Fixed Income

The end of rate hikes: Are we there yet?

As the market patiently waits for central banks to wind down rate hiking, we wonder, is the journey really this long, or have we gotten lost along the way?

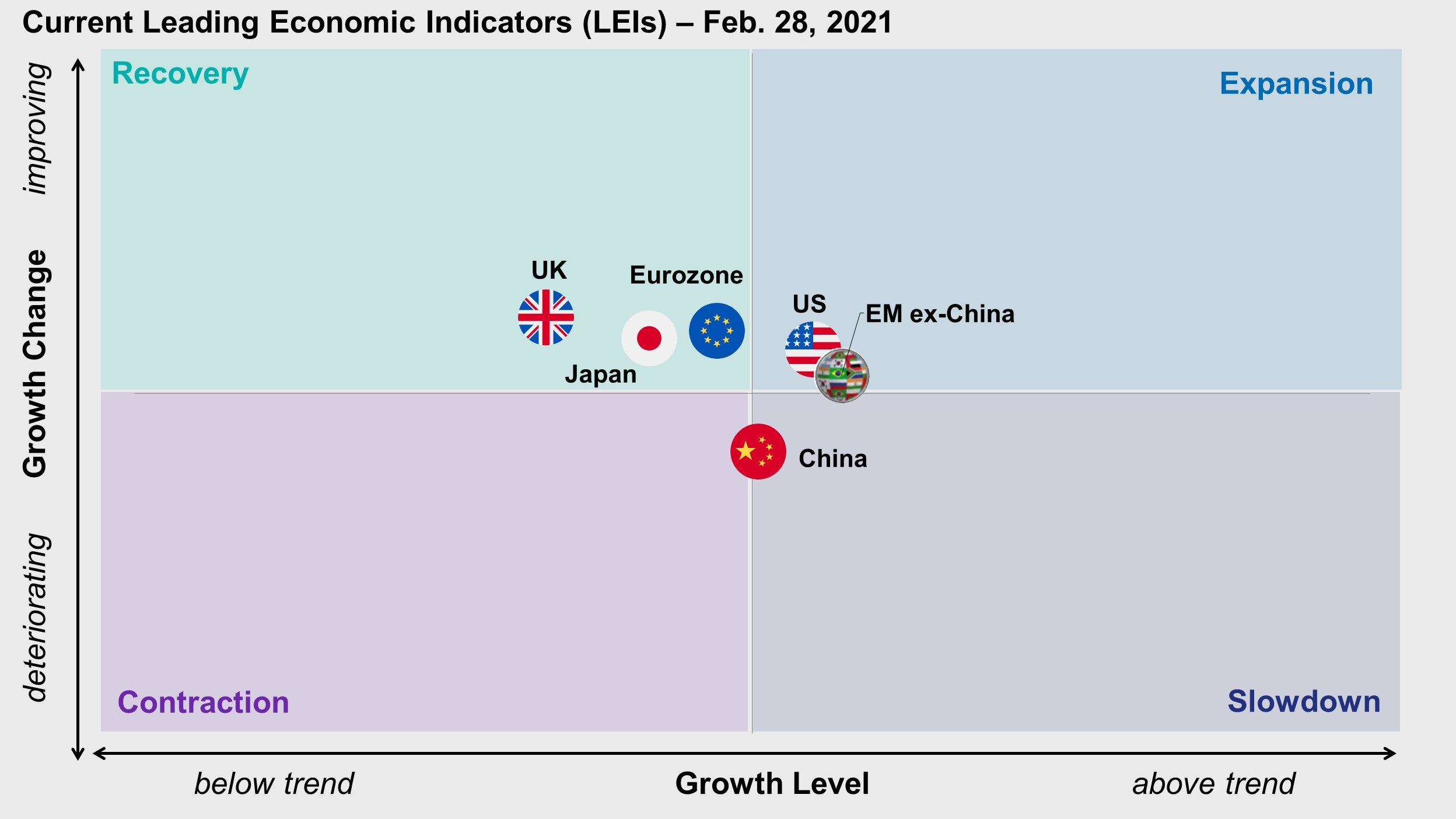

Despite some recent volatility, our assessment of the macro backdrop this month is unchanged. We expect the global economy to remain in an expansionary regime, with growth above its long-term trend and continuing to improve. Growth is accelerating in the developed world across all major countries, including regions that recently experienced setbacks due to new stringent lockdown measures such as the eurozone and the UK. Consumer and business confidence surveys in these regions are showing improvements in expected demand, goods orders, and production trends, suggesting potential for pent-up demand and a rebound in the next few months. Similarly, Japan continues to follow the global recovery, with improving activity in the manufacturing and trade sectors. As mentioned last month, emerging Asia continues to slow on the margin, settling around its long-term trend after leading the recovery.

In the past couple of weeks, markets experienced a meaningful repricing in higher bond yields, which negatively affected most asset classes across equity and fixed income. This recent spike in rates represents a technically driven acceleration in an otherwise more benign, fundamental trend that started in the third quarter of 2020. In our opinion, a continuation of current trends would represent a premature pricing of the end of the current monetary policy regime and liquidity environment, something the U.S. Federal Reserve (Fed) and other central banks have explicitly ruled out in their communications thus far. While we continue to favour a short duration stance, we expect yields to stabilize and potentially decline in the short term. Last month we discussed how these technical corrections are to be expected and could represent valuable buying opportunities under the premise that the global cyclical backdrop remains favourable, as we believe to be the case. As previously outlined, we expect credit spreads to remain low and stable in the expansion regime, possibly preventing short-term technical corrections in equity markets from turning into more enduring, fundamental bear markets.

The negative impact on risky assets has been most evident in emerging markets across equity, fixed income, and currencies, bringing back fears and memories of the broad-based emerging markets sell-off of 2013-2015, triggered by then-Fed Chairman Ben Bernanke’s “taper tantrum” and fueled by the commodity bear market that saw brent oil prices decline from $100 to $35 a barrel.1 We believe analogies with that period are misplaced. At the time, emerging markets suffered from large current account deficits, expensive valuations, and a commodity-induced “terms of trade” shock. Their vulnerability was also exacerbated by extended investor positioning given large capital inflows seeking higher yields in the preceding four years (2009-2013). Today, external funding positions are broadly balanced, commodity prices are on a cyclical rebound, and valuations are attractive across equity, fixed income, and currencies as emerging markets have been largely out of favour for the past decade.

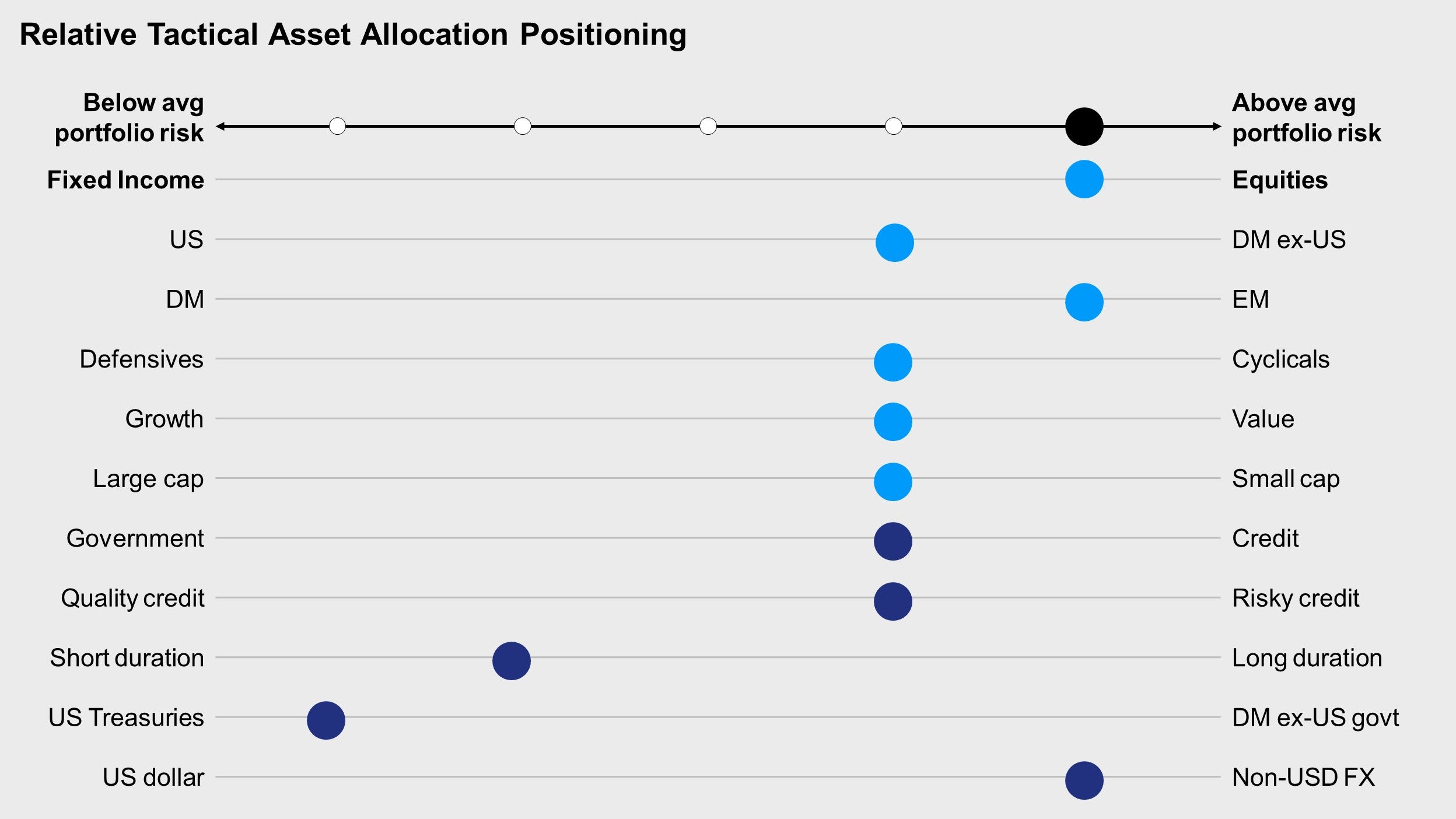

Our global risk appetite framework suggests market sentiment is still improving despite the recent spike in volatility and sell-off in global bond yields. We believe the most attractive opportunities to take advantage of this potential overshoot in yields are in cyclical risky assets such as emerging markets, value, and small-mid cap equities.

Investment positioning

This expansionary regime is supportive for equity and credit premia, cyclical factors, and risk assets more broadly. We expect equities to benefit from improving earnings and falling volatility, and to offer the best total return potential as spreads on lower-quality, risky credit have now compressed below historical averages. This is consistent with historical cycles.

Source: Bloomberg L.P. as of Feb. 28, 2021

Credit risk defined as DTS (duration times spread)

The end of rate hikes: Are we there yet?

As the market patiently waits for central banks to wind down rate hiking, we wonder, is the journey really this long, or have we gotten lost along the way?

The Bank of Canada pauses: Will other central banks follow this week?

It’s a critical week for global monetary policy as the U.S. Federal Reserve, the Bank of England, and the European Central Bank will all be meeting. Kristina Hooper hopes they take their cues from the Bank of Canada.

As the BoC fights inflation, where should fixed income investors focus?

Invesco Fixed Income shares their mid-year outlook for the Canadian economy and where they’re seeing opportunities in fixed income markets for the rest of 2022.

NA4428

Important information

Header image: Jason Denning / Stocksy

Commissions, trailing commissions, management fees and expenses may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the simplified prospectus before investing. Copies are available from your advisor or from Invesco Canada Ltd.

As illustrated in our previous research, we define the four stages of the business cycle based on the expected level and change in economic growth: recovery, when growth is below trend and accelerating; expansion, when growth is above trend and accelerating; slowdown, when growth is above trend and decelerating; and contraction, when growth is below trend and decelerating.

Capital spending (or capital expenditures, or capex) is the use of company funds to acquire or upgrade physical assets such as property, industrial buildings or equipment.

Size (in factor investing) represents the potential higher-than-benchmark returns associated with relatively smaller stocks within the universe being considered.

Value (in factor investing) applies to investments trading at discounts to similar securities, based on measures like book value, earnings or cash flow.

Momentum (in factor investing) identifies investments with positive momentum (recent strong returns) or negative momentum (recent weak returns) in order to calibrate portfolio exposure to either.

Spread represents the difference between two values or asset returns.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Junk bonds involve a greater risk of default or price changes due to changes in the issuer’s credit quality. The values of junk bonds fluctuate more than those of high quality bonds and can decline significantly over short time periods.

Issuers of sovereign debt or the governmental authorities that control repayment may be unable or unwilling to repay principal or interest when due, and the Fund may have limited recourse in the event of default. Without debt holder approval, some governmental debtors may be able to reschedule or restructure their debt payments or declare moratoria on payments.

The dollar value of foreign investments will be affected by changes in the exchange rates between the dollar and the currencies in which those investments are traded.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

Stocks of small and mid-sized companies tend to be more vulnerable to adverse developments, may be more volatile, and may be illiquid or restricted as to resale.

A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets.

There is no guarantee forecasts/outlooks will come to pass.

The opinions referenced above are those of the author as of March 19, 2021. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.