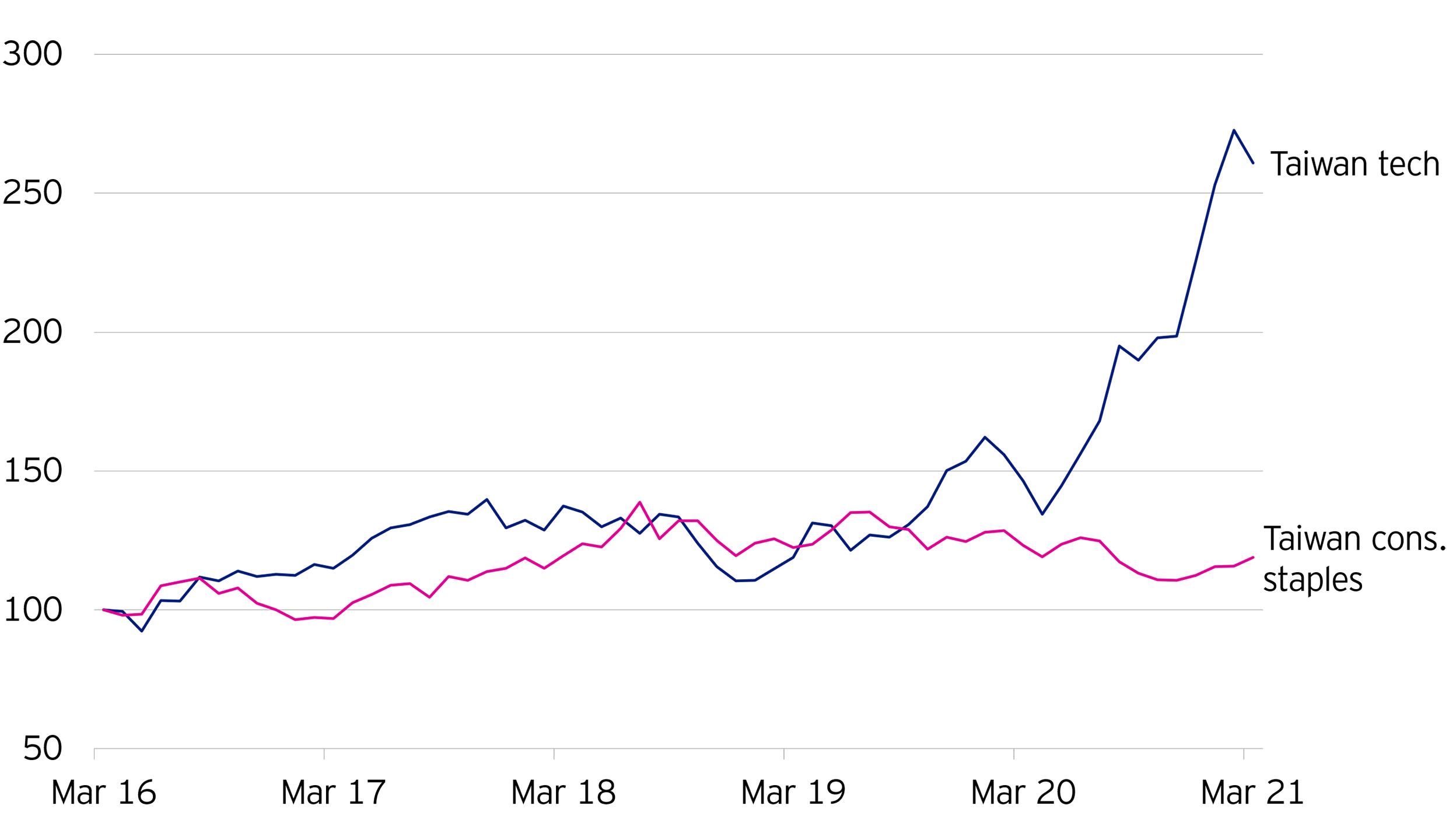

We believe it is right to have a balanced strategy at the current time. We continue to have significant exposure to tech and internet stocks but have been trimming our holdings post the strong gains seen in share prices during 2020. We haven been reinvesting in selected cyclical stocks, and more recently, in the consumer staples and alternative energy sectors.

Trimming in tech and internet stocks post share price gains and reinvesting

Some of the largest positions in the Asian equity strategy are in technology and internet companies. These companies are big beneficiaries of a confluence of demand factors, such as increased 5G proliferation, e-commerce and working from home trends. However, their improved earnings prospects are being increasingly recognised by the market and in keeping with our investment process, we have been taking profits from outperformers, as share prices move close to our estimate of fair value. For example, we have been cutting back positions in the likes of MediaTek, JD.com and Baidu, where a lot of expected growth already appears to be in the price after a period of strong performance.

We continue to invest in attractive opportunities among innovative tech and internet companies that arguably justify their re-rating, and those that are at an earlier stage in their earnings recovery, such as Largan Precision, the world-leading maker of lenses for smartphones. We had an opportunity to buy the shares at an attractive price after the US issued sanctions against Huawei, one of its major customers. We believe Largan can maintain its market leading position and expect that it will successfully transition to other customers over time, with flagship phones continuing to adopt higher spec cameras.

We have also recently introduced Autohome, China’s largest online platform for automobile buyers and sellers, and generally regarded as the best source of information on products, performance, consumer trends and customer preferences. The company is looking to shift monetisation away from advertising and dealer lead generation, toward data services, which increases the business quality in our view. We are also comforted by the company’s net cash balance sheet and free cash flow that has tended to exceed earnings.

Positioning for reflation in recent times

We have been positioned for reflation, with selected cyclical businesses well represented in the Asian strategy. In our view, the discounts currently available in these areas are attractive given the potential for earnings to recover quicker than the market expects.

Multiple themes are evident in this section of the strategy. For example, reopening plays like the integrated resorts operator Genting Singapore, is a good example of a company which has been hit hard by the lack of travel but will be a key beneficiary of conditions normalising. Furthermore, its strong balance sheet (cash $4bn net cash position, which is >30% of its market cap) gave us confidence that they could ride through a tough 2020 and emerge stronger having taken the opportunity to renovate their resorts. Similarly, towards the end of 2020, we added ComfortDelGro, a Singaporean transport company, which we expect will see profits recover on the back of rising passenger numbers as Singapore emerges from lockdown. The market tends to have a myopic view when times are tough, we see this as an opportunity to invest in good free cash flow generating companies at a discount.

As economic conditions normalise, other companies have scope to see their earnings recover quicker than the market expects. This is the case for Covid-sensitive industrials and certain parts of the Asian auto sector such as Astra International, an Indonesian conglomerate with interests in market leading auto-related businesses. While the Indonesian economy is weak in the short term, we believe auto demand should eventually grow as GDP per capita rises. We have also built exposure in Mahindra & Mahindra, another conglomerate with a market leading tractor business in India that has good long-term growth prospects thanks to structural drivers in the domestic agriculture sector. Some auto holdings benefitted from the market’s enthusiasm for ESG positive stories which propelled the share prices of companies with electric vehicle (EV) exposure. This was an opportunity to take some profits.

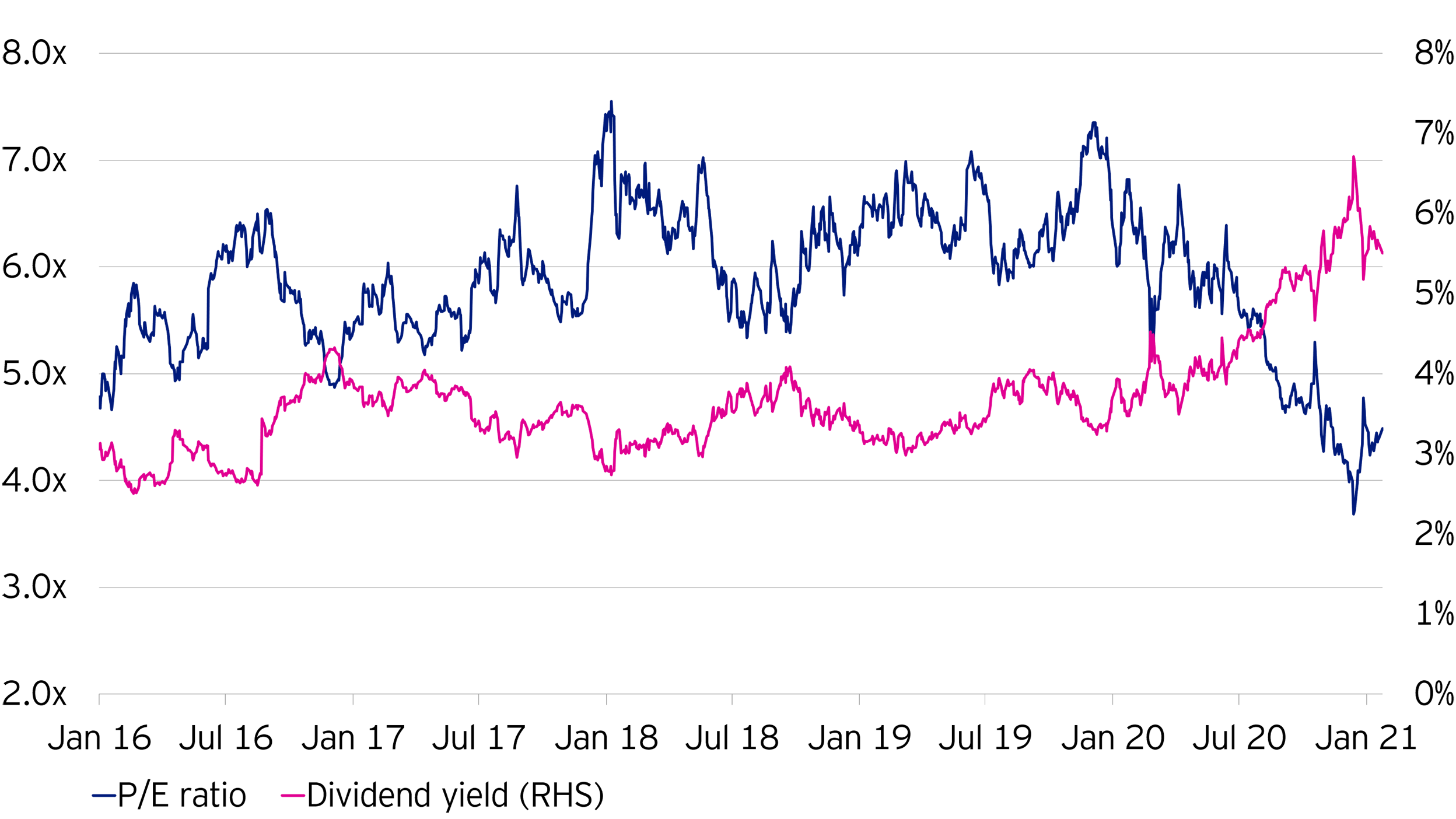

Recently, we have turned our attention to the real estate sector, the worst performing area of the market in 2020, with structural changes under way. In China, the authorities have been tightening financing rules for developers, in an attempt to dampen house price growth and discourage speculation. The measures impacted all developers negatively, but we saw an opportunity to introduce China Overseas Land & Investment, which has a relatively strong balance sheet and the lowest cost of funding among its peers, ensuring that it has the ability to boost future growth by acquiring land banks/projects from overleveraged developers should opportunities arise.

At the same time, we have added to Hong Kong listed real estate company CK Asset, which has assets in commercial property and Hong Kong hotels as well as Greene King Brewery (UK) and an aircraft leasing business, all of which have been challenged by Covid. However, the company has a very healthy balance sheet, only marginal gearing and a lot of financial flexibility, which should support business growth either organically, or through M&A.