ETC How does a swap-based ETF work?

ETFs replicate benchmark indices in different ways: physically, and synthetically – also known as a swap-based approach. Find out how a swap-based ETF works.

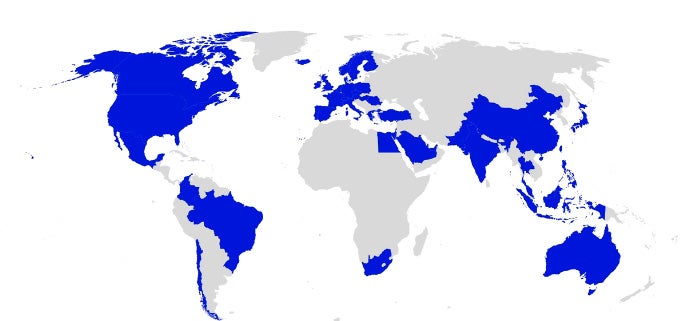

Spreading your investment can reduce risk, and an investment in the Invesco FTSE All-World UCITS ETF gives you more than 4,000 companies in over 50 countries.

If you don’t need extra income now, you can keep the dividends automatically rolling up in the fund to benefit from the “compounding effect”.

The popularity of monthly investment plans has helped the Invesco FTSE All-World UCITS ETF pass US$1 billion of assets under management.

Exchange-traded funds (“ETFs”) are fast becoming an investor favourite. A record-breaking US$266 billion was invested in 2024, taking the total amount invested to US$2.3 trillion at the end of the year. As impressive as those numbers are, we get that you’ll be much more interested in how your own investment can grow. We can’t offer any guarantees on that, but we can offer a simple one-stop solution that investors from all walks of life have been choosing. The growing popularity by individual investors has seen the Invesco FTSE All-World UCITS ETF recently pass US$1 billion of assets under management1.

Source: Bloomberg, showing the total assets under management of ETFs domiciled in Europe, to 31 December 2024

When we talk about “equities” it’s simply another name for the stocks and shares of publicly listed companies. They have produced higher returns over the long run than most other types of investment. Of course, there’s no such thing as a free lunch. The price for those higher returns is increased risk, especially over shorter time periods. That’s where diversification comes in.

The phrase “don’t put all your eggs in one basket” is a good way to think about diversification. If you were to invest all your money into just one company, you would be completely reliant on its success. Maybe it will do well, maybe not. Are you willing to take the chance with your whole nest egg? A much more sensible strategy can be to spread your risk across a wide range of companies. Select ones from different countries, from different industries, maybe some large companies and some smaller ones. Diversification can reduce your overall risk significantly.

An investment in the Invesco FTSE All-World UCITS ETF provides you with exposure to more than 4,000 companies from all sorts of industries in over 50 countries across the world. This includes both developed and emerging market countries, opening up different opportunities and further spreading your risk. Once you have invested in the ETF, that’s it. The fund managers do the rest.

The Invesco FTSE All-World UCITS ETF could be all you need. It’s intended for a wide range of investors but particularly those who may not have the time or the skills to decide how much to invest in US companies, how much in German companies, and so on. Of course, you could always add other funds whenever you want to, and ETFs offer a variety of low-cost choices.

Putting everything you have to invest in the market at once could make you nervous. We get that. That’s why so many people are now using savings plans. Investing smaller amounts on a regular basis instead of a large lump sum that leaves you worrying about the market suddenly falling. By saving in regular intervals, you will automatically buy more units when the market is low and fewer when it’s high. The idea is that your average cost (the average per-unit buying price) will smooth out over time. It is often seen as a less volatile way to invest.

Deciding what to do with the income is also important. For example, the Invesco FTSE All-World UCITS ETF has a current yield of 1.5% per annum. That represents the dividends paid to the ETF over the past year from all the companies it holds, expressed as a percentage of the total fund value. Now, I can hear you say, “1.5% isn’t very much, so I might as well take it in cash.” Well, if you need the extra income, then go ahead and take it. But if you don’t, then that 1.5% accumulated over time can make a substantial difference to the total return from your investment.

Source: Bloomberg and Invesco, illustrating the hypothetical growth of EUR1,000 invested on 22 May 2012 in the FTSE All-World index with and without dividends being reinvested, to 28 February 2025. Please note that you cannot invest in an index, so this chart is intended for illustrative purposes only.

Whether you are new to investing or have been investing for years, ETFs offer one of the lowest-cost ways to gain exposure to the stock market. Compared to investing in one or even a handful of stocks, diversification can help reduce the risk by spreading your risk – and opening up more opportunities – across a wider range of companies, and countries if you invest in a global fund.

One such example is the US$1 billion Invesco FTSE All-World UCITS ETF, which provides exposure to more than 4,000 companies in over 50 developed and emerging market countries for a management fee of 0.15% per annum. And the ETF offers a choice between Accumulating and Distributing shares, enabling you to either have the dividend income paid out to you on a quarterly basis or, if you don’t need the income now, to have it reinvested automatically back into your fund.

An investment in this fund is an acquisition of units in a passively managed, index tracking fund rather than in the underlying assets owned by the fund.

Source: Invesco, AUM of Invesco FTSE All-World UCITS ETF was US$1.06 billion as of 28 February 2025

ETFs replicate benchmark indices in different ways: physically, and synthetically – also known as a swap-based approach. Find out how a swap-based ETF works.

A swap-based ETF replicates the performance of the index it tracks, without owning the stocks directly. This can be advantageous in certain markets. Watch our world tour to find out more.

If you’re among the millions worldwide considering diving into the world of exchange-traded funds (ETFs), here’s what you should know about the different replication methods used.

For complete information on risks, refer to the legal documents.

Value fluctuation: The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

Emerging Markets: As a large portion of this Fund is invested in less developed countries, investors should be prepared to accept a higher degree of risk than for an ETF that invests only in developed markets.

Securities lending: The Fund may be exposed to the risk of the borrower defaulting on its obligation to return the securities at the end of the loan period and of being unable to sell the collateral provided to it if the borrower defaults.

Equity: The value of equities and equity-related securities can be affected by a number of factors including the activities and results of the issuer and general and regional economic and market conditions. This may result in fluctuations in the value of the Fund.

Currency hedging: Currency hedging between the base currency of the Fund and the currency of the Share class may not completely eliminate the currency risk between those two currencies and may affect the performance of the Share class.

Stock Connect: The Fund may use Stock Connect to access China A Shares traded in Mainland China. This may result in additional liquidity risk and operational risks including settlement and default risks, regulatory risk and system failure risk.

Data as at 3 March 2025, unless otherwise stated.

If investors are unsure if this product is suitable for them, they should seek advice from a financial adviser.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment / investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Views and opinions are based on current market conditions and are subject to change. For more information on our funds and the relevant risks, please refer to the share class-specific Key Information Documents / Key Investor Information Documents (available in local language), the financial statements and the Prospectus, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.ie. The management company may terminate marketing arrangements. UCITS ETF’s units / shares purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units / shares on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units / shares and may receive less than the current net asset value when selling them. For the full objectives and investment policy please consult the current prospectus.

Index disclaimer: The Invesco FTSE All-World UCITS ETF (the “Fund”) has been developed solely by Invesco. The Fund is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies. All rights in the FTSE All-World Index (the “Index”) vest in the relevant LSE Group company which owns the Index. FTSE®, ICB®, are trademarks of the relevant LSE Group company and are used by any other LSE Group company under license. The Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the Fund. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from the Fund or the suitability of the Index for the purpose to which it is being put by Invesco.

EMEA4336800/2025