4-Life framework for navigating retirement

Explore more in our 4-Life framework brochure, which includes an analysis of building individuality into a pension scheme through personas.

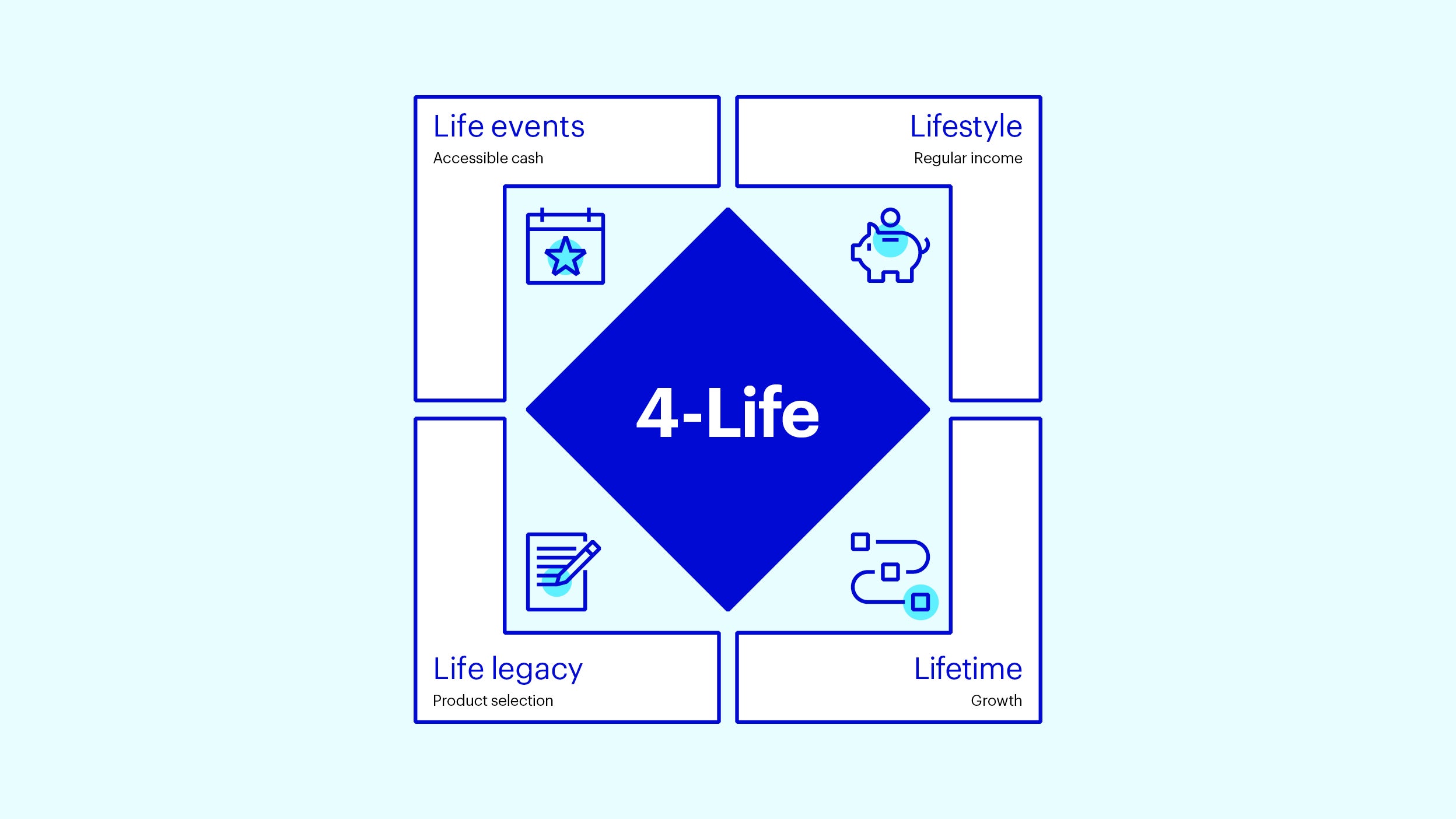

There is a seismic shift underway in the UK pensions market, with responsibility for retirement moving from employers to individuals. The issues may be well-known, but they are difficult to solve for — especially given the intensely personal nature of retirement and how to fund the lifestyle and legacy each client wants to build. To help solve these challenges, Invesco has created the 4-Life framework, designed to drive better outcomes for retirees.

By dividing the retirement journey into four manageable building blocks, the 4-Life framework helps individuals prioritise and achieve their own specific retirement goals — and it helps financial professionals better frame what products and solutions can best serve the needs and aspirations of all retirees.

A full exploration to the framework is available here, including detailed examples of how each building block may be managed for different client personas. Below, we highlight a few client needs and investment implications within each category to consider as a starting point.

Source: Invesco

We believe the 4-Life framework helps put in place a robust retirement plan that explicitly addresses the risks people are increasingly facing as they seek to take control of their retirement path. These risks can be managed at an individual level or aggregated to build default options for pre-determined ‘personas’ within pension schemes.

4-Life framework for navigating retirement

Explore more in our 4-Life framework brochure, which includes an analysis of building individuality into a pension scheme through personas.

Join David Aujla, portfolio manager as he provides a monthly recap of the financial markets. Looking at market trends political developments, the macroeconomic landscape and the impact it has a market volatility stay ahead with expert commentary.

In this regular piece, we summarise the key headlines from the quarter that have impacted investment performance.

Donald Trump completed an historic comeback in November as both he and his Republican Party swept the board in the US Presidential and Congressional elections.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. Views and opinions are based on current market conditions and are subject to change.