Electric vehicles driving emissions down

Another notable climate theme is the shift to electric vehicles. The transport industry is currently a big polluter which needs to change:

- Transport constitutes around one-fifth of global CO² emissions

- 45% of this is driven by road passenger vehicles and a further 29% from road freight.

- Road vehicles in total are therefore estimated to account for 15% of total global CO² emissions, so progress in carbon reduction for this sector is important.3

Although in its infancy, the shift to electric vehicles is now underway as traditional car manufacturers expand their ranges of hybrid and fully electric vehicles. More ambitious traditional car manufacturers are aiming to shift half their global production to electric vehicles by 2030, whilst some smaller volume manufacturers have pledged to go further.

In addition to ending tailpipe emissions, auto makers will also need to reduce their own manufacturing carbon footprint. Indeed, this is a challenging task as the production of an electric vehicle is typically a more carbon intensive process than that of a traditional combustion-engine vehicle.

Fund managers can determine which automakers compare favourably with their peers when it comes to electric vehicle production by looking at the following three areas:

- Comparing existing fleet emissions

- Future plans for electric car production

- The carbon intensity of car manufacturers in the production process

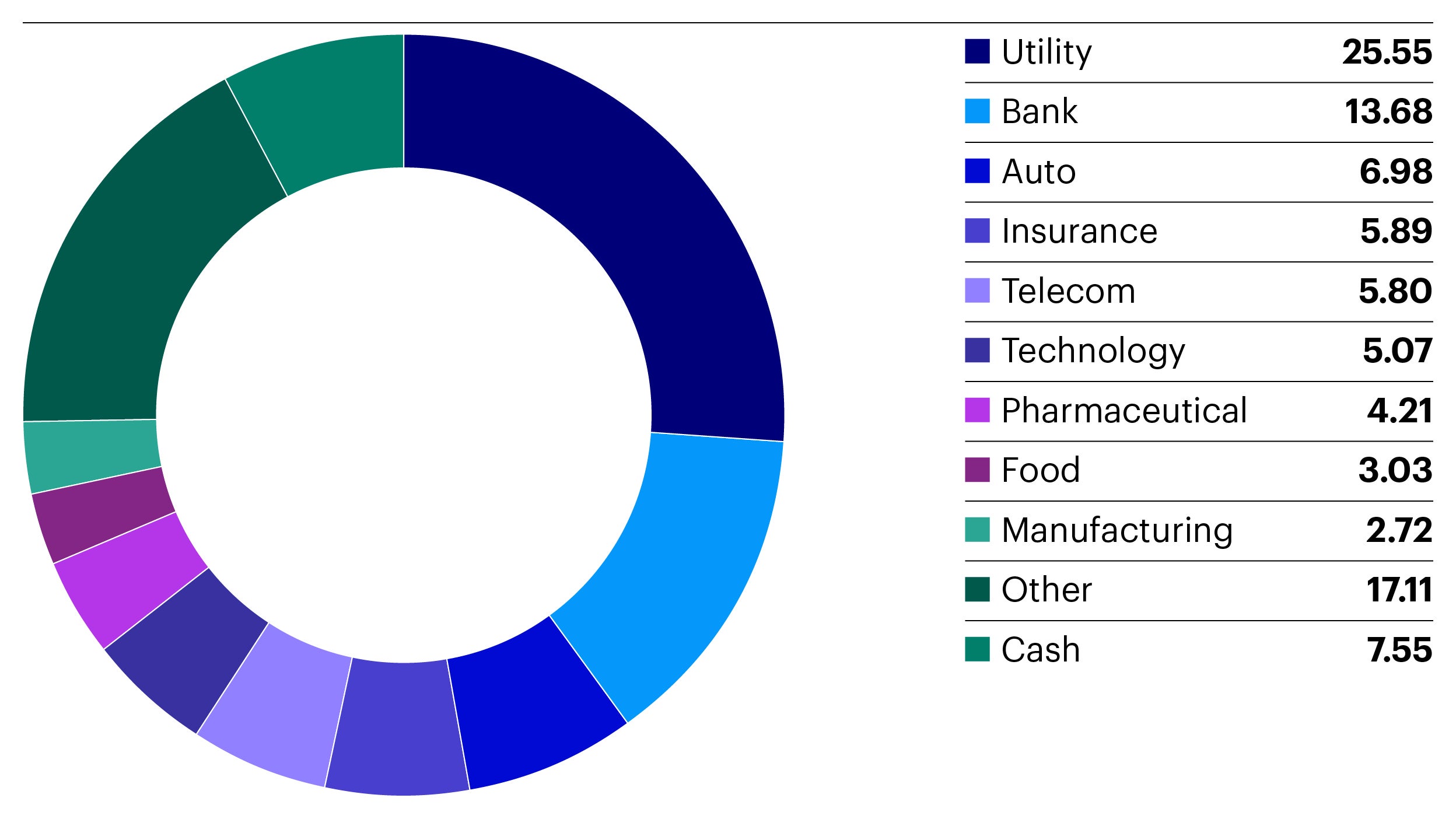

The auto sector constituted 7% of the SICAV fund as of 31 December 2021.

Sustainable finance

The other key area to highlight is the banking sector. Not only is this the largest sector within global corporate bond markets, it’s a challenging theme for a climate investor. Banks’ importance to climate change is not related to their own emissions which are relatively light, but rather tied to the emissions that they finance.

It is difficult to compare the carbon intensity of banks’ lending portfolios as data is sparse and banks don’t report in a way that allows for direct comparison. We consider banks’ Scope 3 emissions, which are the result of activities from assets not owned or controlled by the reporting organisation but nonetheless appear in its value chain, to be little more than guesswork.

Instead, we have devised an alternative approach which sources a number of different qualitative assessments from third parties, in conjunction with our own climate research.

We could have simply chosen to avoid the carbon issue in this sector by focusing on the retail banks that do not provide finance and advisory service to heavy industry. However, we believe that it is better to include banks that, despite funding carbon intensive industries, have clear policies and ambition to reduce their support to fossil fuels, whilst increasing their green lending. Holdings in the finance industry constituted 19.5% of the SICAV fund as of 31 December 2021 (see figure 1 above).

Looking to the future

Other themes will develop over time, as either financial opportunities present themselves, or as sectors develop their own pathway towards net zero emissions.

Overall, managing the Invesco ECO Bond Fund is a challenging yet rewarding endeavour. Just as many people can see the environmental benefits of switching from combustion engines to electric vehicles and insulating their homes, we believe that investors will be interested in ‘greening’ their financial portfolios.