Equities An increasingly connected world

Our work in the Invesco Global Consumer Trends strategy is focused on trying to understand the big changes in consumer behaviour that follow from increased connectivity.

No other device has embedded itself into our lives to the same extent as the smartphone. We take it with us wherever we go, and those who have accidentally left it behind once or twice will know that sinking (though somewhat irrational) feeling of anxiety the moment we realise it is no longer by our side.

Unlike the humble mobile phone of yesteryear that served as a basic communication tool, today’s smartphones can perform numerous functions. It still enables you to make calls, of course, but it is also a music player, a TV and a computer – all in one. And with the number of apps that are currently being developed, the possibilities seem endless.

Tablets have similar functionalities on paper, but their size ascribes to them a different purpose. They are largely used at home or for travel, and they also tend to be shared amongst consumers, unlike the personal devices smartphones have become.

Regardless, both these types of devices have played a role in the shift of our media and music consumption towards mobile. In the US, the share of time adults spend consuming media through mobile devices increased from 12% to 33% in the last seven years leading up to 2019.

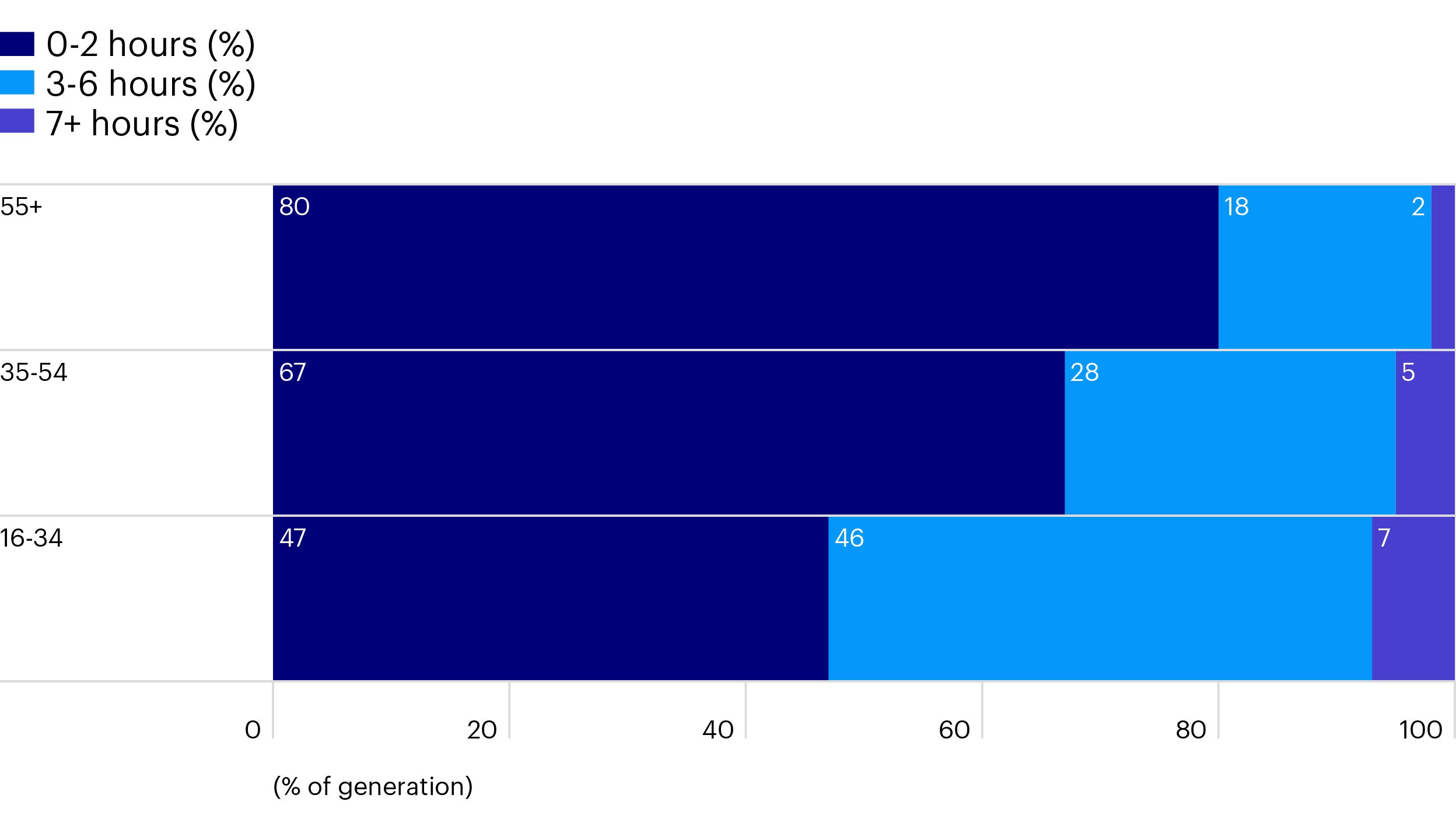

2018 marked the first year, in which mobile technology was expected to surpass televisions as a major platform for media consumption in the US (Figure 1). If we drill further into the numbers and look at the millennial age cohort, media consumption through mobile is up nearly 45% – and for us, that’s a leading indicator that the trend towards mobile is set to continue.

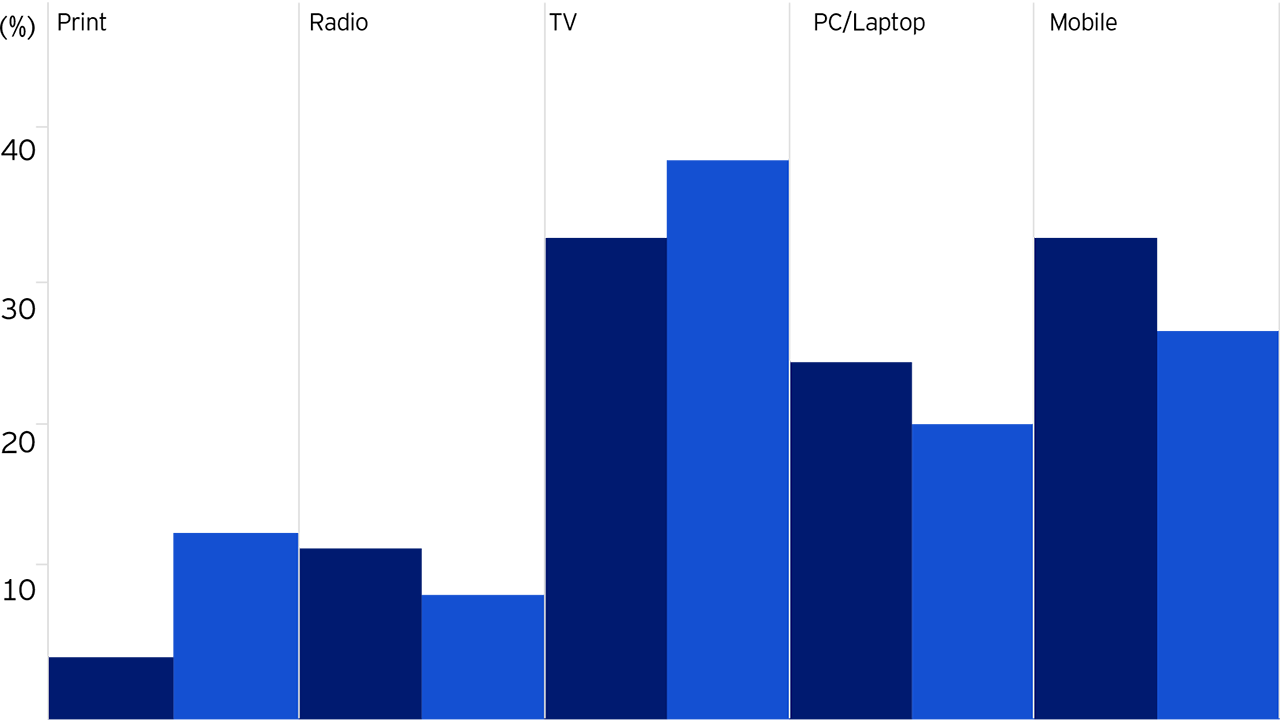

The economic impact that we are focusing on within media is how the shift towards mobile will affect the ad budget. Usually, advertisers want to put as much of their budget on a platform as it has our engagement. In Figure 2, the dark blue bar on the left represents our engagement, whilst the bar on the right represents the ad budget.

If we are looking for an area with the potential for growth, we can clearly see that mobile has the most room to catch up, and as we have previously discussed, it is also the only area that is going to continue to grow and take share from the other segments. This is why we currently focus our media exposure on great mobile assets. For us, these continue to be the big search engine and social media names, such as Google and Facebook, Baidu in China and Yandex in Russia.

One of our holdings within the Invesco Global Consumer Trends Strategy is Alphabet, the company behind Google. As many will know, Google is the number one search engine globally – outside of China, Russia and Japan. It already dominates global internet advertising revenues and took in US$185 billion in advertising revenues in 2019.1 We believe that search activity remains on a positive secular trend as smartphones rise in penetration and more information, commerce and services move online. And as advertisers continue to spend more on internet and mobile ads.

As we walk around with a smartphone in our pocket, we are essentially carrying an on-demand music platform around with us. This has led to a big increase in music consumption. Data shows that millennials as a group consume significantly more music than previous generations (see infographic). And if we look at the growth of music consumption in the US, it has been growing steadily year-on-year in terms of total listening hours, which is amazing for such a mature form of media.

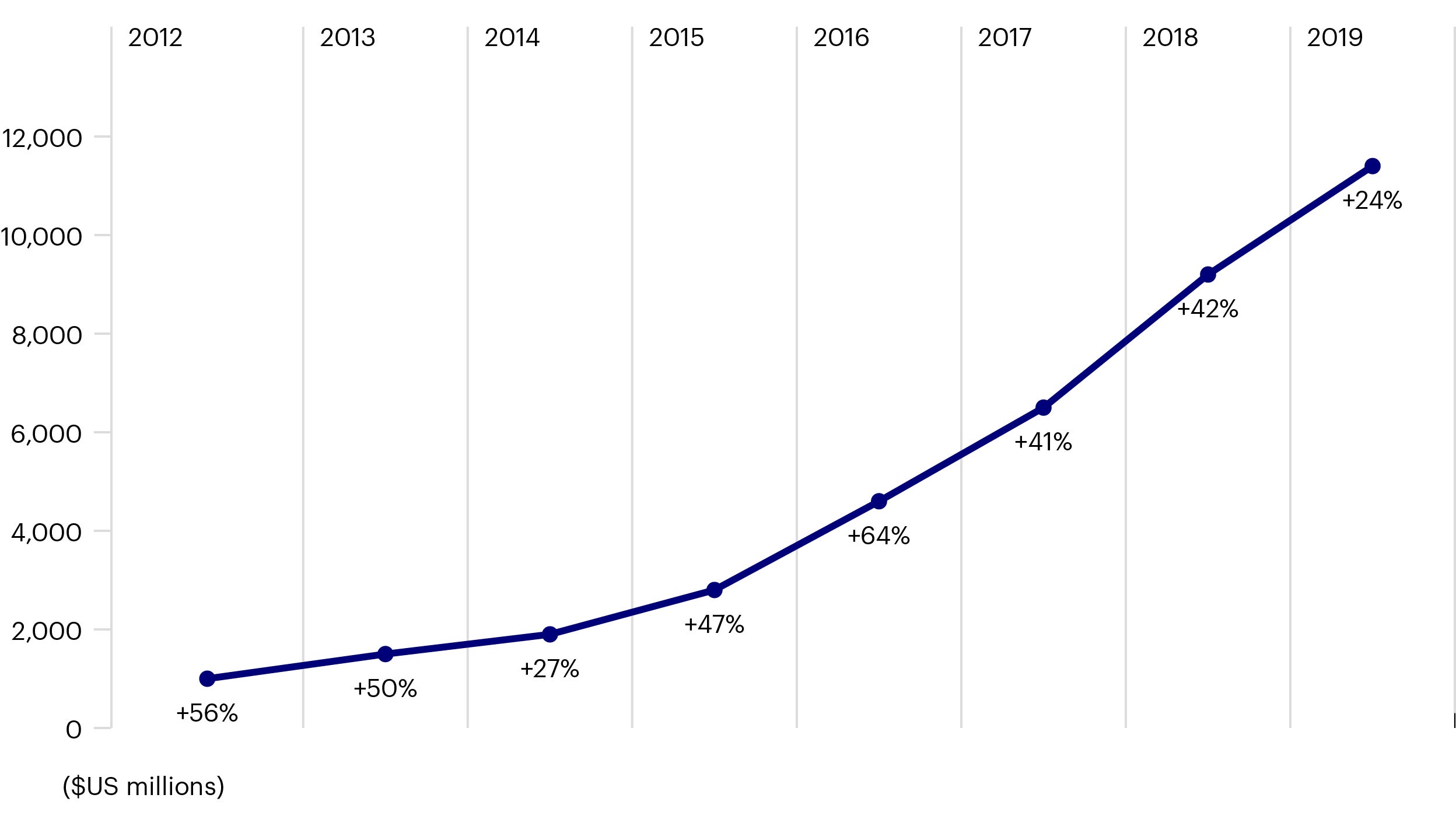

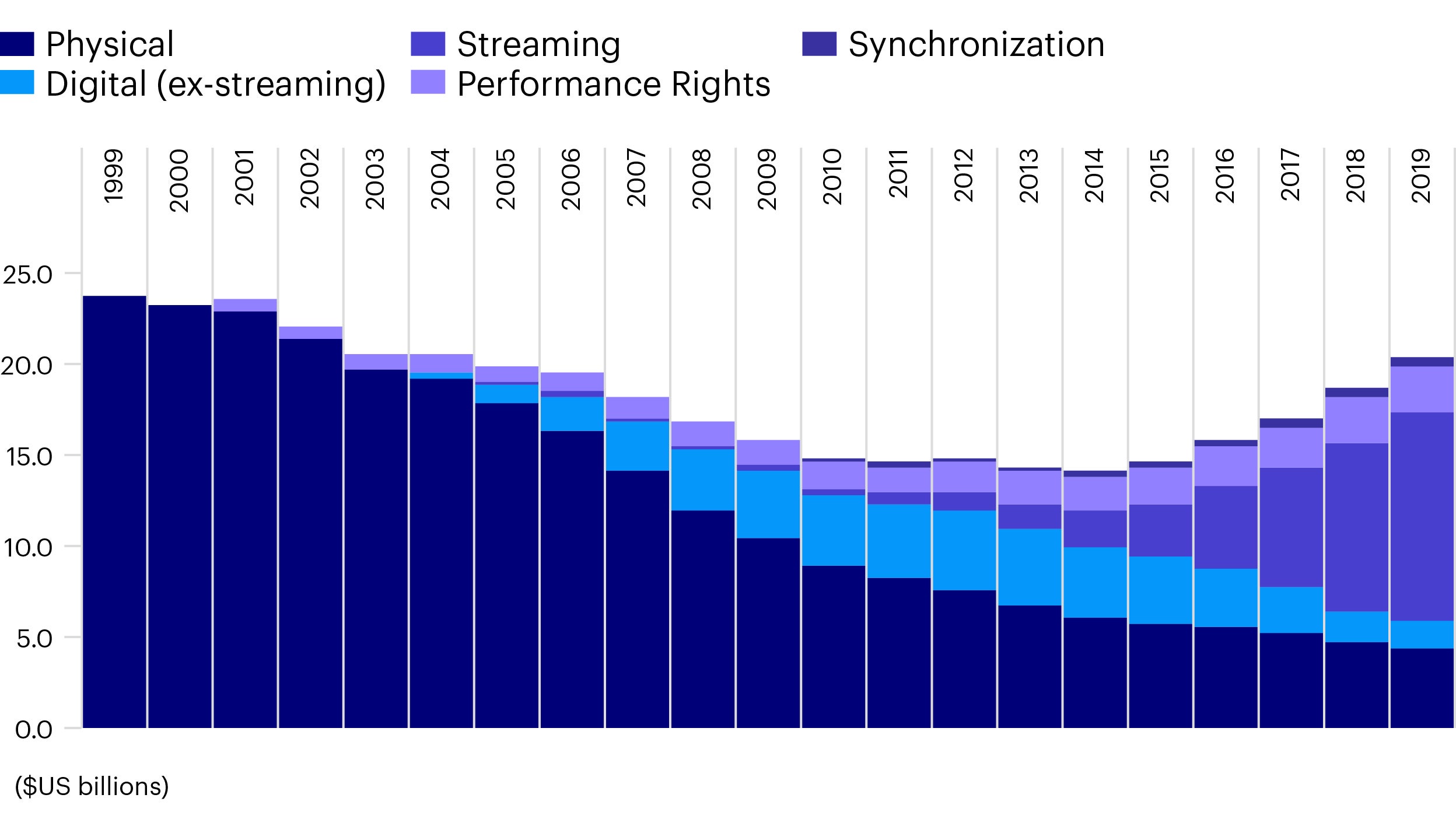

What is compelling is that the way we are purchasing music is changing. Increasingly, we are choosing a subscription to get our music rather than buying it ‘a la carte’. This is very important for the history of revenue in the music industry, which has been a very painful story.

The first decade of the 21st century saw a seismic shift in the way the music industry worked. Consumers were increasingly using computers as a means to buy music, and the rise of digital music consumption led to a change in buying habits. Instead of buying a bundle of goods in the form of an album, we moved towards buying a single unit – a song.

In the media business, you always want to try selling as much of your products as you can. You want to monetize your library consistently. The best way to accomplish that is through a subscription model, whilst the worst option is through ‘a la carte’ sales. This means that we are now moving from the worst-selling model in the music industry to the best.

In the infographic above, you can see that we are beginning to see an inflection in revenue, and we believe this is just the beginning. We have looked at forecasts for subscriptions, and we believe we are in front of a 10-year long period of subscription growth.

In our opinion, the best way to be positioned in this sector is through the content owners. There are three companies that own most of the music content in the world: Sony, Vivendi and Warner Brothers. The Invesco Global Consumer Trends Fund has exposure to the two public companies: Sony and Vivendi.

1 Source: Statista as at 31 December 2019.

Our work in the Invesco Global Consumer Trends strategy is focused on trying to understand the big changes in consumer behaviour that follow from increased connectivity.

The internet has changed the way we shop dramatically...

For complete information on risks, refer to the legal documents. The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. As this fund is invested in a particular sector, you should be prepared to accept greater fluctuations in the value of the fund than for a fund with a broader investment mandate.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports, the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements. This marketing document is not an invitation to subscribe for shares in the fund and is by way of information only, it should not be considered financial advice. This does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer or solicitation. Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences. As with all investments, there are associated risks. This document is by way of information only. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations. The fund is available only in jurisdictions where its promotion and sale is permitted. Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor. Fee structure and minimum investment levels may vary dependent on share class chosen. Please check the most recent version of the fund prospectus in relation to the criteria for the individual share classes and contact your local Invesco office for full details of the fund registration status in your jurisdiction. This fund is domiciled in Luxembourg.

This article is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.