Diversifying traditional 60/40 portfolios: Senior Loans

Key Takeaways

Current 10-year long-term capital market return assumptions for senior loans are at 9.3%, higher than most major equity asset classes*

Leveraging the Invesco Vision portfolio analytics platform, expected long-term volatility of the asset class is 4.3%, lower than global high yield bonds at 6.2%*

Senior loans can both increase returns and reduce risk for traditional fixed income and balanced portfolios, increasing portfolio risk-adjusted returns.

*Source: 2023 Long Term Capital Market Assumptions, data as of December 31, 2022.

This is the second of a four-part blog series on diversifying 60/40 portfolios in the current macroeconomic environment. Traditional 60/40 portfolios are no longer delivering the returns investors were used to over the last decade. Our first blog covered how rising interest rates have created long-term opportunities for investors to deploy public and private credit in 60/40 portfolios. In this second blog we cover the opportunities that exist in senior loans. In subsequent blogs we will delve deeper into the other types of fixed income we believe offer good diversification options, namely core fixed income and emerging market debt.

As shown in our February Invesco Investment Solutions Tactical Asset Allocation blog, improving sentiment and macroeconomic buoyancy have pointed to the increasing possibility of an economic soft landing, which is highly positive for credit-sensitive assets. Since the start of 2023, a wave of increasing investor risk appetite and improved fundamentals has created opportunities across the asset class spectrum – specifically in senior loans.

As we closed out 2022 and moved into 2023, markets have reacted much more favorably to the developing global macroeconomic backdrop, with inflation decelerating meaningfully and China ending its zero-Covid policy. The confluence of these and other factors has led to an improving risk appetite among global investors, increasing the attractiveness of risky assets in the short-to-intermediate term. Coupled with the after-effects of the sharp rising rate environment experienced in 2022, both tactical and strategic opportunities still exist within the senior loans space, even if meaningful increases in baseline interest rates have slowed. The most recent Invesco Investment Solutions long-term capital market assumptions research, which takes a building block-based approach to forward-looking return analysis, point to meaningful improvements in long-term fixed income returns, as discussed in last month’s blog.

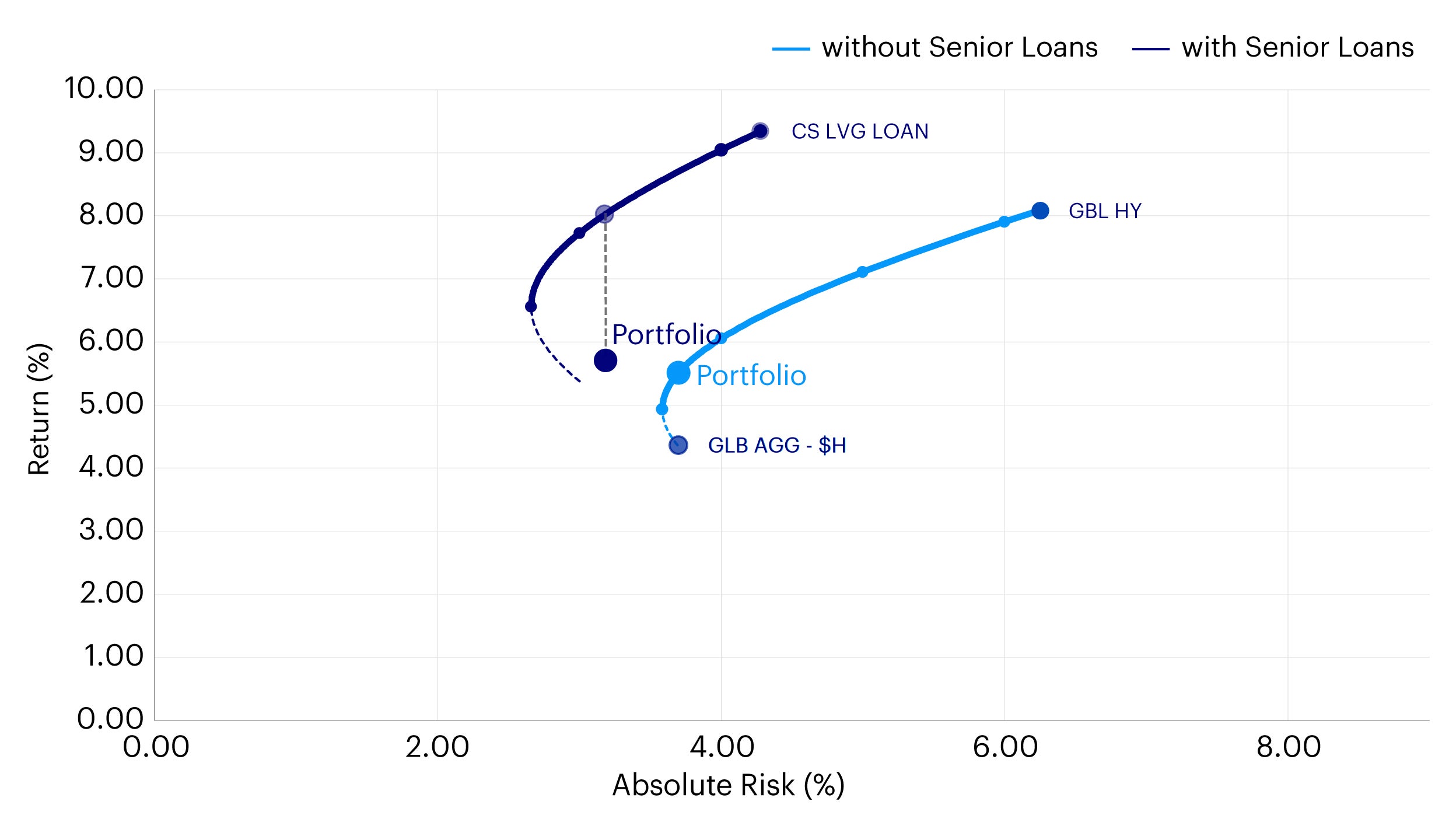

Diving deeper into the fixed income space, asset classes such as senior loans provide not only favorable income-generation potential, but also diversification properties which enhance risk-adjusted returns of both traditional fixed income and multi-asset portfolios. As seen below, the addition of senior loans to a portfolio of global core bonds and global high yield leads to significant efficient frontier expansion.

Source: Invesco 2023 Long Term Capital Market Assumptions

In further analyzing the efficient frontier analysis and examining various portfolio combinations, we sample two different portfolios and gauge the return, risk, and diversification properties using Invesco Vision:

Portfolio 1 |

Portfolio 2 |

|

| Composition | 70% Global Bonds + 30% Global High Yield |

70% Global Bonds + 15% Global High Yield + 15% Senior Loans |

Return (%) |

5.5 |

5.7 |

Absolute Risk (%) |

3.7 |

3.2 |

Source: Invesco Vision, data as of 31 December 2022.

The diversification properties of senior loans are further elaborated upon below, when we look at a forward-looking correlation matrix using our Invesco Vision analytics toolkit. As shown, senior loans have an expected correlation of -.10 with global aggregate bonds and 0.61 with global high yield. In an environment we think could be more challenging to navigate over the longer-term (as discussed in last month’s blog), having an increased focus on diversification will benefit investors over the next market cycle.

Expected correlation |

Global Aggregate Bonds |

Global High Yield |

Senior Loans |

Global Aggregate Bonds |

1.00 | 0.36 | (0.10) |

Global High Yield |

0.36 | 1.00 | 0.61 |

Senior Loans |

(0.10) | 0.61 | 1.00 |

Source: Invesco Vision, data as of 31 December 2022.

As demonstrated above, the integration of senior loans into a traditional fixed income portfolio can increase forecasted return and income while reducing risk, meaningfully improving the efficiency of a fixed income allocation. While senior loans can be sensitive to economic conditions, their floating rate nature can provide a source of diversification in the event rates unexpectedly rise and can immediately increase the overall level of income in the portfolio (expected yields on senior loans are 10% versus 4% for global core bonds1), which we think is a positive tradeoff for strategic investors. Going forward, opportunity set expansion will be key to achievement of core investment outcomes and looking beyond traditional sources of equity and bond returns will be integral to investor success.

In sum, investors will need to use an expanded toolkit to experience similar returns from the most recent 10-year period. As part of the approach, both public and private asset classes will need to be examined for portfolio inclusion. For investors focused on liquid investments, senior loans should be considered as a strategic mainstay in a portfolio. While many investors focus on senior loans purely as a hedge against rising rates, it’s important to consider the multi-faceted benefits associated with the asset class. Those include strong performance in environments with increasing risk appetite, such as we find ourselves in now, the high level of current income, and diversification benefits. Thoughtfully incorporated with a portfolio of traditional core fixed income, senior loans can improve risk-adjusted return opportunities for investor portfolios.

We believe the opportunity in senior loans is particularly favorable for Asian investors, where portfolio income often serves as a primary investment outcome. We also frequently see “return on investment” targets used as secondary portfolio benchmarks in Asia, and high cash flow generating assets such as senior loans can meaningfully increase the probability of meeting those objectives. While the case for loans is global in nature, the relevancy and applicability in Asia is even stronger given the unique attributes of the asset class.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Past performance is no guarantee of future returns.

Most senior loans are made to corporations with the below investment-grade credit ratings and are subject to significant credit, valuation and liquidity risk. The value of the collateral securing a loan may not be sufficient to cover the amount owed, may be found invalid or may be used to pay other outstanding obligations of the borrower under applicable law. There is also the risk that the collateral may be difficult to liquidate, or that a majority of the collateral may be illiquid. Compared to investment grade bonds, junk bonds involve greater risk of default or price changes due to changes in the issuer’s credit quality. Diversification does not guarantee of profit or eliminate the risk of loss.

FOOTNOTES

-

1

Source: Invesco’s 2023 Long Term Capital Market Assumptions