Uncommon truths: What could prevent a further collapse in US stocks?

The VIX is at 45 which is often a good signal for US stocks. However, it feels as though US stocks and the economy risk falling into a negative feedback loop. I think rapid negotiations to limit US tariffs and Fed easing would help but I remain cautious.

Financial markets reacted swiftly to the “Liberation Day” announcement of US reciprocal tariffs on 2 April 2025, reactions that were aggravated by China’s announcement on 4 April of a 34% retaliatory tariff on US goods. Figure 1 shows there was a brutal two day decline in most stock indices after the US announcement, led by the US market (note that Chinese markets were closed on the second of those days, while Taiwan was closed on both days).

Other bearish signals came from copper (-10% in two days, based on LME 3-month futures) and Brent crude (-13% based on 3-month futures). Admittedly, the decline in Brent was exacerbated by the OPEC+ announcement on 4 April 2025 that oil production would rise in May by more than expected. Interestingly, the US dollar has weakened against most major currencies over the last week (see Figure 3), a trend that we expect to continue (see FX Pulse).

That is a pretty good template for how I would expect markets to behave in a global slowdown sparked by US recession. The obvious exception is gold, which I would normally expect to benefit from falling US treasury yields and a weakening dollar (and a ramping up of global tensions). That it has weakened may suggest a lot of the bad news about tariffs was already in the price (see Why is gold at $3000?).

Where things go from here will depend critically upon the intention behind the US reciprocal tariffs, in my opinion. It is tempting to believe they are simply a basis for negotiation with other countries, the aim being to win concessions for the US. The problem is that it is not obvious what other countries can negotiate away. Figure 1 shows that in most cases the tariffs imposed on US goods by trading partners are not out of line with those imposed by the US, with the exceptions of Taiwan and South Korea (the table shows a selection of countries targeted for the highest reciprocal tariffs). As made clear by Figure 1, the reciprocal tariffs imposed by the US were literally based on the size of the imbalance with each country, rather than any real analysis of obstacles to trade (compare columns 1 and 2). If the US deficit simply reflects its own imbalances (too little savings versus investment) and the fact that it produces too few goods at a price that the rest of the world wants to pay, there is not a lot that trade partners can do to help. It will be hard to negotiate when confronted by that logic.

Figure 1: US tariffs, potential economic consequences and stock market reactions for a selection of the most impacted countries

| Goods surplus with US/2 (% of imports) | Reciprocal tariff (%) | WTO tariff imposed on US (%) | WTO tariff imposed by US (%) | Economic impact (%) | Share price index change since 2 April 2025 (%) | |

| Vietnam | 45.2 | 46 | 2.9 | 3.2 | 12.1 | -8.4 |

| China | 33.6 | 34 | 4.9 | 2.4 | 0.5 | -1.7 |

| Taiwan* | 31.7 | 32 | 6.5 | 3.1 | 0.0 | |

| Switzerland | 30.0 | 31 | 0.2 | 1.4 | 1.3 | -7.4 |

| India | 26.1 | 27 | 6.2 | 2.4 | 0.3 | -2.2 |

| S.Korea | 24.9 | 25 | 15.0 | 1.7 | 0.9 | -2.4 |

| Malaysia | 23.8 | 24 | 1.5 | 0.7 | 1.4 | -1.6 |

| Japan | 23.0 | 24 | 1.5 | 1.6 | 0.4 | -6.6 |

| EU | 19.4 | 20 | 1.7 | 1.4 | 0.2 | -7.6 |

| Israel | 15.3 | 17 | 0.7 | 0.8 | 0.2 | -5.0 |

| US** | 1.5 | -10.6 |

Notes: Past performance is no guide to future results. “Goods surplus with US/2 (% of imports)” is our shorthand version of the calculation used by the Office of the United States Trade Representative (USTR) to determine the reciprocal tariff to be imposed on trading partners. It is assumed by USTR that the notional tariff used by the trade partner is equal to that country’s surplus in goods with the US divided by imports from that country (adjusted by factors for the elasticity of imports with respect to prices and the passthrough from tariffs to import prices). The “Reciprocal tariff” was then set by USTR at roughly half of that rate. “WTO tariff imposed on US” shows the weighted average of tariffs imposed on US goods in 2024 (weighted by import values for each good). “WTO tariff imposed by US” shows the weighted average tariff imposed by the US on the partner country in 2024 (weighted by import values for each good). Tariff data is sourced from WTO tariff and trade data. “Economic impact” is the reciprocal tariff multiplied by the trade surplus with the US in 2024 divided by the partner country’s 2024 GDP. “Share price index change” is based on MSCI local currency indices for each country (MSCI Euro for the EU) and shows the change since the close on 2 April 2025 (note that the Chinese market was closed on 4 April 2025 and that for Taiwan was closed on 3 and 4 April 2025). *The WTO website does not include Taiwan, so the data for the tariff imposed on the US is as published by ING in “Taiwan could avoid the worst of Trump’s reciprocal tariffs (27 March 2025)”. **The tariff number quoted for the US in the “WTO tariff imposed by the US (%)” column is a weighted average of tariffs across all trading partners in 2022 as published by the World Bank. Source: IMF, ING, MSCI, Office of the US Trade Representative, US Bureau of Economic Analysis, World Bank, WTO, LSEG Datastream and Invesco Global Market Strategy Office

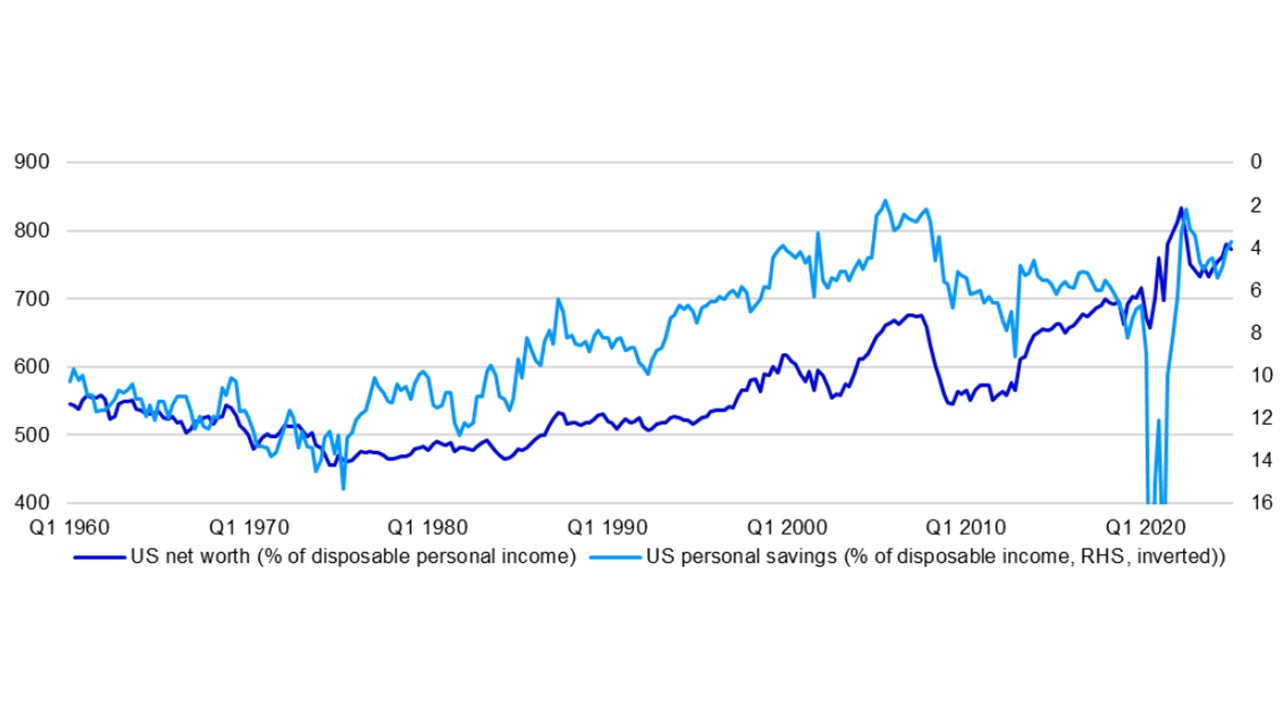

Analysing the short term effect of a prolonged period of the full reciprocal tariffs on the US economy involves a consideration of the impact on inflation, the reaction of the Fed to that inflation and wealth effects. Starting with the latter, Figure 2 is a reminder that household savings rates are inversely correlated to personal wealth. Given that financial assets are around two-thirds of total US personal assets, the direction of financial markets has an important bearing on consumer spending. The drop in stocks could add to economic weakness, giving a negative feedback loop.

On the question of inflation, I assume the average tariff rate imposed by the US will increase by around 20 percentage points (the average reciprocal tariff across the largest trading partners that account for two-thirds of imports is 26%). On that basis, I think the boost to US consumer prices could be around 2% (based on an analysis by the Federal Reserve Board1). I fear that could bring a GDP hit of 1% or more and the risk of recession when wealth effects are added. It could also produce a problematic wage-price spiral. That would put the Fed in a difficult position: should it ease to accommodate the rise in inflation or should it hold rates (or even tighten) to squeeze inflation? I suspect that markets would prefer to see easing but Chairman Powell indicated on 4 April that the Fed will take its time before deciding what to do.

With the S&P 500 and NASDAQ Composite down 17% and 22%, respectively, from their 2025 peaks, is the bad news in the price? Our cyclically adjusted PE ratio (CAPE) for the Datastream US Market Index is now 35, down from a recent peak of 43 but still well above the historical average of 27 (since January 1983). Getting down to that average (seen briefly in 2020) would require a decline of 23% (equivalent to the S&P 500 falling below 4,000). Even worse, falling to the average may not be enough to persuade me that US stocks have reached bargain basement levels in the midst of recession. A CAPE of 20 would be the equivalent of the S&P 500 falling to 2900 (and the CAPE fell to 12.2 during the GFC!).

What could prevent the market experiencing such dramatic downside? First, and foremost, rapid negotiations and/or pushback from within the US (including falling stocks and widening credit spreads) could see the minimum 10% reciprocal tariff become standard. I believe that would limit the uplift to US consumer prices to around 1% and the downside effect on US GDP to no more than 0.5%. I believe the Fed would be willing to look through that and maintain rates at current levels until sometime later this year, before recommencing the easing that started in September 2024. On that basis, I suspect that US stock indices may already have bottomed. Likewise global equities, if there is no further retaliation from other countries.

Second, interest rates have been falling across the globe, real wages are rising and leading indicators are improving. If the trade war doesn’t become globalised, there may be enough momentum to leave non-US economies relatively unscathed.

Third, without such a negotiated outcome, rapid Fed easing could stem market panic. However, the above reported comments from Chairman Powell suggest the markets would have to fall further for that happen.

Finally, the CBOE VIX volatility index reached 45 on 4 April, which has often been a good signal (on the rare occasions when the VIX has touched 45, the S&P 500 has often generated good returns over the next year).

For now, I am happy to continue Underweighting US stocks within my Model Asset Allocation (Figure 5).

All data as of 4 April 2025, unless stated otherwise.

Note: Quarterly data from 1960 Q1 to 2024 Q4. Net worth is for households and non-profit organisations.

Source: LSEG Datastream and Invesco Global Market Strategy Office

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.