Further complications arise when you consider that commodity ETFs provide exposure via the futures markets. Every futures contract has a specific set of criteria applicable to the commodities deemed suitable for delivery. This normally includes minimum quality standards and could also define the countries of origin. For example, coffee beans grown in countries not listed in the contract specs are excluded. Ideally, you will want to isolate only the data that relates to the narrower subset of commodities underpinning each of these contracts.

The solution: allocation based on impact

In May this year, Bloomberg launched a broad commodity benchmark with a novel approach to measuring and adjusting for carbon emissions, while maintaining the characteristics that are so compelling for investors wanting to include the asset class in their diversified portfolios. In July, we launched the first ETF in Europe that provides investors with access to this index.

The fundamental concept is similar to many equity indices that apply tilting to the constituents but with an aim of producing low tracking to the standard index. You overweight those constituents with a characteristic you want, while underweighting those lacking or with less of the characteristic. And you can reduce tracking error by maintaining similar weighting at the broad sector level.

About the index

The Bloomberg Commodity Carbon Tilted Index (BCOMCA) adjusts the weight of individual commodities based on the greenhouse gas (GHG) emissions associated with their production lifecycle, while minimising tracking error to its standard Bloomberg Commodity index (BCOM). It targets a 20% reduction in the implied GHG emissions per unit of production compared to BCOM.

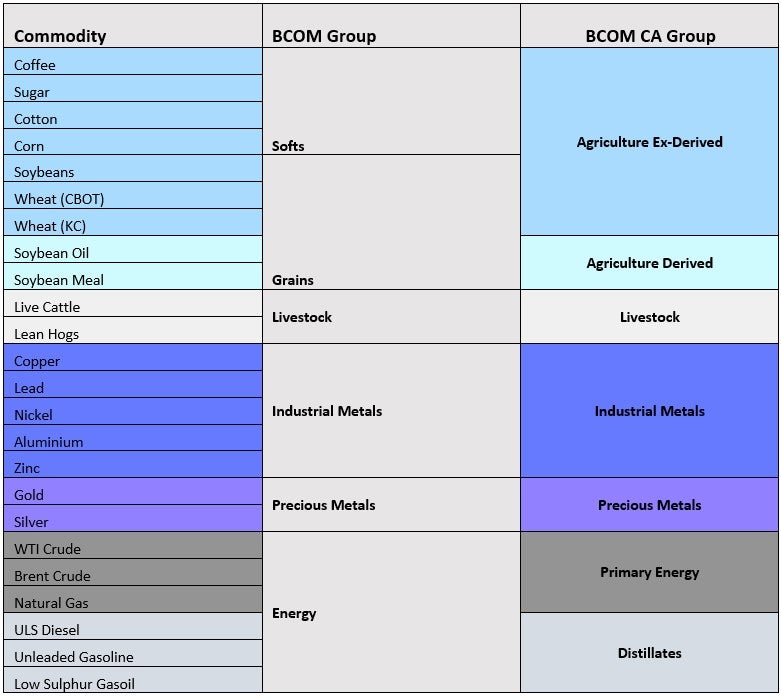

The BCOMCA index comprises futures on the same 24 commodities as the standard BCOM, grouped into commodity sectors based on their production processes. Within the broader agriculture and energy groups, BCOMCA separates primary and derived commodities into subgroups to avoid the double-counting of emissions, for instance between soybeans and soybean meal.