How will Asia Pacific emerge from the Covid pandemic?

Asia was the first epicenter of the Covid-19 outbreak three years’ ago and is likely to be the last region to emerge from the pandemic, with China finally easing Covid controls recently. This paper aims to map out what may lie ahead for the Asia Pacific region (“APAC”) in the post-pandemic era, by looking at the region’s economic resilience, cyclical recovery drivers, secular trends underpinning longer term growth and the associated opportunities in the APAC real estate sector for investors.

Strengthened economic resilience

Over the past few decades, APAC has experienced a few major crises – from the Asian Financial Crisis in 1997-98 and the dotcom bust in 2000-01, to the Global Financial Crisis (“GFC”) in 2008-09 and the Covid pandemic. The result of this was that many Asian countries learned to build up their economic resilience to withstand external shocks and the region was in a much better shape before going into the Covid pandemic.

Compared to 30 years’ ago, the region’s foreign exchange reserves have grown 29 times, and its share of global goods trade rose from 25% in 2000-02 to 41% in 20211. Before the pandemic hit, China was already a top-five trade partner for economies accounting for 99% of global GDP2. By March 2022, China’s GDP overtook that of the European Union and India surpassed the UK to become the world’s fifth largest economy3.

Despite the escalated geopolitical tensions, the regional trade networks within APAC have become more integrated over time. In 2020, amidst mobility restrictions and supply-chain disruptions, the intra-regional goods trade contributed around 60% of the total goods trade of APAC countries4. In addition, the Regional Comprehensive Economic Partnership (“RCEP”)5, which came into force in January 2022, has created the world’s largest trading bloc6. The RCEP could help facilitate economic integration and pave the way for a more sustained recovery in APAC in the post-pandemic era.

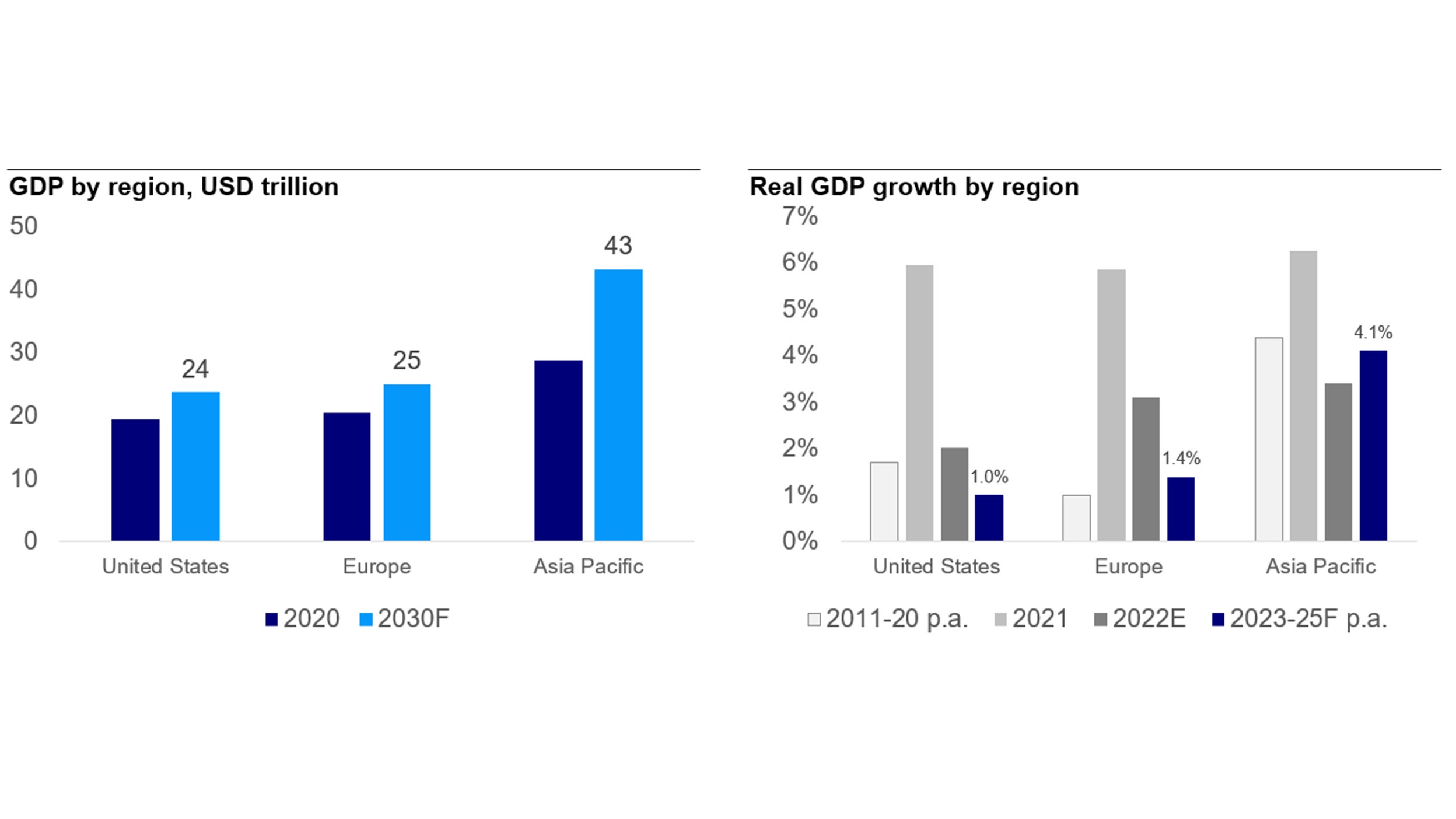

Overall, APAC economies demonstrated more stable growth and less volatility before the pandemic. Even during the onset of Covid in 2020, the Asian economy contracted by 1.5% while the world economy shrank by 3.2%. As we move into the post-pandemic era, APAC’s GDP growth is forecast to average 4.1% per annum in 2023-25 in real terms, outpacing that in the US and Europe by 1.0% and 1.4%, respectively7. With this growth trajectory, APAC could account for close to 40% of the world’s GDP by 2030, up from 35% in 2020. (Figure 1).

Note: constant (2015) prices and exchange rate. E = Estimate; F = Forecast Source: Oxford Economics, January 2023. *Oxford Economics, based on 2015 prices in USD, January 2023.

FOOTNOTES

-

1

Source: McKinsey Global Institute, September 2019; United Nations Economic and Social Commission for Asia and the Pacific, November 2021.

-

2

Source: World Integrated Trade Solution Database, World Bank.

-

3

Source: McKinsey Global Institute, October 2022.

-

4

Source: Asian Development Bank, February 2022.

-

5

A free trade agreement among 15 APAC nations (incl. China, Japan, South Korea, Australia, New Zealand and Singapore). The key goals include eliminating 90% of the tariffs on imports among its signatories within 20 years and the establishment of common rules for e-commerce, trade and intellectual property.

-

6

Source: “RCEP agreement enters into force,” Association of Southeast Asian Nations, January 2022.

-

7

Oxford Economics, January 2023.