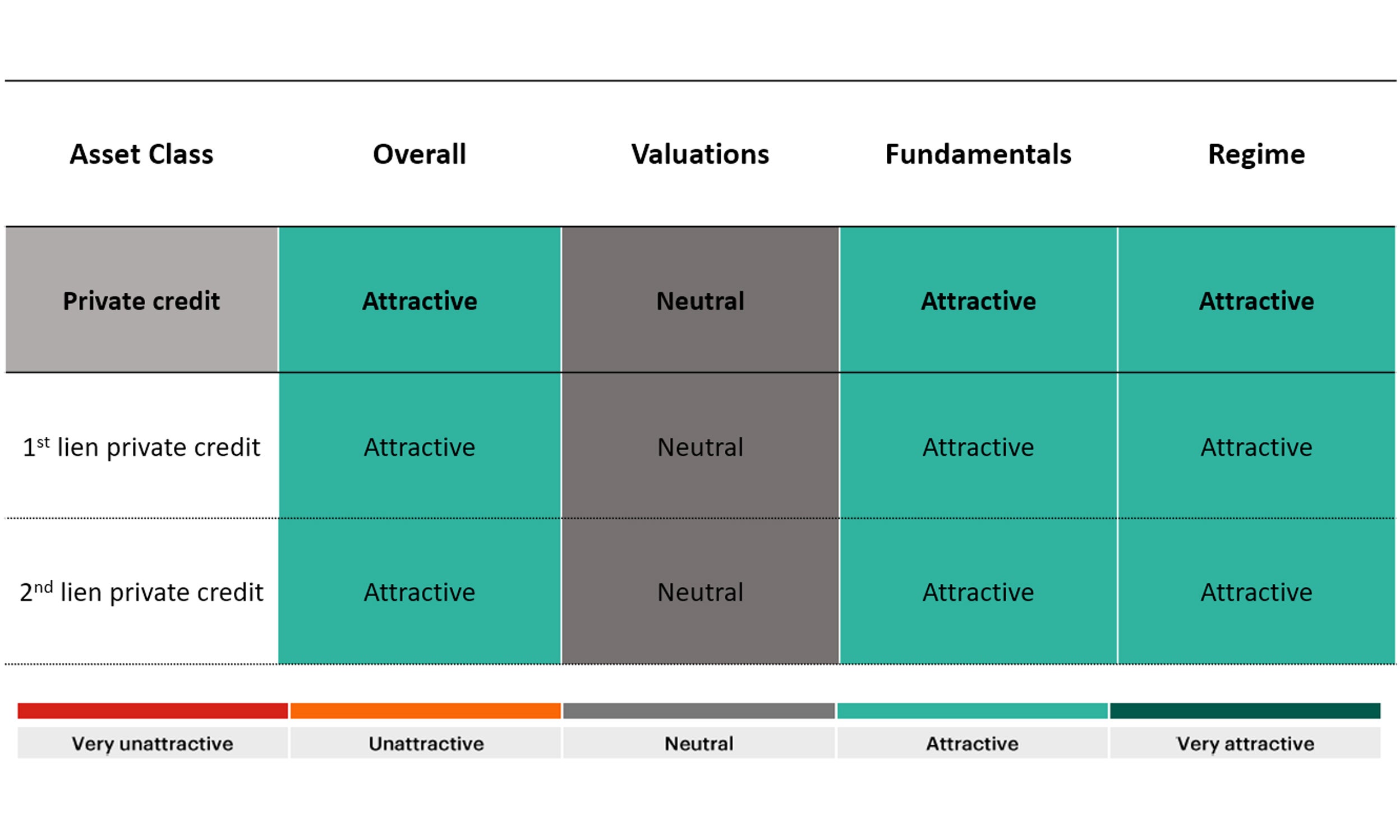

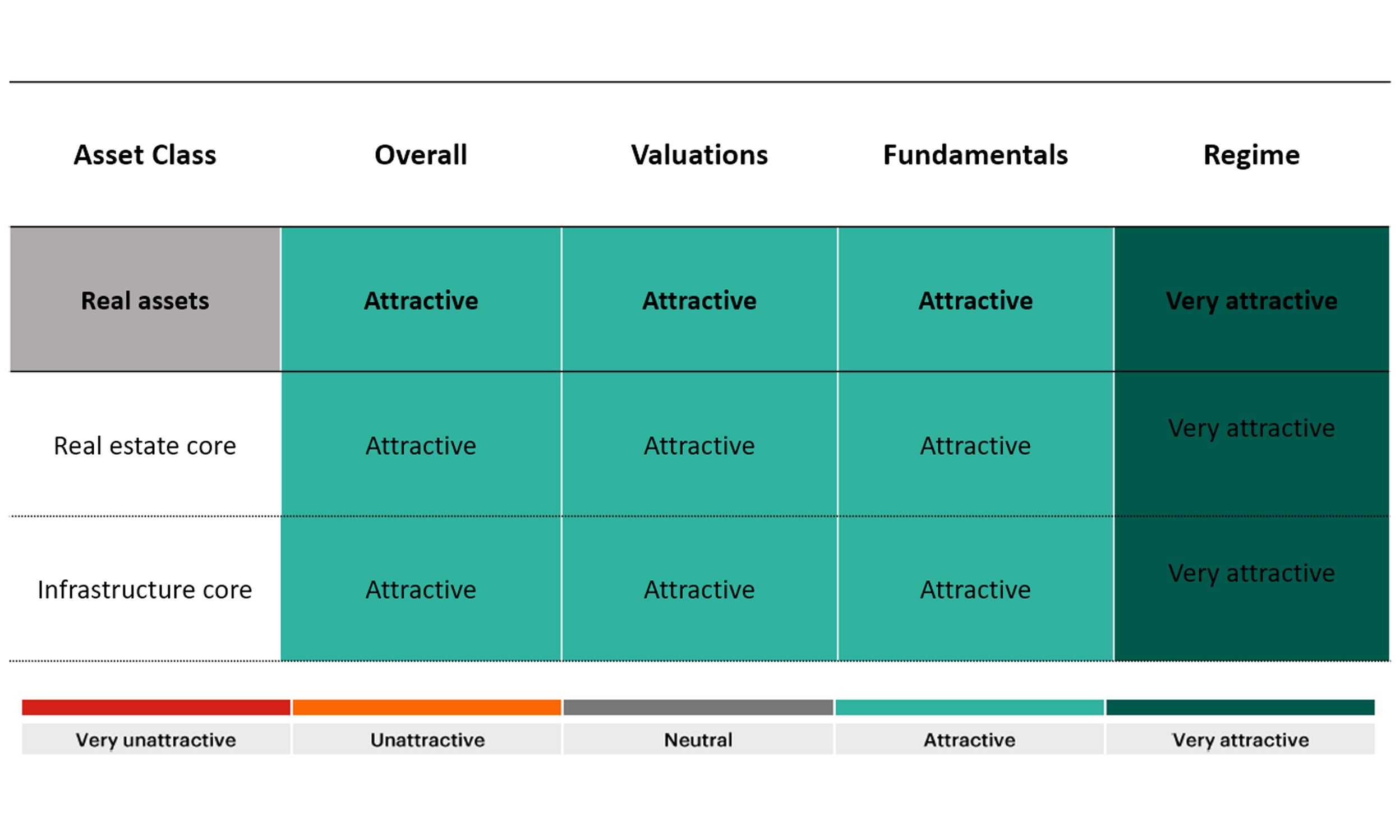

Source: Invesco Investment Solutions, Bloomberg L.P., Burgiss, Preqin. For illustrative purpose only. All historical return data covers a 15Y period, other than 1st lien private credit, which is 10Y, the longest period available for the CDLI-S index. Past performance is not a guarantee of future results. There can be no assurance that any estimated return or projections can be realized that forward-looking statements will materialize or that actual return or results will not be materially lower than those presented. Current return data as of Sep. 30, 2021. Data is unhedged USD. An investment cannot be made into an index. Refer to Proxy information slides 46 - 47 for additional information. Capital market assumptions are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.