Summit Responsible Range first anniversary: Funds built for the future

Key takeaways

1

2

3

The environmental, social and governance (ESG) space is growing. Regulations continue to shift, and client demand is evolving. A year ago, with the future of investment space in mind, we launched our Summit Responsible Range.

The range underscores Invesco’s commitment to ESG, by providing a low-maintenance, low-cost and transparent solution that aims to make responsible investing easily accessible. In practice, this means the funds offer a better ESG quality score, lower carbon intensity and increased levels of female leadership against a traditional non-ESG comparator.

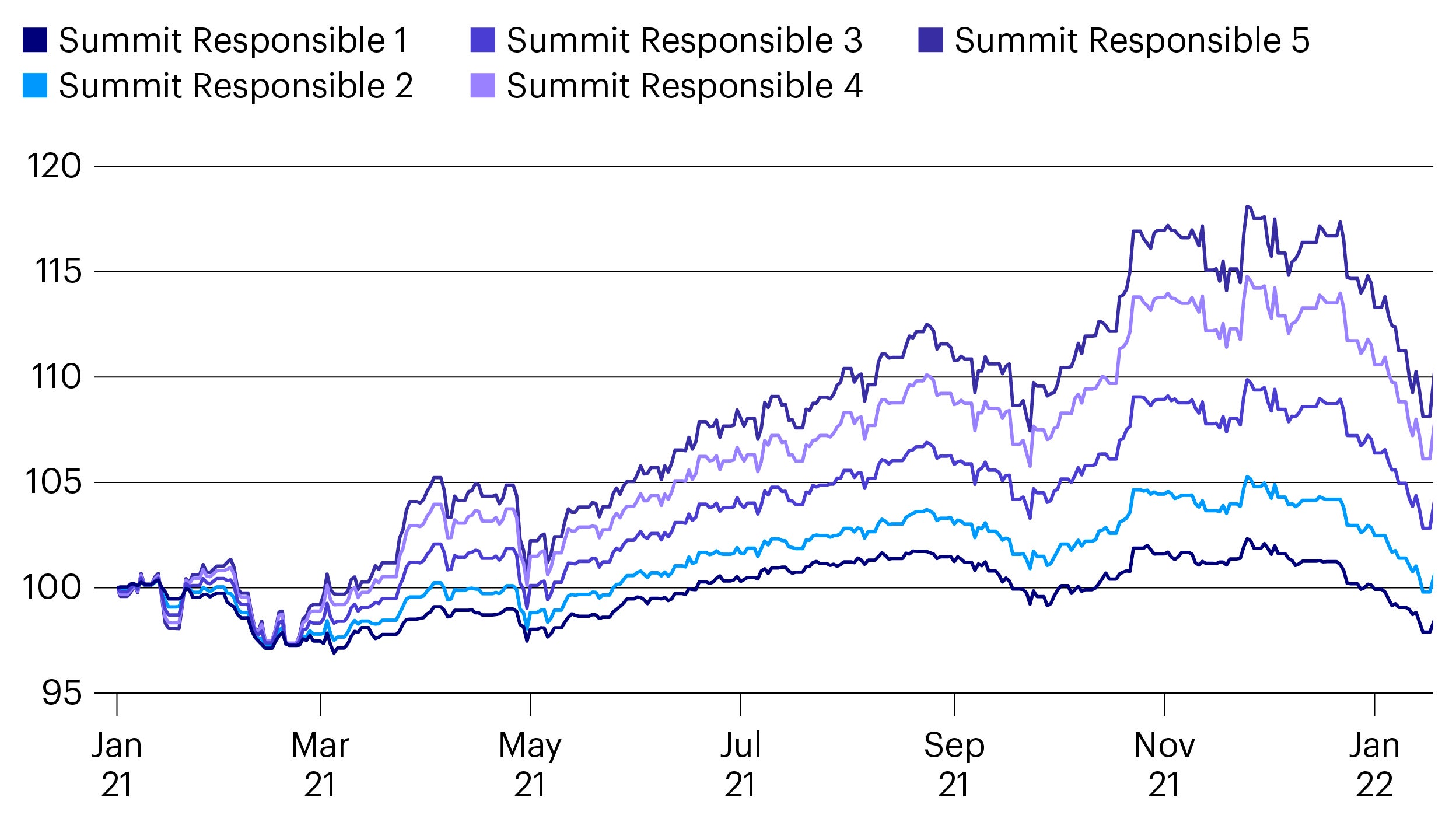

Since launch, the funds have performed in line with expectations. Each fund in the range has performed in line with its intended risk profile while delivering an improved ESG outcome as noted above.

“A year ago, we launched the Summit Responsible range of Global Multi Asset risk targeted funds to respond to the growing demand for credible, consistent and transparent responsible investing that also doesn’t cost the earth,” according to Fund Manager Clive Emery.

“Though the funds are built for this future it is also pleasing to see how well they have performed over their first year both in risk and return terms but also across a huge range of sustainable measures.”

Standardised rolling 12-month performance (%)

| Fund | 31.01.17-31.01.18 | 31.01.18-31.01.19 | 31.01.19-31.01.20 | 31.01.20-31.01.21 | 31.01.21-31.01.22 |

|---|---|---|---|---|---|

| Invesco Summit Responsible 1 Fund (UK) | n/a | n/a | n/a | n/a | -1.20% |

| Invesco Summit Responsible 2 Fund (UK) | n/a | n/a | n/a | n/a | 1.49% |

| Invesco Summit Responsible 3 Fund (UK) | n/a | n/a | n/a | n/a | 5.44% |

| Invesco Summit Responsible 4 Fund (UK) | n/a | n/a | n/a | n/a | 9.67% |

| Invesco Summit Responsible 5 Fund (UK) | n/a | n/a | n/a | n/a | 12.38% |

Past performance does not predict future returns. Source: Lipper. Performance figures are based on the Z Accumulation share class. Performance figures for all share classes can be found in the relevant Key Information Document. Fund performance figures are shown in sterling, inclusive of reinvested income and gross of the ongoing charge and portfolio transaction costs to 31 January 2022, unless otherwise stated. Source: Lipper. 14 January 2021 = 100.

Clive Emery, Richard Batty and David Aujla are the three named managers behind the range. They are further supported by the wider Multi Asset and Invesco’s Investment Solutions team, which oversee a combined total of over US$100bn of assets under management1.

“Responsible investing is becoming mainstream, and this is leading funds to have to invest across three dimensions - return, risk and responsibility,” said Clive.

Continue reading...

To find out more, download the full version of this article, which goes into further depth about how the Summit Responsible Range can help professional investors and their clients, or visit the Summit Responsible product range page on our website.

Footnotes

-

1 As at 31 January 2022.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested.

The Invesco Summit Responsible Range has the ability to use derivatives for investment purposes, which may result in the funds being leveraged and can result in large fluctuations in the value of the funds.

The funds' risk profiles may fall outside the ranges stated in the investment objectives and policies from time to time. There can be no guarantee that the funds will maintain the target level of risk, especially during periods of unusually high or low market volatility.

The funds may be exposed to counterparty risk should an entity with which the funds do business become insolvent resulting in financial loss.

The securities that the funds invest in may not always make interest and other payments nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the fund invests, may mean that the fund may not be able to sell those securities at their true value. These risks increase where the fund invests in high yield or lower credit quality bonds.

The funds invest in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise.

The use of ESG criteria may affect the product’s investment performance and therefore may perform differently compared to similar products that do not screen investment opportunities against ESG criteria.

Important information

-

All information as at 14 January 2022 and sourced by Invesco, unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

For the most up to date information on our funds, please refer to the relevant fund and share class-specific Key Information Documents, the Supplementary Information Document, the Annual or Interim Reports and the Prospectus, which are available on our website.