Investment trusts have lots of unique quirks and whether their shares trade at a discount or a premium is one of them.

What does trading at a discount or premium mean?

As investment trusts are publicly traded companies listed on the London Stock Exchange you invest in them by buying shares at the price stated – the share price.

However, investment trusts also have a net asset value (NAV), which is the value of all the investments the trust holds minus any debt or loans it has. When you divide the NAV by the total number of shares the trust has issued, you have the NAV per share.

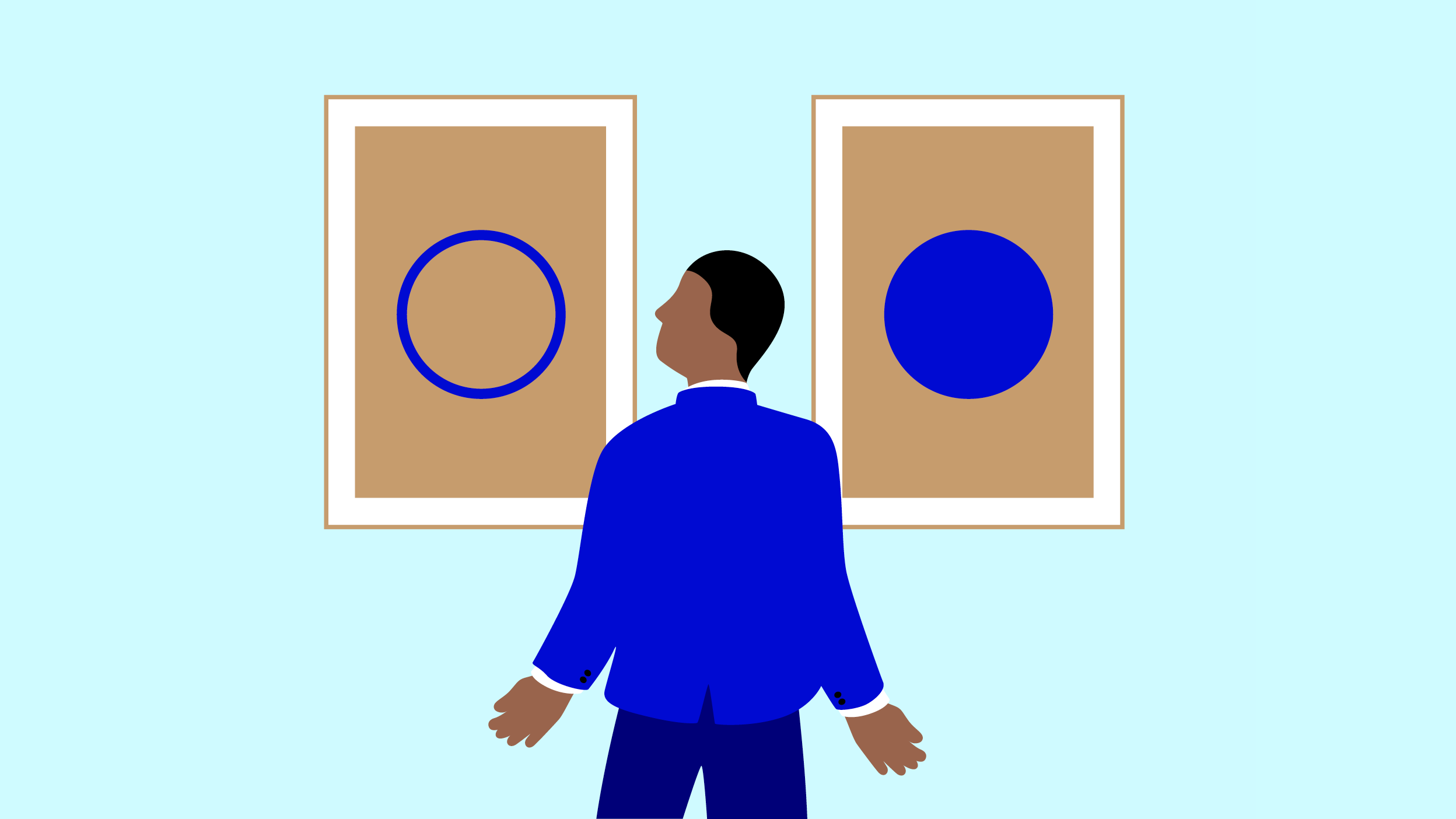

If the share price is higher than the NAV per share, the investment trust is trading at a premium. This means the investment trust is popular with investors and there is strong demand for the shares.

If the share price is lower than the NAV per share, the investment trust is trading at a discount. This means the investment trust isn’t as popular and the demand for the shares isn’t as strong.

If the share price and NAV per share are equal, the investment trust is trading ‘at par’.

Are discounts a bad thing?

You may think that a discounted investment trust is a bad thing but it’s not always the sign of an issue; the share price could have been impacted by something as simple as gloomy market sentiment. If you’re confident that there’s nothing inherently wrong with the investment trust’s investments or the way it’s being run, or that the discount might narrow because the share price goes up, then a portfolio trading at a discount could be a buying opportunity.

Of course, just because an investment trust is trading at a discount and the shares are already cheap, it doesn’t mean the shares can’t fall in price and the discount widen – or get bigger - and you lose money.

Are premiums a good thing?

Investment trusts trading at a premium are in high demand, whether that be because of the strong performance track record, an in-favour investment style, or a booming market. There are lots of reasons why a share price might soar.

However, this puts investors in a bit of a quandary. If they want to invest in a premium-rated investment trust, they have to pay a share price that is higher than the value of the assets in the fund. This means you have to be confident that the manager can continue their run of outperformance.

While the good performance may continue, investment trusts on a premium carry the risk of de-rating; when a once popular investment trust becomes unpopular, sliding from a premium to a discount, at which point you lose money.

Do investment trust boards care about discounts and premiums?

Premiums and discounts matter a lot to investment trust boards. They don’t want either to get too wide and there are measures they can take to narrow either the premium or discount.

What do boards do?

If investment trust shares are trading at a discount to NAV it can give the impression that the shares are cheap because the fund isn’t worth investing in. Although this isn’t always the case, boards don’t want investors to be put off by a discount that is too wide.

To stop investment trusts trading at too wide a discount, many boards employ a ‘discount control mechanism’ (DCM) that triggers at a pre-arranged point, for example if the discount widens to a pre-determined percentage, for example 10%.

The most common DCM allows the investment trust to buy back shares in the market. By reducing the number of shares available, the remaining shares have more of the NAV attributable to them, therefore the discount is reduced.

Boards can also allow shareholders to sell a proportion of their shares back to the company, which is known as a tender offer, or redemption. Shareholders sell their shares back at either a fixed discount to NAV or a price close to the NAV so shareholders don’t lose out by selling their shares at the full discount.

What happens if the discount doesn’t close enough?

A DCM is no guarantee that the discount will actually reduce. If the board employs a DCM but the investment trust still continues to trade at a wide discount, the board can ask shareholders to vote for a change in investment strategy or in extreme circumstances, a change in manager.

Some investment trusts also have a ‘fixed period’ meaning they only exist for a certain amount of time, with shareholders regularly given the option to vote on the wind up of the trust – known as a ‘continuation vote’. If shareholders vote in favour of a wind up they will be paid out their shares of the NAV, or the total assets in the fund.

What do boards do when a premium is too high?

There are very few investment trusts that trade on a consistently high premium, but it does happen. This means it is in high demand or investors have faith that the manager can outperform the market.

The board can take advantage of the confidence in the fund by issuing new shares, typically valued between the NAV per share and the prevailing share price. This entices new investors to buy into the investment trust at a slightly cheaper price without watering down the existing shares.

By issuing new shares, the liquidity of the investment trust improves – meaning it is easier for investors to get their hands on shares. If it is easier to buy in to the investment trust, the theory is, the share price should be squeezed lower.