The analysis shows the effect of taxation policy response, in the wake of the pandemic, has been to increase the burden of tax on UK listed companies, bringing the effective tax rate more into line with European levels, but at the cost of reducing earnings. By contrast, effective tax rates have fallen in the US and China, providing a boost to corporate earnings.

Analysis of consensus earnings expectations shows that the annualised growth in EPS in the US is expected to be 9.5% over the 8-year period, compared to 5.5% in UK. However, half of this EPS growth differential is explained by taxation, and the underlying difference in rate of growth in pre-tax income less than 2%.

Against this backdrop, earnings multiples have in the US expanded from 16.8x consensus expectations for the next 12 months (in January 2017) to 19.6x (31 July 2023). By contrast in the UK, they have contracted from 14.3x to 11.0x, over the same period.

This seems both anomalous and excessive.

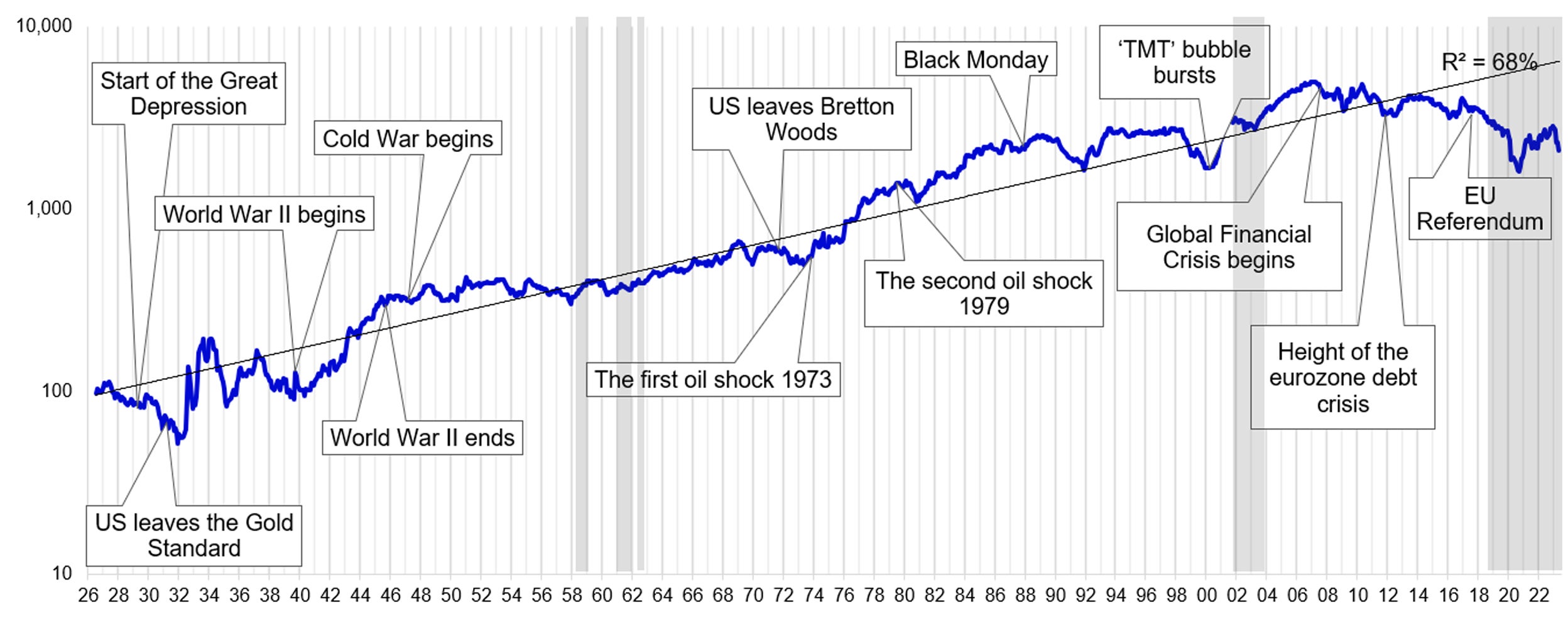

Risks to equity returns

From a top-down perspective, there are a number of macro factors at play that we believe will continue to challenge global equities over the medium term.

We believe inflation is likely to remain stronger for longer in developed markets. In some cases, central bank models of how inflationary pressures are transmitted through the economic system have also been proven to be out of touch. The precise mix in the inflationary cocktail varies from market to market. But it remains potent whatever form.

With inflation set to remain higher for longer, we also expect interest rates to remain higher for longer. Such is the likely persistence of inflation; we have become increasingly concerned at the possibility of policy error by central banks.

Added into the mix, we sense there is a degree of complacency in energy markets. These muddled through last winter through a combination of mild weather, reduced economic activity in China (still largely shut because of Covid), and a physical and financial destocking of oil (especially, of strategic petroleum reserves).

As we look out to the rest of the year and beyond, we are not calling for a recession in any particular market, but the risks of a slowdown of GDP in national economies and of earnings momentum in individual businesses are there to see.

Despite the caution engendered by macro views, we remain optimistic at the medium to long-term outlook for UK equities, particularly on a relative basis.

The bottom line is that UK equities are an attractive source of value. The opportunity set includes many world-class, internationally orientated companies with good earnings momentum. They are undervalued versus their own history and versus the US, and sterling is undervalued too.

UK equities are also an attractive source of real income. Higher inflation and volatility are both likely to continue, but dividends should keep pace with inflation over time. Equity income will be attractive in challenging markets.

Attractive, different, … and available through Invesco Funds which form a consistently managed large-cap, core-value strategy, that has demonstrated an ability to add value to investors over the long term, even in challenging markets.