Senior Portfolio Manager Georg Elsaesser

Diploma in Business Mathematics

Invesco has developed a proprietary, factor-based methodology, which aims to deliver client outcomes better than those of traditional active or passive equity approaches focused on Eurozone equities.

Factor investing aims to systematically exploit drivers of risk and return in order to create portfolios that deliver an enhanced risk-return profile. It is not about traditional stock selection but rather understanding the building blocks of stock returns.

A benchmark-relative equity portfolio with low active risk (1% tracking error) based on a quantitative, factor-based stock selection process. The objective of the strategy is to outperform the Euro Stoxx 50 Index over a medium-term horizon (typically, a 3-year rolling period) and to subsequently exhibit a higher risk-adjusted return.

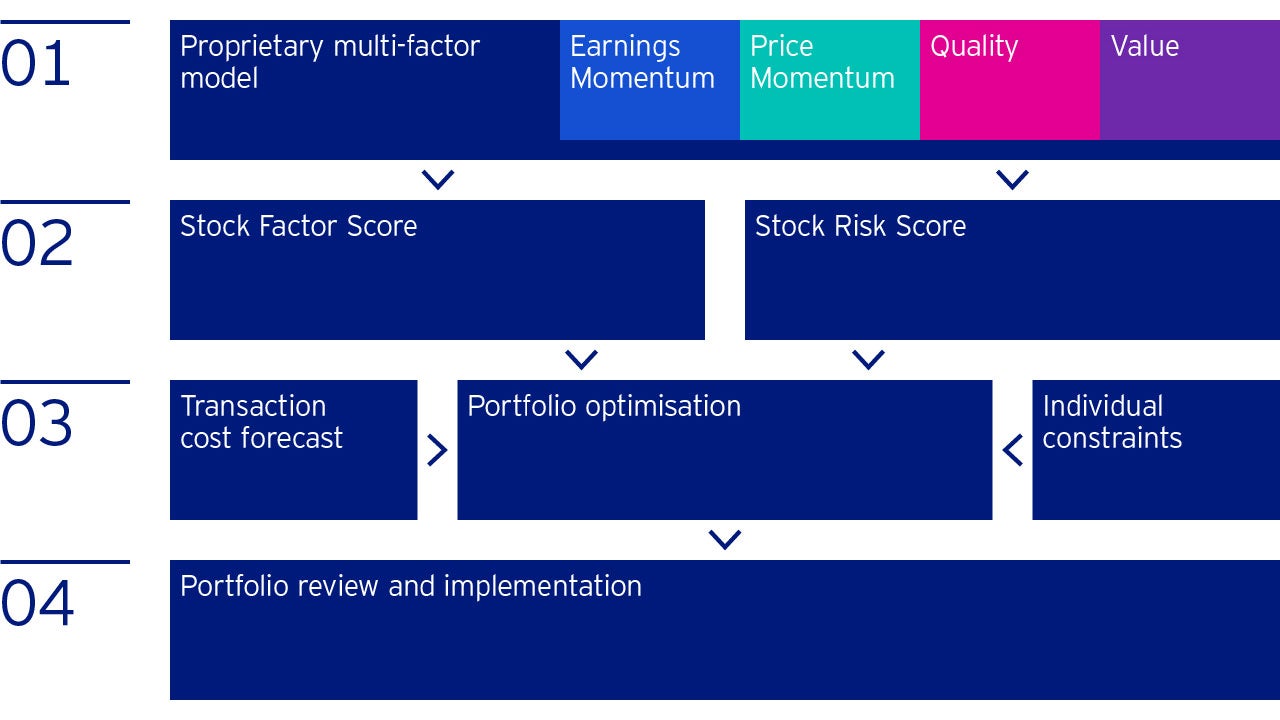

Our factor-based equity strategies aim to capture alpha by following a systematic, rules-based investment process. This begins with stock selection using our proprietary multi-factor model.

Our proprietary multi-factor model

This is based on our belief that a stock’s risk and return is systematically driven by quantifiable factors / attributes. The model ranks the stocks in our investible universe from the most attractive to the least attractive.

From our perspective, a stock is attractive, if

Risk and return forecast

Portfolio optimisation

Final portfolio review and implementation

Invesco’s active approach to factor investing embraces a true diversity of thought. The team is committed to an extensive programme of research, drawing on a broad range of academic resources and our own expertise with the aim of constantly improving client outcomes.

The Invesco Quantitative Strategies team is responsible for managing equity active factor investing strategies. Through a strong commitment to research, the team continues to evolve its investment process and seeks to foster a purposeful evolution of the model, i.e. the enhancement of existing factors and the development of new factors.

This edition of Risk & Reward explores a novel NLP-driven controversy screening tool that complements traditional ESG assessments by effectively identifying financially material controversies through abnormal news flow indicator.

With inflation on the rise it’s about time to dust off the inflation playbook. We investigate the impact inflation has had on the Value, Momentum and Quality factors historically and how investors may want to approach their factor exposures.

Equities provide a return for bearing investment risk over the long term. The question for an investor is, how to identify stocks with the best return potential given their inherent investment risks.

Let us know using this form and one of our specialist team will quickly get back to you.