Deploying capital in changing markets: Our asset allocation views

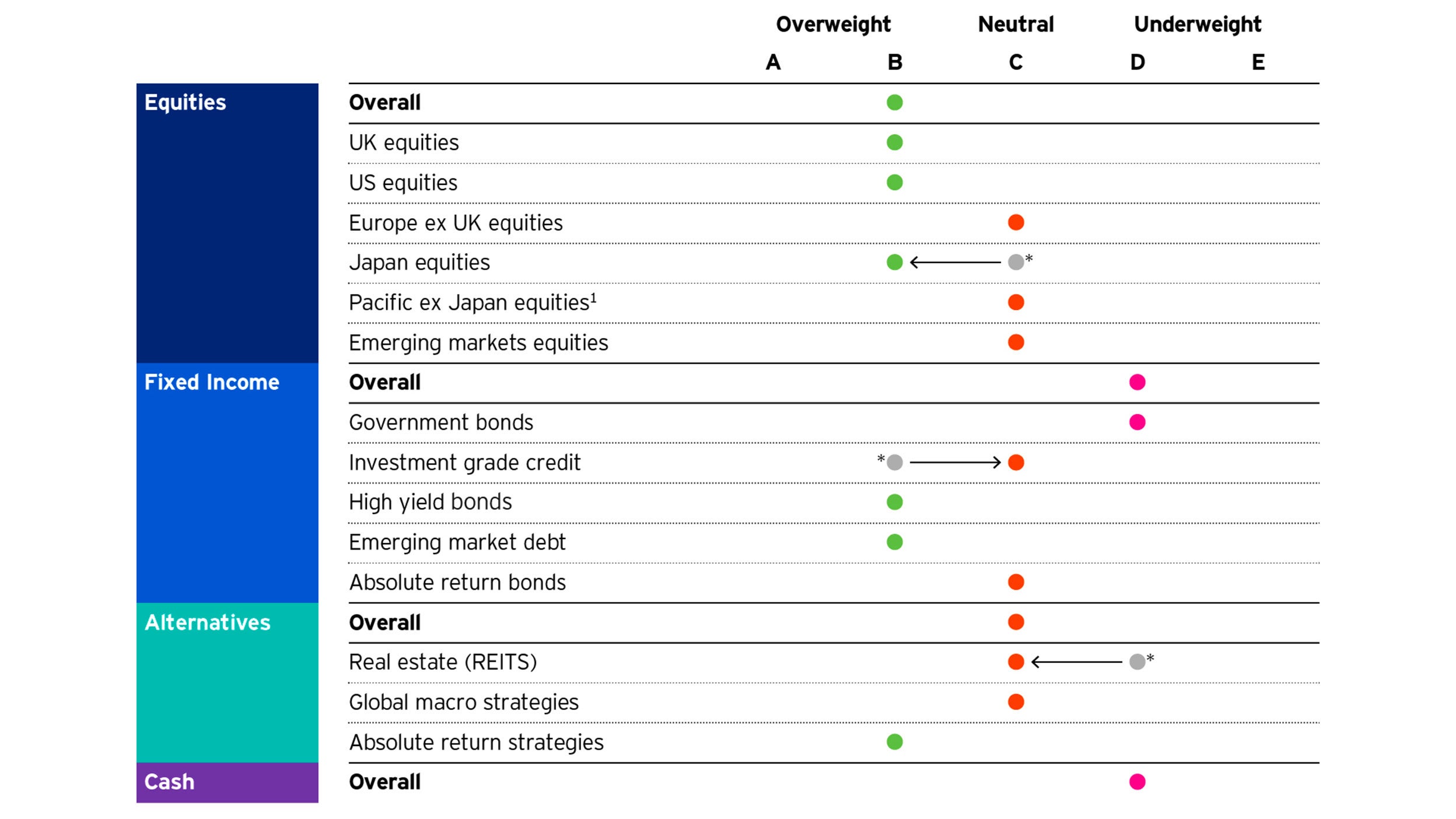

Tactical asset allocation views: A one- to three-year view of markets (as of 31 October 2020)

Here are the Henley Multi Asset team’s fundamental tactical asset allocation views over a 1-3 year investment horizon. Powered by their proprietary VOTES asset allocation framework - which ranks markets on Valuation, Other (e.g. Policy) Technical, Earnings/Economics and Selection (e.g. alpha) drivers - these fundamental preferences are reflected in the team’s long-only portfolios.

Find out more about the Henley Multi Asset team’s Summit Growth range of funds.

Read more about these tactical views below:

Equities

Overall (B: Overweight)

Absolute valuations are not cheap on a standalone basis, but in this investment climate we think relative valuations are more important. Equity valuations remain attractive relative to fixed interest and cash given the risk-free rate is likely to stay close to zero for some time. As we have mentioned before, the likelihood of a disrupted economic recovery means that we would not be surprised to see bouts of equity market volatility in the short-term. Policy support will be very important in sustaining the recovery and supportive of equity markets on a three-year view.

US equities (B: Overweight)

US equities have continued to outperform their developed market counterparts and look expensive, both in terms of absolute valuations and relative to other equity markets. Market leadership, though narrow, has started to broaden a little as investors start to anticipate a less disrupted economy. The outcome of the Presidential election could create some short-term uncertainty, but given the stated policies of both candidates, a decisive outcome (either way) may be less significant for the overall market than it is for potential rotation between sectors within the market, over our tactical timeframe.

Europe ex UK equities (C: Neutral)

Valuations look neutral at best overall suggesting sustained outperformance relative to the broader global equity market will remain difficult. The earnings picture is relatively weak in the context of some other equity markets, and dividends in the region remain at risk. Co-ordinated policy support is modestly helpful, but its potential to meaningfully support European equity markets is arguably limited.

UK equities (B: Overweight)

Valuations versus history and other major equity markets remain attractive, though the sector mix has been unhelpful in terms of driving outperformance. The domestic political landscape is stable, but post-Brexit trade deal issues remain a concern. A combination of attractive valuations, aggressive policy measures, and the potential for foreign investor flows (once a Brexit deal has been finalised) could be supportive of UK equities in the medium-term.

Japan equities (B: Overweight)

Foreign (net) flows have turned positive in recent weeks, after more than 5 years of net outflows. There is once again stability in the political sphere with new PM Suga committing to Abenomics. Corporate action and shareholder activism on governance provides a helpful backdrop. Equity market valuations are attractive in a global context and the policy framework remains helpful with the Bank of Japan being an active buyer and owner of Japanese equities. Japanese balance sheets are strong which should provide support for dividends. Upgrade from Neutral (C) to Overweight (B).

Emerging markets equities (C: Neutral)

Performance in emerging equity markets has been divergent, with Latin American and emerging European markets deep into negative territory for the year. Conversely, emerging Asian markets have been stronger with new-economy China (in particular) relatively resilient throughout the equity market volatility this year and many economies in the region ahead of the Covid curve aiding the earnings and equity markets across the region. Within emerging markets we continue to see some areas as higher risk - such as India and parts of Latin America – which we think are more likely to experience a more disruptive recovery and potential political instability.

Pacific ex Japan equities (Developed Asia) (C: Neutral)

Valuations are not notably cheap, and the earnings recovery has seemingly lagged some other developed markets thus far. However, the coherent and seemingly effective response to the coronavirus pandemic bodes well for a less disruptive economic recovery going forward.

Fixed Income

Overall (D: Underweight)

Fixed income remains unattractive at the asset class level with a significant proportion of the fixed income market offering limited value given ultra-low rates. However, spreads on high yield corporate bonds offer good relative value, despite a potential pick-up in the likely corporate default rate in the coming years.

Government bonds (D: Underweight)

Unless yields move through zero and decisively negative, value in government bonds is currently very limited. We believe policy makers will keep yields anchored at low levels with quantitative easing measures for some time to come while economies endure a difficult recovery. Yield curves have flattened, which means limited roll-down opportunities, but the risk is a steepening (and hence capital losses) as economies start to slowly normalise. While government bonds are an important defensive asset in a multi-asset portfolio, they are potentially less so than they traditionally have been, at current yields.

Investment grade credit (C: Neutral) DOWNGRADE from B

At current levels, investment grade spreads offer reasonable risk/reward opportunities given that the quantitative easing policy framework (‘buy at any price’) provides strong structural support for the asset class. However, we feel that the market is somewhat complacent now as increased debt issuance, tighter spreads mean the total return outlook is limited. Downgrade from Overweight (B) to Neutral (C).

High yield bonds (B: Overweight)

Absolute yields remain high offering attractive rewards for those prepared to take risk. While opportunities exist in both the US and Europe, we prefer the US high yield market because US corporates are potentially better placed to benefit from the likely recovery in profits that is now starting to emerge. The US policy framework is also more supportive in that it includes potentially unlimited central bank purchases of US high yield ETFs, albeit this has yet to be undertaken in a meaningful way.

Emerging market debt (B: Overweight)

Yields are high in a global context (and hence attractive) and we think there are rewards for those prepared to take risk. We are mindful that leverage continues to rise at the country level in emerging markets, that the political backdrop is generally less stable, and that supply is elevated. However, aggressive central bank rate cuts and QE has provided a supportive environment for domestic and international investors.

Absolute return bonds (C: Neutral)

With a significant proportion of the fixed income markets offering low or even negative value, the opportunity set for absolute bond strategies is currently smaller. However, such strategies can take advantage of opportunities in those select areas of the market that offer better value.

Alternatives

Overall (C: Neutral)

Depending on the nature of the strategy, alternatives can help to dampen volatility and provide less correlated sources of return. We have a neutral view on the broad asset class. Our concerns over the outlook for real estate are tempering with valuations becoming more supportive and we have a positive view of absolute return strategies given traditional market valuations.

Real estate (C: Neutral)

The global real estate market continues be unloved, with property rents under pressure and the outlook for the sector uncertain as corporates look to move away from ‘bricks and mortar’ business models. Policy support that is generally supportive for other asset classes remains less so for the real estate sector. However, valuations now appear more supportive, with significant discounts to net asset values to be found. Upgrade from Underweight (D) to Neutral (C).

Global macro strategies (C: Neutral)

Economic uncertainty and valuation disparity between asset classes and markets are positives for global macro strategies. However, such strategies are varied in approach and less full valuations in some parts of the more traditional markets dampens relative attractiveness.

Absolute return strategies (B: Overweight)

In periods of increased market volatility, absolute return strategies can exploit valuation dislocations and provide potentially defensive properties for portfolios. In a potentially low return environment for government bonds and cash, these strategies provide a return potential that is lowly correlated to traditional asset classes.

Cash

Cash (D: Underweight)

Cash rates are close to zero and in some cases negative. While cash offers the ultimate capital protection in another economic downturn, we prefer to obtain defensive exposure elsewhere.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

The Invesco Summit Growth Range has the ability to use derivatives for investment purposes, which may result in the funds being leveraged and can result in large fluctuation in the value of the funds.

The funds may be exposed to counterparty risk should an entity with which the funds do business become insolvent resulting in financial loss.

The securities that the funds invest in may not always make interest and other payments nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the funds invest, may mean that the funds may not be able to sell those securities at their true value. These risks increase where the funds invests in high yield or lower credit quality bonds.

The funds invest in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise.

Important Information

-

All data in this document as at 31 October 2020 unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.