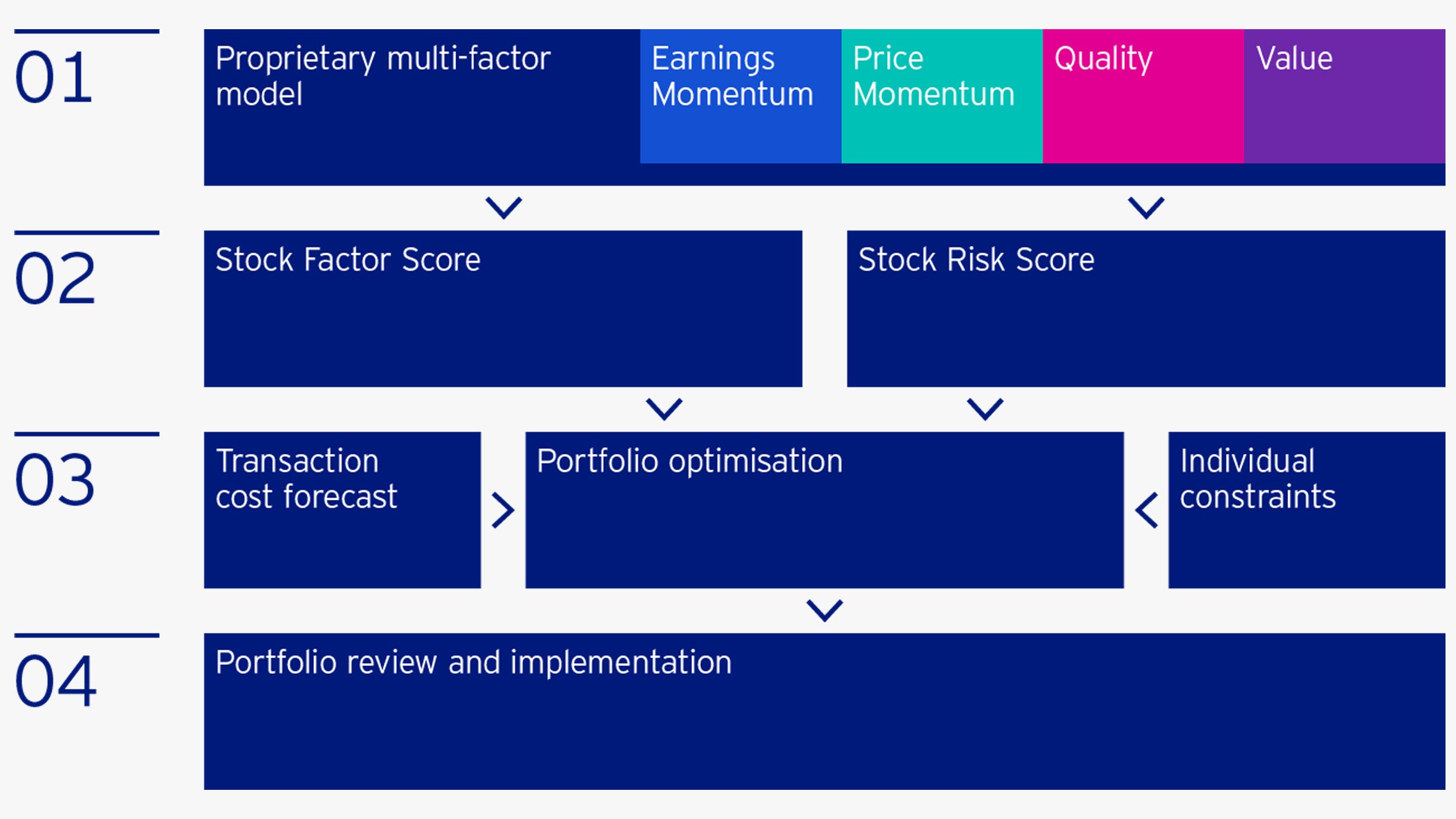

Our factor-based equity strategies aim to capture alpha by following a systematic, rules-based investment process. This begins with stock selection using our proprietary, multi-factor model.

Our proprietary multi-factor model

This is based on our belief that a stock’s risk and return is systematically driven by quantifiable factors / attributes. The model ranks the stocks in our investible universe from the most attractive to the least attractive.

From our perspective, a stock is attractive, if

- it is attractively valued compared with its peers;

- improving earnings momentum suggests further upside;

- it shows positive momentum, indicating positive price momentum; and/or

- it is a high-quality stock in terms of profitability and has a strong balance sheet.

Risk and return forecast

- Based on our multi-factor model, we provide risk and return forecasts for a universe of more than 4,000 global stocks.

- Forecasts are determined on a region- and sector-neutral basis to ensure fair comparisons.

Portfolio optimisation

- Identification of a risk-return optimal portfolio that considers transaction costs, liquidity, individual constraints etc.

- The optimisation process allows a very high degree of flexibility and customisation and can thereby generate portfolios with various risk-return profiles.

- We are able to implement a wide range of constraints, such as tracking error, market beta, sector limits, factor exposure and many more.

Final portfolio review and implementation

- Final plausibility and consistency check

- Implementation of the approved portfolio