Outlook for the High Yield market

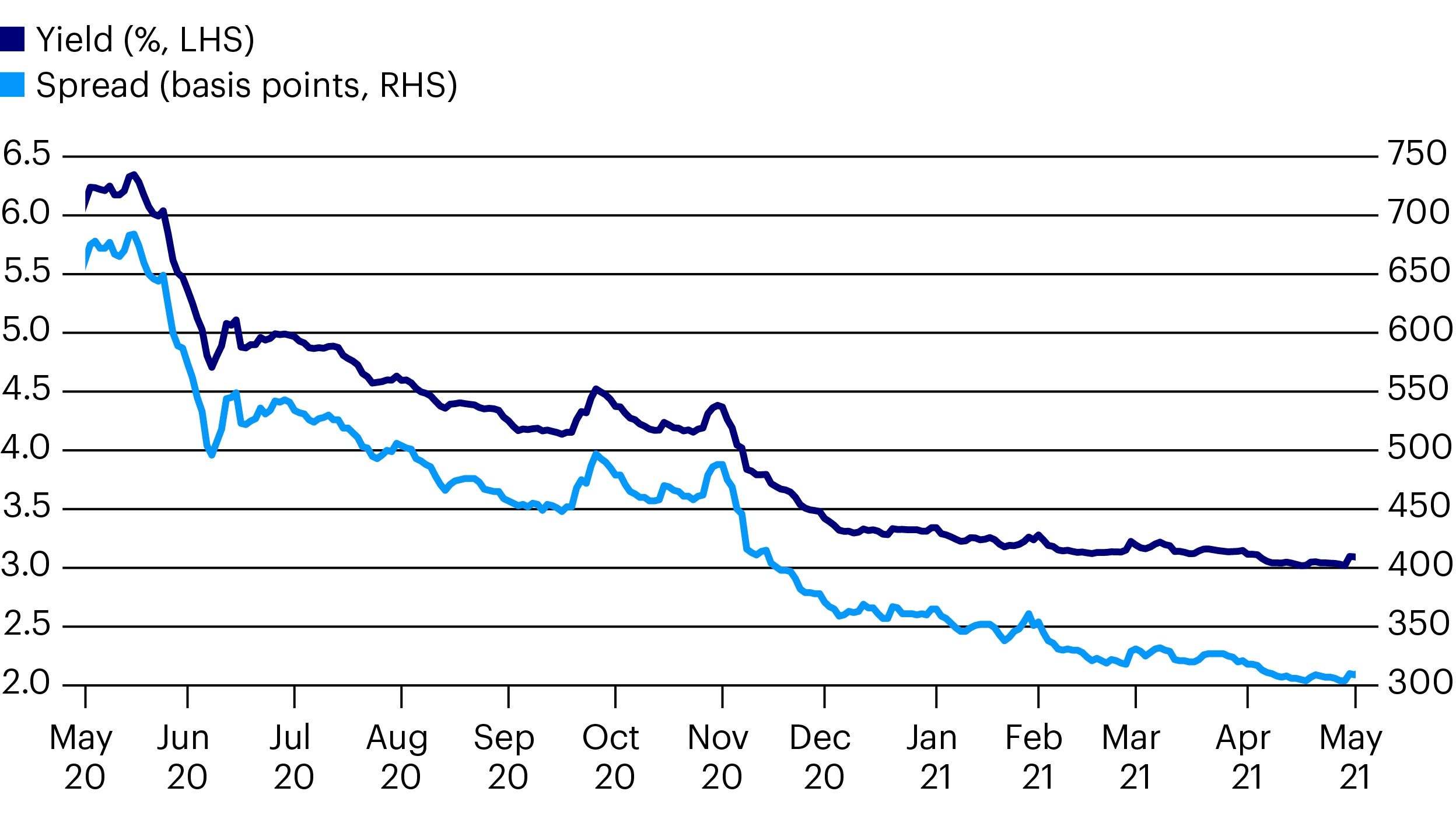

There has been little ambiguity in the direction of the high yield market in the last year! Yields and spreads1 have moved consistently lower since the peaks of March 2020, in one of the sharpest recoveries in the history of the asset class.

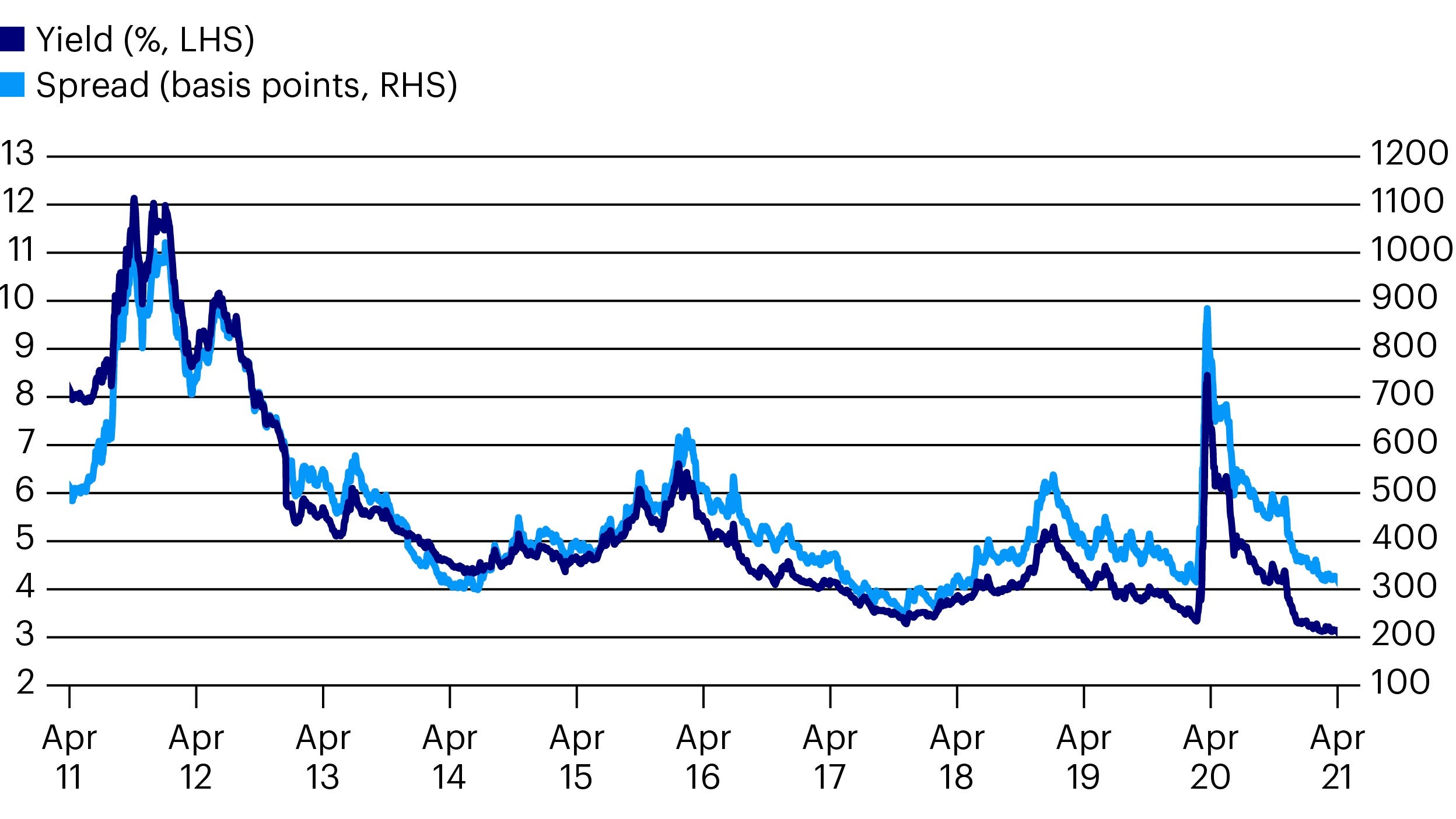

This has been great for investors, with the global high yield market2 delivering a total return of 22% in the 12 months to the end of April 2021. The European market3 has been just behind, on 16.3%. But it has also brought spreads, and yields even more so, to low levels by historic standards (see charts below). On this basis, the market does not look very cheap.

However, to form an outlook for the asset class, these market levels have to be contextualised. Are the yields available on these companies’ bonds a reasonable reward for the risks of the macroeconomic environment and the businesses they own? And are the credit spreads a fair estimate of the extra risks of buying high yield bonds instead of investment grade or sovereigns?

There are plenty of things to worry about. There are obvious risks in the economic environment. The market has been buoyed over the last year by the support measures of the governments and central banks and by the good news on the development and roll-out of effective Covid vaccines. But there are uncertainties with both things. The financial support is real enough, but we do not know how long it will be continued or how it will be unwound. The vaccinations are a scientific triumph, but to what extent will they enable the re-opening of the economy?

At the company level, there is plenty more we don’t know. How will the pandemic period have changed consumer behaviour and business activity? What changes will be permanent and what will revert to ‘normal’ when lockdowns end? Which companies will thrive, and which will have become obsolete?

Along with these open questions, there are negative factors we know for sure. High yield companies in aggregate will be facing the future with more debt. JP Morgan have recently estimated the net leverage of European High Yield issuers at 6.1 times earnings4, higher than at the peak of the financial crisis. Interest coverage ratios5 have also fallen, from 5.8 to 4.6 in the course of 2020.

The positive factors to weigh against all this are centred on the huge levels of support the market has received and continues to receive, the ability of companies to access funding and the strong evidence of accelerating growth.

According to Deutsche Bank6, the global high yield default rate may already have peaked, having only reached a high historically more associated with a mild recession than the biggest downturn in economic activity since the 1940s. This reflects the efforts of the authorities to ensure that as few as possible businesses, that are otherwise solvent, default because of the pandemic and the lockdowns.

The high yield market has benefitted from the general support provided by ultra-accommodative interest rate policies and by quantitative easing in the form of central bank purchases of government and investment grade bonds. Unlike the post-financial crisis period, it has also had direct support.

The Federal Reserve’s (Fed) corporate credit facilities allowed for the purchase of bonds that had fallen from investment grade after 22 March 2020 (a category into which bonds issued by Ford fell very neatly). The Fed also announced that it would be able to buy high yield Exchange-Traded Funds, under certain conditions. In both the US and Europe, tens of billions have been given to companies that are high yield issuers, particularly in the aviation, travel and retail sectors.

In large part because of this support, high yield companies have, to a much greater degree than in previous recessions, continued to be able to access the capital markets. In the euro market, high yield issuance in 2020 was at a similar level to 2019 (itself a strong year). This year it is running at a record rate (€31bn to the end of March). Issuance in the US dollar market in 2020 was far higher than any year before, at more than $400bn, and it is also breaking new ground in 20217. The level of debt companies carry is a very important factor for us as we analyse the high yield market. The ability to re-finance that debt more easily does not in itself improve the quality of a business, but it does make it more sustainable and reduce the risk of liquidity crises and defaults.

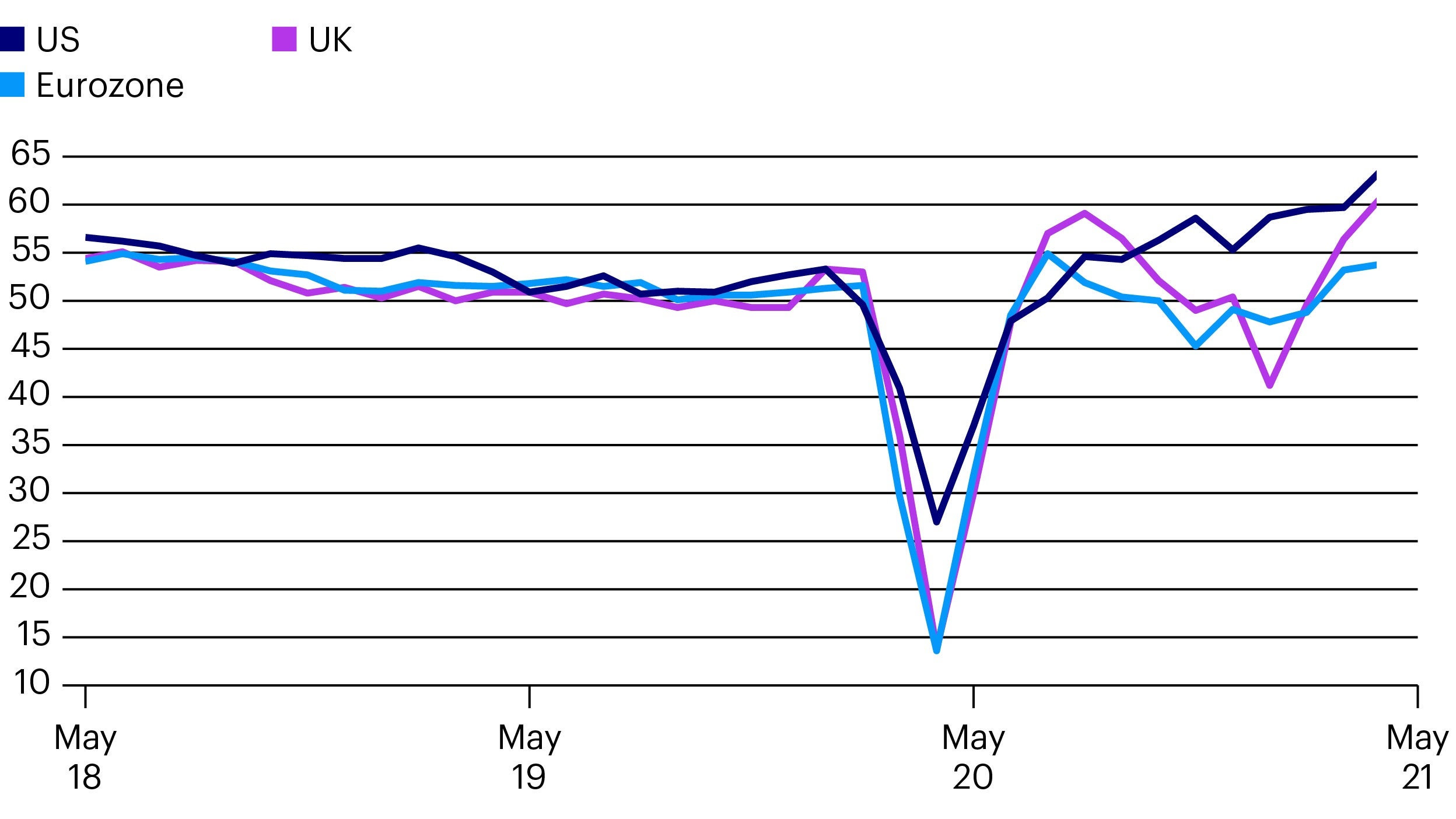

A much more positive factor in strengthening companies is, of course, earnings growth. High yield bonds are typically more sensitive to company earnings and less sensitive to interest rates than other areas of the debt markets. Here there is a lot to be positive about. Economic data has rebounded strongly. Activity and sentiment indicators recovered to pre-pandemic levels quickly and, as can be seen in the PMI8 data below, are now rising further. Employment, especially in the US, is growing strongly and seems set to be a big boost to consumption, along with pent-up demand from the past few quarters. In the current earnings seasons, we are seeing good numbers from a wide range of companies.

For us, of course, assessment of valuations at the market level is only part of the job. Most of our time is spent looking at the individual companies that have issued bonds It is quite reasonable to see market levels of yield and spread as low and levels of debt as high while also seeing opportunities. The same JP Morgan research which showed the recent increase in high yield leverage also showed that when a small number of sectors (Travel, Transport, Leisure and Gaming) are excluded, leverage has fallen recently and is below 2019 levels.

High yield bonds continue to offer good levels of income, especially when compared to the rest of the traditional income-producing markets. We are going through a period of very dramatic economic and social change. This will have repercussions for all companies. There are obvious challenges but there are also factors which are supplying huge support. So, we see this as an excellent time to be active managers of high yield bonds.