Emerging markets equity India’s economic growth: Standing out globally

India is one of the strongest growing economies in Asia, driven by digital transformation, robust consumption and expanding exports. Find out more.

Providing access to some of the world’s fastest growing economies

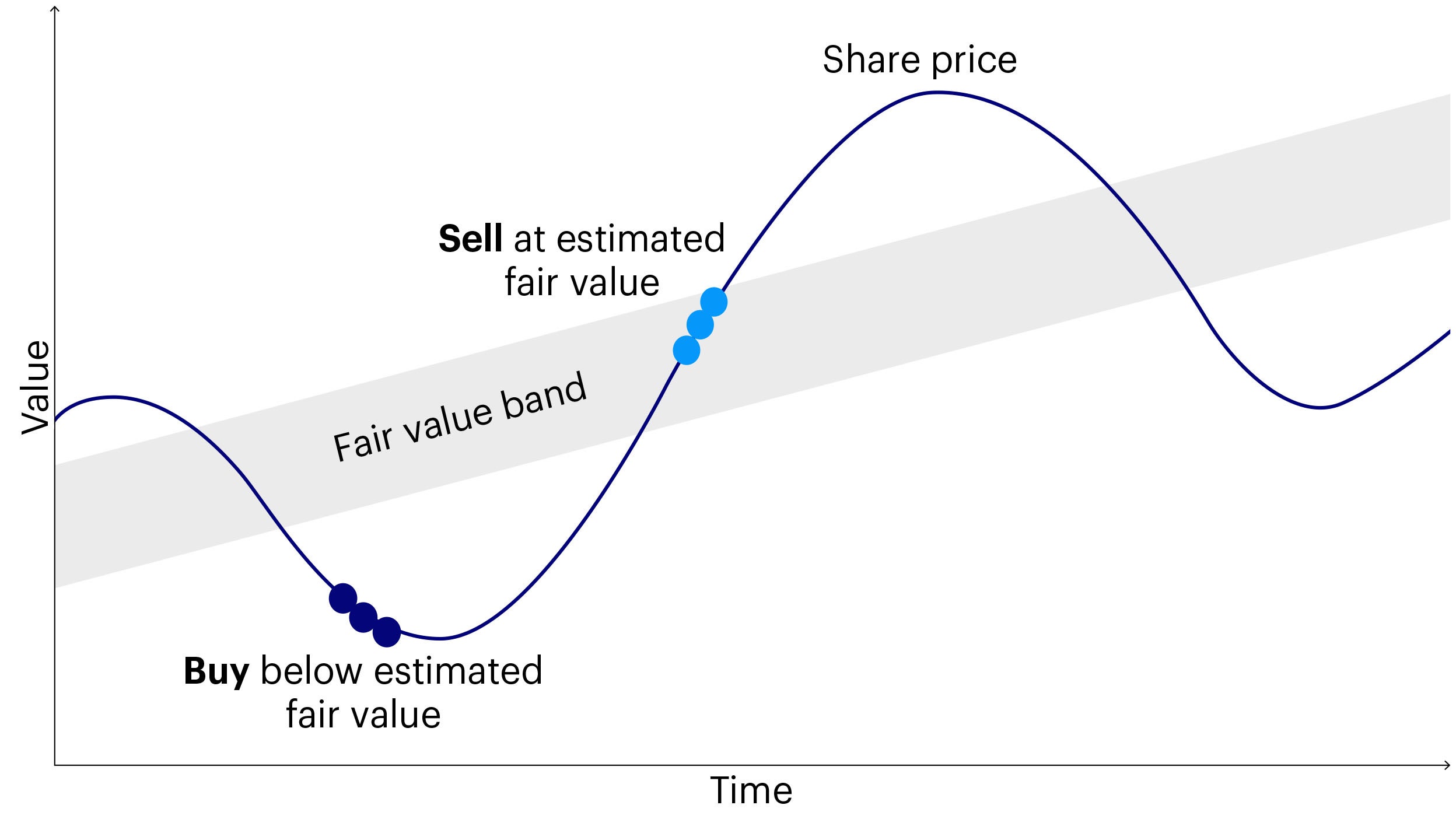

The team’s valuation-driven approach is underpinned by two core beliefs:

The investment process begins with individual stock analysis to determine a company’s fundamental profile. Factors considered include: profitability, growth, cash flow generation, balance sheet strength and Environmental, Social and Governance (ESG) credentials¹, which combined help the team derive a fair value estimate. The team's understanding of macroeconomic conditions provide context and help to build conviction.

From here they are able to identify investment opportunity: companies that they believe are trading at a significant discount to their estimate of fair value.

India is one of the strongest growing economies in Asia, driven by digital transformation, robust consumption and expanding exports. Find out more.

Our Henley-based Asian & EM Equities Team discuss the opportunities of emerging markets and why a shift in perspective is required.

The Indian election was narrowly won by Narendra Modi's Bharatiya Janata Party (BJP), but what are the investment implications. Find out more.

Asian and EM equity markets have struggled for much of 2021, but with conditions beginning to normalise, we find reasons to be optimistic.

Although there has been a clear shift in our portfolios towards cyclicals over the last few years reflecting the value emerging there, we continue to hold exposure in tech/internet: hence what can be termed a barbell.

The Henley-based Asian and Emerging Market Equities team have been successfully investing in their region for over 20 years.

Co-led by William Lam and Ian Hargreaves, the team is made up of nine fund managers and one investment analyst. The group has a wealth of experience, and a demonstrable ability to manage risk and navigate volatile markets over time.

The team take a valuation-led approach, incorporating thorough fundamental analysis. Their skill in forming different views from the market and patience in waiting for their investment theses to play out over time has been key to their successful track record.

Fund managers/analysts

Average years of industry experience2

Products managed

The team provides a number of regional portfolios which have been carefully positioned to make the most of opportunities in emerging markets and meet a variety of long-term investor needs.

| Asset class | Investment type | Region | Focus | Managed by | |

|---|---|---|---|---|---|

| Invesco Asian Equity Fund | Equities | SICAV | Asia and Australasia (ex Japan) | Capital growth | William Lam & Ian Hargreaves |

| Invesco Asia Dragon Trust | Equities | Investment Trust | Asia and Australasia (ex Japan) | Capital growth | Ian Hargreaves & Fiona Yang |

| Invesco Asian Fund (UK) | Equities | ICVC | Asia and Australasia (ex Japan) | Capital growth | William Lam |

| Invesco Pacific Fund (UK) | Equities | ICVC | Asia and Australasia | Capital growth | Tony Roberts & William Lam |

| Invesco Pacific Equity Fund | Equities | SICAV | Asia and Australasia | Capital growth | Tony Roberts & William Lam |

| Invesco Emerging Markets ex China Fund (UK) | Equities | ICVC | Emerging Markets | Capital growth | William Lam, Charles Bond & James McDermottroe |

| Invesco Emerging Markets Equity Fund | Equities | SICAV | Global emerging markets | Capital growth | William Lam, Ian Hargreaves & Charles Bond |

| Invesco Global Emerging Markets Fund (UK) | Equities | ICVC | Global emerging markets | Capital growth | William Lam, Ian Hargreaves & Charles Bond |

Keen to learn more? Visit our valuation opportunities page for:

Let us know using this form and one of our specialist team will quickly get back to you.

1 Whilst our Asian and Emerging Market Equities team consider ESG aspects they are not bound by any specific ESG criteria and have the flexibility to invest across the ESG spectrum from best to worst in class.

2 Source: Invesco as at 30 November 2023. Includes investment centre’s Chief Investment Officer, fund managers, deputy fund managers, analysts and strategists

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Any reference to an award provides no guarantee for future performance results and is not constant over time.

ICVCs

The funds invest in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise.

The funds may use derivatives (complex instruments) in an attempt to reduce the overall risk of their investments, reduce the costs of investing and/or generate additional capital or income, although this may not be achieved. The use of such complex instruments may result in greater fluctuations of the value of the funds. The managers, however, will ensure that the use of derivatives within the funds does not materially alter the overall risk profile of the funds.

As the Invesco Emerging Markets ex China Fund (UK) typically has a concentrated number of holdings, it may carry a higher degree of risk than a fund which invests in a broader range of holdings or takes smaller positions in a relatively large number of holdings.

The Invesco Asian, Asian Equity Income, Pacific and Global Emerging Markets funds (UK) may use Stock Connect to access China A Shares traded in mainland China. This may result in additional liquidity risk and operational risks including settlement and default risks, regulatory risk and system failure risk.

As one of the key objectives of the Invesco Asian Equity Income Fund (UK) is to provide income, the ongoing charge is taken from capital rather than income. This can erode capital and reduce the potential for capital growth.

SICAVs

A large portion of the Invesco Asian Equity, Emerging Markets Equity and Pacific Equity funds are invested in less developed countries. You should be prepared to accept significantly large fluctuations in the value of these funds.

The Invesco Asian Equity, Emerging Markets Equity and Pacific Equity funds may also invest in certain securities listed in China which can involve significant regulatory constraints that may affect the liquidity and/or the investment performance of the funds.

Investment Trust

The Invesco Asia Dragon Trust invests in emerging and developing markets, where difficulties in relation to market liquidity, dealing, settlement and custody problems could arise.

The product uses derivatives for efficient portfolio management which may result in increased volatility in the NAV. In addition, some companies are suspending, lowering or postponing their dividend payments, which may affect the income received by the product during this period and in the future.

The use of borrowings may increase the volatility of the NAV and may reduce returns when asset values fall.

All information as at 31 March 2023 and sourced from Invesco, unless otherwise stated.

Views and opinions are based on current market conditions and are subject to change.

For the most up to date information on our funds, please refer to the relevant fund and share class-specific Key Investor Information Documents, the Supplementary Information Document, the financial reports and the Prospectus, which are available using the contact details shown.

For more information on our SICAV funds, and the relevant risks, please refer to the share class-specific Key Investor Information Documents, the Annual or Interim Reports, the Prospectus, and constituent documents, available from www.invesco.eu.

For more information on our investment trust, please refer to the relevant Key Information Document (KID), Alternative Investment Fund Managers Directive document (AIFMD), and the latest Annual or Half-Yearly Financial Reports. This information is available using the contact details shown.