Insight

Long-term capital market assumptions quarterly update

- Heading into the fourth quarter, we have reached the portion of the business cycle where most major economies outside of Japan have begun to ease monetary policy. The Federal Reserve’s (Fed) recent 50 basis point (bps) cut and forecast of significant cuts to come have prepared investors for a period of lower interest rates and signals that the Fed believes their multi-year battle with inflation has come to an end.

- How should investors position for the first easing cycle since 2020? It very much depends on whether those long lags of the recent tightening cycle catch up with the economy and cause a recession. While not our base case, the downside risks of a recession are a possibility and require serious consideration. Further, a policy mistake where inflation is reignited could make central banks pivot and disrupt their plans for the normalization of interest rates.

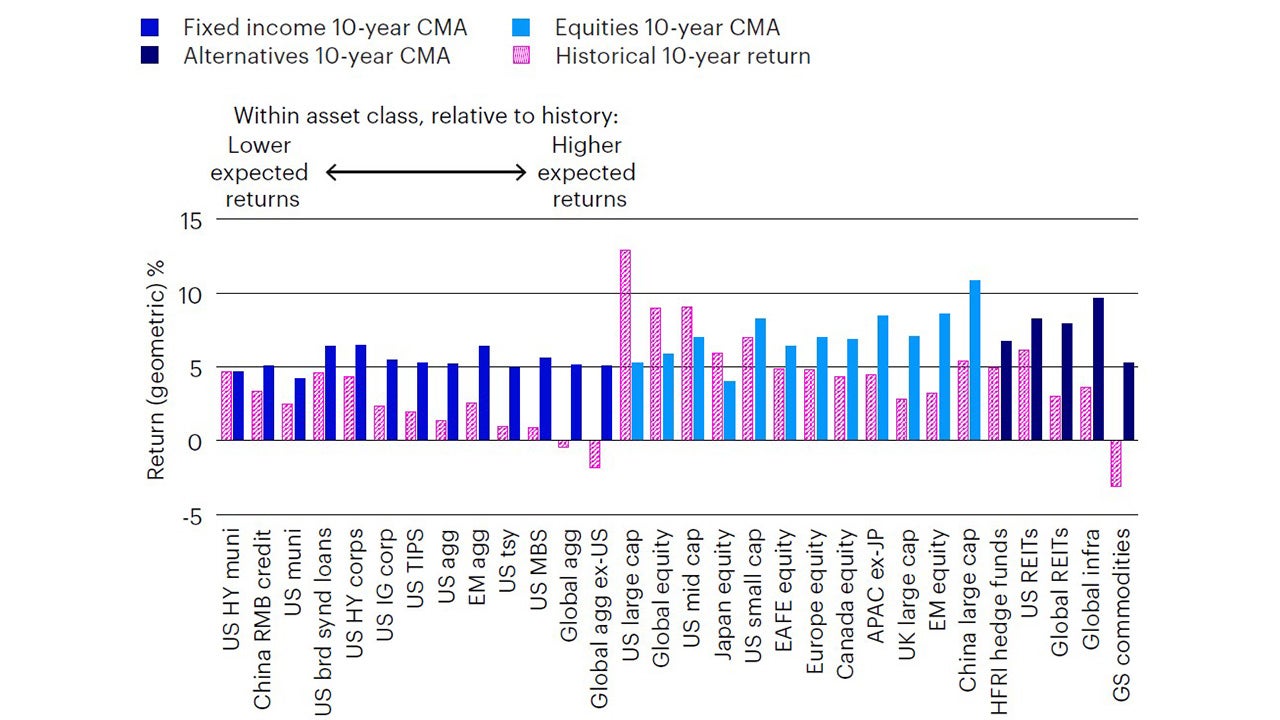

- For most long-term investors, a diversified portfolio is always the answer when uncertainty is high. Our capital market assumptions (CMAs) are indeed forward-looking and aim to assess the risks for assets, both to the upside and downside, relative to history. Data in future quarters will begin to price these risks and probabilities accordingly. To assist in evaluating the possible impact of lower short-term rates and the easing cycle on markets, we have broken down the various channels that may be affected under the assumption that a soft landing is stuck and a recession is avoided.

- To aid investors in identifying the relative risks between our near-term tactical asset allocation and our longer-term CMAs, we have added a new figure that plots the positioning of the two distinct time horizons for common asset class pairs.

Figure 1: Expectations relative to historical average (USD)

Source: Invesco, estimates as of June 30, 2024. Proxies listed in Figure 8. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions. Please see page 11 for information about our CMA methodology. These estimates reflect the views of Invesco Solutions; the views of other investment teams at Invesco may differ from those presented here.

Request Presentation

Connect with us for in-depth presentation focused on your investment challenges and opportunities.