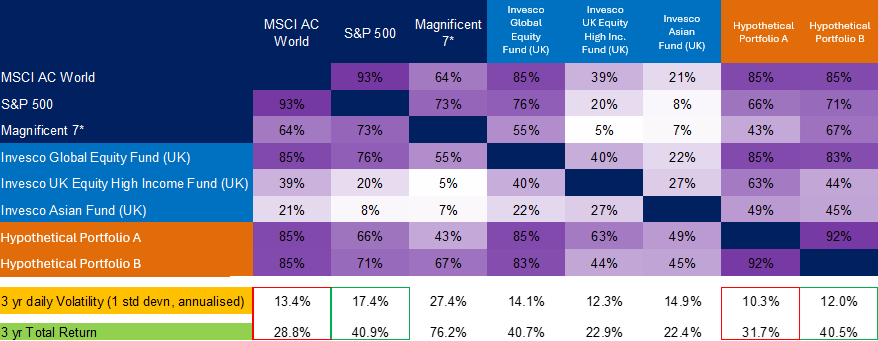

An interesting observation from James Goldstone was the low correlation of the Invesco UK Equity High Income Fund (UK) with the Mag 7. Striking too was the very low correlation of Will’s Invesco Asian Fund (UK) with both the S&P 500 and Mag 7. Furthermore, when we created two different hypothetical portfolios (A and B above) including a mix of our three fund managers and S&P 500 (hypothetical portfolio A) and Mag 7 (hypothetical portfolio B), we found that we were able to produce a compelling risk reward: Hypothetical portfolio A produced MSCI World type returns but with 23% lower daily volatility; hypothetical portfolio B produced S&P 500 like returns but with 31% lower daily volatility.

I found the above analysis interesting. Without trying to optimise returns in any way and even in a period of significant US outperformance, we showed that by combining passive (Mag 7 and S&P 500) and 3 of our active funds, we could deliver superior risk/reward through leveraging the lower correlation of some of our funds together with their ability to generate alpha.

So, what is the role of active investing? If an active manager has a consistent and predictable approach, an ability to generate alpha and/or the benefit of risk diversification, then active strategies can happily coexist with passive: It's active and passive rather than active versus passive.

3. Is there now a bull in the China shop?

In our February webinar, we posed the question to Will’s colleague Charlie Bond, “Is China the new Japan?”. He explained why he didn’t think that was the case with the main point of difference being the attractive valuations to be found in China and the earlier stage of development. More recently we have seen indications from China that they plan to introduce fiscal stimulus.

Will and Charlie’s colleague John Pellegry wrote an excellent blog in response to the initial announcement about China's fiscal stimulus program. Whilst we may lack some details, Will highlighted that we now have a catalyst for the China equity market and “it is as cheap as it has ever been”: