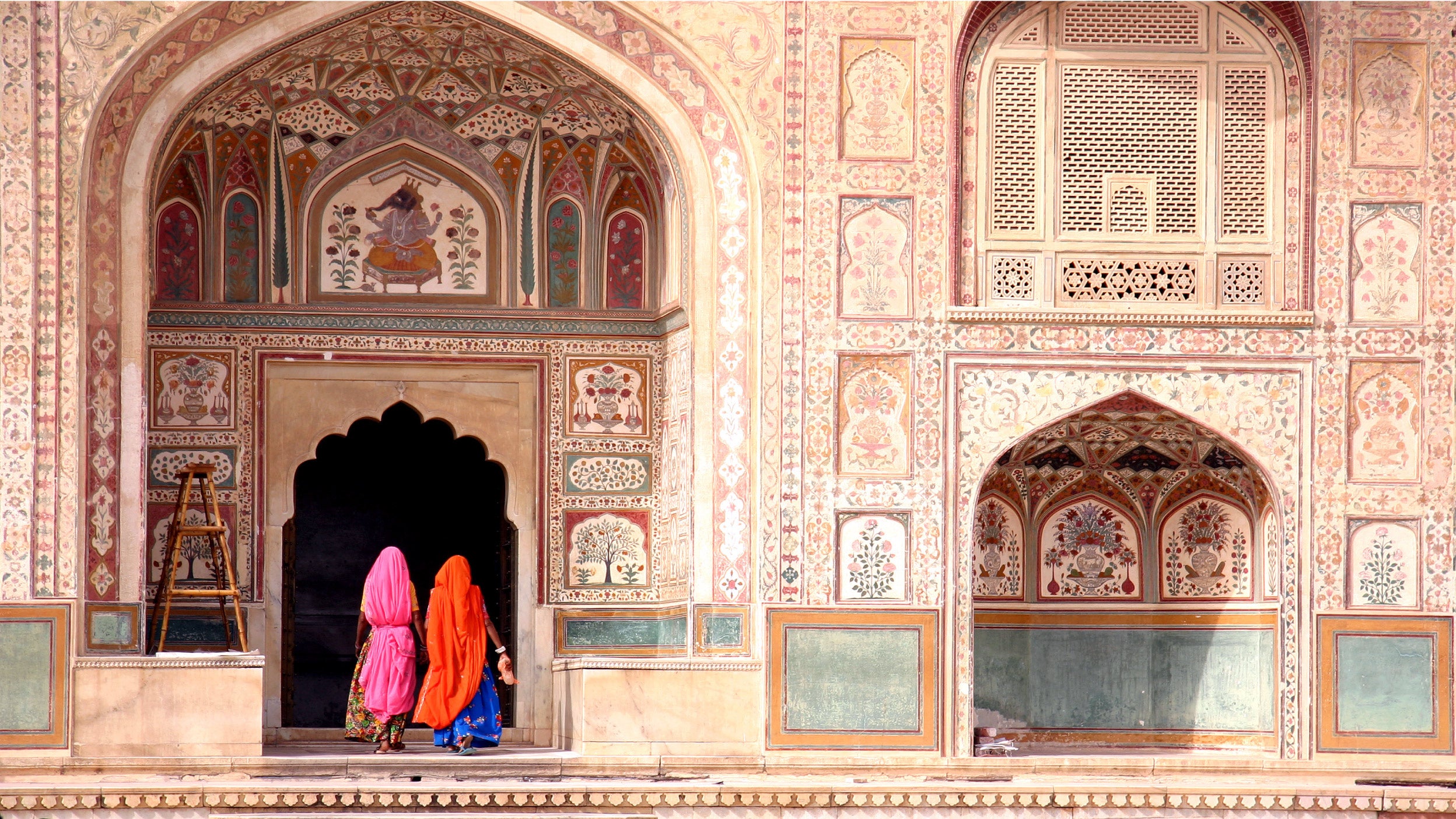

Emerging markets equity India’s economic growth: Standing out globally

India is one of the strongest growing economies in Asia, driven by digital transformation, robust consumption and expanding exports. Find out more.

An actively managed fund that’s not constrained by a benchmark. We find opportunities in unloved areas of the market and our portfolio consists of approximately 50 of our best ideas.

See all product detailsEmerging markets offer investors a world of untapped potential. Home to the vast majority of the world’s population, they’ve outpaced developed markets in terms of economic growth for years. And yet, they remain significantly underrepresented in many equity portfolios.

We are contrarian investors, aiming to buy companies for significantly less than our estimate of ‘fair value’. We favour conservative balance sheets and invest with a 3–5-year time horizon.

As active investors we have a contrarian approach. We don’t take the consensus view, rather we focus on temporarily unloved areas of the market to look for new ideas. Markets often overact to short-term news and place undue influence on current trends. We seek to exploit these market inefficiencies.

Buying when valuations are lower leads to better subsequent returns for investors. We buy undervalued stocks that are trading well below their fair value. We use fundamental analysis focusing on balance sheet health, profitability, cash flow dynamics and accounting quality to gain an idea of a company’s fair value and future earnings growth

We believe equity markets tend to reward those who can take a long-term view. We target a double-digit annualised return from each stock we buy to beat the market and think share prices will reflect fundamentals over time.¹ Access the Invesco Global Emerging Markets Fund (UK) product page to view KIIDs and factsheets.

We are contrarian investors, aiming to buy companies for significantly less than our estimate of ‘fair value’. We favour conservative balance sheets and invest with a 3–5-year time horizon.

As active investors we have a contrarian approach. We don’t take the consensus view, rather we focus on temporarily unloved areas of the market to look for new ideas. Markets often overact to short-term news and place undue influence on current trends. We seek to exploit these market inefficiencies.

Buying when valuations are lower leads to better subsequent returns for investors. We buy undervalued stocks that are trading well below their fair value. We use fundamental analysis focusing on balance sheet health, profitability, cash flow dynamics and accounting quality to gain an idea of a company’s fair value and future earnings growth

We believe equity markets tend to reward those who can take a long-term view. We target a double-digit annualised return from each stock we buy to beat the market and think share prices will reflect fundamentals over time.¹ Access the Invesco Global Emerging Markets Fund (UK) product page to view KIIDs and factsheets

India is one of the strongest growing economies in Asia, driven by digital transformation, robust consumption and expanding exports. Find out more.

Our Henley-based Asian & EM Equities Team discuss the opportunities of emerging markets and why a shift in perspective is required.

The Indian equity market is poised for significant growth, and we believe performance will be supported by strong corporate earnings and GDP figures. Find out more.

The team has been successfully investing in Asian and emerging market equities for over 20 years. Today, the team’s Asian equity strategies have a combined AuM of > EUR 12 billion.²

We are optimistic about the prospective returns for emerging market equities.

Historically, a growing middle class has been a strong indicator of a country’s future economic growth. As the middle class in emerging market countries expands, companies are expected to benefit from growing consumer purchasing power and shifts in spending patterns. Moreover, emerging markets are trading at a significant discount relative to developed markets and world markets, buoyed by strong fundamentals and a number of economies that are at an early stage in their cycle.

Emerging markets’ growth is expected to remain steady in 2024. Emerging economies’ manufacturing and services Purchasing Managers Index surveys, which focus on current and near-term economic expectations, mostly point to economic expansion. Expectations across most emerging markets are that inflation will be trending lower steadily, which should bode well for consumption and company earnings.3

You can invest in emerging market stock markets by investing in actively managed mutual funds or exchange traded funds (ETFs). Invesco offers a broad range of actively managed funds and ETFs.

Historically, a growing middle class has been a strong indicator of a country’s future economic growth. As the middle class in emerging market countries expands, companies are expected to benefit from growing consumer purchasing power and shifts in spending patterns. Moreover, emerging markets are trading at a significant discount relative to developed markets and world markets, buoyed by strong fundamentals and a number of economies that are at an early stage in their cycle.

Emerging markets’ growth is expected to remain steady in 2024. Emerging economies’ manufacturing and services Purchasing Managers Index surveys, which focus on current and near-term economic expectations, mostly point to economic expansion. Expectations across most emerging markets are that inflation will be trending lower steadily, which should bode well for consumption and company earnings.3

You can invest in emerging market stock markets by investing in actively managed mutual funds or exchange traded funds (ETFs). Invesco offers a broad range of actively managed funds and ETFs.

¹ Source Invesco. For illustrative purposes only. There is no guarantee this target will be achieved.

² Source: Invesco as at 31/03/2024

³ IMF World Economic Outlook April 2024 https://www.imf.org/en/Publications/WEO/Issues/2024/04/16/world-economic-outlook-april-2024

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. The fund invests in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise. The Fund may use Stock Connect to access China A Shares traded in mainland China. This may result in additional liquidity risk and operational risks including settlement and default risks, regulatory risk and system failure risk. The fund may use derivatives (complex instruments) in an attempt to reduce the overall risk of its investments, reduce the costs of investing and/or generate additional capital or income, although this may not be achieved. The use of such complex instruments may result in greater fluctuations of the value of the fund. The Manager, however, will ensure that the use of derivatives within the fund does not materially alter the overall risk profile of the fund.

Data is as at 30/04/2024 and sourced from Invesco unless otherwise stated. This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. Views and opinions are based on current market conditions and are subject to change. For the most up to date information on our funds, please refer to the relevant fund and share class-specific Key Investor Information Documents, the Supplementary Information Document, the financial reports and the Prospectus, which are available using the contact details shown.

EMEA3598469/2024

Let us know using this form and one of our specialist team will quickly get back to you.