Investing in multi-asset funds can manage UK CGT liability following cuts to annual allowance

Learn how multi-asset funds can help manage UK CGT liability and reduce risk in market uncertainty.

The days of receiving virtually nothing for the privilege of keeping your money at your local bank are apparently over. In August, the Bank of England’s base rate rose to 5.25% – its highest level since April 2008. That’s up from 0.01% in December 2021.

With cash savings rates so high, why remain invested?

In this article, we explore why investors with medium-to-long term horizons and limited liquidity needs may want to look past present volatility and remain invested in non-cash assets.

1. Doing nothing will cost you |

Inflation’s eroding powers act as a reminder of why it's important to either invest or save with a decent return in mind |

|---|---|

2. Money Illusion? |

The real return on cash is as unattractive as it has been for decades, which means your purchasing power is at risk of erosion |

3. Time in the market and not timing the market |

Staying invested in markets rather than trying to time entry and exit points is likely to pay off in the long-term |

4. Let’s keep it real |

Investors may want to consider retaining meaningful exposure to non-cash assets as they are expected to offer better relative real returns in the coming years |

Whether metaphorical or not, keeping your cash “under the mattress” will see the value of your savings fall in real terms due to inflation. This concept is nothing new, but never in modern times has it been as much of an issue as it is today.

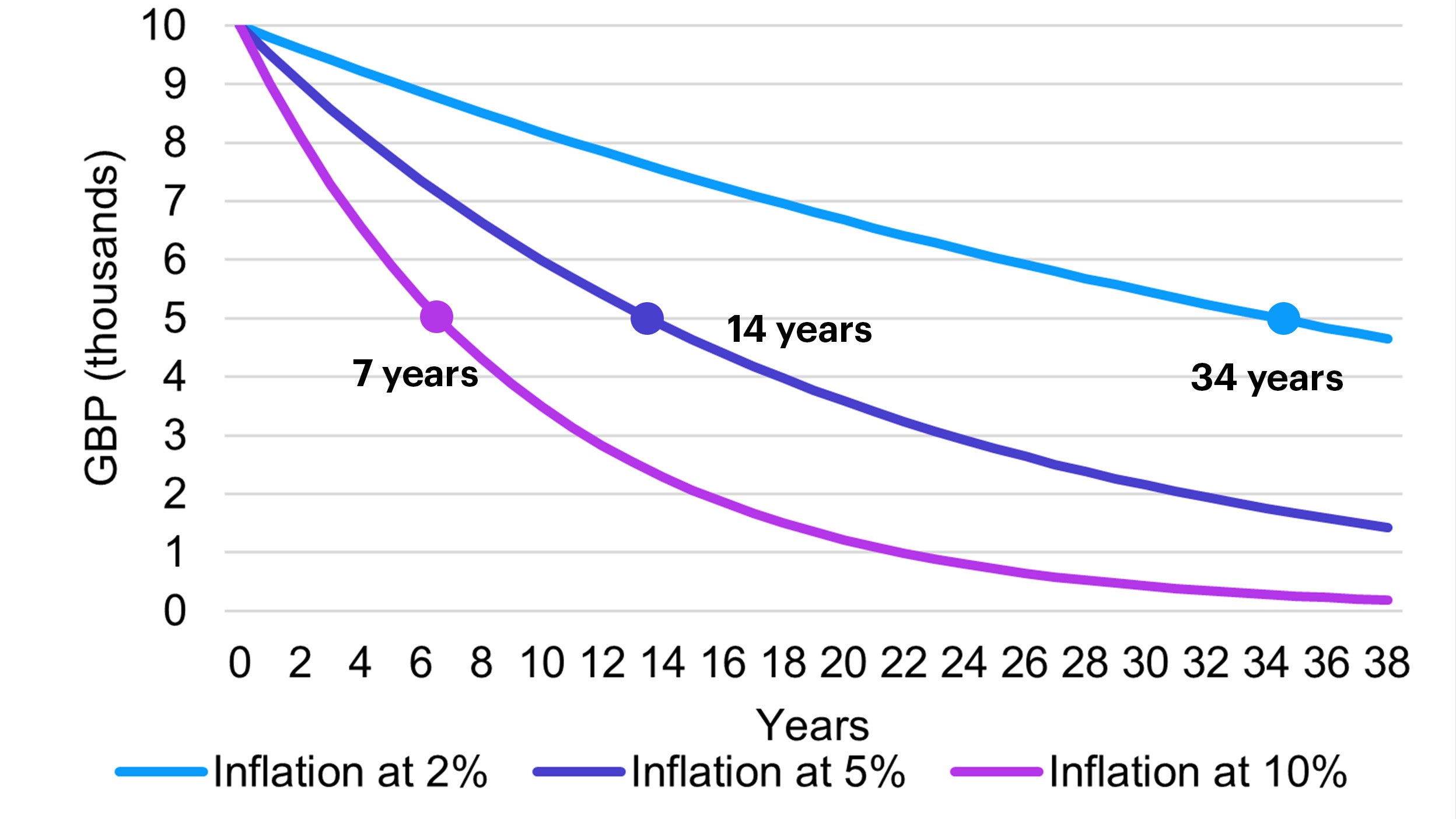

UK inflation rose to 7.9% in the 12 months to June. That’s the sixth highest print since the 30-year high peak of 11.1% reached in October 2022. In practice, this means that what £10,000 would have bought you a year ago will require £10,790 today. In other words, that’s a loss in purchasing power of £790.

Another way to look at it is that, at today’s inflation rate, it would take around eight years for your cash savings to halve (assuming no returns on cash). This compares to 34 years with inflation at 2%, which is the average rate that prevailed for most of the last three decades.

Source: Invesco. For illustrative purposes only. Assumes no return on cash.

Conclusion: Inflation’s eroding powers act as a reminder of why it's important to either invest or save with a decent return in mind.

Investors should be wary of falling prey to what the American economist Irving Fisher called “the money illusion”. The theory states that the average person tends to view their wealth and income in nominal terms instead of real terms, which is ultimately what we should really care about.

Purchasing power can change if the price of goods increases/decreases, or if inflation increases/decreases. A higher real income means a higher purchasing power since real income refers to the income adjusted for inflation.

Nominal interest rates in the UK are very attractive but, as shown in the graph below, the differential between nominal interest rates and the rate of inflation in the UK (i.e. the real return on cash) has plummeted to its lowest level in years.

Past performance is not a guide to future returns.

Source: Bloomberg as at 30 June 2023 based on quarterly data. Proxy used for nominal interest rate on cash is the Bank of England base rate.

Conclusion: The real return on cash is as unattractive as it has been for decades, which means your purchasing power is at risk of erosion.

During periods of pronounced downward volatility it becomes very tempting to exit the market in an attempt to 'reduce risk'. This can often be the worst time to do so, for several reasons.

One being that future returns are often more attractive once markets have fallen. A second reason is that this decision relies on re-entering the market at the right time. And we know that the average investor typically waits too long to do so.

Figure 3 shows the historical performance of a £10,000 investment in global equities, starting in 1999. There are two lines. One shows the performance of an investor who remained invested over the full timespan. The other shows the performance of an investor who missed the 10 best days of performance. In this scenario, the return is nearly 50% lower. This demonstrates the importance of time and patience when it comes to investing.

The best days for markets tend to follow the worst. As such, even if you think you can avoid the worst, you are probably likely to avoid the best too.

Past performance is not a guide to future returns.

Source: Bloomberg as at 30 June 2023.

Another example is an investor in the S&P 500 who shifted to cash after the first 25% decline during the Global Financial Crisis. They would find their portfolio still underwater today. This compares with breaking even in mid-2013, 4.8 years later, if they had remained invested in the stock market.

Conclusion: Staying invested in markets rather than trying to time entry and exit points is likely to pay off in the long-term.

One of the positives that comes out of severe asset price corrections (like the one investors experienced in 2022) is the prospect of higher future returns as valuations normalise over time.

Our colleagues at Invesco Solutions produce Capital Market Assumptions (CMAs) for over 170 asset classes. These are risk and return estimates, focusing on a 10-year investment horizon. Currently, their estimates suggest that cash will deliver very little ‘real’ return over that time period – i.e. limited return after inflation. Other assets, on the other hand, are likely to perform better in real terms, as Figure 4 shows.

Source: Invesco as at 30 June 2023. Nominal return estimates are forward looking based on Invesco’s 10-year Capital Market Assumptions (CMAs). They are not guarantees, and they involve risks, uncertainties, and assumptions. Expected nominal 10-year returns are adjusted by inflation using GBP Inflation Swaps Forward 5Y5Y.

Equities are a good example. At first investors will discount equity valuations at a higher interest rate due to rising inflation. This is to compensate for the fact they are worth less in today’s money.

In time, equities can often act as a buffer against inflationary pressure. How? Well, inflation leads to increased nominal revenues for those companies that can maintain their pricing power, and ultimately increased earnings for those who can also manage their input costs. Earnings in particular are a powerful driver of share prices over time.

Conclusion: Investors may want to consider retaining meaningful exposure to non-cash assets as they are expected to offer better relative real returns in the coming years.

So, for those with limited liquidity needs, it may be more prudent to stay invested in assets that are more likely to deliver a positive real return (and therefore grow the real value of your money) over the coming years.

Our analysis suggests that a portfolio of diversified assets such as equities, high yield credit and emerging market debt is well placed to do just that.

This is why within our Summit Growth and Summit Responsible multi asset fund ranges we look beyond short-term volatility to find the best risk-adjusted opportunities in markets with exposure to asset classes that can protect against inflation over the long-term.

Invesco’s heritage in managing multi asset investments for our UK clients goes back over 25 years. Our risk-targeted Summit Growth Range, Summit Responsible Range and Model Portfolio Service are globally diversified across a variety of asset classes and markets to better navigate volatile times.

Each range is made up of multiple diversified portfolios which are risk rated by the major risk profilers, including Defaqto, FinaMetrica and Synaptic.

Investing in multi-asset funds can manage UK CGT liability following cuts to annual allowance

Learn how multi-asset funds can help manage UK CGT liability and reduce risk in market uncertainty.

June 2024 MPS Market Review

Following a challenging June, stock markets enjoyed a recovery in May, delivering firmly positive performance across most developed markets, despite a slew of high-profile political developments.

May 2024 MPS Market Review

Following a challenging April, stock markets enjoyed a recovery in May, delivering firmly positive performance across most developed markets, despite a slew of high-profile political developments.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

The securities that the Summit Growth and Summit Responsible funds invest in may not always make interest and other payments, nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the funds invests, may mean that the funds are not be able to sell those securities at their true value. These risks increase where the funds invest in high yield or lower credit quality bonds.

The funds invest in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise.

The funds have the ability to use derivatives for investment purposes, which may result in them being leveraged and can result in large fluctuation in the value of the funds.

The funds may be exposed to counterparty risk should an entity with which they do business become insolvent resulting in financial loss.The use of ESG criteria may affect the Summit Responsible funds’ investment performance and therefore they may perform differently compared to similar products that do not screen investment opportunities against ESG criteria.

The Summit Responsible funds’ risk profiles may fall outside the range stated in the investment objective and policy from time to time. There can be no guarantee that the funds will maintain the target level of risk, especially during periods of unusually high or low market volatility.

All information is as at 30 June 2023, sourced from Invesco unless otherwise stated.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. Views and opinions are based on current market conditions and are subject to change.

For the most up to date information on our funds, please refer to the relevant fund and share class-specific Key Investor Information Documents, the Supplementary Information Document, the Annual or Interim Reports and the Prospectus, which are available using the contact details shown.