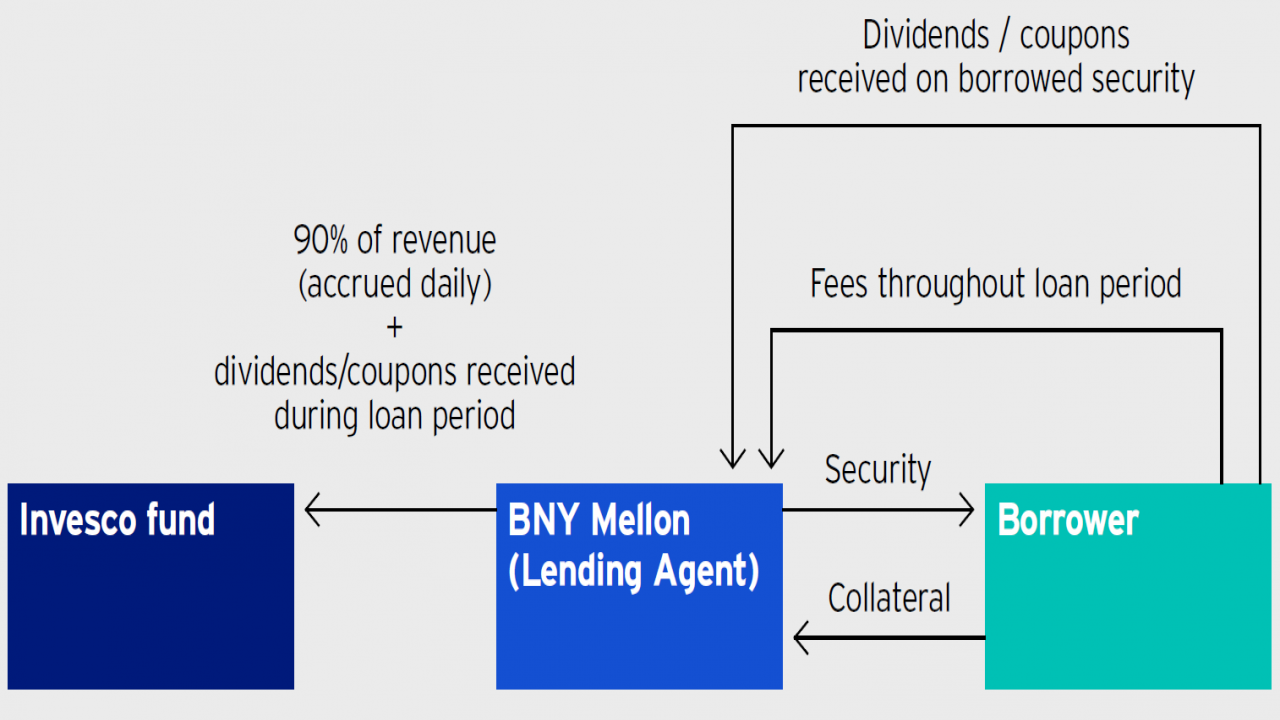

Securities Lending is a well-established practice involving the short-term transfer (loan) of securities by a fund for an open-ended time period. The borrower of the securities provides collateral and pays an agreed fee for the duration of the loan as well as any income received from those securities. On termination of the loan, the borrower is obliged to return the securities in return for the collateral. Invesco’s Securities Lending programme will be administered and managed by a third-party lending agent, Bank of New York Mellon (“BNY Mellon”).

Who receives revenues from Invesco’s programme?

Each Invesco ICVC fund will receive 90% of any revenue arising from securities lending, with the remaining 10% deducted by the Lending Agent for its fees and to cover direct and indirect operational costs. Invesco will not receive any revenue from the programme. Revenue accrues daily within the fund.

How will this affect my investment?

The objective of the programme is to enhance fund performance with the revenues received from borrowers. The amount of revenue – and in turn the potential performance enhancement – will vary depending on whether the fund makes use of the securities lending program and if so, on the amount of the fund’s securities being loaned as well as the terms negotiated by the lending agent. The introduction of securities lending will not lead to an increase in the charges you pay.

Securities lending involves additional risks, including the risk that the borrower is unable to return the securities at the end of the loan period. This “counterparty risk” is being mitigated through the credit analysis and approval process of potential borrowers, as well as maintenance of suitable collateral and, ultimately, indemnification provided by BNY Mellon.

Collateral

Borrowers must post suitable collateral as a percentage of the securities being borrowed. This helps to mitigate the risk to the fund and its investors from the unlikely event of the borrower being unable to return the securities at the end of the loan period. Acceptable types of collateral include approved equity and government securities.

Indemnification

The indemnity provided by BNY Mellon allows for full replacement of the securities lent if the collateral received does not cover the value of the securities loaned in the event of a borrower default.

Lending agent

We have selected BNY Mellon to manage and administer the Securities Lending programme. They have the largest global securities lending programme, with US$4.3 trillion of lendable assets and US$441 billion on loan. BNY Mellon’s credit rating is Aa2/AA-2.

As lending agent, BNY Mellon will be responsible for conducting credit analysis on each of the potential borrowers approved by Invesco. BNY Mellon will also be responsible for negotiating terms of the loans with borrowers, indemnifying the fund(s) in the event of borrower default or delay and monitoring the securities and collateral.

BNY Mellon will provide the revenue earned from the loans to the fund(s) on a monthly basis in the currency earned, 10 business days after month end. They will provide a daily earnings report to allow daily accruals to be booked.

Who can borrow

Each potential borrower goes through both a credit analysis conducted by BNY Mellon and formal approval process by Invesco before being accepted into the programme. All borrowers are required to have and maintain a minimum credit rating of A2 (Standard & Poor’s) / P2 (Moody’s). The list of approved borrowers will be reviewed by BNY Mellon and Invesco on an ongoing basis.

BNY Mellon provides the fund with indemnity in case of default or delay by the borrower. BNY Mellon is responsible for making the fund “whole” for any costs incurred because of a delay or default from a borrower in returning loaned securities or any dividends/coupons paid.

Obligations of the borrower

When a security is loaned out, the title and ownership are transferred to the borrower, who is obligated to return like securities upon termination of the loan. The borrower is also obligated to pay all dividends and coupons received on the borrowed securities, including any result of corporate actions.

BNY Mellon will settle all income and dividends on loaned securities on the same day that it would have otherwise been credited had the securities not been on loan, in accordance with the pay standards of each country. BNY Mellon then takes the responsibility for the collection of the income or dividend from the borrower.

If you have any further questions, please call 0800 085 8677. We’re here Monday to Friday, from 8.30am to 6:00pm (excluding Bank Holidays). Alternatively, you can contact us via email at enquiry@invesco.com.

1 Excludes the Invesco Money Fund (UK).

2 Source: BNY Mellon, as at September 2020.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Data as at 1 November 2020, unless otherwise stated.

For the most up to date information on our funds, please refer to the relevant fund and share class-specific Key Investor Information Documents/Key Information Documents, the Supplementary Information Document, the Annual or Interim Reports and the Prospectus, which are available using the contact details shown.