2023 Stewardship Report

Our 2023 Stewardship Report highlights our commitment to sustainable growth and responsible asset management, reinforcing our mission to prioritise long-term value.

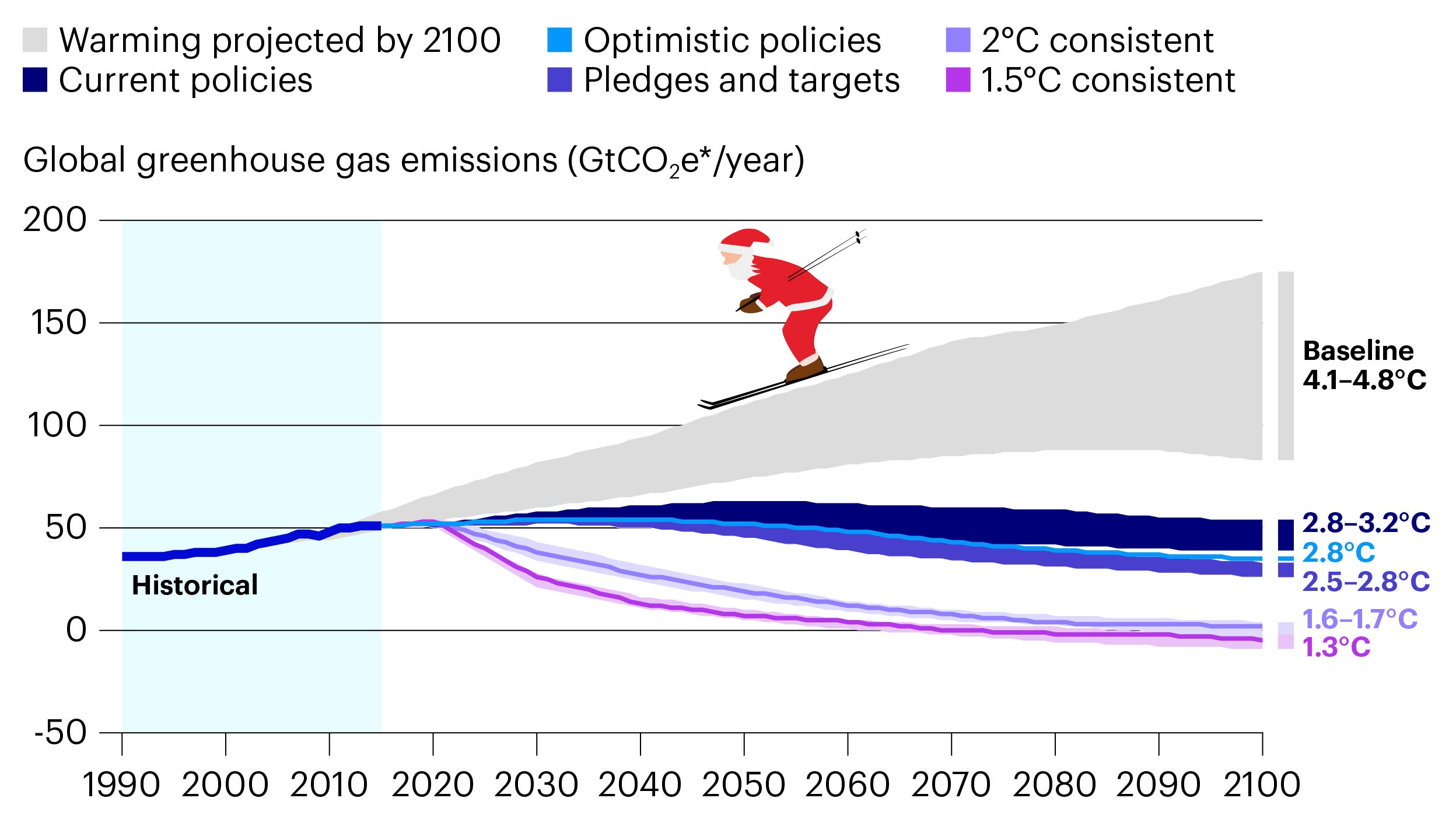

We’re already seeing the effects of global warming, with hotter summers and colder winters in some places, rising sea levels and Arctic sea ice in decline.

According to the Intergovernmental Panel on Climate Change, by limiting global warming to 1.5°C rather than 2°C, we could achieve an effective reduction of the impact of climate change on ecosystems, health and wellbeing.

Today’s chart follows on from our piece published on 6 December, where we showcased global temperature projections for 2100. It shows historical emissions and outlines how future emissions could look based on different policies and pledges.

Taken from Invesco’s inaugural TCFD report, published in July 2020. Our 2021 report, published this month, can be accessed here.

Source: Climate Analytics and NewClimate Institute, as of 31 December 2019. *Gigatons of equivalent carbon dioxide

Count down to Christmas with our festive charts as we publish a new piece each day. Recognise the images that feature on our calendar windows? Each corresponds to a city where an Invesco office is based.

Our 2023 Stewardship Report highlights our commitment to sustainable growth and responsible asset management, reinforcing our mission to prioritise long-term value.

Kevin Grundy, Managing Director, Fund Management, Europe, Invesco Real Estate, discusses the broader market environments in the region and where he is finding the most compelling investment potential for value-add and opportunistic strategies.

The second instalment of our thematic sustainability blog series discusses what a circular economy is. We look into what’s required for it to be successful, and how it can generate unique investment opportunities.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

All data is provided as at the dates shown, sourced from Invesco unless otherwise stated.

When using an external link you will be leaving the Invesco website. Any views and opinions expressed subsequently are not those of Invesco.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.