Diversifying traditional 60/40 portfolios: A focus on income

Key Takeaways

From a strategic perspective, 2022 has created long-term opportunities for multi-asset investors, particularly due to increased bond yields.

- 10-year expected return for global 60/40 portfolio currently 6.4%, up from 4.8% one year ago.

- Strategically we are overweight bonds versus stocks.

From a tactical perspective, improvement in market sentiment and stabilization of leading economic indicators have created short-term opportunities, but lagged impact of monetary policy could begin to take hold later in 2023, particularly in developed markets such as the US.

Strong opportunities in private markets income space, where increased rates and improved diversification have made alternative asset classes an increasingly important component of multi-asset portfolios.

This is the first of a four-part blog series on diversifying 60/40 portfolios in the current macroeconomic environment. Traditional 60/40 portfolios are no longer delivering the returns investors were used to over the last decade. In this first blog we outline how rising interest rates have created long-term opportunities for investors to deploy public and private credit in 60/40 portfolios. In subsequent blogs we will delve deeper into the types of fixed income we believe offer good diversification options, namely senior loans, core fixed income and emerging market debt.

Most investors would probably like to put 2022 behind them, and perhaps still might be experiencing apprehension with respect to capital allocation decisions. However, we believe due to the sharp dislocations across asset classes last year, there are compelling long-term opportunities for strategic investors to diversify their portfolios with public and private debt instruments.

The negative backdrop in 2022 was driven by was a confluence of factors – COVID’s impact on economic growth, geopolitical conflict, and strong consumer positioning from stimulus efforts and subsequent demand/supply imbalances (e.g., housing, autos) – all leading to historically elevated inflation, particularly in the US. Outside of the US, dollar strength exacerbated inflation conditions globally. These factors in combination led to the steepest global tightening regime by central banks in decades, which shocked both stock and bond markets, and led to one of the worst years for balanced portfolios on record. Investors felt perplexed by an environment where major asset classes declined in tandem, and therefore delayed capital deployment decisions and “sat on the sidelines”.

However, this sharp increase in interest rates has created strong long-term opportunities for investors to deploy into fixed income. For investors focused on generating income, the environment has become much more favorable as it is easier to achieve both income and diversification investment outcomes, without making meaningful sacrifices to accomplish one objective versus the other. For additional context, the 10-year expected return for a global 60/40 portfolio is currently 6.4%, up from 4.8% one year ago.1 The overwhelming majority of this increase is due to increased bond yields.

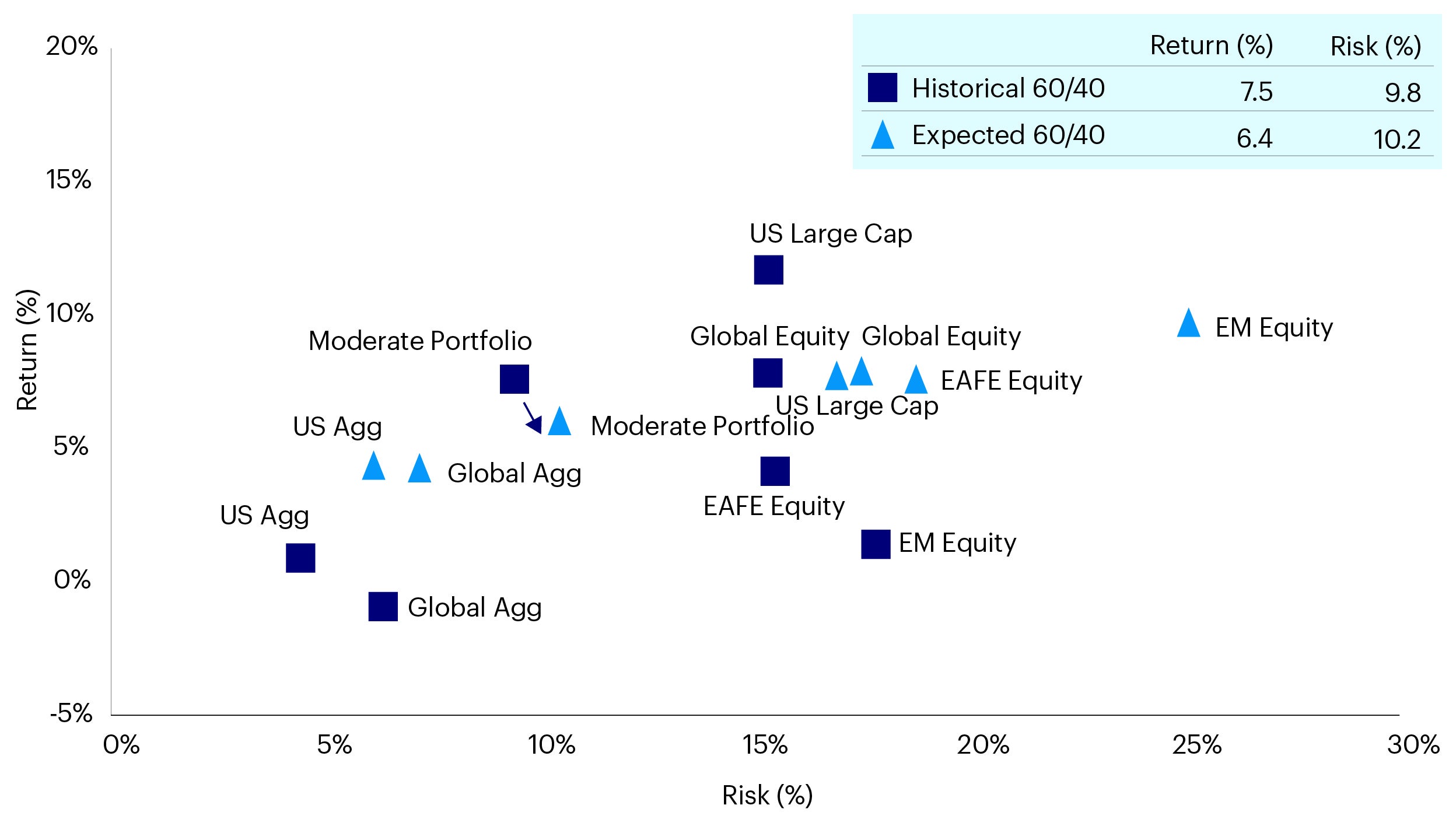

While rising fixed income yields have made the forward-looking value proposition of 60/40 portfolios better, expected returns are still meaningfully lower than what we’ve experienced over the last 10 years amid increased risk, making the achievement of core investment outcomes more challenging (Figure 1). This has made diversifying the traditional 60/40 opportunity set, specifically from a fixed income perspective, more critical.

Source: Invesco Investment Solutions, as of September 30, 2022. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions. The 60/40 Portfolio is a blend of 60% S&P 500 Index and 40% Bloomberg Barclays US Aggregate Index.

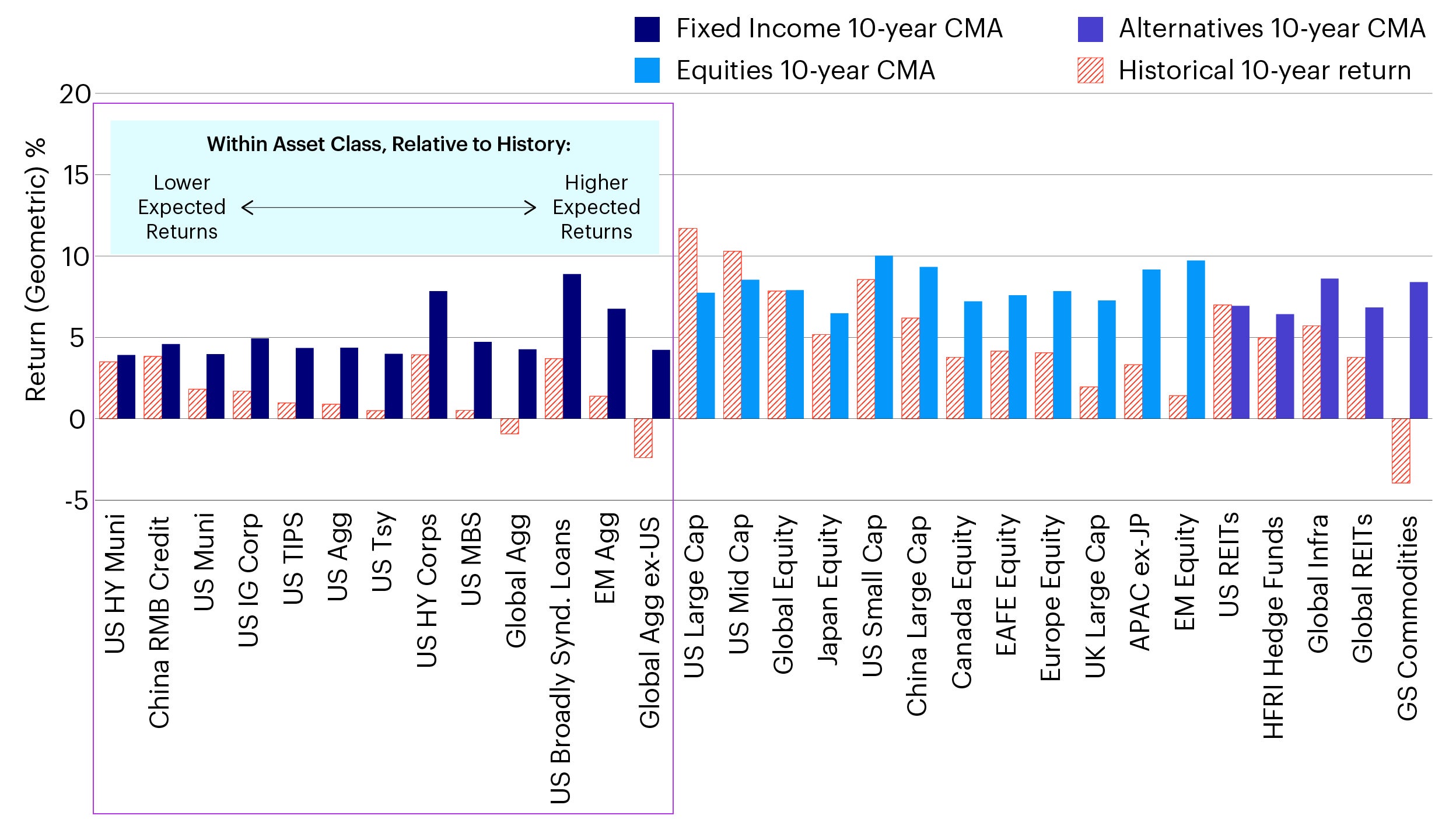

Looking further at our long-term capital market assumptions (LTCMAs), we expect the long-term returns from fixed income to be substantially higher than what we have seen over the last 10 years, across most of the asset classes we model (Figure 2). We believe this alone could give investors much-improved conditions with which to improve their asset allocation profiles and increase the probability of meeting long-term investment outcomes.

Source: Invesco, estimates as of September 30, 2022. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

In terms of portfolio income generation, the path is much more straightforward than in past years, particularly with two-year U.S. Treasuries currently at over 4%. This is a substantially different environment than we were facing a year ago. If an investor wanted to achieve 4% yields in early 2021, this would require a heavy deployment of non-investment grade credit and other risky assets. Now that the level of many government bond yields is around the 4% mark, the key challenges are implementing a diversified exposure that complements the rest of the portfolio and enables the investor to address unique considerations specific to their individual needs.

For example, if you are a long-duration investor such as a pension or insurer, you may think about income generation differently than a typical high-net-worth (HNW) investor who is concerned about current income. We believe ultimately investors need to take an “all of the above” approach to portfolio construction, particularly solving for income, and leverage public and private markets building blocks. At this point, putting together balanced multi-asset portfolios with 5-6% yield and still exhibiting defensive characteristics from fixed income is very achievable. Shorter-term, we believe the environment is favorable for credit-sensitive assets such as emerging market bonds. Long-term, we believe this is a great entry point for fixed income across the board.

From a tactical perspective, we are of the view inflation will continue to decelerate and rates hikes will subside in 1H 2023. However, there are obviously still upside risks to inflation, as jobs data in the US has come in strong for January and corporate earnings remain resilient. Geopolitical risks continue to persist, and we have yet to fully ascertain the impact of China’s reopening on global demand. We also have concerns about steady-state inflation eventually settling in at a higher rate than what we saw in the 2011-2019 timeframe, which could no doubt have an impact on portfolio allocations.

In terms of investor allocations, we believe it becomes more of a balance between mitigating inflation risks and a potentially decelerating macro backdrop, particularly coming from the US (see most recent ISM manufacturing survey). Although we remain opportunistic on risk assets now and think that window will stay open for the next several months, we are of the mindset that this current cycle is not over and investors would need to be nimble and tactically shift portfolios according to shorter-term conditions, to complement a sound strategic asset allocation process.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Footnotes

-

1

Invesco Investment Solutions, data as of September 2022.