Invesco Global Thematic Innovation Equity Fund

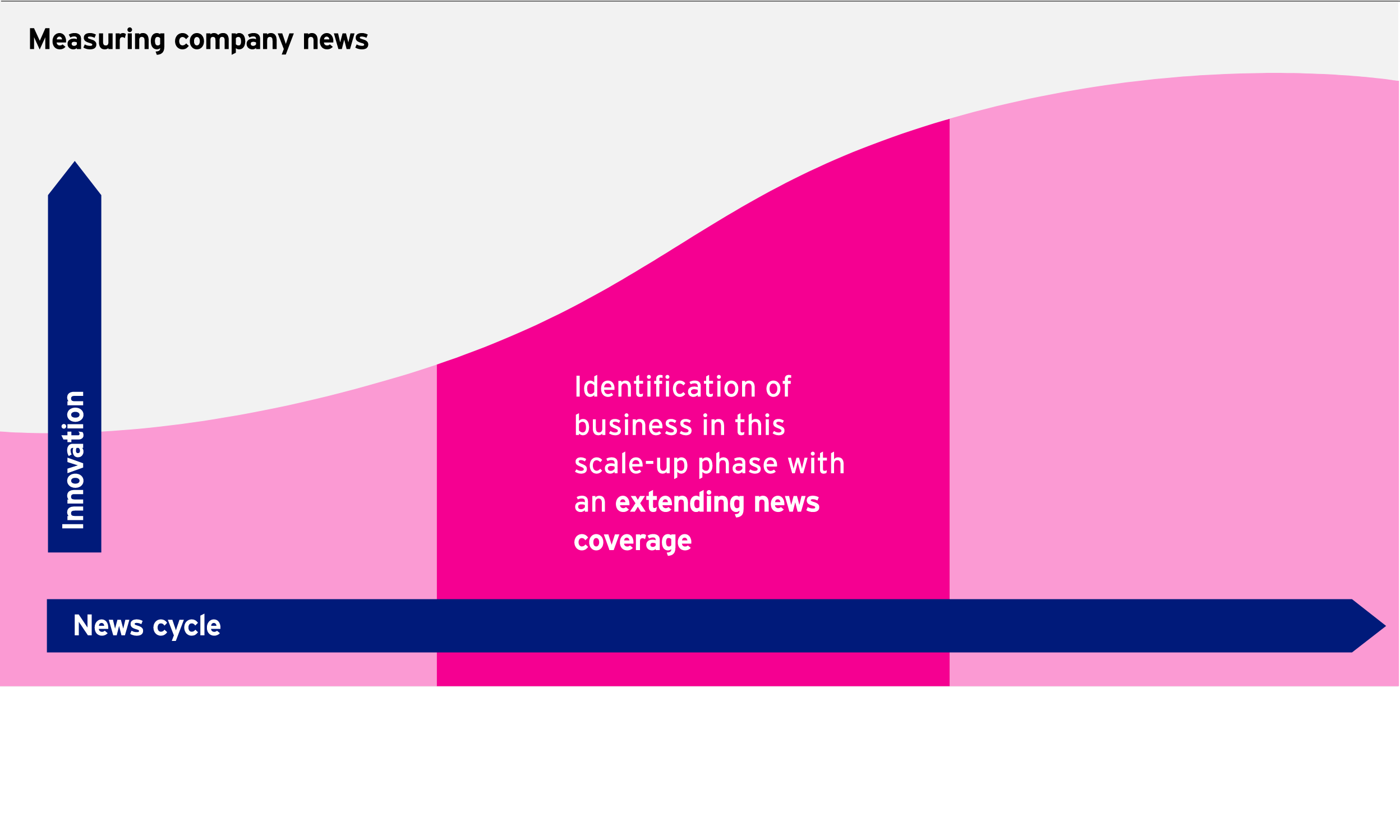

Access innovations earlier through the analytical power of Natural Language Processing (NLP), an application of artificial intelligence.

Key advantages

Investment risks

For complete information on risks, refer to the legal documents.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

The fund may invest in certain securities listed in China which can involve significant regulatory constraints that may affect the liquidity and/or the investment performance of the fund.

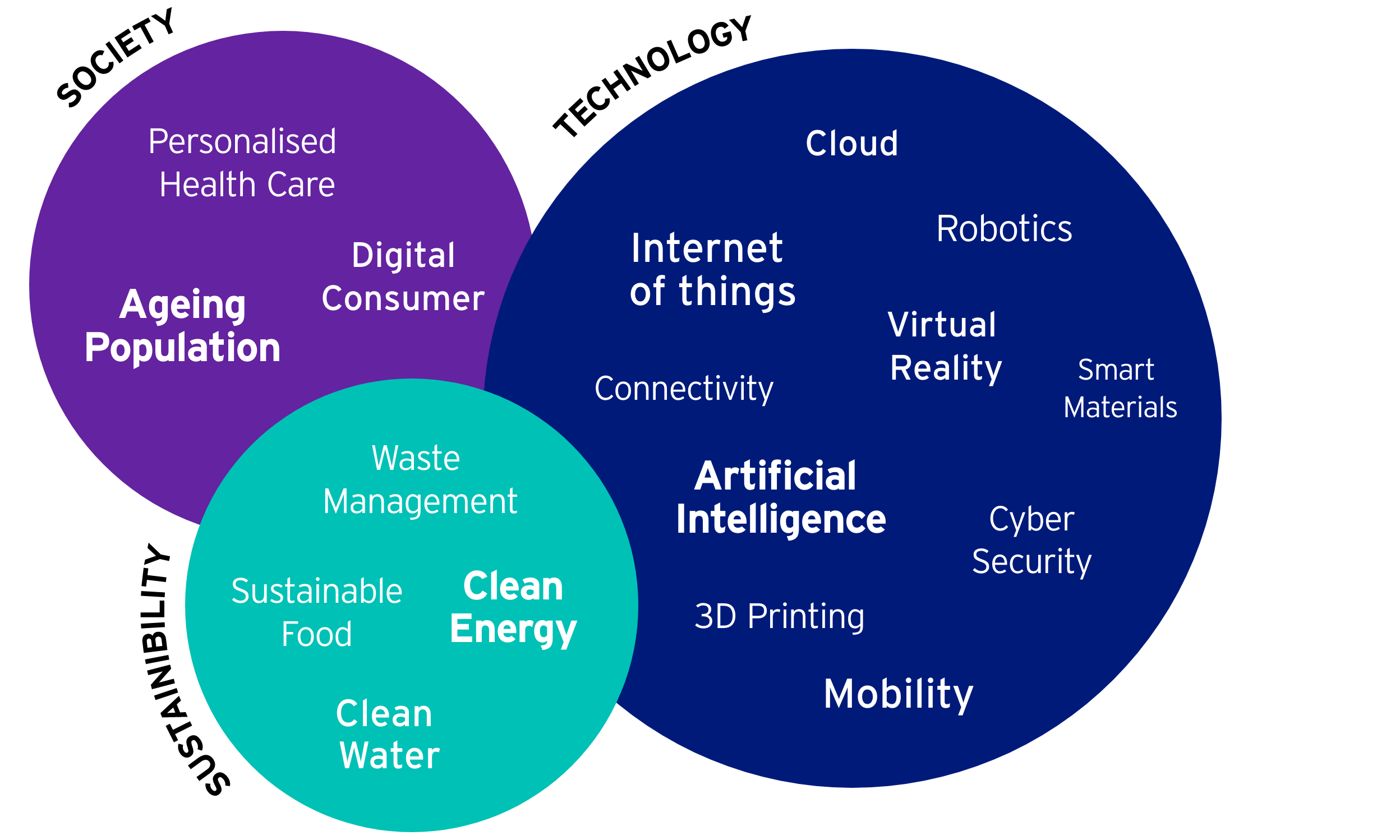

Three overarching megatrends

The world will continue to change at a rapid pace, driven by the megatrends of evolutions in technology, changes to demographics and society and the need for a more sustainable lifestyle. In this environment, we believe that highly innovative companies will be more successful.

Get the fund flyer

Want to know more about the fund?

Simply complete the form to download our 'at a glance' facts and figures.

The investment process

The goal is to capture innovations by investing in equities that are associated with multiple investment themes around the three key overarching megatrends.

The Invesco Quantitative Strategies (IQS) team has developed analytical tools through their research in machine learning and Natural Language Processing. These tools enable them to analyse news data with the aim of finding companies that have the highest exposure to and the highest relevance for each investment theme. Or in other words: companies who will profit most from the rising importance of each investment theme.

The investment concerns the acquisition of units in an actively managed fund and not in a given underlying asset.²

1. Spotting themes

2. Identifying companies

3. Creating a multi-theme portfolio

The performance

The IQS team has been testing its investment approach for five years now.

Past performance does not predict future returns.

12 months rolling returns (%)

| 30/11/2016 30/11/2017 |

30/11/2017 30/11/2018 |

30/11/2018 30/11/2019 |

30/11/2019 30/11/2020 |

30/11/2020 30/11/2021 |

|

|---|---|---|---|---|---|

| Fund | - | - | - | - | 15.19 |

| Benchmark | - | - | - | - | 19.27 |

The theme dictionaries as of 31 December 2021 were used to screen monthly news data for companies that are associated with the investment themes. Performance results do not reflect the deduction of investment advisory fees. A client’s actual return will be reduced by the advisory fees and any other expenses which may be incurred in the management of an investment advisory account.

The IQS team

The Invesco Quantitative Strategies (IQS) team has been working with large amounts of data for over three decades. They have a long track record in in systematically translating large data sets into investable portfolios. Current research projects include: Artificial Intelligence, ESG, Machine Learning and Natural Language Processing.

35+

50+

24

Billion USD Assets under management³

Footnotes

-

1 Source: Statista as of April 2020.2 The investment concerns the acquisition of units in a fund and not in a given underlying asset.

The Fund is actively managed and is not constrained by its benchmark, the MSCI All Country World Index, which is used for comparison purposes. However, the majority of the Fund’s holdings are likely to be components of the benchmark. As an actively managed fund, this overlap will change and this statement may be updated from time to time.

3 Source: Invesco as of 31 December 2021.

Important information

-

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports, the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements. This marketing document is not an invitation to subscribe for shares in the fund and is by way of information only, it should not be considered financial advice. This does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer or solicitation. Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences. As with all investments, there are associated risks. This document is by way of information only. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations. The fund is available only in jurisdictions where its promotion and sale is permitted. Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor. Fee structure and minimum investment levels may vary dependent on share class chosen. Please check the most recent version of the fund prospectus in relation to the criteria for the individual share classes and contact your local Invesco office for full details of the fund registration status in your jurisdiction. This fund is domiciled in Luxembourg.