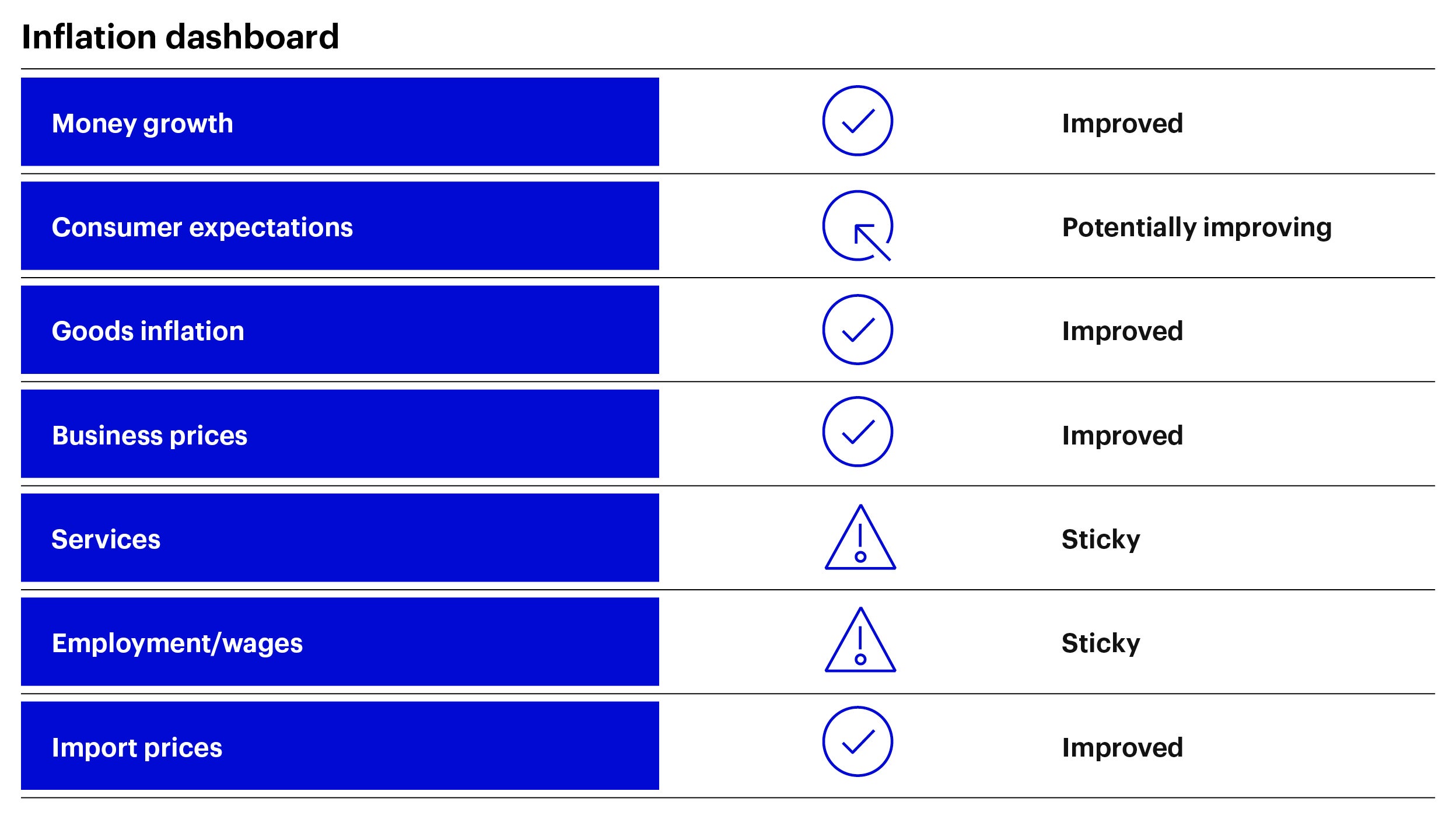

Money growth: Improved

Money supply growth has plunged as the U.S. Federal Reserve (Fed) has tightened monetary conditions and fiscal spending slowed meaningfully. The M2 money supply is now flat over the past 12 months.1 The growth (or lack thereof) in the money supply tends to lead inflation by roughly 12 to 18 months. From that lens, one could deduce that inflation may decline rapidly in the coming months.

Consumer expectations: Potentially improving

U.S. consumer one-year inflation expectations have been rolling over but remain above the Fed’s perceived “comfort zone.” It doesn’t appear, however, that long-term inflation expectations are becoming unanchored. The Fed is likely taking comfort that longer-term inflation expectations currently sit within their perceived “comfort zone.”2

Goods inflation: Improved

Supply-chain challenges have eased, and retailers have been successfully rebuilding inventories. The inventory to sales ratio from the U.S. Census Bureau (as of Dec. 31, 2022) is now at the highest level since the early days of the pandemic. The goods inflation story has largely been easing and is likely to continue to do so, even as consumer spending remains resilient.

Business prices: Improved

Business sentiment regarding future inflation has eased meaningfully according to the Institute for Supply Management (ISM) Manufacturing Prices Paid Index (as of Jan. 31, 2023.) The number of purchasing managers reporting backlogs on orders has plunged. The number of purchasing managers reporting slower delivery times has also fallen drastically.

Services: Sticky

Concerns still linger about service inflation. The service categories in the U.S. Consumer Price Index (as of Jan. 31, 2023) shows that shelter prices remain elevated but may be poised to decline. Transportation and recreation costs are also high, as anyone who has recently attempted to fly, rent a car, or attend an event can attest. One positive to note is that the used cars and trucks component of the Consumer Price Index has fallen by 11.6% over the past 12 months.

Employment/wages: Sticky

The job market remains very tight as highlighted by the 3.6% unemployment rate (as of Jan. 31, 2023). Average hourly earnings growth, which has already been slowing from elevated levels, has tended to peak ahead of recessions and coincident with peak employment. Workers surveyed in January by the Federal Reserve Bank of New York expect their income growth to fall from 4.6% to 3.3%, the biggest one-month decline in the survey on record.

Import prices: Improved

Slowing consumer demand has hit prices for containers. Freight costs have fallen from over $10,000 per 40-foot box at the height of the supply-chain challenges to under $2,000 in mid- February.3 The import prices of goods into the U.S. have been moderating in kind according to the Bureau of Labor Statistics Import Price Index (as of Jan. 31, 2023).

Conclusion

Inflation is moderating and will continue to decline over the next year, in our view. It’s unlikely to decline fast enough to appease policymakers suggesting more tightening is in the offing. As a result, in the short term we would expect markets to retrace early 2023 gains only to recover as inflation ultimately travels towards the Fed’s perceived “comfort zone.”