Diversifying traditional 60/40 portfolios: Core fixed income

This is the third of a four-part blog series on diversifying 60/40 portfolios in the current macroeconomic environment. Traditional 60/40 portfolios are no longer delivering the returns investors were used to over the last decade. Our first blog outlined how rising interest rates have created long-term opportunities for investors to deploy public and private credit in 60/40 portfolios. In our second blog we covered the opportunities that exist in senior loans, and this piece looks at the diversification advantages of core fixed income. The last blog in our series will cover the merits of emerging market debt.

Given recent market developments, particularly around heighted volatility due to US bank failures and additional concerns from Europe, we thought this month’s blog should address how to think about diversifying portfolios with core fixed income assets, particularly investment grade (IG) corporate bonds. As discussed in January’s piece, the return-risk tradeoff for high quality fixed income exposure has reached the most attractive levels in over a decade. Coupled with the volatility in equities, it’s important for investors to think about bonds not only as a source of income, but also as an important source of volatility mitigation in a portfolio, which is an essential component in the long-term achievement of investment objectives.

- Current 10-year long-term capital market assumptions for global investment grade corporate bonds are at 5%; similar assumptions for global treasuries at 4.4%1

- Expected long-term volatility of global IG corporates is 5.6% utilizing the Invesco Vision portfolio analytics platform; 6.1% expected volatility for global treasuries2

- Integration of investment grade corporate bonds can improve risk-adjusted returns by providing levels of income above 5%3

- Current yield environment provides an attractive entry point for strategic investors, particularly those with long-term liabilities

As investors navigated the post-global financial crisis landscape, generating yield became an incredibly complicated journey, often leading to an “overallocation” of risk into a portfolio through the fixed income sleeve. This was done through structural (and sometimes unintended) overweights to credit-sensitive asset classes, which was required for investors to achieve desired income and cash flow targets. As discussed last month, there is a definite place for these types of assets in investor portfolios, but we believe the overarching goal of fixed income should be to effectively integrate both defensiveness and stable income. Given that, in our view an investor’s allocation to fixed income should start with core exposure – particularly investment grade-rated securities. The largest allocation within the Bloomberg Global Aggregate Index, by far, are treasury and government-related bonds, comprising roughly two-thirds of overall exposure. The remaining exposure is split between corporate and securitized bond issues.

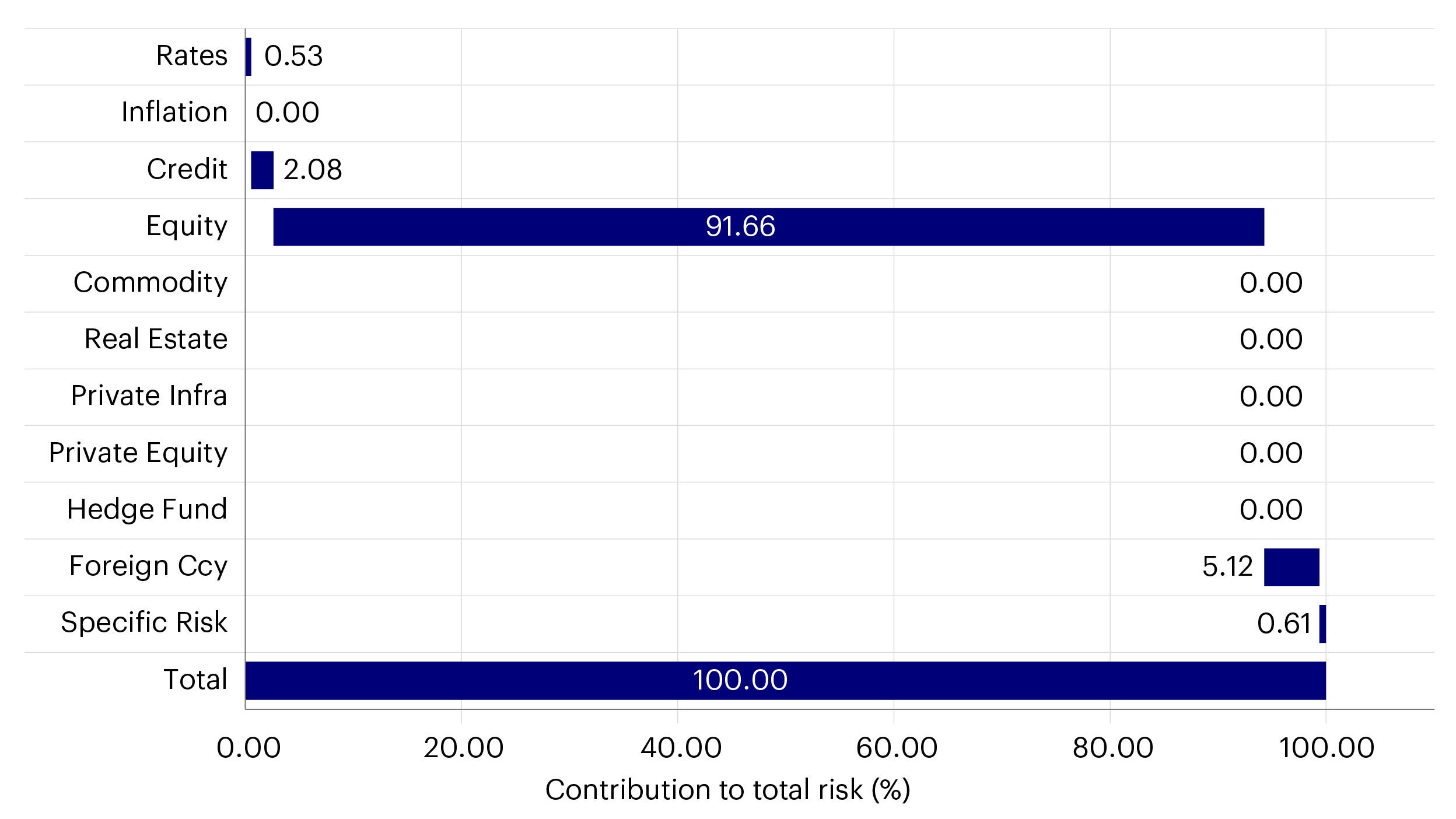

We believe the formation of a fixed income allocation should typically start with this core exposure, with tweaks then implemented using tactical and strategic market views to enhance portfolio returns while still providing ballast to a global equity allocation. It’s important to note in a “60/40” portfolio, the equity allocation is going to create over 90% of portfolio risk (Figure 1). Depending on whether an investor decides to hedge core fixed income exposure, this will drive anywhere from 2.5% to 8.5% of a portfolio’s total risk using this construct.4 This highlights how important core fixed income is simply for its ability to diversify equity exposure. However, in the previous low-yield environment, the tradeoff between income and diversification was more tenuous, with many investors opting to emphasize the former over the latter. During a market selloff, which often is preceded by an expansion of credit spreads, credit sensitive assets do not serve as optimal diversifiers compared to their investment grade counterparts. Therefore, the first step in our fixed income portfolio construction process starts with core exposure.

Source: Invesco Vision, data as of 31 January 2023; risk decomposition of 60% MSCI World, 40% Bloomberg Global Aggregate (USD-hedged) portfolio. Return estimates are based on the Q1 2023 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

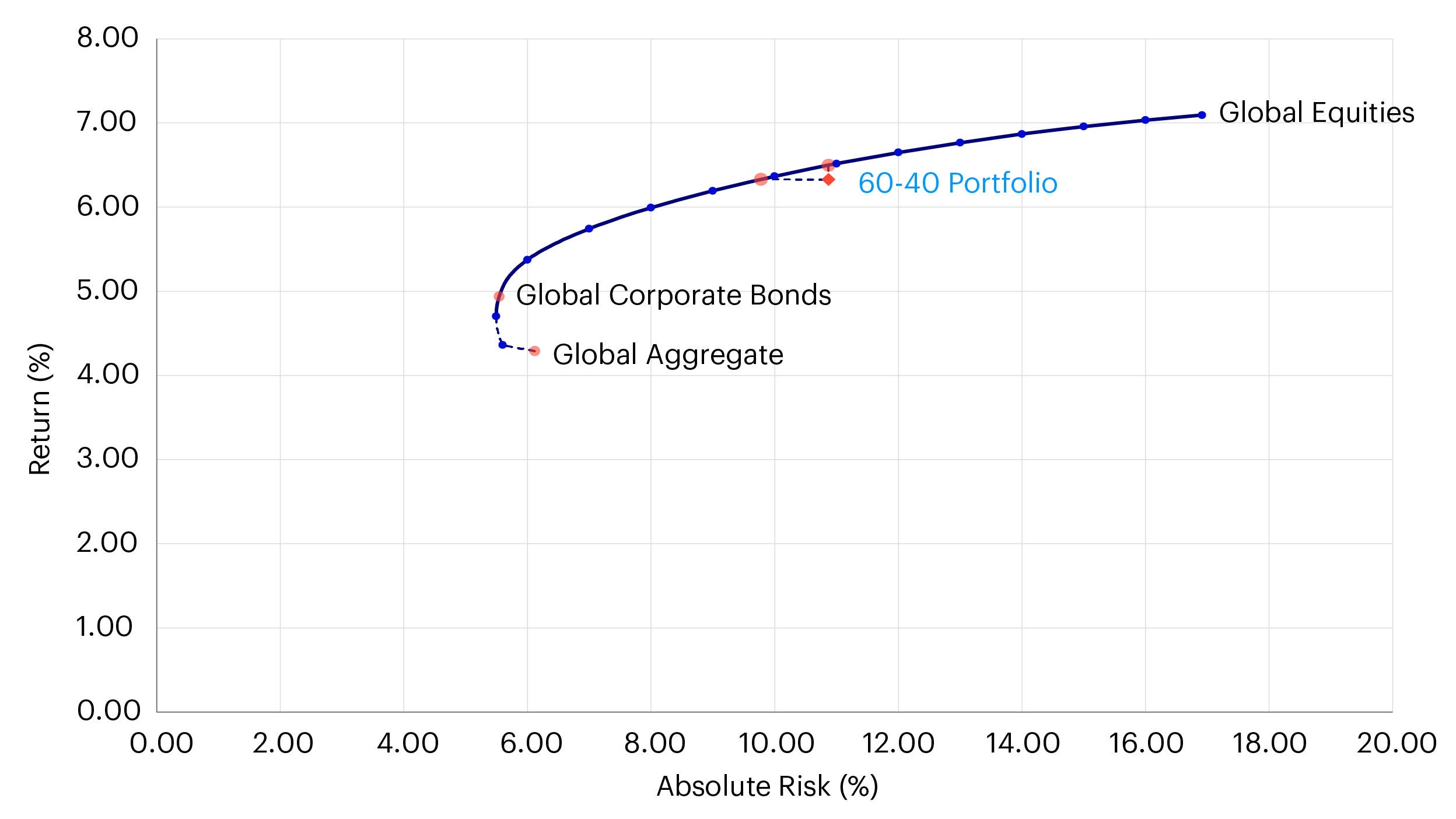

As discussed in January’s blog, the current tradeoff between equities and high-quality fixed income, at least from a risk-adjusted perspective, is at historic levels.

Source: Invesco Vision, data as of 31 January 2023. Return estimates are based on the Q1 2023 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

| Portfolio 1 | Portfolio 2 | |

| Composition | 100% Global Equity | 60% Global Equity + 40% Global Core Fixed Income |

| Return (%) | 7.1% | 6.3% |

| Absolute Risk (%) | 16.9% | 10.9% |

Source: Invesco Vision, data as of 31 January 2023.For illustrative purposes only. There can be no assurance that any estimated returns or projections can be realized.

Implementing a 40% allocation to core bonds creates a portfolio with roughly 90% of the expected returns of global equities with 65% of the risk. As a starting point, this puts investors far ahead of where they found themselves in the last cycle. This is particularly advantageous for liability-aware investors such as pension schemes, as the ability to exceed liability returns with less relative risk (liabilities have a bond-like risk profile) greatly enhance the probability of outcome achievement. However, the portfolio construction process is far from over, and our view is that additional levers will need to be implemented across the asset class spectrum, both public and private, to achieve desired investment outcomes over the next cycle.

Global investment grade corporate bonds as a source of stable income and volatility mitigation

Within the core fixed income domain, we believe investment grade corporate bonds are an attractive building block. Given the strong expected risk-adjusted returns of the asset class, even higher than global treasuries due to a shorter duration profile and credit spread premia, we believe it warrants inclusion in a diversified portfolio. There is also strong potential for active management in this space, as seasoned managers can harvest meaningful benefits from market dislocations, which are much more commonplace than in the equity markets. The confluence of these factors warrants strong consideration of a standalone portfolio allocation.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Past performance is no guarantee of future returns.