Uncommon truths: What if Marine Le Pen wins?

Key takeaways

We believe the second round of French presidential elections will be between Emmanuel Macron and Marine Le Pen. A victory for the latter (which we do not expect) could destabilise markets, in our view, and looks more likely than we thought.

It had all seemed so easy for Emmanuel Macron (incumbent president from the centrist La Republique en Marche party). The first round of presidential elections is taking place right now (10 April 2022), with the second round due on 24 April 2022 (if no candidate wins an outright majority in the first round, the two leading contenders will contest the second round).

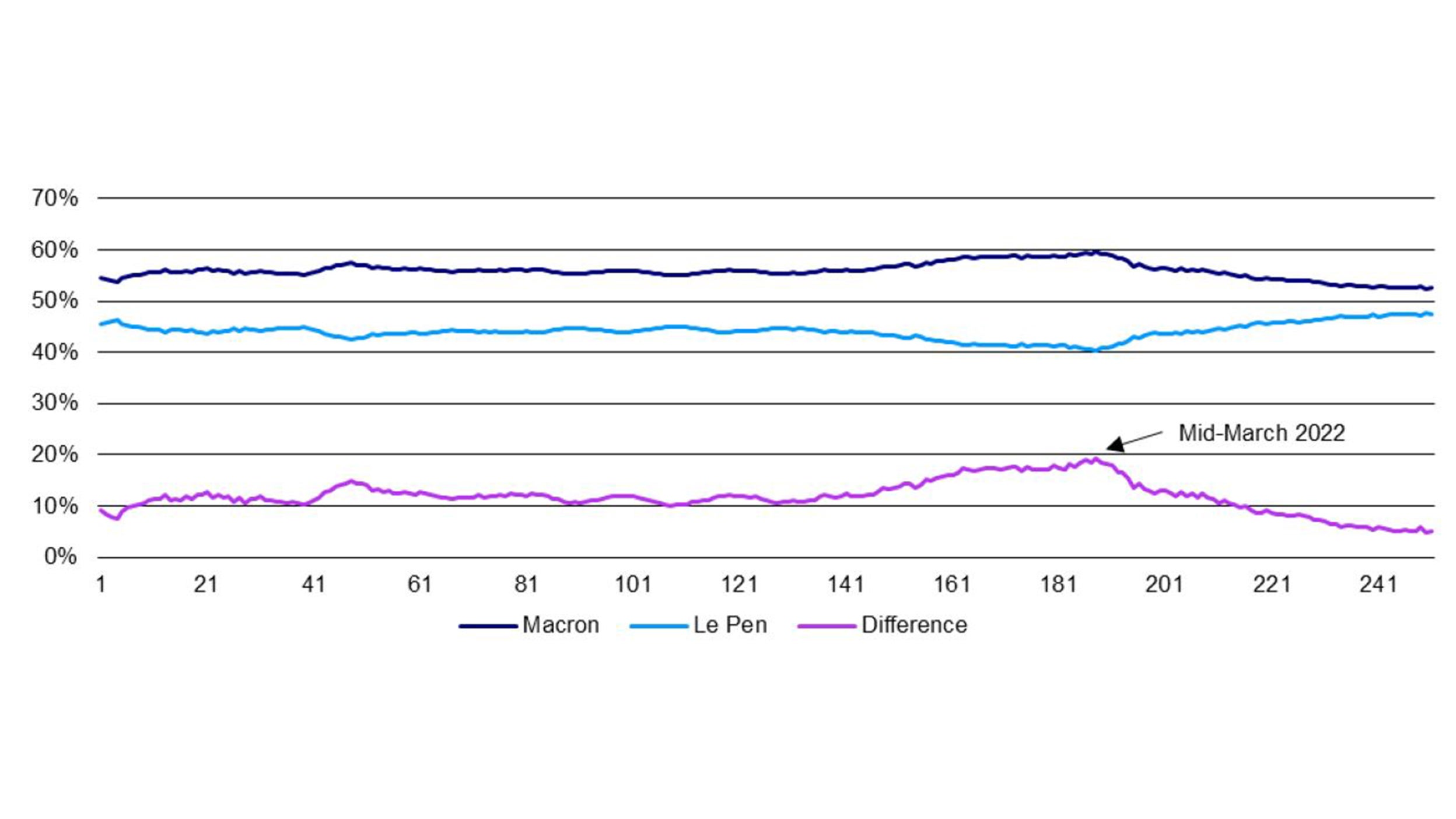

He had a comfortable lead in opinion polls against any of the likely second-round contestants. Figure 1 shows that his lead versus Marine Le Pen (far-right Rassemblement National and most likely second-round opponent, in our view) was above 10% for most of the period since early-April 2021. Even better, that lead approached 20% after Russia’s invasion of Ukraine, as Macron was seen to play an important role in negotiations with, and then sanctions against, Russia.

However, more recent opinion polls suggest that something has gone wrong, with our 10-poll moving average suggesting the lead has dwindled to 5 percentage points (53% versus 48%), with some polls much tighter than that. We suspect the cost of living crisis is punishing incumbent leaders around the world, to the benefit of populists. In the case of France, opinion polls suggest that President Macron is losing vote share to both Marine Le-Pen (far-right) and Jean-Luc Mélenchon (far-left). Of the 12 candidates in the first round, these three seem the most likely to come out on top and we believe the order will be Macron, Le-Pen and Mélenchon.

Hence, we suspect that Macron and Le Pen will contest the second round on 24 April. Momentum appears to be with Le Pen and if the recent trend continues she could win the second round to become the next president of France. We later consider whether this is likely but first outline what difference it could make to France, Europe and the world.

The manifesto of Marine Le Pen (M la France: Mon Projet Présidentiel) makes for interesting reading. Apart from the expected anti-Islamic and anti-immigrant themes, there is a mix of liberalism and conservatism (economic and social) that has much in common with far-left ideology, as well as the more anticipated right-wing content (and some ideas that are more central). The manifesto makes a lot of economic commitments, some of them precise, but with no costing and no idea of how they will be financed. We suspect this, along with anti-EU proposals, could unsettle financial markets.

Note: Based on opinion polls from 14 April 2021 to 8 April 2022 (the horizontal axis shows the number of opinion polls conducted since 14 April 2021). The second round of elections is due to take place on 24 April 2022 and the chart assumes the two candidates will be Emmanuel Macron and Marine Le Pen. Source: Atlas Intel, BVA, Elabe, Harris Interactive, Ifop, Ifop-Fiducial, Ipsos, Ipsos-Sopra Steria, Odoxa, OpionWay, OpinionWay-Kéa, Redfield & Wilton, YouGov, Wikipedia, Invesco

The 35 page document is broken down into 13 main sections. Below is a quick summary, with what we think are the main points likely to interest investors.

- Defence: Withdraw from NATO, end industrial cooperation with Germany and lay the basis for deeper military cooperation with the UK (while coming out of the yoke of the US). Boost the annual military budget to €55bn by 2027 (from the €40.9bn budgeted for 2022). Focus on fighting Islamic terrorism, cybersecurity and space.

- Immigration: hold a referendum within six months to control who is allowed into France (and its territories) and to make it easier to expel foreigners. Ban extreme ideologies and introduce legislation targeting Islamic idealogues.

- Law and Order: Boost resources to fight criminality and gangs (expel criminals from overseas). Establish a ministry to fight social fraud (benefits fraud etc.). Halve the time needed for court cases by increasing the number of magistrates. Set minimum sentences and raise the prison population to 85,000 (from 63,000 in 2020).

- Healthcare: reverse the concentration of resources in big cities; reduce administrative staff to a maximum of 10% of the total and raise salaries for healthcare and social care staff.

- The handicapped: constitutional right to equal treatment; decoupling of benefits from income of partner; improve employment chances and provision in schools.

- France in the world: make France more independent and self-interested; establish a union of French speaking (francophone) countries; create an Alliance of European Nations to eventually replace the EU; protect French territorial seas (also around overseas territories) and fiscal incentives to invest in overseas territories.

- Economy, employment and incomes: localism, not globalism; public spending focused on French suppliers; control imports but reduce bureaucracy (especially EU rules) to encourage smaller businesses; reduce taxation on businesses and inheritance tax; replace property based wealth tax with a financial asset wealth tax; reduce VAT on fuel and electricity from 20% to 5.5%, reduce road tolls by 15% and eliminate the TV licence fee (and privatise public TV stations); boost household incomes by €150-€200 per month; offer favourable tax treatment to companies that boost salaries by 10% or more; encourage investment in the regions and set up a French Sovereign Fund to attract savings of French households (interest rate of at least 2%) and to invest in France (overseas energy sources, nationalise autoroutes, ecological transformation, make France a technological leader).

- Youth: no income tax for under-30s (and no business taxes for first five years on enterprises set up by young people); retirement age linked to age at which employment started; supplement pay of students who also work; free off-peak transport for 18-25 year olds and apprenticeship payments of €5,700-€8,000 per year to be split equally between employer and employee.

- Energy independence: reinforce nuclear and hydro capabilities, while halting the rollout of wind power (and eventually dismantling existing wind facilities).

- Agriculture: increase food security by increasing and stabilising prices (add national subsidies to those of EU); invest in abattoirs and farms; aid farmers in negotiations with food manufactures and ban imports that lead to deforestation.

- Families: raise the birth rate via fiscal incentives to have more children; family benefits payable only if at least one parent is French; double family support to one-parent families; reintroduce indexation of pensions (and giving half of pension to the spouse of deceased); reduce inheritance tax and the tax on lifetime gifts and give compensation to those caring for close relatives.

- Education: reduce primary school class sizes to 20 (requires more teachers); a 3% increase per year in teacher salaries; change the secondary system so that most go into professional training at the age of 14 (can include doctors, for example).

- French culture: a form of voluntary national service for 18-24 year olds to help protect national culture; taxes on historical monuments to be adapted to their conservation and the establishment of the francophone union mentioned above.

Notes: monthly data from 31 December 1969 to 31 March 2022. Past performance is no guarantee of future results. Shaded areas show the political affiliation of the incumbent president. MSCI indices are price indices expressed in US dollars.

Source: Encyclopaedia Britannica, Refinitiv Datastream and Invesco

So, under a Marine Le Pen presidency we think France would be fiscally expansive, more isolationist (and less open to immigration and more hostile to Muslims), would leave NATO and be less enthusiastic about (and perhaps eventually leave) the EU.

If she follows through on the manifesto, it could set France on a collision course with the EU. There is plenty of talk of giving control back to the French (immigration, reducing VAT on energy and removing EU red-tape) and also the idea of creating an Alliance of European Nations that could eventually supersede the EU (France together with Hungary, say). Though the idea of France leaving the EU (Frexit) is not mentioned, there are plenty of undertones to that effect. A France that plays a less constructive role within the EU (or eventually leaves) could bring volatility to European financial assets, in our opinion.

Likewise, a France that tries to flex its muscles on the world stage (taking its rightful place, in the eyes of Marine Le Pen) could add another layer of uncertainty in a changing geopolitical landscape. We think a Le Pen presidency would be more antagonistic towards the US, while recent statements suggest she would be more forgiving of Vladimir Putin.

Finally, the sheer quantity of fiscal commitments (spending and tax reductions) is likely to lead to a large increase in budget and balance of payments deficits, in our opinion (though the manifesto argues the opposite). We doubt that financial markets would be accepting of widened budget deficits in France if the rest of the world is redressing the fiscal imbalances created during the pandemic. For example, the spread on 10-year government bonds versus Germany has widened by around 10 basis points in the last month and we suspect that trend could continue under a Le Pen presidency.

However, Figure 2, suggests that the performance of French equities relative to broad European indices does not depend on the political persuasion of the president. Perhaps the best comparison with a Le Pen presidency would be that of socialist Francois Mitterrand who was elected in 1981 and was in office until 1995. After the initial equity market shock, French stocks then went on to outperform European counterparts, partly because Mitterrand was forced by financial markets to drop his more radical proposals. We suspect something similar could happen under a Le Pen presidency: after an initial period of enthusiastic implementation of manifesto promises, a negative financial market reaction would force a more orthodox approach.

All that remains is to consider whether she could actually win. As already stated, momentum is on her side and our experience suggests she is a better communicator than Macron. However, we suspect that the best is already behind her. First, we think there is a ceiling to the proportion of the population that will vote for a candidate from the far-right, though we acknowledge the ceiling has been raised, in part because of the cost of living crisis. Second, we have been here before, when her father (Jean-Marie Le Pen) reached the second round in 2002 and was soundly beaten by Jacques Chirac (the margin was 82% to 18% after the country united to block Le Pen, though the daughter has a softer image than the father). Third, the most recent election (2017) also pitted Macron against Marine Le Pen and the outcome was not as good for Le Pen as had been suggested by opinion polls (in the days prior to the second round vote, she was polling at between 37% and 41% but only received 33.9% on election day).

In conclusion, a Marine Le Pen presidency would initially take France down a very different path (more isolationist, more assertive, anti-EU/US and fiscally expansive). Though we think the reality of office could soften the approach, we fear that financial markets would react negatively in the first instance, with French and other peripheral Eurozone assets suffering. Nevertheless, we think it unlikely that she gets elected but it is a lot closer than we had imagined, even a few weeks ago. The eyes of the world will be on France over the next two weeks.

All data as of 8 April 2022, unless stated otherwise.