Tariffs and trade wars: What do they mean for investors?

We assess what President Trump’s “Liberation Day” tariffs might mean for US and global markets, European and UK equities, and more.

Following on from our food sustainability article, the second instalment of our thematic sustainability blog series will discuss what a circular economy is. We’ll look into what’s required for it to be successful, and how it can generate unique investment opportunities for us to exploit.

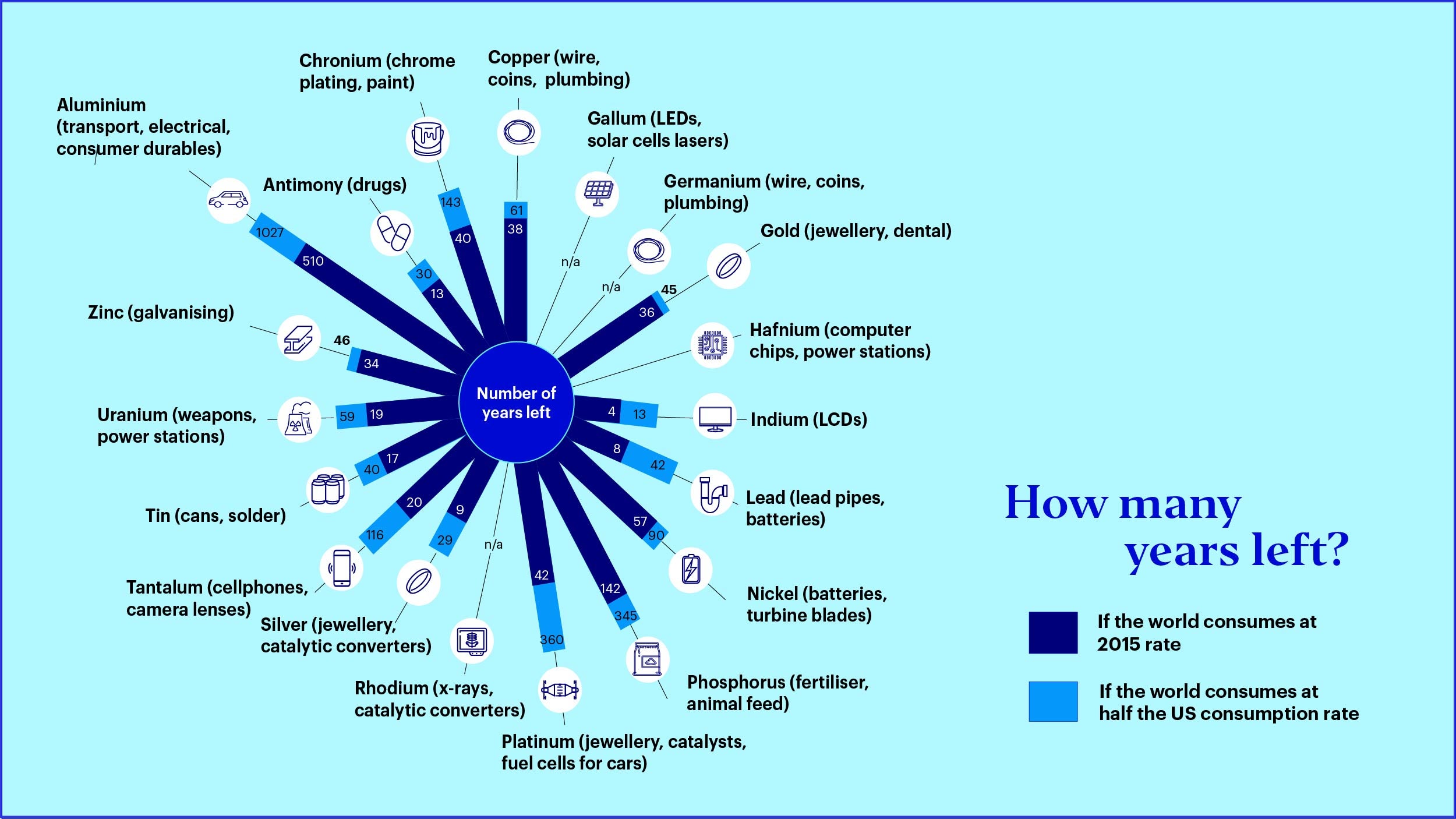

Just like the food sector, today’s consumption of goods is unsustainable. The sheer scale of basic resources we consume means we’re heading towards a reserve depletion of many minerals. This is very topical on World Earth Day.

Source: New Scientist. UK Ministry of Defence, Global Strategic Trends. Years left based on 2015 global consumption rates (lower figure) and half the US 2015 consumption rate (higher figure). For example, gold has 36 years left on the 2015 global consumption rates or 45 years left at half US consumption rate.

A lot of minerals that we consume end up in landfill as waste. The waste we produce holds the potential to become valuable feedstocks (inputs for manufacturing processes) for something else.

Either we change what we consume (the world’s richest 10% produce roughly half of global emissions) or how we produce it. The latter is an easier option for policy makers. One solution is to make supply chains more circular. The heavy reliance on linear supply chains rather than circular is one of the reasons our level of consumption is unsustainable.

Creating circular supply chains is not just about reducing the negative externalities of manufacturing goods – stopping microplastics entering the sea or reducing potentially hazardous waste to landfill – it’s about using waste to create feedstocks for future products and saving the associated emissions linked to the extraction or production of virgin feedstocks (a previously unused raw material). There is a growing need for substituting virgin feedstock where possible to help mitigate climate change. Maternal Economics estimates that circular practices could reduce the carbon footprint of cement, steel, aluminium and plastics, by 60% in the EU.

Source: OECD, Barclays Research.

This will require suppliers to ramp up the production of recycled feedstocks and increase the number of buyers of these products. Regulation such as carbon credits can be used to help align the virgin and recycled feedstocks prices, but, importantly, we already have the underlying ingredients for growing supply and demand of circular feedstocks.

Furthermore, we are not starting from scratch. The private sector has already built circular supply chains where the economics make sense. For example, EU recovery rates for demolition waste is close to 90%, more than half of steel scrap is used in steel production and over 75% of boxes in Europe are made from recycled paper.

The task of promoting the circular economy is being made easier by today’s high commodity prices. Reaching parity between recycled and virgin feedstocks is easier when the latter have already increased. The tight supply and demand dynamics across the commodity space makes us confident that commodity prices will remain elevated for a long period of time. Circular supply chains also help reduce dependency on regions where mineral deposits are located. This is an important factor in a world of growing geopolitical tension.

| EU quantitative circularity targets | |

|---|---|

| Minimum share of municipal waste to be recycled by 2035 | 65% |

| Minimum share of packaging waste to be recycled by 2030 | 70% |

| Paper and cardboard | 85% |

| Ferrous metals | 80% |

| Aluminium | 60% |

| Glass | 75% |

| Plastic | 55% |

| Wood | 30% |

| Maximum share of municipal waste to be processed to landfill by 2035 | 10% |

| Share of plastics packaging that must be reusable or recyclable in a cost-effective manner | 100% |

Source: European Commission, Barclays Research.

There are only a handful of ways to get exposure to the circular economy in Europe. The multi-year outlook for these companies will be strengthened by any consumer, corporate or policy driven demand boost for recycled feedstocks. We have identified several companies that in our view are likely to be beneficiaries of this and have built exposure to them through our various European equity strategies. We separate them into two types of circular economy-linked business models: feedstock creators and circular economy capex plays.

Feedstock creators: OMV and Neste are examples of feedstock creators. Both businesses are ramping up their recycled feedstock capacity to produce commodities that are seeing strong demand growth. OMV will use recycled feedstock to create sustainable polyolefins and Neste use used cooking oil and animal fats, rather than virgin feedstocks such as corn, to create biofuel.

Circular economy solutions: Piovan, Waga Energy, Kemira and Veolia all provide circular economy solutions. Piovan produces equipment for plastic materials processing businesses. Waga Energy designs, builds, and operates landfill gas recovery. Kemira helps industrial businesses harness waste organic matter for use in biogas production. Veolia designs and provides water, waste, and energy management solutions.

They are all large beneficiaries of more investment into the circular economy. Again, the demand levers here are multi-fold. The amount of waste we produce is growing, the recycle rate of this waste needs to grow and the recycling complexity of this waste is increasing due to miniaturization and the use of metal alloys within products. These three factors create the need for more capex in waste management and recycling networks.

We believe the market is underappreciating the potential high returns of the circular business models. Where companies can build competitive advantages, they will have the ability to generate excess returns. Neste is still growing its biofuel capacity group, but its current biofuel projects earn a 30-40% return on investment. This compares to a mid-single digit ROI at their traditional oil refinery.

To us, it’s clear that Europe will take a leadership role, and that the circular economy is set to grow significantly from here. This has allowed us to find investment opportunities in the trash, and we’re happy to have a meaningful exposure to this area.

It’s worth noting that whist the circular economy will play a key role in decarbonising global supply chains, this will need to be done in conjunction with creating carbon-free virgin feedstocks too. In the final instalment of this thematic sustainability series we will discuss the impacts of ramping up carbon-free virgin feedstocks.

We assess what President Trump’s “Liberation Day” tariffs might mean for US and global markets, European and UK equities, and more.

Stephen Anness and Joe Dowling discuss why strong company fundamentals drive long-term performance, emphasizing the importance of focusing on business quality over short-term market turbulence caused by geopolitical events.

US equity markets were boosted in Q4 by enthusiasm around Trump’s election victory, although enthusiasm was tempered in December by the Fed’s cautious approach to future interest rate cuts. Read our quarterly US equities update to find out more.

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.

1The Greenhouse Gas Protocol Corporate Standard classifies a company’s greenhouse gas emissions into three ‘scopes’. Scope 1 emissions are direct emissions from owned or controlled sources. Scope 2 emissions are indirect emissions from the generation of purchased energy. Scope 3 emissions are all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.