How SFDR is enhancing ESG product transparency

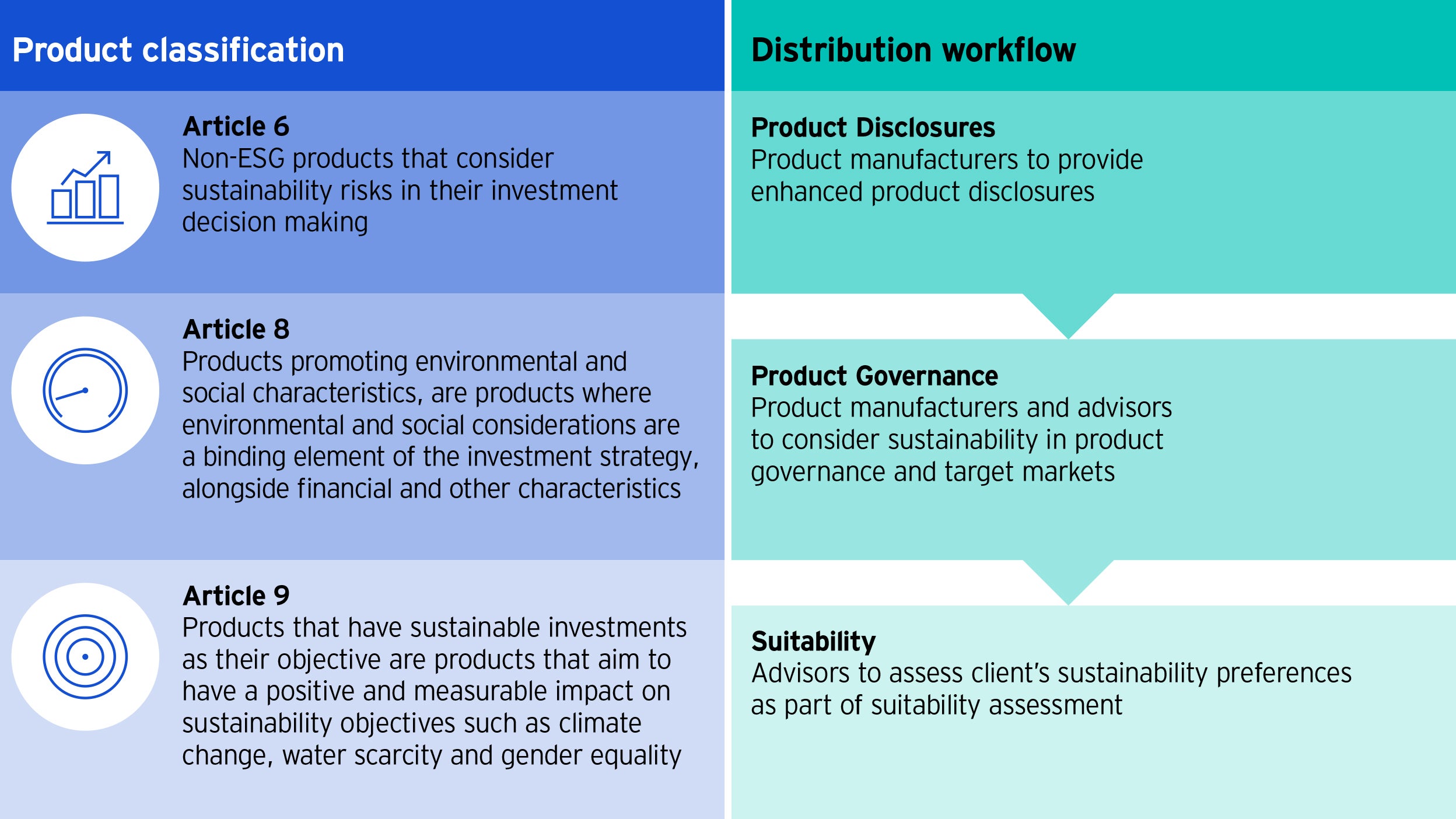

The Sustainable Finance Disclosures Regulation (SFDR) will mandate enhanced transparency for ESG products as well as introduce a differentiation between broad ESG products and impact products.

For Article 8 and Article 9 products that invest in sustainable investments with an environmental objective, additional disclosures will apply regarding the extent to which these products invest in Taxonomy-aligned investments, although the final details are still under development by the ESAs.

The precise scope of these categories is currently subject to a certain amount of interpretation, which the European Supervisory Authorities have sought to clarify with the European Commission. Pending such clarification, it is currently left to firms to categorise their funds as either “Article 8” or “Article 9” products. Where a firm considers that a product falls within one of the above categories, it will need to provide additional information on the ESG strategy pursued in the fund’s pre-contractual disclosures, in website disclosures and in periodic reporting. While only a high-level and principles-based implementation is expected by 10 March 2021, products falling under Article 8 and Article 9 will need to comply with the detailed disclosure obligations and templates set out in the Regulatory Technical Standards, which will enter into effect on 1 January 2022.

Beyond the disclosure elements of SFDR, the European Commission intends to go further and embed this new classification system into existing product governance and suitability requirements under MiFID. In doing so, it would require product manufacturers and distributors to clearly articulate whether a product was designed for clients with sustainability preferences and require advisors providing investment advice to assess their clients’ sustainability preferences. However, the rules published in April 2021 go beyond the SFDR product classification to require products to meet one of three criteria to be eligible to meet a client’s sustainability preference: a) a minimum percentage invested in Taxonomy-aligned investments; b) a minimum percentage invested in sustainable investments as defined by SFDR; and c) the consideration of principal adverse impact. In all three cases, the rules are framed around the client defining in more detail how these criteria are to be include in their investments, which is likely to represent a significant challenge for advisorsand product manufacturers alike. The rules will take effect 12 months after they are finalised, currently expected to be around Q3 2021.

An added complexity stems from a number of local initiatives that are also underway that go beyond the baseline established by the EU. A notable example of this is the French regulator, the AMF, introducing a new ESG marketing regime that will introduce clear criteria that ESG funds would need to meet in order to include ESG as a central pillar of their marketing communications, together with detailed disclosures rules that such marketing documents would need to comply with. The new regime applies to French funds as well as any non-French fund that is marketed in France.

The above article is an excerpt from our recent whitepaper, which you can download in full here: Shifting Gears: Preparing for the new sustainable finance regulations in Europe.

Click on one of the below pieces or go back to the hub.

Keep up-to-date

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Data as of 31 January 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.