What is Bitcoin?

First and foremost, we need to decide whether Bitcoin is a form of money (or money substitute), or a dollar-denominated asset class.

Traditionally, economists have viewed money as having three characteristics: it acts as a medium of exchange, a store of value, and a unit of account.

These features are to some degree overlapping. For example, something would not be used as a popular medium of exchange or a unit of account (e.g. for valuing a company or a portfolio) unless it was relatively stable in value. These properties are all micro-economic i.e. they are features of money viewed from the standpoint of an individual holder.

But fiat money, which is the type of money generally used in economies today, also requires a macro-economic property - it needs to be capable of being managed by the issuer(s) in a way that will promote economic stability.

Specifically, it needs to be both elastic (e.g. in the event of a liquidity crisis) and capable of exerting some discipline (e.g. tightening up after a period of excess issuance).

Here we will assess Bitcoin in the light of three fundamental properties of money:

- Its relative stability as a store of value.

- Its elasticity of supply and potential role as money.

- Its ability to be used as a medium of exchange to settle transactions such as tax payments, or the purchase of assets, goods and services.

Store of value

Bitcoin does not behave as a stable store of value, as reflected by its sharp price swings.

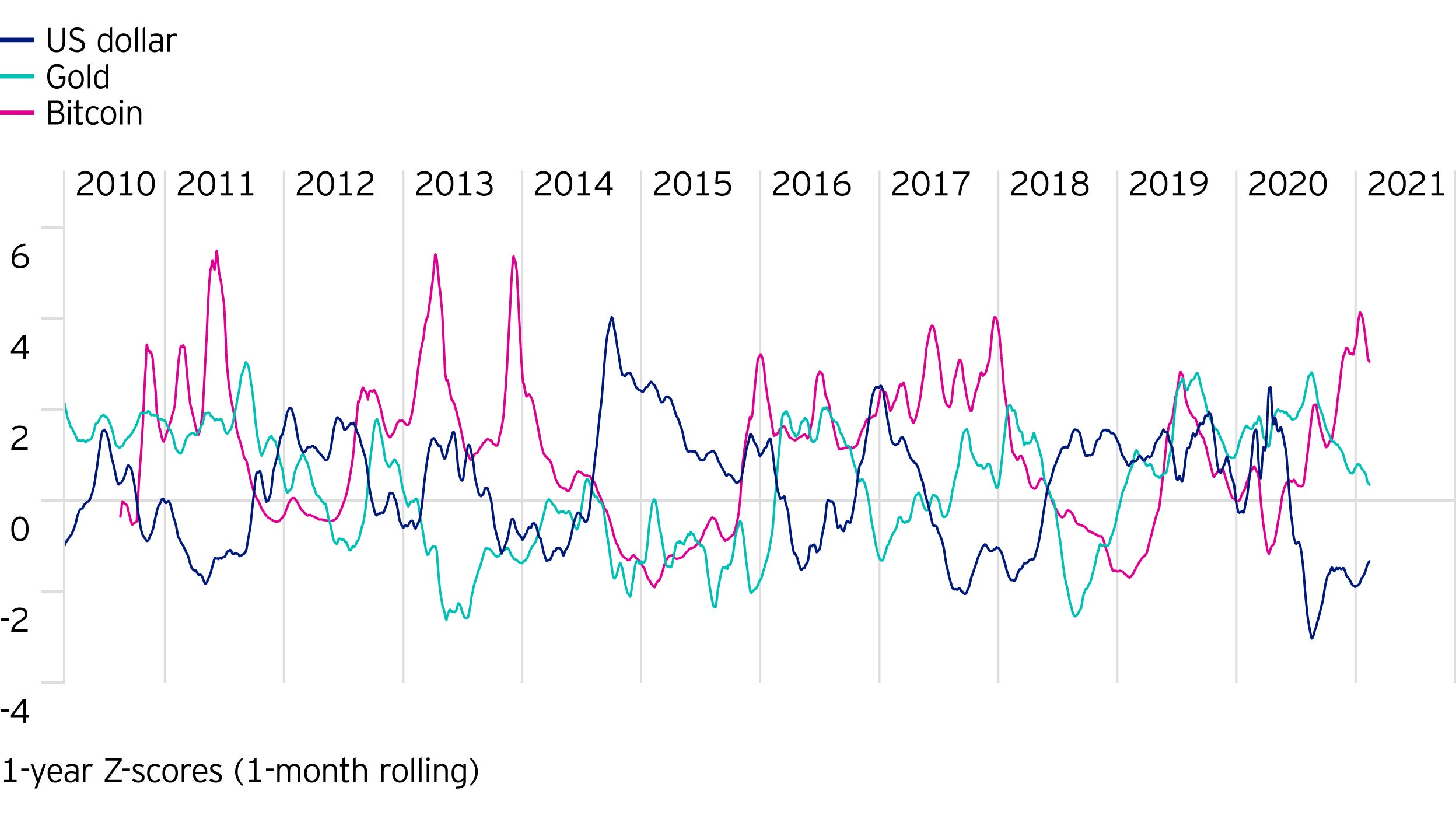

Z-scores measure the standard deviation adjusted difference from the average value of the period, here over 1-year. An important property of Z-scores is that they are not linear; a Z-score of 3 indicates significantly more volatility than a Z-score of 2 for instance.

Comparing 1-year Z-scores between the US dollar, gold and Bitcoin, it is clear to see that the latter is significantly more volatile.

More tangibly, since 2010, daily changes in the price of Bitcoin are roughly 14 times more volatile than daily changes in the broad US dollar index, whilst on an annual basis, changes in the price of Bitcoin are over 300 times more volatile.

Elasticity of supply and potential role as money

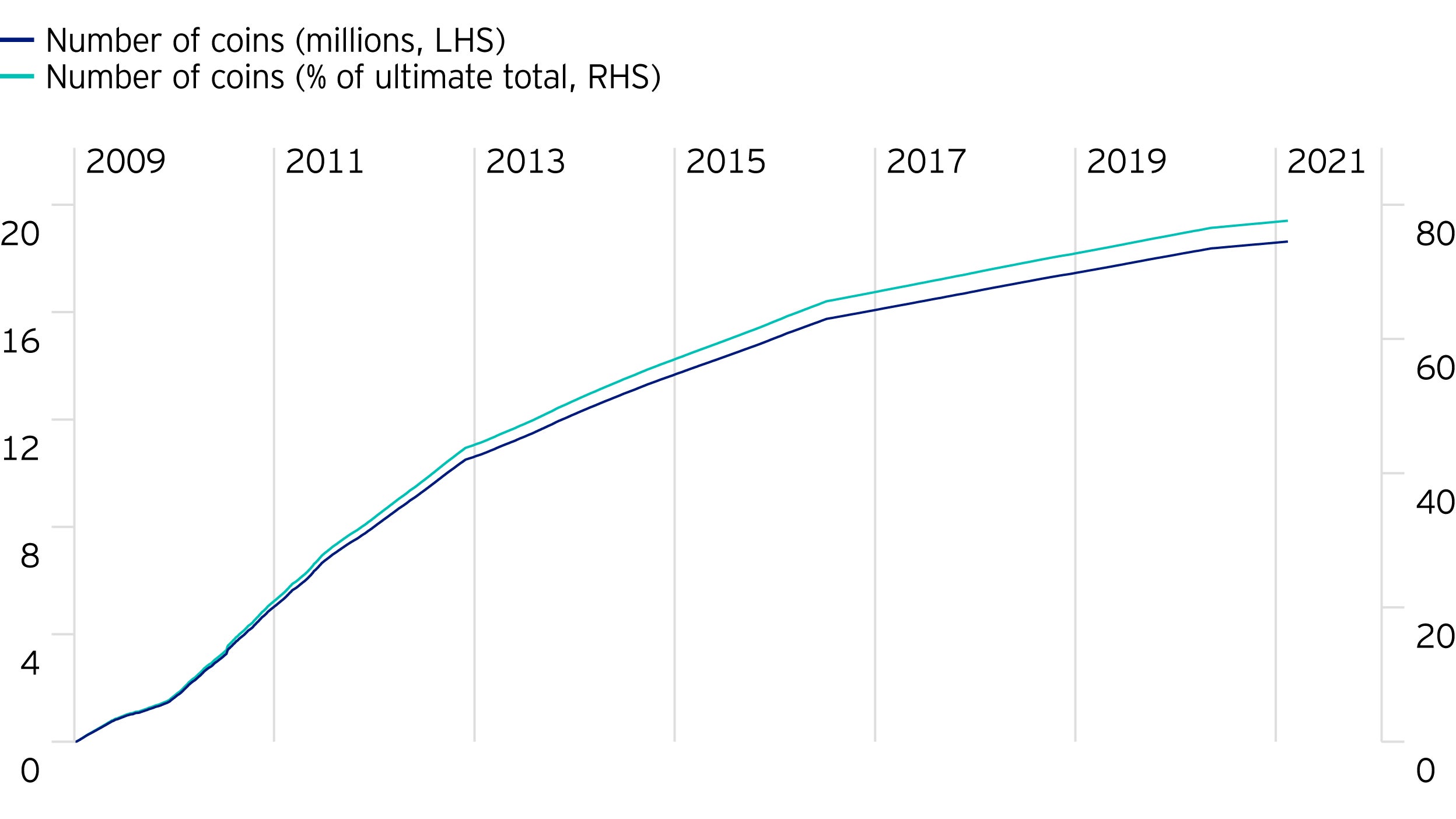

From a macro viewpoint, the outstanding stock of Bitcoin cannot be managed, whereas the conventional money supply is “elastic” in the sense that as economies grow, more money is created by banks and by the central bank to facilitate transactions.

Any significant lack of growth in the money supply can have devastating consequences, as seen during the Great Depression (when the US money supply declined by one third).

In the case of Bitcoin, it is true that sub-divisions of single units will be possible to many decimal places, the total nominal stock is limited by its original code to 21 million units. Conversely, a conventional central bank needs to be able to exert some “discipline” over the money supply by tightening lending conditions or withdrawing funds from the money markets. A classic example of this was the monetary tightening that occurred in the US after the appointment of Paul Volcker as US Federal Reserve Chairman in August 1979.

In the preceding four years (1976-79) M2 had persistently increased by 10.3% p.a. on average - far too high for price stability - and Mr Volcker saw it as his task to re-impose some discipline to curtail the inflation.

From this macro viewpoint, Bitcoin could never operate as an appropriate money supply for any economy. Like gold or silver, if it was used as a currency in this sense, any steep appreciation in price would have disastrous consequences for the economy concerned. A good example of this is what happened to China in 1933-35 when, in anticipation of the US Silver Purchase Act of June 1934, the market price of silver rose abruptly from US$0.25 to about US$0.81 cents per ounce.

(The President authorised the Secretary of the Treasury to buy silver up to US$1.29, the original nominal monetary value of silver dating from 1792.)

Until that point China, which had been on the silver standard, had been largely immune from the Great Depression because the price of silver had been steadily falling, meaning that as China’s exchange rate declined her exports remained competitive. As soon as the silver price surged, China’s exports were threatened with collapse, the outflows of silver caused monetary contraction and deflation, forcing the country to abandon the silver standard. It would be the same for any country adopting Bitcoin as a currency.

Medium of exchange

Although PayPal and Venmo agreed last October to allow customers to use Bitcoin, Ethereum and Litecoin for purchases from the 26 million sellers on its website, it is not clear how many of these vendors will accept cryptocurrencies. Bitcoin is therefore still not widely accepted as a medium of exchange for the purchase of assets, goods or services, and cannot be used for example to pay taxes. One reason it is not widely used is that Bitcoin transactions via the blockchain are slow, cumbersome and expensive. For example, presently the upper limit for Bitcoin transactions is roughly five every second, whereas payment processing companies like Visa or Mastercard can process over 2,000 transactions every second.

Until people or firms or governments can accept Bitcoin as a regular, near-immediate, widely accepted means of settlement, this third crucial property of money does not apply to Bitcoin.

In this sense it is not going to become a genuine competitor of conventional money any time soon.

Read the next article in this series, What are the supply/demand characteristics of Bitcoin?, by clicking on the link below, or by going back to the Bitcoin Hub here.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

All data is as at 31 January 2021 unless otherwise stated.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where John Greenwood and Adam Burton have expressed opinions, they are based on current market conditions, may differ from those of other investment professionals and are subject to change without notice.