In keeping with the rest of 2020, Q4 brought further significant moves in equity markets. Given where we were at the end of Q1, it is remarkable that the S&P 500 reached new highs on New Year’s Eve. Technology stocks were the standout winner in 2020 as the Nasdaq rose 45% over the course of the year. The market rally in Q4 was driven by three important events in the quarter, all of which undoubtedly impacted the market and economic outlook.

Q4 events

US election: A Biden victory was the over-whelming favourite in betting markets and indeed the stock market had priced in a Democratic sweep of the White House and Senate running into the election. The Democrats also won control of the US Senate following the run-off elections in Georgia. The chamber will have a 50-50 partisan split, with Kamala Harris, incoming vice-president, having the tiebreaking vote.

A Democrat controlled Senate is likely to increase the chance of significant fiscal support via pandemic relief and long-term infrastructure spend. However, it would also increase the chances of tax rises (both corporate and personal), greater regulation and rising bond yields. With such marginal control of the Senate we suspect any major legislation will be difficult.

Vaccine data: The data from the various trials (Pfizer/BioNtech, Moderna, Oxford/AstraZeneca) has rightly been well rewarded by the market. Efficacy levels are in general higher than expected with safety issues minimal. These trial results have allowed the market to price the probability of a return to normality sooner; we can debate what the new normal looks like and indeed how quickly that reversion takes place, but this news suggests that a worst case is substantially less likely.

This news has had a substantial impact on companies which are more economically sensitive, or which have been negatively impacted by work from home/lockdown policies such as travel & leisure.

Brexit: Four and half years after the initial referendum the UK has finally agreed terms for the ongoing relationship post withdrawal from the EU. The deal was signed very recently and whilst question marks remain, the initial take suggests this is a reasonable outcome for both sides- it certainly removes the risk of ‘no deal’ and the economic instability that risked.

Portfolio impact (Invesco Perpetual Select Trust Plc – Global Equity Income Share Portfolio)

All three pieces of news were generally supportive for both the wider market and for the portfolio as the combination of events drove a significant internal market rotation. The portfolio performed well through this period as financials, industrials and select consumer discretionary stocks which have been relatively weak performers in 2020 have reflected a more optimistic outlook for 2021. However, we continue to see further upside for such sectors as valuations look attractive and we expect economic stimulus to continue to be a factor going forward.

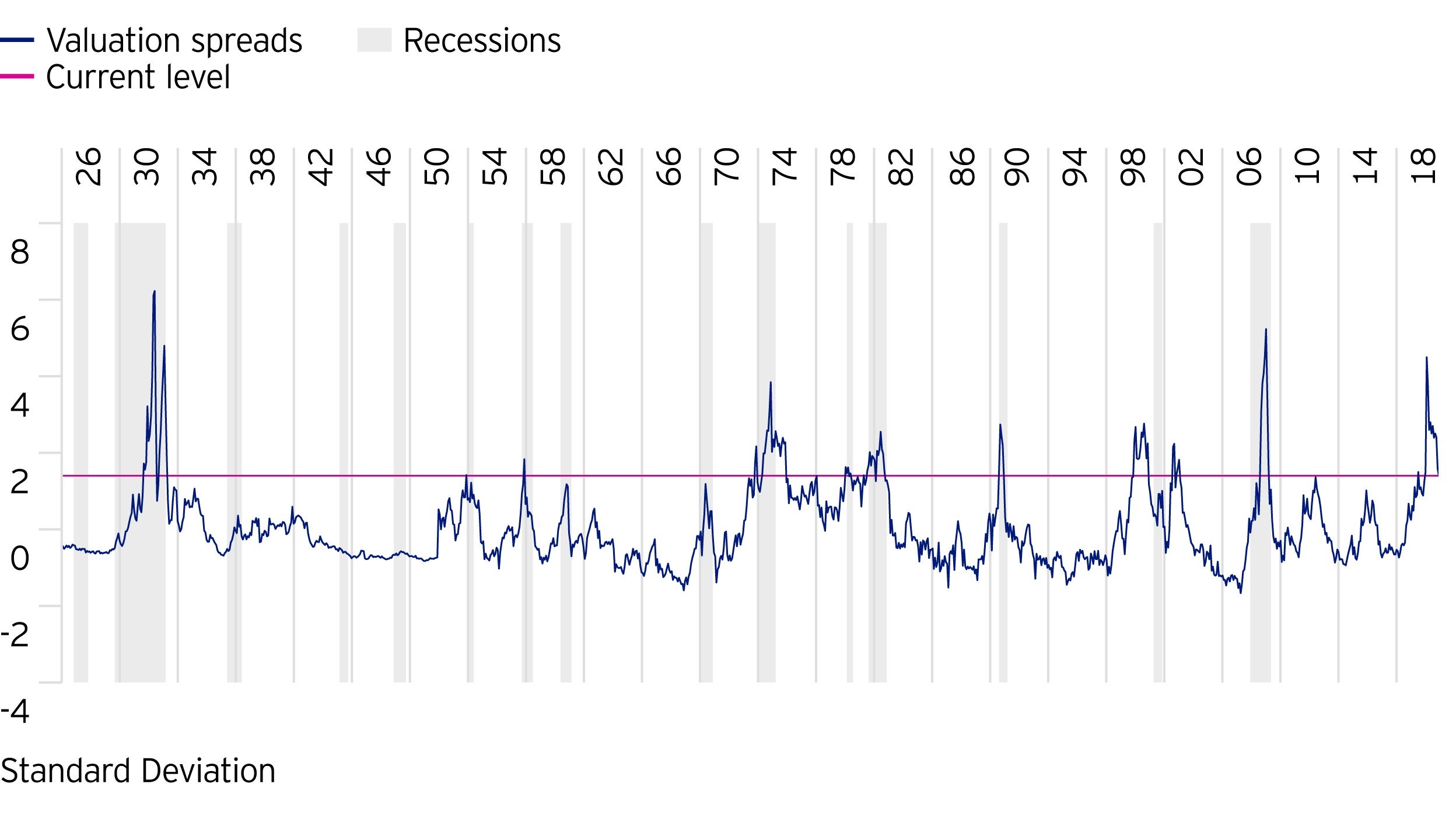

As we highlighted last quarter one of our favourite measures to gauge the market is valuation spread. Spreads have continued to narrow, suggesting less extreme valuation differentials. Whilst still above long-term averages they are not quite as provocative as they were; this leads us to greater balance within the portfolio.

Attribution commentary

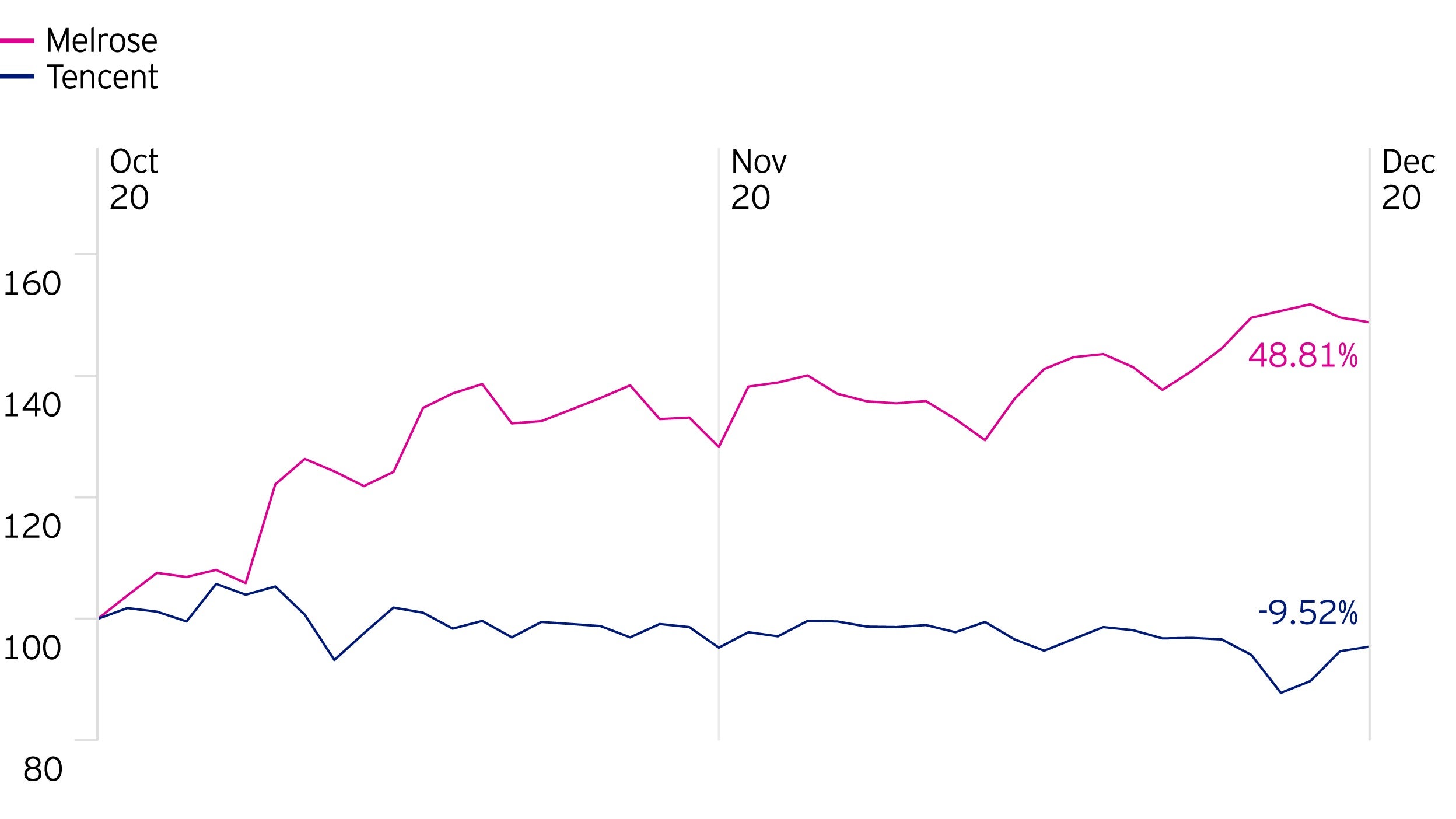

JP Morgan performed strongly as the bank reported excellent operating results, a resumption of capital return and the reduced risk of further draconian regulation under a Democratic sweep. Rolls Royce, Melrose and Amadeus performed well as the vaccine data allowed investors to begin to price in a resumption of flight travel, encouragingly, where air travel has re-opened there is clearly strong appetite from consumers.

Samsung, TSMC and Texas Instruments performed well reflecting a more positive outlook for memory and analog chips and general industrial production.

On the negative side, a number of companies which had performed well up to Q4 underperformed a strongly rising market; this is not wholly surprising as many were seen as ‘Covid winners’. Companies such as Home Depot, NetEase and Progressive fall into this category.

Bayer and CME also detracted from performance (more below).