The role of the EU taxonomy in combatting “greenwashing”

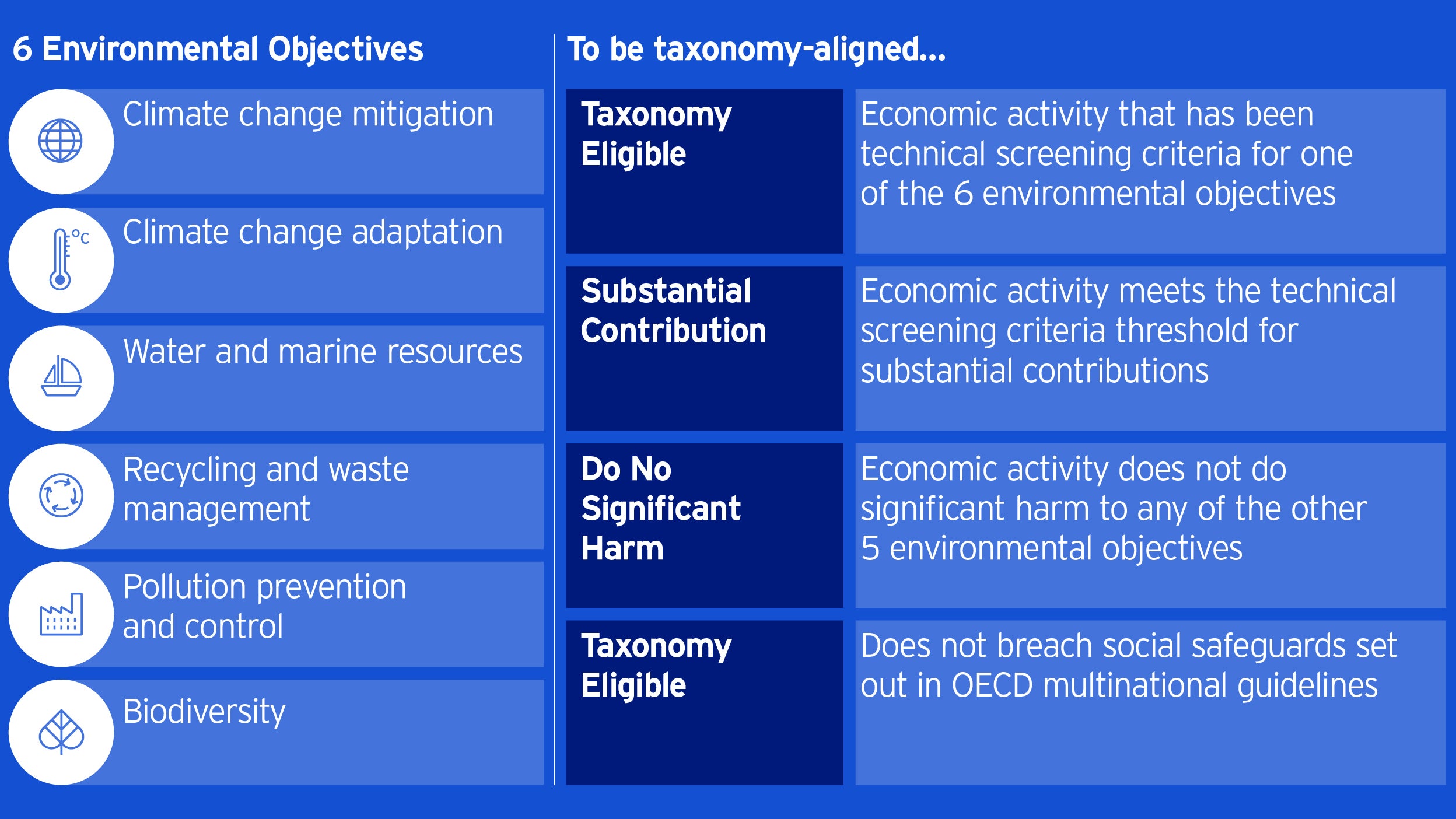

Combating “greenwashing” is a central pre-occupation of the European Commission alongside channelling investments into sustainable and green investments. The cornerstone of this drive for clear standards on what can be considered as green comes in the form of the EU Taxonomy, which will set out clear rules and thresholds sector-by-sector for an activity to be considered as making a significant contribution to one of the 6 environmental objectives under the Taxonomy.

Additionally, such investments will need to be screened to ensure that they do not do significant harm to any of the other environmental objectives and meet minimum social safeguards under the OECD Multinational Guidelines.

The EU Taxonomy is operationalised through two distinct disclosure requirements: firstly, large listed companies that currently report under the Non-Financial Reporting Directive will be required to disclose the percentage of revenues, CapEx and/or Opex that complies with the Taxonomy criteria. Secondly, ESG products classified as Article 8 or Article 9 that have an environmental objective will also be required to disclose the share of investments that are Taxonomy-aligned as part of the SFDR disclosures. Disclosures relating to climate change are due by the end of 2021, whereas disclosures relating to the four other environmental objectives will only begin at the end of 2022.

Additional uses for the Taxonomy come in the form of a new EU Green Bond Standard, which corporate issuers looking to issue green bonds with a regulatory seal of approval may choose to apply for and where the use of proceeds would need to be aligned with the Taxonomy, and a new retail investment product label that would mandate a minimum share of investments in Taxonomy-aligned investments. Both of these initiatives are still under development.

Aside from any regulatory requirements, firms may wish to explore the investment opportunities that can be derived from the Taxonomy, for example by considering how the Taxonomy could provide an additional data point in their analysis of ESG risks and opportunities or in explicitly seeking to align their investment products to the Taxonomy criteria.

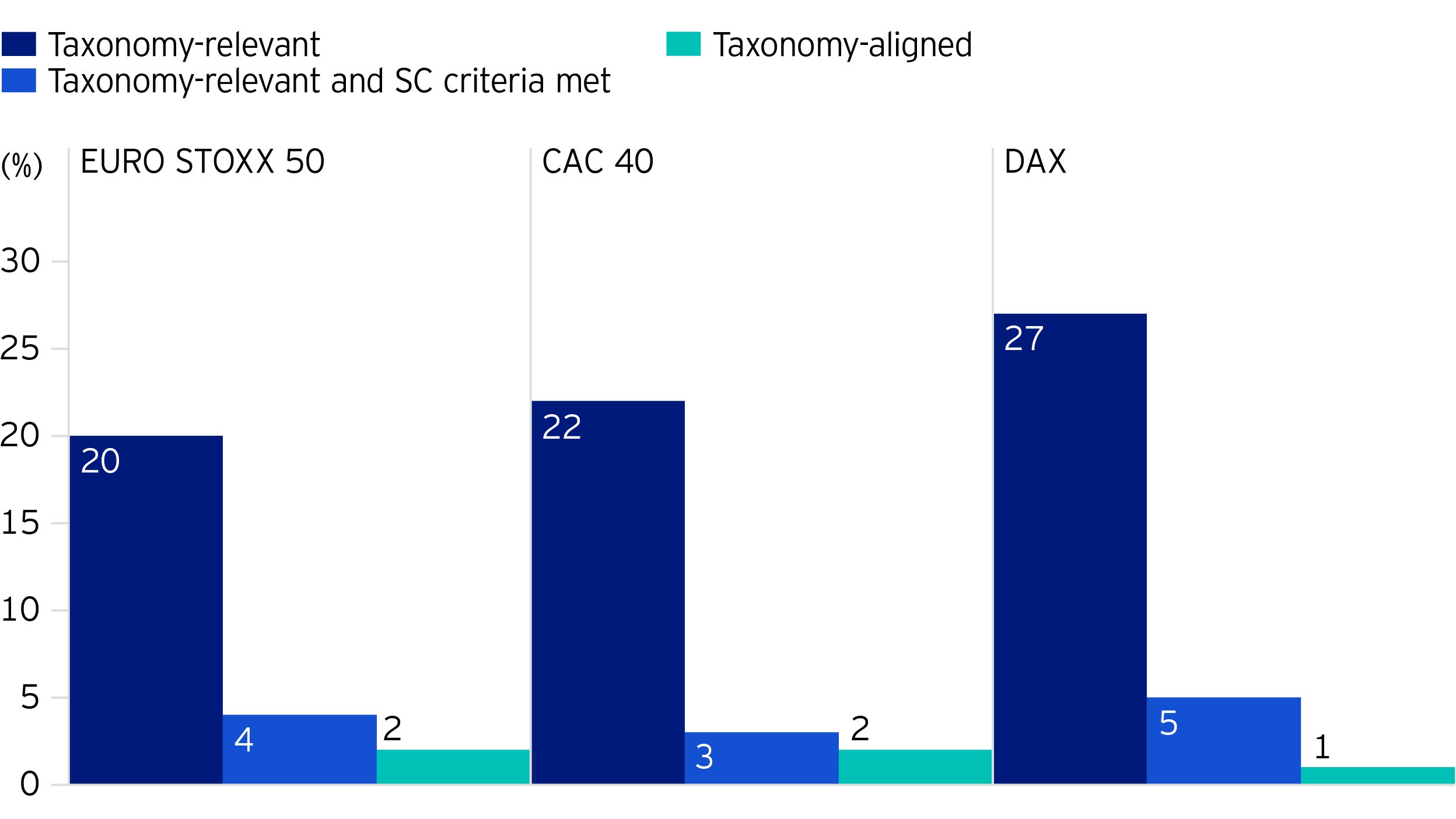

While the framework for the Taxonomy was adopted last year, work in the more detailed technical rules setting out the criteria for climate change mitigation and adaption are still underway. While many of the data pointed needed to undertake a full analysis of the scope of the draft criteria is lacking, some initials studies point to a rather limited investment universe: a study on the constituents of three of the major stock indices in Europe, the Eurostoxx 50, the CAC40 and the DAX indicates that so far, only around 20-25% of sectors are eligible (i.e. sectors for which screening criteria have been developed), of which only 1-2% would meet the thresholds prescribed.

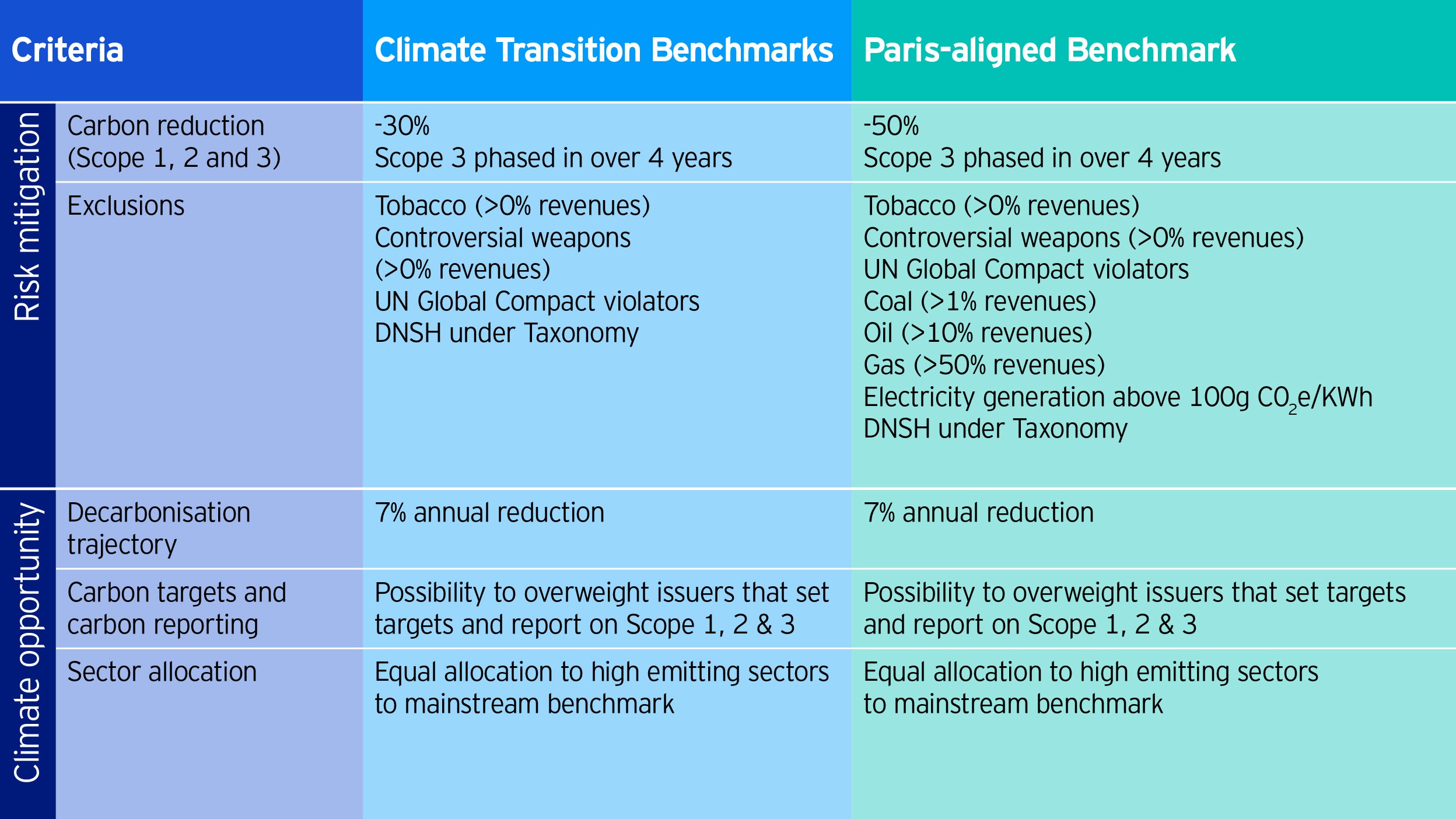

For those wishing to offer products with a focus on carbon reduction, the new EU Climate Transition Benchmarks and EU Paris-Aligned Benchmarks will offer investors a clear methodology for such benchmarks to follow, including a portfolio-level carbon reduction targets and minimum exclusions.

The above article is an excerpt from our recent whitepaper, which you can download in full here: Shifting Gears: Preparing for the new sustainable finance regulations in Europe.

Click on one of the below pieces or go back to the hub.

Keep up-to-date

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Data as of 31 January 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.